Drone Analytics Market Report Scope & Overview:

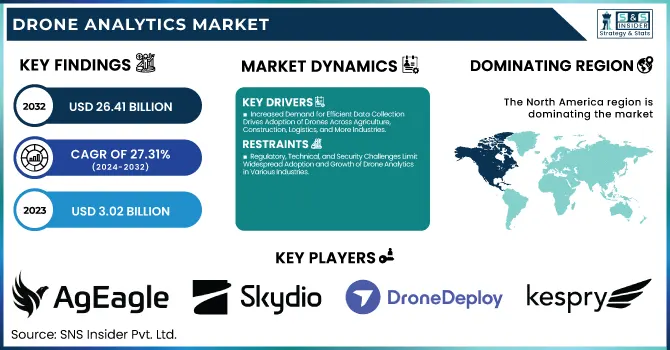

The Drone Analytics Market was valued at USD 3.02 billion in 2023 and is expected to reach USD 26.41 billion by 2032, growing at a CAGR of 27.31% from 2024-2032.

To Get more information on Drone Analytics Market - Request Free Sample Report

This report includes key insights into the market's adoption rate, cost analysis, regulatory compliance statistics, R&D investment trends, and data accuracy & efficiency. The rapid adoption of drone analytics across various industries, coupled with falling operational costs and significant investments in research and development, is driving market growth. Regulatory frameworks are evolving to ensure safe and efficient drone operations. Innovations in data accuracy and efficiency are enhancing the overall effectiveness of drone analytics, fueling their widespread use in sectors like agriculture, construction, and logistics.

Drone Analytics Market Dynamics

Drivers

-

Increased Demand for Efficient Data Collection Drives Adoption of Drones Across Agriculture, Construction, Logistics, and More Industries

The increasing demand for effective and inexpensive data collection practices is driving the use of drones in various sectors. Drones provide a differentiating factor with their ability to capture high-definition, real-time data in areas that are hard to reach with traditional methods of data collection that are labor-based. This advantage is especially welcome in industries such as agriculture, where they can be employed in crop monitoring and soil testing, and construction, where drones support surveying and project monitoring. Additionally, industries such as logistics and mining are utilizing drones to inspect sites and manage inventory. As companies are relying more and more on accurate data to enhance operations, drones have emerged as a vital resource, propelling their increasing usage and adoption in multiple markets.

Restraints

-

Regulatory, Technical, and Security Challenges Limit Widespread Adoption and Growth of Drone Analytics in Various Industries

Stringent regulatory systems and airspace prohibitions in various locations present immense challenges for the widespread use of drones in analytics. Most regulations restrict drone use, hindering complete deployment in some sectors. High upfront expenses for drones, software, and upkeep are also economic barriers, especially for small and medium-sized businesses. Privacy issues based on the collection of sensitive information also present apprehensions regarding the use of drones. Technological constraints, e.g., battery life, carrying capacity, and range, can limit the productivity and use of drones in business. Weather like rain or winds also hinders drone activities, while the limited availability of talented operators and analysts makes it more difficult to enjoy smooth market development and use.

Opportunities

-

AI Integration, Smart Cities, and Industry Applications Drive Significant Growth Opportunities in the Drone Analytics Market

The integration of machine learning and AI with drone analytics is unlocking new possibilities by streamlining data processing, accuracy in prediction, and automation. It opens the gates to more accurate analysis in areas such as agriculture, where drones are used to streamline crop monitoring and yield estimation. The growth of smart cities provides more opportunities as drones are capable of enabling urban management and infrastructure surveillance. In disaster response, drones are emerging as key instruments for real-time data gathering, enhancing emergency response. The oil and gas industries are also embracing drones for monitoring and pipeline inspection. The insurance sector also gains from drones for effective damage assessment, while e-commerce firms are investigating drones for quicker, cheaper last-mile delivery options, propelling logistics growth.

Challenges

-

Weather, Regulatory, and Operational Barriers Limit the Widespread Adoption and Growth of the Drone Analytics Market

Adverse weather, like heavy rain, fog, or high winds, can greatly hamper drone operations, impacting their reliability for data gathering. Furthermore, stringent regulations on the use of drones, airspace limitations, and data privacy issues are key hindrances to widespread adoption. Steep operational expenses for drones, such as maintenance, upgrades, and analytics software, also restrict market access for small businesses. Technical constraints, including battery life, payload capacity, and range of operation, also affect drone efficiency in some sectors. The absence of skilled operators and data analysts also makes it challenging to exploit the full potential of drone analytics. In addition, concerns regarding privacy and surveillance among the public can discourage consumer acceptance and pose difficulties for companies seeking to use drones in their operations.

Drone Analytics Market Segment Analysis

By Deployment

The On-Premises segment led the Drone Analytics Market with the largest revenue share of 65% in 2023 because of its popularity among large businesses for data security and control. Organizations dealing with sensitive information tend to use on-premises solutions to maintain compliance with stringent regulations and protect proprietary data. The fact that it can store and manage data within their own infrastructure also gives improved performance, reliability, and scalability, making it the first choice of many industries.

The On-Demand segment is expected to grow at the fastest CAGR of 28.48% during the period 2024-2032, owing to the growing need for flexibility and cost-effectiveness. Companies are increasingly opting for cloud-based solutions in order to steer clear of the exorbitant initial investments and maintenance expenses for on-premises systems. On-demand services provide scalability, instant access to data, and lower operational overheads, rendering them very popular among small businesses and startups, especially across sectors like agriculture and logistics.

By Solution

The End-to-End solutions segment led the Drone Analytics Market with the largest revenue share of around 66% in 2023, as these end-to-end solutions provide businesses with end-to-end analytics capabilities from data collection to processing and insights. Businesses opt for end-to-end solutions due to their capability to simplify operations, minimize integration complexity, and offer a single platform. This segment is preferred by big businesses looking for efficiency and cost savings in handling intricate drone data across sectors such as agriculture, construction, and infrastructure.

The Point Solutions segment will grow at the fastest CAGR of approximately 28.93% during 2024-2032 owing to the growing need for specialized, customized solutions for particular tasks. Companies like point solutions for their capability to solve specific problems, e.g., crop monitoring, infrastructure inspection, or environmental monitoring. Point solutions are affordable, simple to implement, and scalable, which makes them especially appealing to small and medium-sized businesses that want to streamline specific operations without having to invest in full systems.

By End Use

The Power & Utility segment dominated the Drone Analytics Market with a maximum revenue contribution of 30% in 2023 because of the essential necessity to inspect, maintain, and monitor infrastructure such as power cables, pipelines, and energy plants frequently. Drones offer an optimal method for a safe, economical, and effective means to receive real-time insights, providing instantaneous fault detection or inefficiencies identification. The emphasis of this industry on minimizing cost of operations, improving safety, and enhancing reliability has led to the large-scale implementation of drone analytics.

The Construction & Infrastructure segment is expected to grow at the fastest CAGR of 29.50% during 2024-2032 as a result of growing needs for accurate, real-time information for project management, surveying, and inspection. Drones facilitate more efficient and precise site surveys, 3D modeling, and progress monitoring, which can improve decision-making and minimize delays. Increasing smart technology applications across construction and demands for enhanced monitoring and safety are compelling the high growth of drone analytics in this industry.

By Application

The Thermal Detection segment led the Drone Analytics Market with the largest revenue share of approximately 35% in 2023 because it has the capability to offer vital insights in use cases such as power line inspections, building surveys, and environmental monitoring. Thermal drones are capable of detecting temperature differences that are not visible to the human eye, assisting in identifying equipment failures, fire risks, and energy waste. This ability has rendered thermal detection essential in businesses like utilities, construction, and firefighting, leading to market leadership.

The 3D Modeling segment is expected to expand at the fastest CAGR of approximately 29.09% during the forecast period of 2024-2032 owing to the growing demand for detailed, precise visualizations in construction, architecture, and urban planning industries. 3D modeling facilitates exact mapping and visualization of structures, terrains, and environments for improved decision-making and project planning. As industries embark on digital transformation and require more effective design and monitoring, the pace of demand for advanced 3D modeling with drones is building up.

Regional Analysis

North America led the Drone Analytics Market with the largest revenue share of around 37% in 2023 owing to the region's sophisticated technological infrastructure, early embracement of drone solutions, and robust presence of major market players. The U.S. and Canada have invested heavily in drone technology for a range of industries, including agriculture, construction, energy, and defense. Additionally, favorable government regulations, innovations in AI and machine learning, and widespread commercial drone applications have contributed to North America's market dominance.

Asia Pacific is anticipated to grow at the fastest CAGR of approximately 29.99% during 2024-2032 based on high urbanization, rising infrastructure spending, and widening use of drones across industries such as agriculture, construction, and logistics. China, India, and Japan are spending significantly on drone technology to enhance efficiency, lower the costs, and resolve key issues in agriculture, disaster management, and transportation. The increasing technology environment in the region is fueling high market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

AgEagle (eBee X, FarmLens)

-

Skydio (Skydio 2+, Skydio X10)

-

DroneDeploy (DroneDeploy Flight App, DroneDeploy Analytics)

-

Kespry (Kespry 2S, Kespry Cloud)

-

Insitu (ScanEagle, Integrator)

-

Parrot (Anafi AI, Sequoia)

-

AeroVironment (Quantix Recon, Puma 3 AE)

-

ESRI (ArcGIS Drone2Map, Site Scan for ArcGIS)

-

Draganfly (Commander 3XL, Draganflyer X4-P)

-

PrecisionHawk (Lancaster 5, PrecisionAnalytics)

-

Viatechnik (Virtual Design & Construction, Reality Capture)

-

Pix4D (Pix4Dmapper, Pix4Dfields)

-

Options (Not enough publicly available product information)

-

HUVRdata (HUVR Platform, Inspection Data Management)

-

DJI (Matrice 300 RTK, Phantom 4 RTK)

-

3D Robotics (Site Scan, Solo)

-

Sentera (Sentera PHX, Sentera Double 4K)

-

Agribotix (Agribotix FarmLens, Agribotix Drone Data Services)

-

Airware (Airware Analytics, Airware Cloud)

-

Delta Drone (Delta X, Delta Y)

-

Optelos (Optelos Visual Intelligence, Optelos Drone Data Management)

Recent Developments:

-

In November 2024, AgEagle Aerial Systems secured 17 new purchase orders for its eBee TAC drones from U.S. defense and security customers. This strengthens the company's position in the tactical intelligence, surveillance, and reconnaissance (ISR) market.

-

In June 2024, Parrot showcased its ANAFI USA drone at Eurosatory, highlighting its role in modernizing the French Army as part of the Scorpion program. The drone’s advanced capabilities were presented for military and defense applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.02 Billion |

| Market Size by 2032 | USD 26.41 Billion |

| CAGR | CAGR of 27.31% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-Premises, On-Demand) • By Solution (End-to-End Solutions, Point Solutions) • By End Use (Power & Utility, Construction & Infrastructure, Oil & Gas, Agriculture, Transportation & Logistics, Others) • By Application (Thermal Detection, Aerial Monitoring, Ground Exploration, 3D Modelling, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AgEagle, Skydio, DroneDeploy, Kespry, Insitu, Parrot, AeroVironment, ESRI, Draganfly, PrecisionHawk, Viatechnik, Pix4D, Options, HUVRdata, DJI, 3D Robotics, Sentera, Agribotix, Airware, Delta Drone, Optelos |