AI-Generated Video Game Dialogue Market Report Scope & Overview:

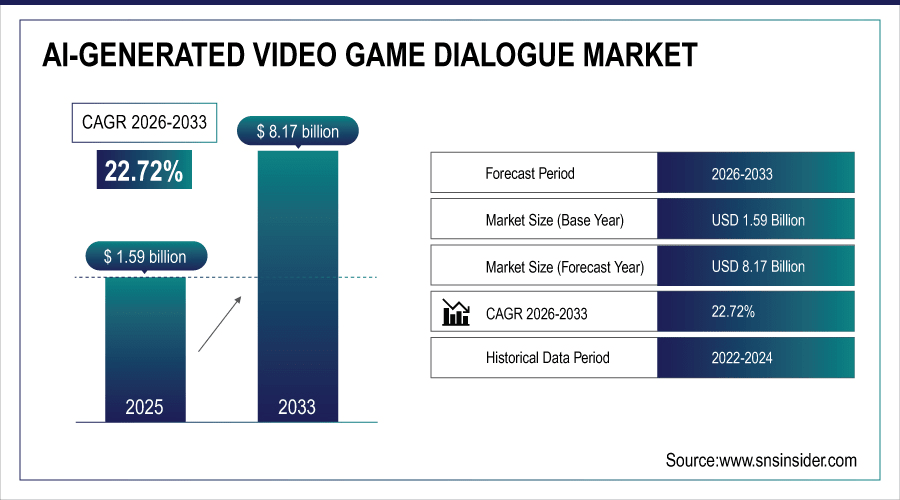

The AI-Generated Video Game Dialogue Market Size was valued at USD 1.59 Billion in 2025E and is expected to reach USD 8.17 Billion by 2033 and grow at a CAGR of 22.72% over the forecast period 2026-2033.

The growing need for a more interactive, immersive gaming experience is the key driving factor for the AI-Generated Video Game Dialogue Market. NPCs are expected to behave naturally in the game world, respond contextually to various inputs and react to player actions in a more natural manner than scripted dialogue can efficiently provide and that is something that can be accomplished using NLP tools. Furthermore, the increasing popularity of RPGs, simulation games and educational games that are heavily dependent on narrative and dialog are expanding the market, prompting studios to implement AI dialogue solutions to ease development and shorten time-to-market. According to study, AI dialogue integration can reduce NPC dialogue scripting time by 30–50%, accelerating development cycles.

To Get More Information On AI-Generated Video Game Dialogue Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 1.59 Billion

-

Market Size by 2033: USD 8.17 Billion

-

CAGR: 22.72% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

AI-Generated Video Game Dialogue Market Trends

-

NPC dialogues powered by AI provide a better gameplay experience as they are immersive, dynamic and context aware.

-

Adaptive dialogue in narrative-heavy games like RPGs for player engagement.

-

Developers reduce manual scripting time using scalable AI dialogue platforms.

-

Language localizes AI conversations that engage a deep, personal experience for players around the world.

-

An educational and simulation games expand using interactive, adaptive AI-driven storytelling.

-

Emerging markets fuel AI dialogue adoption, expanding audiences and revenue opportunities.

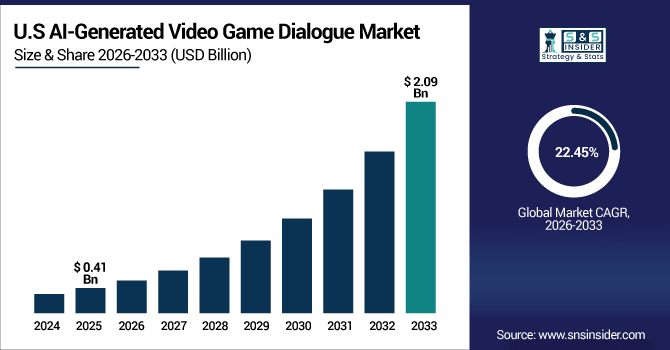

The U.S. AI-Generated Video Game Dialogue Market size was USD 0.41 Billion in 2025E and is expected to reach USD 2.09 Billion by 2033, growing at a CAGR of 22.45% over the forecast period of 2026-2033, due to a mature gaming industry, high AI adoption, advanced cloud platforms, strong AAA and indie studio presence, and growing demand for immersive, narrative-rich, and interactive player experiences.

AI-Generated Video Game Dialogue Market Growth Drivers:

-

Immersive AI Dialogue Transforms Gaming Experiences, Boosting Engagement and Replay ability Worldwide

The rising demand for more immersive, engaging, and interactive gaming experience is the major driving force for the growth of the AI-Generated Video Game Dialogue Market. Today's gamers demand that NPCs act like real people, respond contextually to player decisions and offer dynamic, branching dialogue and traditional, scripted methods fall short here. Game developers can create adaptable, situation-responsive chat with the use of AI voice chat systems to make their story, relationship engagement, and replay gain a new dimension. These tools are especially beneficial for genres that are heavily narrative-based, such as role-playing games, simulation games, and educational games. Not only do AI dialogue solutions reduce manual scripting effort and minimize development time, but they also allow studios to scale content for the volume of assets needing to be developed at a more efficient rate, making the technology an integral part of modern game development pipelines.

AI dialogue systems can generate 3–5x more branching dialogues than traditional scripting.

AI-Generated Video Game Dialogue Market Restraints:

-

High Costs And Technical Complexity Limit Adoption Of AI Dialogue Systems

Despite the advantages, the adoption of AI-generated dialogue systems faces challenges due to high implementation costs and technical complexity. It takes huge investment in infrastructure, cloud services and a team of talented AI / ML engineers to build or integrate AI dialogue engines. Those costs are likely too steep for smaller studios or indie developers, which will prevent market penetration in these segments. It also highlights the need for ongoing model training and testing to ensure realistic, context-aware dialogues, extending development cycles. Dialogue output that is inconsistent or worse inappropriate, for culturally diverse games, may also represent a risk associated with loss of player experience or even, brand reputation.

AI-Generated Video Game Dialogue Market Opportunities:

-

Emerging Markets Offer Multilingual AI Dialogue Growth And Expanding Game Audiences

A major opportunity lies in expanding AI dialogue adoption in emerging gaming markets across Asia-Pacific, Latin America, and the Middle East. These are regions with fast expanding gaming audiences and rising smartphone and console penetration. Dialog systems using AI can create content based on different languages and cultures, allowing developers to target a wider segment at a lesser effort. Moreover, the growing demand for educational and simulation games in these territories further boosts growth prospects, with AI-generated dialogue allowing for tailored learning and interactive storytelling experiences, thereby creating additional revenue channels for studios as well as service providers.

Educational and simulation games account for 20–25% of AI dialogue integration in emerging markets.

AI-Generated Video Game Dialogue Market Segmentation Analysis:

-

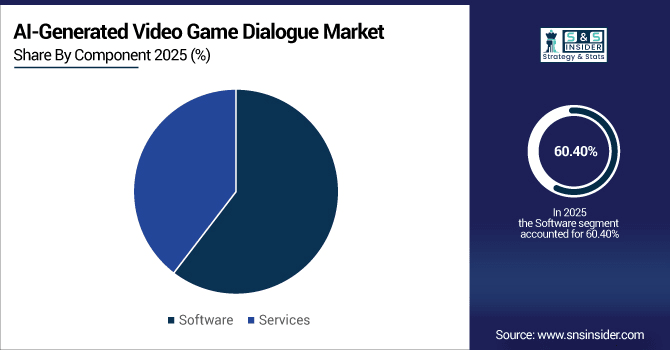

By Component: In 2025, Software led the market with share 60.40%, while Services are the fastest-growing segment with a CAGR 22.04%.

-

By Application: In 2025, Role-Playing Games the market 34.20%, while Educational Games fastest-growing segment with a CAGR 23.16%.

-

By Deployment Mode: In 2025 Cloud-Based led the market with share 65.24%, with the fastest-growing segment with a CAGR 23.28%.

-

By End Use: In 2025, Game Developers led the market with share 41.34%, while Independent Studios is the fastest-growing segment with a CAGR 21.70%.

By Component, Software Leads Market and Services Fastest Growth

In the AI-Generated Video Game Dialogue Market, the Software segment is expected to dominate the market, as most game developers and studios are adopting AI-powered Dialogue Engines and tools to design dynamic, context-aware NPC interactions quickly. In modern game development pipelines, software solutions lie at the heart of new methodologies that allow studios to minimize manual scripting efforts, deepen narrative experience and scale content across multiple games. On the other hand, Services is the fastest-growing segment, with growth due to rising demand for AI integration, consulting, customization, and managed solutions, especially among smaller studios and in emerging markets. This has accelerated the worldwide adoption of AI dialogue systems as the services provide a way for developers to build these systems without a reliance on heavy infrastructure.

By Application, Role-Playing Games Leads Market and Educational Games Fastest Growth

In the AI-Generated Video Game Dialogue Market, the Role-Playing Games segment dominates in the AI-Generated Video Game Dialogue Market due to high dependency on narrative depth and interactive storytelling requiring extensive NPC dialogues and branching conversations. RPG developers are seeing more and more benefits from implementing these solutions, which offer immersive, context-aware experiences, enhance player engagement, and increase replay ability across multiple paths of gameplay by generating responsive dialogue. On the other hand, the Educational Games segment is anticipated to grow the fastest due to the increasing requirement for personalized learning, interactive storytelling, and adaptive content. The integration of AI dialogue allows educational games to provide a personalized experience, cater to multilingual learners, and facilitate higher knowledge retention, presenting a lucrative opportunity for developers & service providers globally, within this segment.

By Deployment Mode, Cloud-Based Leads Market with Fastest Growth

Based on deployment, the cloud-based segment dominates the AI-Generated video game dialogue market by offering scalability, easy integration, seamless continuous delivery, and real-time capable automatic dialogue generation that can support high levels of concurrency for online-playable video games on multiple platforms such as PC, consoles, and mobile. Cloud solutions give game developers the ability to work remotely, minimize infrastructure expenditure and enable a more efficient rollout of updates, making them the go-to solution for AAA and indie studios alike. It is also the fastest-growing segment for this reason as well, in particular due to the growing use of cloud AI services, adoption of multilingual, and adaptive dialogue, as well as emerging gaming markets that contribute to the rapid integration of AI dialogue worldwide.

By End Use, Game Developers Lead Market and Independent Studios Fastest Growth

Game Developers emerge as the dominant end-user in the AI-Generated Video Game Dialogue market, utilizing AI-powered dialogue tools to bring immersive, dynamic, and context-aware NPC interactions to life across various game genres. Such developers from the AI dialogue benefit by a reduction of manual scripting, accelerated development cycles, and deeper narratives which makes it emerging as an integral element of today’s game production pipeline. Meanwhile, Independent Studios are the fastest-growing sector, requiring affordable, scalable and customizable AI dialogue tools. The data also reveals how AI tools are slowly, but steadily being utilized into the how the games are being developed to prepare newer story lines, facilitate multi lingual content and customizable games with faster pace and adoption due to small studios adopting and facilitating the gaming market worldwide.

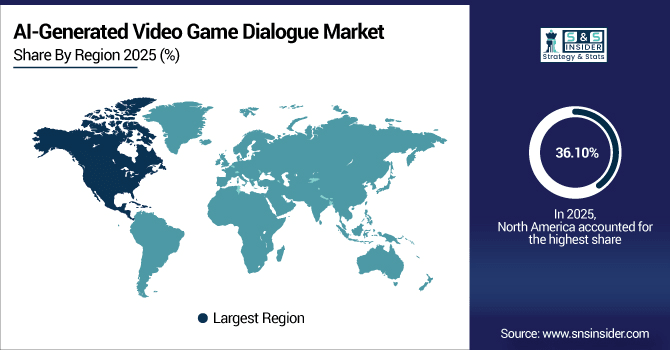

AI-Generated Video Game Dialogue Market Regional Analysis:

North America AI-Generated Video Game Dialogue Market Insights:

The AI-Generated Video Game Dialogue Market in North America held the largest share 36.10% in 2025, due to a mature gaming industry, high adoption of advanced technologies, and substantial investment in AI-driven game development. The major studios, AAA game publishers and established development pipelines allow for swift integrations of AI dialogue solutions. In addition, the increasing inclination towards immersive, narrative-oriented RPGs, action-adventure, and simulation games also boosts adoption. Cloud based AI platforms and recommendations system are also available for better engagement and replay ability at providing multilingual dialogue tools. North America continues to be the top global market due to its apparent strong infrastructure, high gamer population, and constant innovation in the industry.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Dominates AI-Generated Video Game Dialogue Market with Advanced Technological Adoption

The U.S. dominates the AI-Generated Video Game Dialogue Market, driven by advanced technology adoption, mature gaming industry, high investment in AI-driven development, widespread cloud-based platforms, and strong demand for immersive, narrative-rich, and interactive gaming experiences across multiple genres.

Asia-Pacific AI-Generated Video Game Dialogue Market Insights

In 2025, Asia-Pacific is the fastest-growing region in the AI-Generated Video Game Dialogue Market, projected to expand at a CAGR of 24.28%, due to increasing number of gamers along with penetration of smartphones and consoles and increasing use of AI based cloud solutions. RPGs, simulation and educational games that often depend on interactive, AI-generated dialogues are growing rapidly in countries such as China, Japan and Korea. The multilingual and culturally adapted AI dialogue systems are increasingly being adopted by developers in the region to meet the needs of a wider audience. In addition, the growth of indie studios and digital distribution platforms hasten AI adoption consequently Asia-Pacific is significant market for growth and potential income in the world application landscape.

China and India Propel Rapid Growth in AI-Generated Video Game Dialogue Market

China and India drive rapid growth in the AI-Generated Video Game Dialogue Market, fueled by expanding gamer populations, increasing smartphone adoption, rising demand for interactive games, and AI-driven multilingual dialogue integration.

Europe AI-Generated Video Game Dialogue Market Insights

Europe accounts for a substantial portion of the AI-Generated Video Game Dialogue Market due to an established gaming ecosystem, robust technological infrastructure, and early acceptance of AI-driven dialogue systems. Developers across the region have been making use of AI to provide immersive, adaptive, and multilingual NPC interactions that become an integral part of storytelling and replay ability across genres. The rise of demand for narrative-heavy RPGs, simulations and educational games has played the role of catalyst for AI dialogue incorporation. Cloud-based platforms, advanced AI services, and personalized gaming experiences further enhance steady market expansion. The region has a variety of players and innovation that make Europe an important part of the global market expansion.

Germany and U.K. Lead AI-Generated Video Game Dialogue Market Expansion Across Europe

Germany and the U.K. lead AI-Generated Video Game Dialogue Market expansion across Europe, driven by advanced gaming industries, early AI adoption, strong infrastructure, and high demand for immersive, narrative-rich gaming experiences.

Latin America (LATAM) and Middle East & Africa (MEA) AI-Generated Video Game Dialogue Market Insights

The Growth in Latin America and Middle East & Africa, represents emerging growth regions in AI-Generated Video Game Dialogue Market with rapidly developing gamer population, smartphone and console penetration, and digital infrastructure. As an example, RPG, simulation and educational games driven by AI-powered interactive dialogues are getting increasing traction in Brazil, Mexico, UAE and Saudi Arabia. Multilingual and culturally adapted dialogue systems are getting implemented by developers in order to make the solution more interactive to the different audiences. Furthermore, the cloud-based AI solutions let studios scale efficiently, opening doors to expanding in new markets and generating revenue in the Latin American and the Middle East and Africa regions.

AI-Generated Video Game Dialogue Market Competitive Landscape

Microsoft leverages Azure AI to provide developers with scalable, intelligent tools for creating context-aware game dialogues. By integrating AI-driven conversational systems into games, studios can automate NPC interactions, support multilingual content, and enhance immersive experiences. Azure AI accelerates development workflows and reduces manual scripting, enabling faster deployment and adaptive, interactive gameplay.

-

In May 2025, Microsoft (Azure AI) enhanced Azure AI tools, enabling developers to build intelligent applications with AI-driven game dialogue systems.

Google DeepMind is advancing AI-generated video game dialogue through its Genie 3 world model, capable of creating dynamic 3D environments and interactive NPC interactions from text prompts. This innovation enables developers to design immersive, adaptive game worlds, enhancing storytelling, realism, and player engagement across RPGs, simulations, and educational titles.

-

In Aug 2025, Google DeepMind introduced Genie 3, a world model generating dynamic 3D environments from text prompts for gaming and simulations.

NVIDIA’s ACE (Autonomous Conversational Entities) technology drives the creation of intelligent, autonomous game characters. These AI-driven NPCs perceive, plan, and act like human players, generating dynamic dialogues and responsive interactions. NVIDIA’s solutions enhance gameplay realism, enable immersive storytelling, and provide developers with GPU-accelerated AI tools for real-time conversational experiences across diverse game environments.

-

In Jan 2025, NVIDIA has expanded its ACE (Autonomous Conversational Entities) technology from conversational NPCs to autonomous game characters that perceive, plan, and act like human players.

AI-Generated Video Game Dialogue Market Key Players:

Some of the AI-Generated Video Game Dialogue Market Companies are:

-

Inworld AI

-

Replica Studios

-

Charisma.ai

-

Latitude (AI Dungeon)

-

Unity Technologies

-

Google DeepMind

-

Microsoft (Azure AI)

-

NVIDIA

-

Obsidian Entertainment

-

Sony Interactive Entertainment

-

Electronic Arts (EA)

-

Ubisoft

-

Epic Games

-

Rockstar Games

-

Activision Blizzard

-

Square Enix

-

CD Projekt

-

Take-Two Interactive

-

Bandai Namco Entertainment

-

Bethesda Softworks.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.59 Billion |

| Market Size by 2033 | USD 8.17 Billion |

| CAGR | CAGR of 22.72% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Application (Role-Playing Games, Action/Adventure Games, Simulation Games, Educational Games, Others) • By Deployment Mode (On-Premises, Cloud-Based) • By End-User (Game Developers, Game Publishers, Independent Studios, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Inworld AI, Replica Studios, Charisma.ai, Latitude (AI Dungeon), Unity Technologies, Google DeepMind, Microsoft (Azure AI), NVIDIA, Obsidian Entertainment, Sony Interactive Entertainment, Electronic Arts (EA), Ubisoft, Epic Games, Rockstar Games, Activision Blizzard, Square Enix, CD Projekt, Take-Two Interactive, Bandai Namco Entertainment, Bethesda Softworks, and Others. |