Online Event Ticketing Market Report Scope and Overview:

The Online event ticketing market size was valued at USD 72.84 Billion in 2024. It is expected to hit USD 107.1 Billion by 2032 and grow at a CAGR of 4.96 % over the forecast period of 2025-2032.

Get More Information on Online event ticketing market - Request Sample Report

Online Event Ticketing Market Size and Forecast:

-

Market Size in 2024: USD 72.84 Billion

-

Market Size by 2032: USD 107.1 Billion

-

CAGR: 4.96% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Online Event Ticketing Market Key Trends:

-

Mobile-first and contactless ticketing – Widespread adoption of mobile apps, QR codes, and digital wallets is transforming the ticket purchase and entry process.

-

Virtual and hybrid events – The growth of hybrid event formats, combining physical and digital experiences, is expanding market opportunities.

-

Dynamic pricing strategies – Platforms are increasingly using real-time demand data to adjust ticket prices, optimizing revenue and enhancing accessibility.

-

Enhanced security and fraud prevention – Use of blockchain, AI, and identity verification technologies is helping reduce counterfeit tickets and fraudulent activities.

-

Personalized user experience – Data-driven recommendations, targeted promotions, and interactive seat maps are improving event discovery and customer engagement.

-

Regulatory scrutiny and transparency – Rising pressure on ticketing companies to disclose fees and curb unfair resale practices is shaping industry practices.

. The surge in global internet users has created significant opportunities for e-marketers. By 2023, online ticket purchases in the United States were dominated by Ticketmaster, which held the majority share of 61% of event ticket transactions. Event Ticket Center and SeatGeek, both taking up 21% of the market, were among the standout players. ACE Ticket followed closely behind at 20%, with Gold Coast Tickets holding 16%. North America's strong presence in online ticket purchasing systems was clear, as these companies were responsible for most event ticket sales, showing a high consumer preference for internet platforms in the region.

Online ticketing vendors specialize in advertising marketing and promotional efforts, offering user-friendly apps, and redesigning websites to improve the booking experience. The substantial use of 4G and 5G has made mobile booking more famous than conventional online methods. Continuous updates and improvements to mobile interfaces have further driven growth in this sector. Features like seating preferences, mobile tickets, and combination deals are enhancing the customer experience. Additionally, new technologies like RFID tags and prepaid smart cards are simplifying the ticketing technique, especially for multi-day events. Social media and technological advancements in data evaluation and wireless technology are also transforming event advertising and promotions, creating more customized and attractive experiences for clients.

Online Event Ticketing Market Drivers:

-

Higher internet accessibility worldwide facilitates easier online ticket purchases.

-

A shift towards digital platforms across industries drives online ticket sales.

-

Innovations like blockchain for ticket verification and AI for customer service enhance user experience.

Increased penetration of the internet is a major driver for the online event ticketing market. With more people getting access to the internet globally, the capacity consumer base for online ticketing platforms has expanded dramatically. This widespread connectivity helps less complicated and quicker access to online services, together with tickets for events concerts, and sports activities to theaters. The proliferation of excessive-speed internet and broadband services, mainly driving the market, has played an important role in this boom. For example, in India, the wide variety of Internet users is predicted to reach 900 million by 2025, growing due to the lower cost of data plans and initiatives of govt. promoting digital inclusion. This surge in internet users directly correlates with an increase in online transactions, such as ticket purchases. Moreover, the upward push of mobile internet usage has similarly bolstered this trend. As of 2024, mobile internet users are over 60% of overall internet traffic globally. This shift highlights the growing dependence on smartphones for diverse activities, including buying event tickets, which gives extraordinary convenience and accessibility. These factors together make multiplied internet penetration a pivotal driver for the online event ticketing market.

Online Event Ticketing Market Restraints:

-

The risk of data breaches and online fraud can deter users.

-

Limited access to the internet in some regions restricts market growth.

-

Website crashes or technical glitches during high-demand periods can cause user frustration.

-

Issues with ticket scalping and counterfeit tickets can undermine consumer trust, Lack of awareness about online ticketing options in certain demographics.

The restraint in the online event ticketing market is cybersecurity issues. As a huge number of transactions are going through online, the risk related to data breaches, and cyber fraud has emerged as a pressing issue for customers and corporations alike. Instances of hacking attempts, phishing scams focused on target ticket buyers, and unauthorized access to personal information have raised alarm amongst users, impacting trust among platforms of online ticketing. Despite improvements in cybersecurity technology, the evolving nature of cyber threats continues to venture into the industry. Mitigating those risks requires strong security features, including encryption protocols, multi-factor authentication, and ongoing cybersecurity training for workers and customers. Building trust through transparency in data handling with practices is crucial to retaining consumer confidence in online ticketing offerings.

Online Event Ticketing Market Segmentation Analysis:

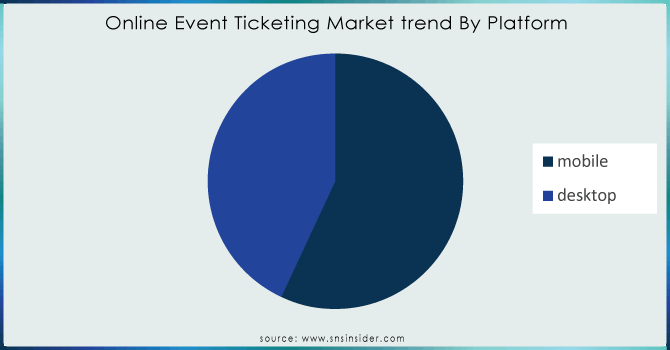

By Platform, Mobile dominates online ticketing with 55% share, driven by convenience and connectivity, Desktop segment to grow steadily with 4.92% CAGR, offering security and enhanced browsing

The Mobile segment held the largest share of revenue 55% In 2024 and is expected to grow at a significant annual growth rate. The preference for mobile devices stems from declining charges of the internet and the extensive adoption of 3G and 4G connectivity. Mobile booking is seen as simpler than traditional online methods, with user-friendly interfaces and frequent updates enhancing the experience. Service providers also use loyalty programs to retain mobile platform users. The speed and reliability of online booking drive the growth of the market.

The desktop segment is projected to grow significantly with a CAGR of 4.92%, with desktops offering larger screens, and a better browsing experience. This allows users to view event details and seating charts more easily, improving conversion rates and customer satisfaction. Desktops often have advanced security features, providing users with confidence when sharing personal and financial information, which is crucial for those who prioritize data protection. This sense of security can drive more online transactions on desktop platforms.

Need any customization research on Online event ticketing market - Enquiry Now

By Event Type, Music leads with 37% share, fueled by live concerts, streaming integration, and fan experiences, Sports ticketing gains momentum with 29% share, boosted by global tournaments and government support

In 2024, the music segment held the largest revenue share at 37% and is projected to grow at a CAGR of 5.01%. The rising popularity of live music events and immersive experiences drives demand for online ticket purchases. Music enthusiasts are looking for concerts and festivals, while advancements in mobile apps and websites enhance user interfaces, personalized recommendations, and real-time ticket updates, boosting market growth. In 2023, Live Nation organized over 50,000 events, with revenue reaching approximately USD 22.73 billion, highlighting the growing demand for online ticketing. Online platforms are integrating with music streaming services, making ticket purchasing more accessible. Trends like "the Taylor Swift effect" influence consumer travel decisions, prompting companies like AirAsia to integrate event bookings within their apps.

The sports segment held a revenue share of 29% in 2024, is expected to grow significantly, driven by major events like the NFL, FIFA World Cup, Olympics, ICC Cricket World Cup, and IPL. support of the government for sports events also boosts demand for tickets, resulting in increasing traffic on online platforms. The movie ticketing segment remains competitive with services like Fandango and Movietickets.com offering discounts and partnerships with cinemas.

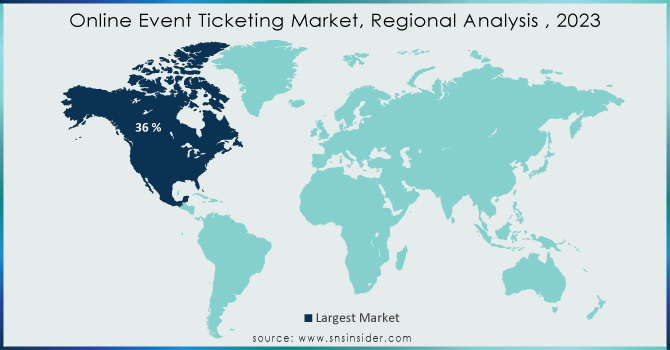

Online Event Ticketing Market Regional Analysis

North America dominates the Online Event Ticketing market in 2024

In 2024, North America holds an estimated 38% share of the Online Event Ticketing market, driven by its mature entertainment industry, widespread smartphone usage, and advanced digital payment infrastructure. The region benefits from a strong lineup of live music, theater, sports, and cultural events, supported by high disposable incomes and consumer preference for digital convenience. Leading players such as Ticketmaster, StubHub, and SeatGeek maintain dominance through secure, user-friendly platforms and dynamic pricing models. These factors collectively sustain North America’s leadership position and reinforce its role as a hub for innovation in online ticketing.

-

United States leads North America’s Online Event Ticketing market

The United States dominates due to its expansive live entertainment ecosystem, including major sports leagues (NFL, NBA, MLB) and a vibrant music and theater culture. With millions of events hosted annually, U.S. consumers increasingly prefer mobile-first ticketing platforms for convenience, security, and loyalty rewards. Integration with payment apps, widespread use of QR-code entry, and advanced fraud-prevention systems strengthen adoption. Major promoters and venues also partner with technology-driven platforms to improve fan experiences. This robust ecosystem, paired with high consumer spending power, secures the U.S. as the largest contributor to North America’s ticketing revenues.

Asia Pacific is the fastest-growing region in the Online Event Ticketing market in 2024

The Asia Pacific Online Event Ticketing market is projected to expand rapidly, with an estimated CAGR of 7.2% from 2025 to 2032, fueled by rising smartphone penetration, affordable internet access, and a growing middle class. Increasing popularity of live concerts, sports events, and movies drives strong demand for mobile-first platforms. Local service providers integrate regional languages, loyalty programs, and real-time updates to enhance accessibility. Partnerships with OTT and travel apps are also boosting market reach. Collectively, these factors accelerate online adoption and position Asia Pacific as the fastest-growing region in the forecast period.

-

India leads Asia Pacific’s Online Event Ticketing market

India dominates the Asia Pacific market due to its massive base of mobile-first users and the success of platforms like BookMyShow. Cricket tournaments such as the IPL, blockbuster Bollywood releases, and global music tours create consistent ticketing demand. Affordable 4G access, diverse payment options, and app-based convenience increase user adoption across urban and semi-urban areas. Integrations with streaming services, promotional campaigns, and loyalty rewards further drive ticket purchases. Combined with a young, entertainment-driven population, India’s rapid digitalization ensures its leadership in the region’s online event ticketing industry.

Europe Online Event Ticketing market insights, 2024

Europe shows steady growth in 2024, supported by its vibrant cultural events, international sports tournaments, and expanding festival landscape. The region benefits from cross-border touring, high mobile adoption, and regulatory focus on consumer protection and pricing transparency. Platforms offering seamless resale solutions and personalized experiences are gaining traction. Strong demand for concerts, theater shows, and football tournaments underpins growth.

-

United Kingdom leads Europe’s Online Event Ticketing market

The United Kingdom dominates the European market due to its world-class music festivals, thriving theater industry, and advanced digital infrastructure. Popular events such as Glastonbury, West End shows, and Premier League football create massive ticketing demand. UK consumers show strong adoption of mobile platforms, benefiting from secure digital wallets and dynamic pricing systems. Combined with high internet penetration and a strong tradition of live entertainment, these factors make the UK the region’s primary revenue contributor in 2024.

Middle East & Africa and Latin America Online Event Ticketing market insights, 2024

The Online Event Ticketing market in the Middle East & Africa and Latin America is experiencing moderate growth in 2024. In the Middle East, rapid urbanization and investments in mega-events, concerts, and sports leagues—particularly in Saudi Arabia and the UAE—fuel digital ticketing adoption. Africa’s emerging urban centers are gradually adopting mobile-based platforms as smartphone penetration rises. In Latin America, Brazil and Mexico lead adoption due to their strong football culture, music festivals, and cinema growth. Affordable internet access, mobile wallets, and increasing event tourism support steady expansion across both regions.

Competitive Landscape for the Online Event Ticketing Market:

Ticketmaster

Ticketmaster is a U.S.-based global leader in online event ticketing and a core subsidiary of Live Nation Entertainment. The company provides ticketing services for concerts, sports, theater, and festivals, serving millions of customers across more than 30 countries. Its platforms integrate primary sales, verified resales, mobile ticketing, and venue management solutions, supported by advanced data analytics and fraud prevention systems. Ticketmaster’s role in the online ticketing market is vital, as it combines scale, innovation, and security to deliver seamless access to live experiences worldwide.

-

In 2024, Ticketmaster expanded its mobile-first ticketing solutions, introducing enhanced fraud-prevention features and deeper integration with Live Nation’s global concert and festival ecosystem.

Eventbrite

Eventbrite is a U.S.-headquartered online event management and ticketing platform specializing in live events, classes, and community gatherings. The company empowers independent creators, promoters, and small businesses to plan, promote, and sell tickets through its user-friendly digital platform. Eventbrite’s services include event registration, mobile ticketing, analytics, and marketing tools, making it a go-to solution for small to mid-sized organizers worldwide. Its role in the ticketing market is significant, enabling grassroots and niche events to reach broader audiences while driving digital transformation in community-driven entertainment.

-

In 2024, Eventbrite launched AI-powered event discovery and marketing tools, helping creators attract new attendees with personalized recommendations and targeted campaigns.

StubHub

StubHub is a U.S.-based online ticket marketplace that specializes in the resale of tickets for concerts, sports, theater, and live entertainment. Acquired by Viagogo, StubHub provides a secure, verified platform where fans can buy and sell tickets globally. Its services include interactive seat maps, price transparency, and mobile ticket delivery, offering flexibility and choice to consumers. StubHub’s role in the online ticketing market is central, as it bridges supply and demand for high-demand events while enhancing consumer trust in the secondary ticketing space.

-

In 2024, StubHub rolled out dynamic pricing tools for sellers, improving resale efficiency and enhancing fan engagement with real-time market-driven pricing.

SeatGeek

SeatGeek is a U.S.-based mobile-focused ticketing platform known for its intuitive interface, transparent pricing, and innovative features. The company provides ticketing for sports teams, concert venues, and theaters, partnering with leagues like the NFL, NBA, and MLS. SeatGeek’s platform offers mobile ticket delivery, fan-to-fan resales, and analytics-driven marketing solutions for event organizers. Its role in the online ticketing market is growing rapidly, as it challenges incumbents by prioritizing user experience, mobile innovation, and team partnerships.

-

In 2024, SeatGeek expanded its partnerships with major sports franchises, enhancing its mobile ticketing app with AI-driven fan engagement and loyalty features.

Online Event Ticketing Market Key Players:

-

Ticketmaster

-

Eventbrite

-

StubHub

-

SeatGeek

-

Viagogo

-

AXS

-

See Tickets

-

Dice

-

TickPick

-

Ticketek

-

BookMyShow

-

Fandango

-

Tixr

-

Ticket Tailor

-

Cvent

-

Universe

-

Brown Paper Tickets

-

Front Gate Tickets

-

Skiddle

-

Kyazoonga

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 72.84 billion |

| Market Size by 2032 | US$ 107.1 Billion |

| CAGR | CAGR of 4.96% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Desktop, Mobile) • By Event Type (Sports, Music, Movies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Carnival Cinemas, AOL Inc. (Yahoo), PVR LTD., Tickets Please, Bigtree, Ticketmaster, StubHub, Cinemark Holdings, Inc., KyaZoonga, Inc, EasyMovies, Cineplex Inc., VOX Cinemas, TickPick LLC, and others |