Data Centre UPS Market Report Scope & Overview:

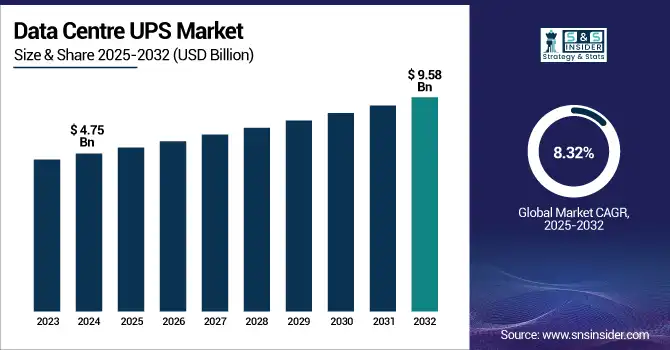

The Data Centre UPS Market size was worth USD 4.75 billion in 2024 and is anticipated to be USD 9.58 billion by 2032, registering a CAGR of 8.32% during the forecast period of 2025-2032.

To Get more information on Data Centre UPS Market - Request Free Sample Report

The Data Centre UPS market is growing due to rising data traffic, cloud computing, and the demand for secure power in edge and hyperscale data centers. Digital transformation within industries and increased data protection regulation also boost investment in continuous power solutions to ensure business continuity, reduce downtime, and aid in the growing global digital infrastructure.

According to the 2024 Uptime Institute Global Data Center Survey, demand for UPS systems will continue to increase as operators increasingly aim to improve infrastructure resiliency, with 40% of operators experiencing higher redundancy levels within their primary data centers during the last three to five years.

In fact, 55% of data center operators have experienced outages in the past three years, and 25% have resulted in over USD 1 million in costs, emphasizing the critical role for dependable UPS solutions to prevent costly power outages and ensure business continuity.

Huawei Technologies delivers 99.1% efficient UPS systems and 0 ms switchover in S-ECO mode. Huawei also employs AI-based optimization to improve the efficiency of energy, ensuring that power is used sustainably and lowering operation costs in data centers.

U.S. Data Centre UPS Market size was valued at USD 1.36 billion in 2024 and is expected to reach USD 2.51 billion by 2032, growing at a CAGR of 8.00% from 2025-2032.

The U.S. Data Centre UPS market is expanding due to the rise in data centers, increased usage of cloud, and mounting demand for uninterrupted power in mission-critical IT infrastructure. The spurt in digital services, AI implementation, and remote work culture also boosts the demand for scalable, dependable UPS systems across the country.

According to research, as of March 2025, there were reported 5,426 data centers in the United States the highest number in any nation globally emphasizing the high demand for strong power backup systems.

Data Centre UPS Market Dynamics

Drivers

• Increased speed of data creation and cloud computing need is driving the requirement for stable power continuity in data centres.

The sudden explosion of digital data, driven by AI, IoT, and cloud computing, requires robust infrastructure to deliver uptime. 24/7 operation data centers require UPS systems to prevent downtime and data loss. With the transition of businesses to cloud and hybrid IT infrastructures, the demand for dependable power solutions is increasing. The growth of hyperscale data centers and government digitalization also fuels demand for scalable, efficient UPS systems.

Fuji Electric Co., Ltd.'s expansion project to raise capacity by 50% and add more efficient systems is a sign of such additional demand as well as the new trend towards new energy-saving UPS solutions.

Vertiv foresees that AI workloads will require UPSes with greater power densities to address sudden load dynamics, from 10% underload to 150% overloading, highlighting the dynamic performance needs for AI-enabled infrastructure.

Restraints

• Limited technical knowledge and availability of skilled personnel hinder effective deployment and upkeep of advanced UPS systems.

Implementation of sophisticated UPS technologies such as modular architecture, lithium-ion batteries, and remote monitoring needs expertise. Lack of trained personnel in power management and UPS maintenance impedes seamless implementation, resulting in inefficiencies in operations and increased failure likelihood. For operators of data centers, particularly in the emerging markets, recruiting qualified individuals or upskilling teams proves to be logistics- and cost-related challenges. Such talent shortages not only hinder the development of markets but also increase dependence on third-party providers, which may not always prove cost-effective or feasible.

Opportunities

• Lithium-ion battery technology integration offers new prospects for high-performance, compact, and energy-efficient UPS solutions in data centres.

Lithium-ion is a prime example of an innovative technology that get at longer life, lower profile and higher energy density that serves as a very suitable alternative for lead-acid for the UPS market. Batteries recharge quicker, are less maintenance-intensive, and exhibit improved environmental performance, making them suitable for the newer data center infrastructure. Modular UPS systems backing them up and facilitating predictive maintenance, lithium-ion solutions enhance reliability. As the cost decreases, it is more viable, inviting energy-efficient and environmentally friendly data centers, driving the transition to more environmentally sound backup power options.

For instance, Mitsubishi Electric's lithium-ion UPS batteries retain a 15–20 year life cycle, 4 times power density of conventional batteries, a 40–60% smaller footprint, 60% lower weight, enhanced safety, and lower cost of ownership through fewer replacement and maintenance.

Challenges

• Environmental and regulatory limits challenge the conformity and sustainability of old UPS systems for modern data centres.

Traditional UPS systems are being regarded as inefficient in terms of power consumption, heat generation and battery disposal, so they face rising pressure to lower energy reduction and carbon footprint. Stringent regulation of electronic waste and emissions push data center owners to modernize systems towards cleaner alternatives. Compliance will require retrofitting existing infrastructure and investments in green solutions that raise costs.Manufacturers face the challenge of innovating with recyclable material and space-efficient designs, thereby posing a challenge to balancing sustainability and providing an unbroken power supply.

According to research, data centers account for a minimum of 4% of all U.S. energy use, rising to more than 25% in Virginia and again demonstrating environmental concerns and the importance of clean power solutions

Data Centre UPS Market Segment Analysis

By Setup

Centralized UPS segment dominated the Data Centre UPS market share during 2024 with a revenue share of approximately 66% due to the fact that they are able to supply large, high-density data centers with top-of-the-line power backup. Centralized UPS systems provide centralized management, reduced complexity of maintenance, and enhanced efficiency at scale, which is appropriate for enterprise and colocation environments where high-scale availability of power across infrastructure is needed.

The distributed UPS market is expected to expand at the fastest CAGR of 9.61% during 2025 to 2032, with increasing edge computing and decentralized IT infrastructures fueling the demand. Increased adoption of modular and scalable deployment in smaller or distant facilities, particularly in Tier 2 and Tier 3 cities, is stimulating the need for flexible, localized power solutions that are deployable and manageable near data generation points.

By UPS Architecture

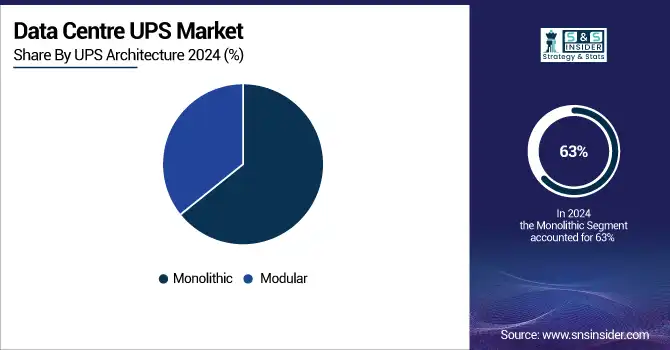

The monolithic segment dominated the Data Centre UPS market in 2024 with a revenue of 63% because of its established leadership in mission-critical applicationsIts established reliability, power density, and support for centralized architectures make it the ideal candidate for large-scale enterprise and legacy applications needing fault tolerance and stability over modular flexibility.

Modular UPS systems will grow at the highest CAGR of 9.44% during 2025-2032 due to the growing need for scalable and space-efficient solutions. Organizations are using modular architecture increasingly to be in sync with fluctuating workloads, support rapid growth, and minimize downtime for maintenance. Particularly, hyperscale and cloud environments that are keen on agility and powerefficiency fall in this category.

By End Use

The IT & Telecommunications segment contributed the largest revenue proportion of approximately 30% in 2024 due to the industry's inherent need for high-availability data and network availability. With enormous volumes of data traffic, low-latency needs, and widespread dependence on digital infrastructure, IT companies and telecommunication operators invest in fail-safe UPS solutions to provide continuous services and high-stringency SLAs.

The BFSI sector is likely to post the highest CAGR of 10.42% during 2025-2032 with the rapid digitalization, use of online banking, and stringent regulatory requirements. With banks upgrading their infrastructure and enhancing digital services, the need for high-performance UPS systems with secure, always-on power backup has gained momentum, driving investments in minimizing risk and protecting data.

By Data Center Size

Small data centers (20 kVA to 200 kVA) held the largest revenue market share of 47% in 2024 due to the fact that they are widely deployed in enterprise branch offices, edge facilities, and mid-sized IT settings. They are economical, involve fewer installation complexities, and are aligned with shifting distributed IT models, which has made them a key ingredient for facilitating modern business continuity strategies.

Big data centers (over 500 kVA) are anticipated to record the highest growth CAGR of 10.23% during 2025-2032, driven by hyperscale expansion, cloud service expansion, and AI workloads. These centers need high-capacity, fault-tolerant UPS systems to handle high-density computing operations and power densities, and hence are best investment opportunities as global data consumption rises.

By Product

Double conversion UPS systems led the market in 2024 with a 58% revenue market share as they offer better power protection features and are more apt for mission-critical usage. Their ability to provide clean, uninterrupted power by breaking equipment from power outages makes them inevitable in data centers where even brief outages can result in huge losses.

The line interactive UPS market will develop at the highest growth rate of 9.73% between 2025 and 2032, due to growing applications in small and medium-sized installations for moderate power. Its cost-friendly design, high energy efficiency, and ability to manage minor undulations make it a choice pick for edge computing sites and distributed networks requiring durable yet economical backup options.

Regional Analysis

North America led the Data Centre UPS market with the largest revenue share of approximately 38% in 2024 due to a well-developed data center infrastructure, high cloud computing penetration, and heavy investments from leading tech players. The region also enjoys strong hyperscale data center presence and growing demand for sophisticated UPS systems to provide data security, operational continuity, and adherence to rigorous power reliability and uptime requirements.

The U.S. dominated the Data Centre UPS market due to advanced IT infrastructure, high data center density, strong cloud adoption, and continuous investments in power reliability solutions.

The Asia Pacific is anticipated to attain the highest growth rate of about 10.19% during the forecast period 2025-2032 due to aggressive digitalization, growing internet penetration, and enhanced investments in new data centers across nations such as China, India, and Southeast Asia. The growth is also driven by favorable government policies supporting digital infrastructure, increasing cloud services, and increasing demand for scalable UPS solutions in developing economies with increasing enterprise and consumer data needs.

China is driving the Data Centre UPS market with its rapid growth in data centers, strong adoption of cloud computing, and deep investments into digital infrastructure, driving demand for power solutions that are reliable.

Europe dominates the Data Centre UPS market because of the region's advanced digital infrastructure, high data security demand, and stringent regulatory measures. Growing adoption of cloud along with investments in green and energy-efficient data centers also drives the market further.

Germany is dominating the Data Centre UPS market in Europe due to its advanced IT infrastructure, high concentration of data centers, strong industrial base, and investments in alternative energy solutions for data center operations.

The Middle East & Africa and Latin America are increasingly gaining momentum in the Data Centre UPS market due to increasing digital infrastructure, increasing uptake of cloud infrastructure, and increasing demand for reliable power solutions across emerging economies. Data center and connectivity investment is additionally driving market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Data Centre UPS Market Companies included ABB Ltd., Vertiv Group Corp., Eaton Corp., Schneider Electric, Emerson Electric Co., General Electric Company, Mitsubishi Electric Corporation, Huawei Technologies, Delta Electronics, Inc., Legrand, Toshiba International Corporation, Fuji Electric Co., Ltd., AMETEK, Inc.

Recent Developments:

-

In October 2023, Eaton launched a new software platform as part of its Brightlayer Data Centers suite. This platform unites asset management, IT and operational technology device monitoring, and power quality metrics in a single application, aiming to enhance sustainability, resiliency, and performance of critical infrastructure in data centers.

-

In December 2024, Vertiv introduced the PowerUPS 9000, a compact, high-power density UPS system designed for large data centers and critical applications. It offers scalability, energy efficiency with up to 97.5% double-conversion efficiency, and a 32% smaller footprint compared to previous models.

-

In 2023, Huawei introduced the next-generation indirect evaporative cooling solution EHU, achieving a Power Usage Effectiveness (PUE) as low as 1.15 and water usage effectiveness of 0.6 L/kWh, enhancing energy efficiency and reliability in large data centers.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 4.75 Billion |

| Market Size by 2032 | USD 9.58 Billion |

| CAGR | CAGR of 8.32% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Setup (Centralized, Distributed) • By UPS Architecture (Monolithic, Modular) • By Data Center Size (Small Data Centers [20 kVA to 200 kVA], Medium Data Centers [200.1 kVA to 500 kVA], Large Data Centers [More than 500 kVA]) • By Product (Line Interactive, Standby, Double Conversion) • By End Use (IT & Telecommunications, BFSI, Healthcare, Government, Manufacturing, Media & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ABB Ltd., Vertiv Group Corp., Eaton Corp., Schneider Electric, Emerson Electric Co., General Electric Company, Mitsubishi Electric Corporation, Huawei Technologies, Delta Electronics, Inc., Legrand, Toshiba International Corporation, Fuji Electric Co., Ltd., AMETEK, Inc. |