Neobanking Market Size & Overview:

Get more information on Neobanking Market - Request Sample Report

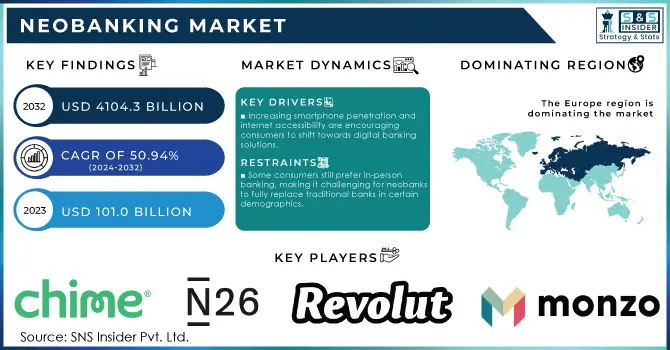

Neobanking Market was valued at USD 101.0 Billion in 2023 and is expected to reach USD 4104.3 Billion by 2032, while growing at a CAGR of 50.94% over the forecast period of 2024-2032.

The Neobanking Market is rapidly expanding as demand for digital banking solutions grows, influenced by evolving consumer preferences and financial technology advancements. As fully digital, branchless entities, neobanks are transforming the banking industry with app-based services that resonate with a tech-savvy customer base. By 2023, approximately 73% of global banking consumers reported using digital-only banking services, highlighting a shift toward accessible, convenient digital options. Europe leads in this adoption trend, with the UK alone surpassing 20 million Neobank users by early 2024, driven by supportive regulations and high consumer trust.

AI and machine learning innovations further fuel neobanking growth, enhancing user experiences through tailored products, faster processing, and predictive insights. For instance, Indian neo-bank Jupiter leverages AI to analyze spending patterns and recommend personalized financial solutions, leading to a 50% user base increase within a year. Additionally, open banking initiatives, particularly in Europe and Asia-Pacific, stimulate competition and enable neobanks to leverage traditional bank data (with consent) to provide more customized services.

The global proliferation of smartphones, projected to exceed 5.5 billion users by 2024, also drives growth. High mobile adoption rates in developing markets allow neobanks to scale quickly in areas with limited traditional banking access; Nubank in Brazil, for example, added nearly 10 million users from 2022 to 2023, especially among underserved populations.

Regulatory developments continue to support expansion. In the U.S., the Office of the Comptroller of the Currency (OCC) has started issuing limited banking licenses to neobanks, allowing them to broaden services without traditional bank partnerships. Growing consumer awareness of neobanks' lower fees, favorable interest rates, and easy account setup further accelerates adoption. As neobanks diversify into areas like loans, investments, and insurance, they are set to attract even more customers, driving substantial global market growth.

Market Dynamics

Drivers

-

Increasing smartphone penetration and internet accessibility are encouraging consumers to shift towards digital banking solutions.

-

Advanced technologies, such as AI and machine learning, enhance user experiences through personalized services and efficient processing.

-

The integration of chatbots and digital assistants improves customer engagement and support, making banking more accessible.

The Neobanking Market has significantly benefited from the integration of chatbots and digital assistants, which enhance customer engagement and support, ultimately making banking services more accessible. These AI-driven tools provide immediate responses to customer inquiries, effectively addressing the challenges often encountered in traditional banking. In contrast to conventional banks, where wait times for customer service can be lengthy, neobanks utilize chatbots to offer real-time assistance, resolving common questions and issues around the clock. This swift access to information enables customers to quickly address their concerns, boosting overall satisfaction and loyalty. Chatbots are capable of managing a wide variety of tasks, from basic account inquiries to more complex operations like transaction tracking and payment processing. For instance, users can effortlessly check their account balances, transfer funds, or receive personalized financial advice tailored to their spending habits, all through an easy-to-use chat interface. This level of convenience not only meets the expectations of tech-savvy customers but also attracts those who might be reluctant to embrace digital banking due to worries about accessibility and support.

Moreover, digital assistants can learn from user interactions, continuously refining their responses to offer more personalized experiences. By analyzing customer data, they can provide tailored recommendations that empower users to make informed financial choices. This level of personalization builds trust and connection, which are crucial for retaining customers in a competitive market. Additionally, the implementation of chatbots and digital assistants allows neobanks to efficiently scale their customer service operations. As their customer base grows, these tools can handle increasing volumes of inquiries without necessitating a proportional rise in staffing, leading to reduced operational costs and freeing up resources for other business areas.

In conclusion, the integration of chatbots and digital assistants serves as a vital driving force in the Neobanking Market, enhancing customer support and engagement while making banking services more user-friendly and accessible.

Restraints

-

Some consumers still prefer in-person banking, making it challenging for neobanks to fully replace traditional banks in certain demographics.

-

Heavy reliance on digital infrastructure means any technical issues or outages can disrupt services, impacting user trust.

-

Some consumers still prefer in-person banking, making it challenging for neobanks to fully replace traditional banks in certain demographics.

The rapid expansion of the Neobanking Market faces a significant obstacle: many consumers still favor in-person banking, hindering neobanks' ability to completely replace traditional banks. Established banks, with their branch networks, provide face-to-face interactions that foster personal connections and trust, which are particularly important during complex transactions and major financial decisions. Older or less tech-savvy customers often rely on these in-person experiences for their reliability and immediate support, areas where digital-only platforms may struggle to compete.

Moreover, in-person banking remains crucial in rural and underserved areas, where limited internet access makes it difficult for consumers to depend entirely on app-based banking. Even in technologically advanced markets, the existence of physical branches helps build brand trust and credibility. Traditional banks also offer personalized services, such as financial advice and loan consultations, which can be hard to replicate online. While neobanks are recognized for their convenience, low fees, and speed, they frequently face challenges in forming the deep personal relationships that brick-and-mortar banks provide. This gap can negatively affect customer loyalty, especially during financial uncertainties when consumers often seek direct, personalized support. Topics such as debt management and large loans may be easier to discuss in person than through digital channels.

To overcome this challenge, neobanks are improving customer support through chatbots, video consultations, and AI-driven personalized recommendations. Some are also exploring hybrid models by collaborating with traditional banks to provide limited in-person services. However, until neobanks can fully replicate the trust and personal touch of traditional banking, they may find it difficult to cater to certain consumer demographics. To effectively meet these varied preferences, neobanks must continue to innovate in customer engagement and trust-building strategies.

Segment Analysis

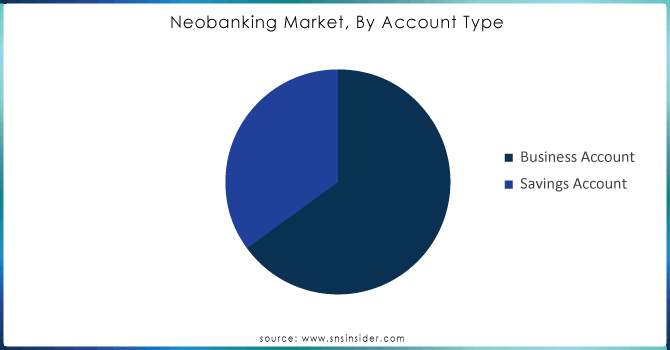

Account Type

Business accounts dominated the market in 2023, capturing over 68.6% of total revenue. A growing number of businesses worldwide are choosing neobanking as their preferred option for handling bulk payments. Neobank platforms contribute to the growth of this segment by streamlining processes and minimizing human intervention in vendor disbursements and other transactions with stakeholders.

The savings account segment is expected to experience the highest compound annual growth rate (CAGR) during the forecast period. Furthermore, many health tech companies are partnering with fintech firms to develop and launch products and services that meet the increasing demand in this sector. For example, In March 2023, Fino Payments Bank partnered with Practo, a health tech platform, to launch a health savings account. This account combines features such as medical insurance coverage, smart savings options, and a health debit card, allowing users to manage healthcare expenses efficiently.

Do you need any custom research on Neobanking Market - Enquire Now

By Application

The enterprise segment dominated the market in 2023 and represented over 51.8% of total revenue. These platforms provide a variety of enterprise-related services, such as credit management, transaction management, and asset management. Numerous neobanking service providers targeting SMEs are actively pursuing acquisitions to enhance their product offerings and improve customer experiences. For example, in April 2023 Chime, a prominent neobanking platform, acquired Gohenry, a digital banking service for children and teens, in a deal valued at USD 75 million. This acquisition aims to enhance Chime’s offerings by integrating youth-focused financial education tools into its platform, further expanding its user base and promoting financial literacy among younger audiences.

Moreover, the personal application segment is expected to experience the fastest growth during the forecast period. The widespread adoption of smartphones has encouraged customers to utilize neobanking services due to their convenience and user-friendly interfaces. These services are delivered via mobile app platforms, allowing users to perform money transfers and payments with ease. The simplicity of opening and managing accounts is likely to further drive the growth of neobanking in this segment in the coming years.

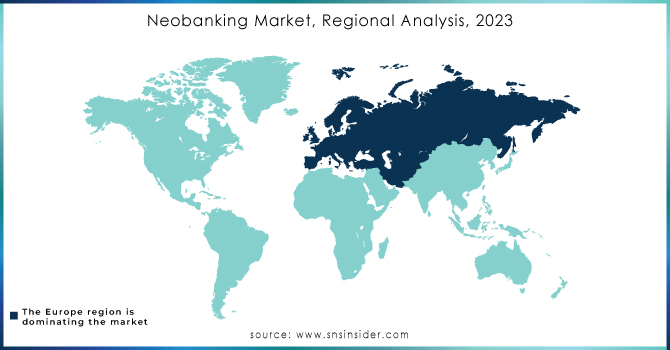

Regional Analysis

In 2023, Europe dominated the market, capturing over 30.6% of total revenue. This growth is primarily attributed to advancements in innovative technologies and the early adoption of new solutions. European companies are actively introducing new product platforms and forming strategic partnerships to bolster their market presence. Additionally, many neobanks have established brick-and-mortar distribution channels to implement an online-to-offline (O2O) model, generating new growth opportunities.

The Asia Pacific region is anticipated to be the fastest-growing market during the forecast period. The increasing adoption of Internet services, coupled with the rising use of smartphones, is expected to drive market growth. Moreover, the demand for convenient banking services and the proliferation of digital-only banks in countries such as Japan, India, and China will further stimulate growth in this region. The youthful demographics of the Asia Pacific are also likely to facilitate the adoption of neobanks.

Key Players

The major key players along with their products

-

Chime - Chime Account

-

N26 - N26 Bank Account

-

Revolut - Revolut Card

-

Monzo - Monzo Bank Account

-

Ally Bank - Ally Interest Checking Account

-

Starling Bank - Starling Personal Account

-

Varo Bank - Varo Savings Account

-

TransferWise (now Wise) - Wise Multi-Currency Account

-

Aspire - Aspire Business Account

-

Open - Open SME Banking

-

Zeta - Zeta Banking Stack

-

Judo Bank - Judo Business Loan

-

Lili - Lili Business Banking Account

-

Kiva - Kiva Loan Platform

-

Qonto - Qonto Business Account

-

Tink - Tink Payment Initiation

-

Tommy - Tommy Business Account

-

Bank Novo - Novo Business Checking Account

-

Zelle - Zelle Payment Service

-

NerdWallet - NerdWallet Financial Management Tools

Recent Developments

-

March 24: Starling Bank launched a business account aimed specifically at freelancers and self-employed individuals, featuring tailored tools for invoicing and expense tracking.

-

February 24: Chime partnered with several retailers to offer exclusive discounts to users who utilize their Chime Card for purchases.

-

January 24: Revolut launched a new subscription service that provides users with advanced financial tools, including budgeting insights and investment features.

| Report Attributes | Details |

| Market Size in 2023 | USD 101.0 billion |

| Market Size by 2032 | USD 4104.3 billion |

| CAGR | CAGR of 50.94 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Account Type (Business Account, Savings Account) • By Application (Enterprises, Personal, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Chime, N26, Revolut Monzo, Ally Bank, Starling Bank, Varo Bank, TransferWise (now Wise), Aspire Open |

| Key Drivers | • Increasing smartphone penetration and internet accessibility are encouraging consumers to shift towards digital banking solutions. • Advanced technologies, such as AI and machine learning, enhance user experiences through personalized services and efficient processing. • The integration of chatbots and digital assistants improves customer engagement and support, making banking more accessible. |

| Market Restraints | • Some consumers still prefer in-person banking, making it challenging for neobanks to fully replace traditional banks in certain demographics. • Heavy reliance on digital infrastructure means any technical issues or outages can disrupt services, impacting user trust. • Some consumers still prefer in-person banking, making it challenging for neobanks to fully replace traditional banks in certain demographics. |