Data Center Renovation Market Report Scope & Overview:

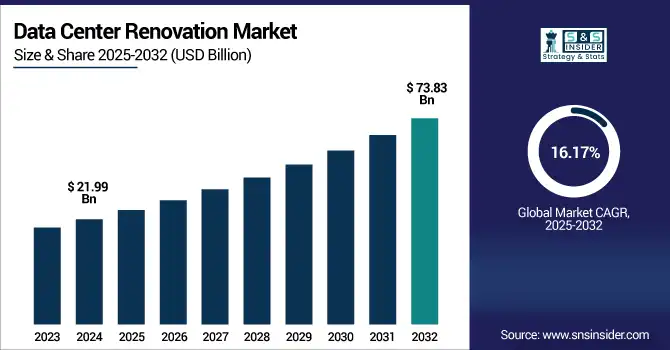

The Data Center Renovation Market size was valued at USD 21.99 billion in 2024 and is expected to reach USD 73.83 billion by 2032, expanding at a CAGR of 16.17% over the forecast period of 2025-2032.

To Get more information on Data Center Renovation Market - Request Free Sample Report

With organizations looking to improve energy efficiency, security, and computing capacity, the Data Center Renovation Market has seen a rapid improvement in energy efficiency over time. As cloud, edge, and AI technology improve, many companies are choosing to renovate their legacy instead of building greenfield. This includes efficient cooling and even integration of renewable energy because of sustainability goals and carbon regulations, which are spurring green renovations as well. This process can perform electrical upgrades, optimize space, and enhance power and cooling Services. The market in North America is expected to hold the largest share, due to the aged infrastructure and high demand for digital upgradation, while in terms of growth, Asia-Pacific is projected to grow at the fastest due to increasing IT investments with the growing digital infrastructure.

According to research, nearly 50% of global data centers are over a decade old, and over 30% of renovations in 2024 sought LEED or similar certifications, highlighting a strong shift toward sustainable modernization.

The U.S Data Center Renovation Market size reached USD 7.55 billion in 2024 and is expected to reach USD 23.59 billion in 2032 at a CAGR of 15.33% from 2025 to 2032.

The U.S. leads the market, fortified by the large number of old data centers located in the country, fast adoption of digital technologies, and rising requirement for energy-efficient infrastructure. The main factors contributing to this are cloud computing, edge computing, and AI workloads that need the facilities to be brought up to speed, leading to more power and cooling systems having to be installed. What is more, stringent environmental regulation and corporate sustainability targets are compelling operators to upgrade existing centres with green technologies.

Market Dynamics

Drivers:

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts Data Center Renovation Market Growth.

The growing focus of various industries on sustainability is bolstering demand for products by modifying the equipment purchase pattern in the data center renovation market. By using energy-efficient solutions, organizations can minimize their carbon footprints along with operational costs. Such a shift can identify with advanced cooling technologies like liquid cooling that can mitigate the high energy consumption of traditional systems. Furthermore, the use of renewable energy sources such as solar and wind in data center operations is gaining traction. As these data center renovation market trends coincide with environmental incentives and provide long-term economic advantages, they represent a sustainable approach to infrastructure modernization for a business.

According to research, over 38% of global data center renovation projects in 2024 were initiated specifically to meet environmental and sustainability targets

Restraints:

-

High Capital Expenditure Requirements and Complex Regulatory Compliance Impede Market Expansion.

High capital investment needed for data center refurbishment is a major market hindrance. The process of upgrading infrastructure to modern standards is high in costs, including the purchase of state-of-the-art equipment and the installation of energy-efficient, resource-conserving systems. Additionally, the multitude of regulations concerning the environment and other safety standards creates another hurdle, as it can be a lengthy and expensive process. These financial and regulatory hurdles tend to deter organizations, especially SMEs, from making the renovations they need to, and this, in turn, restricts the total market growth.

Opportunities:

-

Integration of Renewable Energy Sources Presents Significant Opportunities for Sustainable Data Center Renovations.

The use of renewable resources in data-center facilities provides a great opportunity for green retrofits. "With data centers under pressure to use energy more efficiently and make the most of renewable energy sources, many have begun to look at solar, wind, and natural gas to power their facilities. In addition to decreasing dependence on fossil fuels, this shift contributes to international sustainability targets. Recent developments, such as big tech’s sustained investment in on-site renewable energy projects, exemplify how the industry continues to prioritise green measures. The move to renewables is not just about strategically doing your part for the environment; it also means major savings, in large part because those data center developers, owners, and operators just can’t ignore the savings opportunity during new builds or remodels.

Challenges:

-

Power Infrastructure Bottlenecks and Energy Supply Constraints Challenge Data Center Renovation Efforts.

New releases of data centers are becoming more difficult to expand and renovate due to power infrastructure restrictions and energy supply blocks. Powering data centers on increasingly larger scales, accommodating larger and larger centers, it requires a stable and substantial power supply. But today’s power systems are not always capable of satisfying these growing needs, and this factor may cause delays and inflation of costs in renovation projects. Furthermore, whilst renewable energy system infrastructure is a good thing, it has a level of variability in power supply that requires sophisticated energy management systems.

Segment Analysis

By Renovation Type

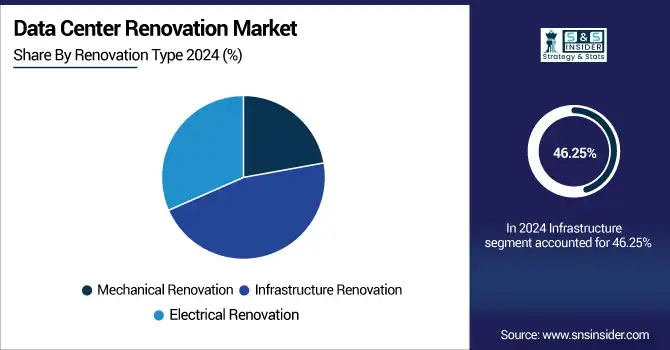

Infrastructure Renovation held the largest share of 46.25% in 2024, which includes the significant requirement of upgrading old data center sites to support new workloads. Most of the time, infrastructure renovation is about structural changes like raised floor, expansion of server room, better fire suppression systems, and physical security. Market leaders like Equinix and Digital Realty have supported significant retrofitting projects to enhance resiliency and prolong facility utility. For example, newer trends in the data center renovation market industry, such as modular building technologies and pre-fabricated solutions, shorten the duration of time it takes to renovate. These features are key to maintaining business workflow, meeting regulatory requirements, and operating the data center more efficiently in the modern data center.

The Electrical Renovation segment is expected to witness the fastest CAGR at 16.94% from the increased emphasis on retrofitting old power distribution units (PDUs), switchgear, and back-up power systems to support higher density computing, Cloud workloads, and AI applications require stable and scalable power systems. As part of renovation needs, Vertiv and Schneider Electric have introduced modular electrical infrastructure solutions. With increasing awareness of energy efficiency, preventing downtime, and regulatory compliance, electrical upgrades are a significant data center renovation area.

By Renovation Goal

The Modernization and Upgrading segment captured 44.02% of the revenue share in 2024, as data centers try to stay relevant with the newest tech. Everything from swapping legacy systems for high-performance servers to automation, disaster recovery capabilities. The upgrading of legacy centers with edge computing and AI integration by Amazon Web Services and Microsoft Azure is a recent illustration of this. In essence, the driver is a greater need for agility, reliability, and readiness to go digital. With an ever-increasing digital transformation, modernization is by far the most dominating part of renovation initiatives across industries, keeping it at the top of its game in the market.

The Improved Energy Efficiency segment is projected to grow at a CAGR of 16.85%, due to escalating energy prices as well as stricter environmental regulations. As a result, operators are currently investing in efficient UPS units, speed-controlled cooling fans, and state-of-the-art energy monitoring technologies. AI-powered real-time energy optimization for data centers, such as by Google and Meta. Operators are transitioning facilities to sustainable energy designs driven by efforts to reduce operational costs and meet ESG goals. Green data centres are quickly becoming the de facto standard, and this segment is gaining rapid momentum and will become a heterogeneous investment type in the market.

By Infrastructure Component

The Power Systems segment led with 37.73% of revenue share in 2024, due to the fundamental need for power anytime and at scale for data centers. Today's workloads require the highest redundant and resilient power infrastructure. Data centers have these requirements in mind as companies are launching new products, like Eaton has launched scalable UPS systems, and ABB has launched smart switchgear. It is purely driven by the high-density servers, which are being deployed and pushing the limits of legacy power systems. Renewable power availability, reliability, and load management are triggering investments in renovation efforts that are putting this segment as a key pillar in maintaining the efficiency of next-generation data centers.

The Cooling Systems segment is growing at a CAGR of 17.20%, driven by growing power densities due to high-performance computing and AI-centric workloads. For renovation projects, data center renovation market companies like Vertiv and STULZ are launching liquid cooling and energy-efficient air-handling units. Improved cooling is necessary for uptime and hardware service life. Modern cooling solutions are likewise being spurred by regulations regarding energy consumption and sustainability goals. With rising demand for low PUE, the demand for efficient cooling upgrades is inescapable, which is further driving the growth of this segment in the renovation market.

By Data Center Age

Data centers aged 11–15 years held the largest revenue share at 30.18% in 2024, because these facilities are still operational but require immediate upgrades. The centers are inefficient and ill-equipped to meet modern digital needs. Factors operating behind are accelerating speed of technological obsolescence and high energy utilization. IBM and NTT address middle of the cycle refreshes with the drive towards server consolidation and infrastructure optimization to provide for greater efficiency without a full rebuild. These renovations offer optimal ROI by enabling compliance, boosting energy efficiency, enhancing performance, and extending asset lifespan, making this age group highly attractive for targeted upgrade investments.

The Over 20 Years segment is projected to grow at a CAGR of 17.47%, fueled by the desperate need to replace aging infrastructure that no longer meets the demands of today's workloads. These legacy centers often suffer from lower energy efficiency and higher operational risk. Iron Mountain and Cyxtera are two recent examples of efforts to redevelop existing facilities with new monitoring, power, and cooling systems. The main motivator is the cost-benefit of a renovation in locations where rebuilding is impractical, or via real estate limitations. This rapidly growing segment further pushes investments with a strong focus on sustainability and compliance.

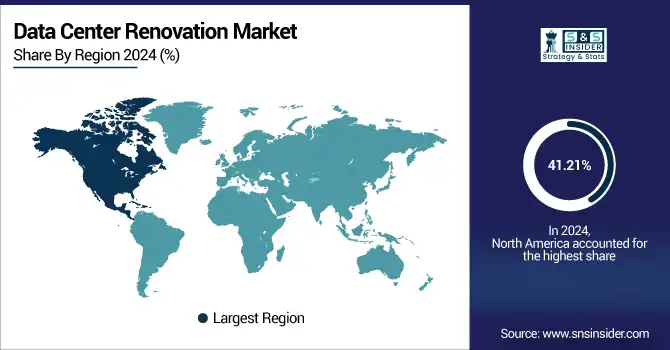

Regional Analysis

North America leads the Data Center Renovation Market share of 41.21%. As North America has Technologies & Tools for a great infrastructure, coupled with many aging data centers needing renovation, the data center renovation market can be observed. It is a highly digital transforming place, has solid energy-efficient and secure data center technologies investment in the region.

This market is dominated by the U.S. primarily due to the presence of legacy data centers and large modernization investments driven by cloud and sustainability demands.

Europe continues to experience gradual growth in data center renovations with stringent environmental regulations and growing green technology adoption, The area prioritizes data center operation energy efficiency and carbon footprint reduction as far as possible.

Germany, assisted by its industrial base and sustainability focus leading the market in Europe through large-scale renovation works that are energy-driven and compliance-focused.

Asia Pacific is the fastest-growing region with a CAGR of 17.07% as growing digital infrastructure, increasing cloud adoption, and quick industrialisation. As consumption and performance demand continue to increase, investments toward modernization of older, expansive facilities are climbing.

China rules in this market, fueled by the country's data centers, government projects supporting the development of the digital economy, and energy-efficient renovation technologies.

Driving factors such as growing digital transformation trends, internet adoption, and energy-efficient infrastructure are contributing to data center renovation adoption in regions such as the Middle East & Africa, and Latin America. Underpinned by government stimulus and rising demand for cloud and edge computing infrastructure, the UAE and Brazil are driving the growth in their regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players of the Data Center Renovation Market are Schneider Electric, Vertiv, Eaton Corporation, ABB Ltd., Dell Technologies, Hewlett-Packard Enterprise, IBM Corporation, Cisco Systems, Siemens AG, Microsoft Azure, and others.

Key Developments

-

In May 2025, Schneider Electric collaborated with Nvidia to create digital twins of AI data centers, increasing electricity management and operational efficiency with the latest simulation technology.

-

In May 2025, Schneider Electric and EcoXpert partner Advanced Power Technology won 'Data Centre Upgrade Project of the Year' at the DCS Awards 2025 for renovation excellence.

-

In May 2025, Cisco announced 8th-generation UCS C-Series and UCS X-Series servers with Intel Xeon 6 processors, accelerating data center modernization and performance capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 21.99 Billion |

| Market Size by 2032 | USD 72.83 Billion |

| CAGR | CAGR of 16.7% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Renovation Type (Mechanical Renovation, Electrical Renovation, Infrastructure Renovation) •By Renovation Goal (Improved Energy Efficiency, Increased Capacity and Density, Modernization and Upgrading) •By Infrastructure Component (Cooling Systems, Power Systems, Racks and Enclosures, Security Systems) •By Data Center Age (0-5 Years, 6-10 Years, 11-15 Years, 16-20 Years, over 20 Years) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Schneider Electric, Vertiv, Eaton Corporation, ABB Ltd., Dell Technologies, Hewlett-Packard Enterprise, IBM Corporation, Cisco Systems, Siemens AG, Microsoft Azure |