Narcotics Scanner Market Report Scope & Overview:

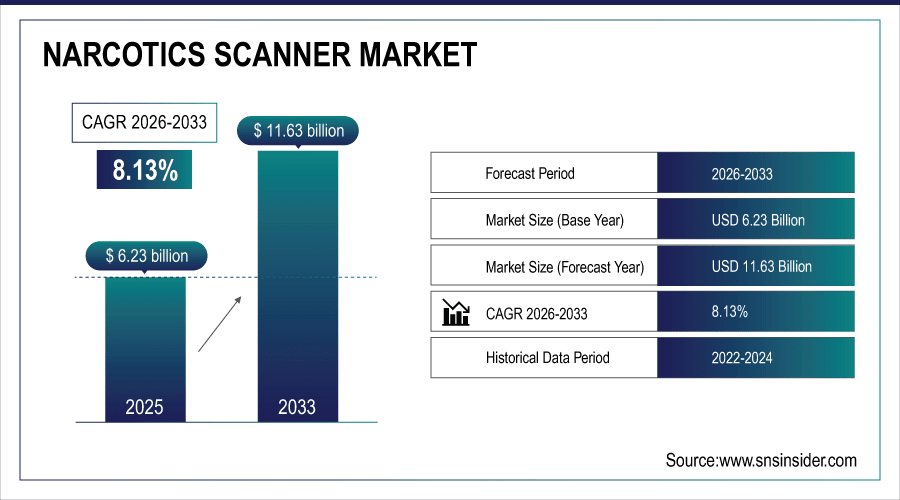

The Narcotics Scanner Market Size was valued at USD 6.23 Billion in 2025E and is expected to reach USD 11.63 Billion by 2033 and grow at a CAGR of 8.13% over the forecast period 2026-2033.

There are majorly three factors driving the growth of the Narcotics Scanner Market: the growing demand for improved security in key infrastructure, transportation centers, and law enforcement departments. With the drug trafficking and smuggling of psychoactive substances becoming more common, airports, seaports, border checkpoints and public transport are spending on sophisticated narcotics detection technologies. Portable handheld scanners, table-top units, and modern-day walkthrough detection systems are creating high throughput for security personnel to quickly identify narcotics and offer public assurance from stringent regulatory framework practices. That said, operations of government programs and plans relating to improvement of border control and preventing crimes associated with drugs play a major role in growth of the market space. According to study, around 60% of public transportation hubs (railways, metro stations, and bus terminals) are reported to be integrating narcotics scanning solutions.

To Get More Information On Narcotics Scanner Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 6.23 Billion

-

Market Size by 2033: USD 11.63 Billion

-

CAGR: 8.13% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Narcotics Scanner Market Trends

-

Increasing adoption of handheld and portable scanners across airports and borders.

-

Governments enforcing stringent security regulations to curb drug trafficking activities.

-

Integration of AI and IoT technologies in modern narcotics scanners.

-

Growing demand for scanners in healthcare, educational, and event sectors.

-

Rising investments in advanced Ion Mobility Spectrometry and infrared detection systems.

-

Focus on cost-effective, easy-to-use devices for non-traditional application areas.

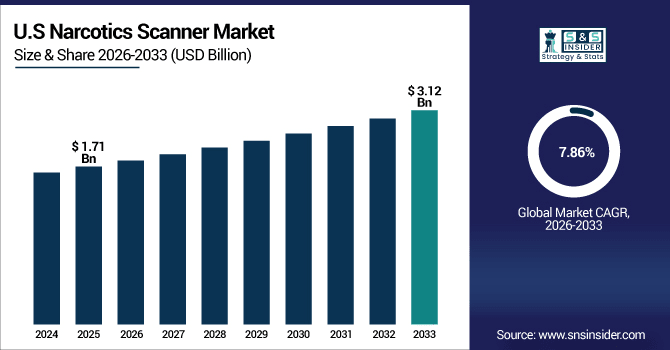

The U.S. Narcotics Scanner Market size was USD 1.71 Billion in 2025E and is expected to reach USD 3.12 Billion by 2033, growing at a CAGR of 7.86% over the forecast period of 2026-2033, driven by stringent security regulations, high adoption of advanced technologies like IMS and AI-assisted scanners, and significant investments in airports, border checkpoints, and public infrastructure to prevent drug trafficking and ensure public safety.

Narcotics Scanner Market Growth Drivers:

-

Rising Global Security Threats Fuel Demand for Advanced Narcotics Scanners

The growth of the narcotics scanner market is largely due to the growing requirement for security equipment in the critical areas like airports, seaports, border crossing, public transport, correctional facilities and critical infrastructure. This increasing trend of drug transport, illegal substance importation, and organized crime has caused governments and law enforcement to allocate large sums of money to new and advanced scanning technologies. Handheld scanners that are portable, table-top units, and walkthrough detection systems indicate narcotics with a fast, accurate detection, ensuring the safety of people. Furthermore, strict regulatory frameworks as well as government initiatives enforcing security compliance also increases adoption of narcotics scanners across the globe. For instance, several airports and border control agencies are setting up Ion Mobility Spectrometry (IMS) and infrared spectroscopy-based scanners to identify trace amounts of banned substances instantly in order to curb security lapses.

Infrared spectroscopy-based scanners represent around 25–30% of technology adoption.

Narcotics Scanner Market Restraints:

-

High Cost and Operational Complexity Limit Adoption of Narcotics Detection Systems

High cost of advanced narcotics scanners in high-precision table-top and walkthrough systems are one of the prominent restraints hindering the growth of the market. These systems demand high capex that includes all the hardware, installation, calibration, and ongoing maintenance and servicing costs. The market penetration of these technologies would likely be limited in certain areas due to a lack of means at small airports, emerging markets, or public transportation agencies. In addition, continuous expenses like energy usage and replacement services can prove burdensome on a budget as well. The reserved pricing on these top-not devices comes with the technical complexities that require trained personnel, thus adding to operational costs as well that may outweigh smaller organizations from investing in security as evident that the costs of high-end scanners are just reserved for larger organizations.

Narcotics Scanner Market Opportunities:

-

Non-Traditional Sectors Present Lucrative Growth Opportunities for Scanner Deployment

Narcotics scanner is expected to open wide opportunities in untapped segments such as healthcare, schools and universities and event and entertainment venue. Increasing regulation for drug abuse, drug trafficking abuse, and regulated medicine management within these industries leads to increasing requirements for portable and easy-to-use scanners. Scanners, for example, can be deployed by healthcare and rehabilitation centres to stop the influx of illegal drugs into their centres protecting patients and staff. Likewise, schools, fairs, and other massive public events can provide peace of mind and a safe environment with the use of specific walkthrough or handheld scanners. As demand progresses towards more mobile, AI-assisted, and IoT-integrated, manufacturers are enabling cost-effective devices for these new applications, which provide new market opportunities enabling growth into the future.

40% of large educational institutions may implement scanners for campus security.

Narcotics Scanner Market Segmentation Analysis:

-

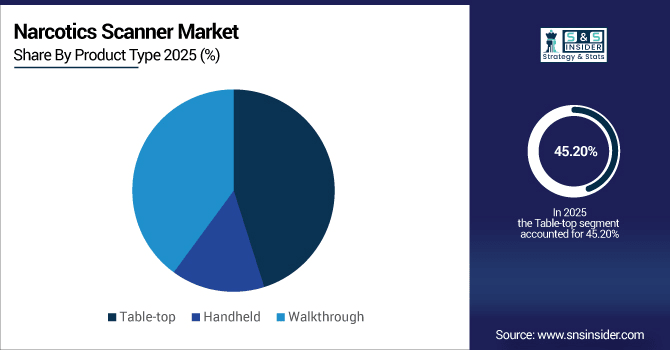

By Product Type: In 2025, Table-top led the market with share 45.20%, while Handheld are the fastest-growing segment with a CAGR 7.04%.

-

By Technology: In 2025 Ion Mobility Spectrometry (IMS) led the market with share 44.54%, while Infrared spectroscopy the fastest-growing segment with a CAGR 7.84%.

-

By Application: In 2025, Correctional Facilities led the market with share 35.06%, while Healthcare & Rehabilitation Centers is the fastest-growing segment with a CAGR 7.14%.

-

By End User: In 2025, Law Enforcement led the market with share 47.84%, while public transportation is the fastest-growing segment with a CAGR 7.24%.

By Product Type, Table-top Leads Market and Handheld Fastest Growth

Table-top scanners lead the Narcotics Scanner Market as they provide high accuracy, reliability, and are best suited for use in critical infrastructure including airports, border checkpoint, and correctional facilities among others. Such machines are known for better throughput speeds and accuracy making them the right choice for high throughput environments. On the other hand, Handheld scanners are approaching the fastest rise, due to their portability and ease of use, and their quick adoption by law enforcement and public transportation authorities, in addition to non-traditional sectors such as those of health and educational institutions. The global handheld device market, complementary to traditional security installations, is set to grow owing to the upsurge in demand for mobile, AI-assisted, IoT-integrated, devices as effective, flexible, and low-cost solution for various security and other applications worldwide.

By Technology, Ion Mobility Spectrometry (IMS) Leads Market while Infrared spectroscopy Fastest Growth

In the Narcotics Scanner Market, Due to the simplicity and rapid detection, with high sensitivity over a wide range of compounds, Ion Mobility Spectrometry (IMS) leads the technology segment for Narcotics Scanner Market and accounts for the major share in the global market followed by gas chromatography, which is extensively used at airports and border checkpoints, and is widely used by the law enforcement agencies. IMS are very accurate in detecting small amounts of narcotics and are commonly used where high-security is needed. On the other hand, the highest growth rate is provided by Infrared spectroscopy, due to improvement in sensor technology, ability to be used for non-destructive testing, and growing penetration in nontraditional end-user industries like health care, academic institutions, and public events. The availability of infrared scanners that are portable, AI-assisted, and IoT-enabled will further contribute towards market expansion across the globe.

By Application, Correctional Facilities Lead Market and Healthcare & Rehabilitation Centers Fastest Growth

In the Narcotics Scanner Market, correctional facilities hold the largest share, as the prevention of drug smuggling inside correctional facilities is necessary for maintaining high-security standards and should be the top priority in prisons and detention centers. These facilities conduct drug detection primarily through various scanners such as handheld, table-top, and walkthrough scanners. At the same time, the healthcare and rehabilitation center segment is expected to grow at the highest rate due to the government initiatives to increase awareness about drug abuse, control substance, and ensure patient safety. In these centers, the adoption of portable, AI-assisted, and IoT-enabled scanners are creating new opportunities by maintaining consistent operational efficiency and security at a lower cost.

By End User, Law Enforcement Lead Market and Public transportation Fastest Growth

In the Narcotics Scanner Market, law enforcement dominates the end-user category as they utilize sophisticated scanners in airports, border checkpoints, seaports, and urban security operations. Law enforcement use handheld, table-top and walk-through scanners to rapidly and reliably detect the presence of illegal substances, ensuring the safety of the public and compliance with the law. And at the same time, the fastest-growing part of public transportation is public transport itself as more metro systems, railways, and bus terminals use portable and AI-powered scanners to secure commuters and prevent any drug- or substance-related incidents. This increasing interest in cost effective mobile detection solutions are leading to substantial adoption by transit networks around the world.

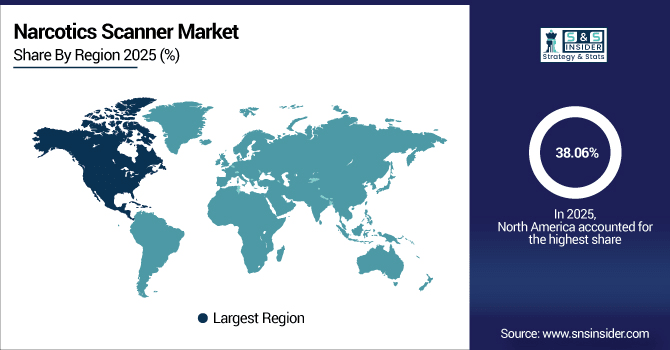

Narcotics Scanner Market Regional Analysis:

North America Narcotics Scanner Market Insights:

The Narcotics Scanner Market in North America held the largest share 38.06% in 2025, owing to mandatory security regulations, early adopting nature towards latest technologies and high investment on critical infrastructure. Handheld, table-top, and walkthrough scanners are widely used at airports, seaports, border checkpoints, and correctional facilities for rapid and effective narcotics detection. Early adoption of technologies such as Ion Mobility Spectrometry (IMS), infrared spectroscopy, and artificial intelligence (AI)-assisted devices in the region guarantees reliable detection and efficient operation of detectors. Growing efforts of governments to end drug trafficking and trafficking of illicit substances combined with rising investment regarding security of public transport are other factors boosting the market growth in North America continuously.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates Narcotics Scanner Market with Advanced Technological Adoption

The U.S. dominates the Narcotics Scanner Market, driven by advanced technological adoption, including IMS, AI-assisted, and IoT-enabled scanners, strong regulatory support, and significant investments in airports, borders, and critical infrastructure.

Asia-Pacific Narcotics Scanner Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the Narcotics Scanner Market, projected to expand at a CAGR of 9.53%, owing to increasing security concerns and growing drug trafficking along with high investments in critical infrastructure and transportation hubs. Handheld, table-top, and walkthrough scanners are being adopted rapidly to defend airports, seaports, and public transportation throughout the region. More than several technologies such as Ion Mobility spectrometry (IMS), infrared spectroscopy, and AI-assisted devices are driving the market faster while ensuring security compliance through government initiatives and regulatory frameworks. Furthermore, rising drug trafficking awareness and the need for rapid, portable, and cost-effective detection solutions drive the growth of the market in the region.

China and India Propel Rapid Growth in Narcotics Scanner Market

China and India drive rapid growth in the Narcotics Scanner Market, fueled by rising security concerns, increasing scanner adoption, advanced technologies, and supportive regulatory initiatives across critical infrastructure and transportation systems.

Europe Narcotics Scanner Market Insights

Europe is estimated to occupy a noteworthy share in Narcotics Scanner Market, owing to high-security regulations and high adoption rate of the advanced detection technologies along with high investments for the airports, seaports, and critical infrastructure. Scan narcotics using readily available handheld, table-top and walkthrough scanners for effective narcotics detection for public and workplace safety. Ion Mobility Spectrometry (IMS), infrared spectroscopy, and AI-assisted devices used for metal detector technologies significantly improve the accuracy of detection and operating efficiency of the devices. Moreover, infrastructural projects taken by governments to enhance border protection together with an increase in awareness regarding risks of drug trafficking is driving the consistent growth of the market. It also looks to continue regional focus on innovative, portable and low-cost scanners in all sectors.

Germany and U.K. Lead Narcotics Scanner Market Expansion Across Europe

Germany and the U.K. lead Narcotics Scanner Market expansion in Europe, driven by advanced technology adoption, stringent security regulations, extensive airport and border deployments, and growing investments in public safety infrastructure.

Latin America (LATAM) and Middle East & Africa (MEA) Narcotics Scanner Market Insights

Latin America and Middle East & Africa represent emerging markets in the Narcotics Scanner sector, with growing adoption driven by increasing security concerns, rising drug trafficking, and the need for enhanced border and transportation security. Handheld, table-top, and walkthrough scanners are being implemented across airports, seaports, and public infrastructure to detect narcotics efficiently. The adoption of advanced technologies such as Ion Mobility Spectrometry (IMS), infrared spectroscopy, and AI-assisted devices is gaining traction, supported by government initiatives and regulatory frameworks. Additionally, rising awareness of substance smuggling risks and investments in cost-effective, portable scanning solutions are driving steady market growth in these regions.

Narcotics Scanner Market Competitive Landscape

Smith’s Detection is a leading provider of advanced threat detection and screening technologies. Their portfolio includes the IONSCAN 600, a portable, non-radioactive trace detector for explosives and narcotics. This device enhances security screening efficiency, aiding in the detection and identification of illicit substances in various environments.

-

In September 2025, Smiths Detection Inc. launched the IONSCAN 600, a portable, non-radioactive trace detector for explosives and narcotics, improving security screening efficiency.

Teledyne FLIR specializes in thermal imaging and sensing technologies. Their Griffin G510X is a portable chemical detector designed for rapid identification of narcotics, including fentanyl. This device supports law enforcement and first responders in quickly analyzing substances, enhancing safety and operational efficiency in field conditions.

-

In October 2025, Teledyne FLIR introduced the Griffin G510X, a portable chemical detector enabling rapid identification of narcotics like fentanyl for law enforcement.

Thermo Fisher Scientific offers a range of analytical instruments, including the TruNarc Delta and Tau Handheld Narcotics Analyzers. Utilizing Raman spectroscopy, these devices provide rapid, non-destructive identification of narcotics, aiding law enforcement in the field by delivering quick and accurate substance analysis.

-

In May 2025, Thermo Fisher Scientific Inc. introduced TruNarc Delta and Tau Handheld Narcotics Analyzers using Raman spectroscopy for rapid substance identification.

Narcotics Scanner Market Key Players:

Some of the Narcotics Scanner Market Companies are:

-

OSI Systems Inc.

-

Smith’s Detection Inc.

-

FLIR Systems Inc.

-

Bruker Corporation

-

L3Harris Technologies

-

Nuctech Company Limited

-

Viken Detection

-

Thermo Fisher Scientific Inc.

-

CEIA SpA

-

DetectaChem LLC

-

Astrophysics Inc.

-

Chemring Group PLC

-

QinetiQ Group PLC

-

Leidos Holdings Inc.

-

Teledyne Photon Machines

-

Rigaku Corporation

-

Aventura Technologies, Inc.

-

Safran SA

-

Science Applications International Corporation (SAIC)

-

Elbit Systems Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 6.23 Billion |

| Market Size by 2033 | USD 11.63 Billion |

| CAGR | CAGR of 8.13% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Table-top, Handheld, Walkthrough) •By Technology (Ion Mobility Spectrometry (IMS), Contraband detection equipment, Visual inspection system, Infrared spectroscopy) •By Application (Airports, Seaports, Border Control, Public Transportation, Critical Infrastructure) •By End User (Airport, Defense & military, Law enforcement, Public transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | OSI Systems Inc. , Smiths Detection Inc., FLIR Systems Inc. Bruker Corporation, L3Harris Technologies, Nuctech Company Limited, Viken Detection, Thermo Fisher Scientific Inc., CEIA SpA, DetectaChem LLC, Astrophysics Inc., Chemring Group PLC, QinetiQ Group PLC, Leidos Holdings Inc., Teledyne Photon Machines, Rigaku Corporation, Aventura Technologies, Inc., Safran SA, Science Applications International Corporation (SAIC), Elbit Systems Ltd.., and Others. |