Enterprise IoT Market Report Scope & Overview:

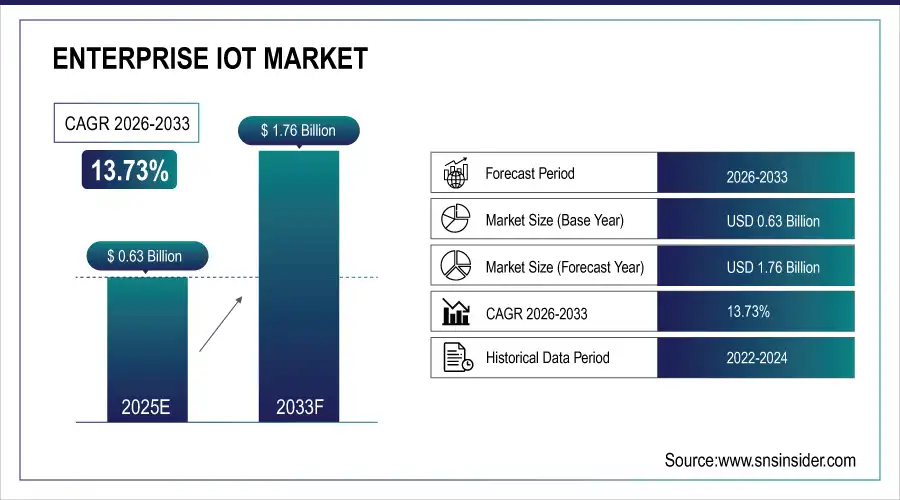

The Enterprise IoT Market Size was valued at USD 0.63 Billion in 2025E and is expected to reach USD 1.76 Billion by 2033 and grow at a CAGR of 13.73% over the forecast period 2026-2033.

The Enterprise IoT Market analysis, driven by rising uptake of the connected devices and smart technology across various industry verticals that facilitate real-time monitoring, predictive maintenance and process automation. Cloud computing, AI integration and edge analytics are shaping IoT capabilities, while government programs to facilitate digital transformation speed up adoption. According to study, Average number of connected devices per enterprise: 500–2,000 depending on industry size.

Market Size and Forecast:

-

Market Size in 2025: USD 0.63 Billion

-

Market Size by 2033: USD 1.76 Billion

-

CAGR: 13.73% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Enterprise IoT Market - Request Free Sample Report

Enterprise IoT Market Trends:

-

Rapid adoption of connected devices drives operational efficiency across multiple industries.

-

Predictive maintenance minimizes downtime and extends equipment lifespan using IoT solutions.

-

AI integration enables real-time analytics, insights, and smarter enterprise decision-making.

-

Edge computing reduces latency, improving performance for critical industrial applications.

-

Cloud-based IoT platforms enhance scalability, flexibility, and cost-effective data management.

-

Growing investments in smart sectors create new opportunities for IoT adoption.

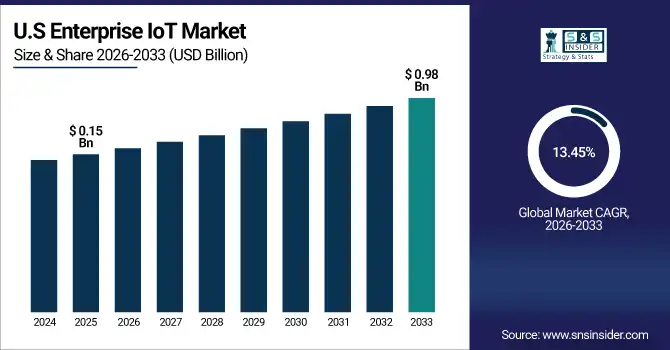

The U.S. Enterprise IoT Market size was USD 0.15 Billion in 2025E and is expected to reach USD 0.42 Billion by 2033, growing at a CAGR of 13.45% over the forecast period of 2026-2033, driven by widespread adoption of connected devices, cloud platforms, and AI analytics. Industries leverage IoT for real-time monitoring, predictive maintenance, and process automation, enhancing efficiency, reducing costs, and enabling data-driven decision-making.

Enterprise IoT Market Growth Drivers:

-

IoT Enables Enterprises to Boost Efficiency Through Predictive Maintenance Solutions

Enterprises IoT Market growing, driven by high investment on adopting more IoT solutions to streamline their operations, reduce the costs, gain increment rate of productivity. Connected equipment and sensors enable real-time monitoring of machines, supply chains and processes to identify preventative maintenance issues. That equals less unplanned downtime, longer equipment life and lower operating costs. Manufacturing, transport and energy sectors especially are capitalizing on IoT to automate processes, extract insights from data and make faster more efficient decisions supporting the market.

Average enterprise adoption: 60–70% of large-scale manufacturing, transport, and energy companies have implemented IoT solutions.

Enterprise IoT Market Restraints:

-

Security Concerns and Data Privacy Challenges Limit IoT Adoption Growth

The proliferation of IoT devices leads to a growing attack surface and potential data compromises. Enterprises usually gather sensitive operational and customer data, with IoT networks emerging as a lucrative destination for cyber-attacks. Concerns about unauthorized access, malware and data privacy compliance can limit adoption. Deploying stringent security measures and encryption drives up costs, and the complexity, delaying time to market growth despite improving prospects.

Enterprise IoT Market Opportunities:

-

AI and Edge Computing Create New Opportunities for Enterprise IoT

The combinations of AI and edge with IoT have tremendous growth Opportunity. AI driven analytics is able to analyze large scale IoT data for predictive insights, anomaly detection and real-time process optimization. Reducing latency, edge computing processes data at the local level to speed up response times for these types of industrial, healthcare and smart city applications. An organization that leverages this technology trends can see increased efficiency, instant decision-making and a competitive edge by the potential for new markets and services.

Process optimization: IoT with AI and edge computing improves workflow efficiency by 15–20% in manufacturing and smart city operations.

Enterprise IoT Market Segmentation Analysis:

-

By Component: In 2025, Hardware led the market with a share of 57.30%, while Software & Solutions is the fastest-growing segment with a CAGR of 14.60%.

-

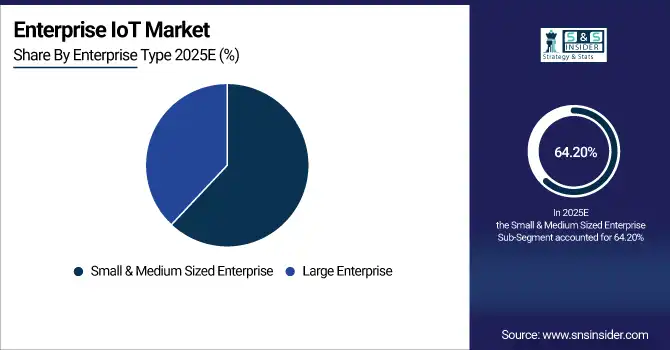

By Enterprise Type: In 2025, Small & Medium-Sized Enterprises (SMEs) led the market with a share of 64.20%, while Large Enterprises are expected to grow at a CAGR of 13.50%.

-

By Deployment Model: In 2025, Cloud led the market with a share of 71.24%, while Hybrid is the fastest-growing segment with a CAGR of 16.14%.

-

By End-use: In 2025, Manufacturing led the market with a share of 27.96%, while Healthcare is the fastest-growing segment with a CAGR of 15.30%.

By Component, Hardware Lead Market and Software & Solutions Fastest Growth

The Hardware lead the market in 2025, due to the essential role of sensors, gateways, and connected devices are the critical components required to deliver IoT operations across industries. Real-time monitoring, predictive maintenance, and process automation are based on hardware and represent the most expanded part. Meanwhile, Software & Solutions are the fastest-growing segment with strong growth in AI-powered analytics, edge computing and IoT platform solutions. Companies are spending big on software capabilities to improve operational productivity, automate workflows and allow data-led decision making in manufacturing, transportation, healthcare services and beyond.

By Enterprise Type, Small & Medium-Sized Enterprises (SMEs) Lead Market and Large Enterprises Fastest Growth

The Small & Medium-Sized Enterprises (SMEs) lead the market in 2025, due to adoption as they integrate connected devices and IoT solutions to enhance efficiency, productivity and lower costs. Small and medium enterprises use IoT technology for continuous monitoring, predictive maintenance and process automation in manufacturing, healthcare and transportation sectors. Meanwhile, Large Enterprises are the fastest-growing segment, due to growing investments in sophisticated IoT platforms, AI integration and edge computing solutions. These businesses are deploying IoT in a big way to organise data-enabled decision making, fine tune operational efficiency and gain competitive advantage in the new world of digital business.

By Deployment Model, Cloud Lead Market and Hybrid Fastest Growth

The Cloud leads the market in 2025, as businesses depend more on cloud platforms for scaling capabilities, better flexibility and managing of connected devices and IoT data. Implemented as cloud solution to provide real time monitoring, analytics and easily integration across multiple locations, it can be the best candidate for manufacturing industry, healthcare organization and transportation industries. Meanwhile, the Hybrid is a fastest growing segment due to, large enterprises wanting the scale of cloud with the control of on-prem. Hybrid solutions help companies keep sensitive data on-premises and take advantage of the cloud for analytics and operational efficiency, so we do expect a lot of growth there.

By End-use, Manufacturing Lead Market and Healthcare Fastest Growth

The Manufacturing leads the market in 2025, driven by as businesses continue to deploy more connected devices and IoT technologies to streamline manufacturing processes and make equipment more productive while enabling predictive maintenance. IOT offers real-time tracking, automation and data decision systems through supply chain activities which endorsee cost effectiveness and operational advantages in manufacturing industry. Meanwhile, the Healthcare sector is a fastest growing segment due to an increasing current consumption of connected medical devices, remote patient monitoring and smart hospital systems. IoT is used for patient care enhancement, real-time data analytics and telemedicine setting the stage for growth in the next generation of digital healthcare services.

Enterprise IoT Market Regional Analysis:

North America Enterprise IoT Market Insights:

The North America dominated the Enterprise IoT Market in 2025E, with over 34.10% revenue share, due to advanced digital infrastructure, leading to a heavy deployment of connected devices and investments made by various industries for smart technologies. The local area is served by a mature technology ecosystem, widespread deployment of cloud and edge computing and high application of AI in enterprise. Critical industries like manufacturing, healthcare, BFSI and transport are speeding up the adoption of IoT for predictive maintenance, process automation and analytics driven decision making.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Enterprise IoT Market Insights

The U.S. and Canada lead the Enterprise IoT market due to advanced digital infrastructure, high adoption of connected devices, strong investments in AI, cloud, and edge computing, and widespread use of IoT for predictive maintenance, process automation, and data-driven decision-making across industries.

Asia Pacific Enterprise IoT Market Insights:

The Asia-Pacific region is expected to have the fastest-growing CAGR 14.64%, owing to a surge in demand for enterprise IoT solutions and services from industry verticals such as manufacturing, energy and utilities, transportation and logistics, telcos. The emergence of cloud computing, AI embedding, and edge analytics is driving faster IoT implementation. Increasing government aid, infrastructure work and increasing awareness regarding operational efficiency, predictive maintenance and cost reduction are also contributing to market growth. These factors make Asia Pacific as a high-growth hub for enterprise IoT technologies where businesses have already started to adopt IoT solutions in their operations through increased productivity and data-based decision making.

China and India Enterprise IoT Market Insights

China and India are driving Enterprise IoT market growth due to rapid industrialization, increasing digital transformation initiatives, and rising adoption of connected devices. Investments in cloud computing, AI integration, and edge analytics, along with a focus on operational efficiency, cost reduction, and smart industrial solutions, fuel expansion.

Europe Enterprise IoT Market Insights

Europe holds a significant position in the Enterprise IoT market, owing to the presence of well-developed infrastructure and automation in industries and the usage of connected devices across various industry verticals. Businesses use IoT solutions for monitoring in real time, predictive maintenance and process improvement to improve productivity and reduce costs. Intelligent data driven decision support is further provided through AI, cloud computing and Edge analytics. Favorable regulations, digitalisation efforts and investments in smart industries are fuelling growth, positioning Europe as a key enterprise IoT market for manufacturing, healthcare transport and other key sectors.

Germany and U.K. Enterprise IoT Market Insights

The U.K. and Germany are witnessing Enterprise IoT market growth due to advanced technological infrastructure, high adoption of smart devices, and focus on digital transformation. Strong investments in AI, cloud platforms, and automation enable predictive maintenance, operational efficiency, and data-driven decision-making across key industries.

Latin America (LATAM) and Middle East & Africa (MEA) Enterprise IoT Market Insights

The Latin America (LATAM) and Middle East & Africa (MEA) Enterprise IoT Market are emerging regions showing steady growth driven by rising industrial automation, digital transformation endeavours, emergence of the connected devices in major industries. Corporations are using AIoT systems for real-time surveillance, predictive maintenance and process optimization in order to increase operational performance and lower operating costs. Increasing investments in cloud computing, AI integration, and edge analytics will enable the faster deployment of internet of things (IoT), whereas favorable government policies and infrastructure development will attest to market growth in these regions.

Enterprise IoT Market Competitive Landscape:

Qualcomm plays a key role in the Enterprise IoT market with its processors, connectivity solutions, and IoT platforms. Its innovations, including ultra-high frequency RFID integration and AI-enabled edge computing chips, enhance real-time monitoring, automation, and predictive analytics. Qualcomm supports enterprises in sectors such as logistics, manufacturing, and healthcare to deploy scalable IoT solutions, optimize operations, improve efficiency, and accelerate digital transformation initiatives across complex enterprise environments.

-

In August 2025, Qualcomm launched the Dragonwing Q-6690, the first enterprise processor integrating ultra-high frequency RFID directly into the chip. This launch strengthens Qualcomm’s position in the enterprise IoT and smart logistics markets.

Texas Instruments (TI) drives Enterprise IoT adoption through advanced semiconductor solutions, including power management, sensors, and AI-enabled chips. TI’s products enable real-time data acquisition, edge computing, and predictive maintenance across industries like manufacturing, healthcare, and transport. By providing reliable hardware for IoT devices and AI infrastructures, TI empowers enterprises to enhance operational efficiency, reduce downtime, and implement scalable, intelligent IoT solutions for data-driven decision-making.

-

In October 2025, Texas Instruments (TI) launched new power management devices for AI computing, targeting next-generation AI infrastructures in data centers. These devices aim to improve energy efficiency and support high-performance edge AI applications.

Siemens AG is a leading player in the Enterprise IoT market, providing industrial automation, smart building solutions, and IoT-enabled digital platforms. The company focuses on integrating AI, cloud, and edge computing to optimize operations, enhance interoperability, and enable predictive maintenance. Its IoT solutions help enterprises streamline manufacturing, energy management, and infrastructure monitoring, driving efficiency, sustainability, and data-driven decision-making across diverse industrial sectors.

-

In July 2025, Siemens entered a collaboration with Microsoft to enhance IoT interoperability in buildings, aiming to reduce integration efforts by 80%. The partnership focuses on creating standardized, scalable solutions for smart buildings and industrial IoT deployments.

Enterprise IoT Market Key Players:

Some of the Enterprise IoT Market Companies are:

-

Intel Corporation

-

Qualcomm

-

Texas Instruments

-

Bosch

-

Siemens AG

-

STMicroelectronics

-

Hewlett Packard Enterprise (HPE)

-

Juniper Networks

-

Nokia

-

3M Company

-

Amazon Web Services (AWS)

-

Microsoft Corporation

-

Google Cloud

-

Oracle Corporation

-

PTC Inc.

-

SAP SE

-

IBM Corporation

-

Cisco Systems Inc.

-

Accenture

-

Deloitte

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 0.63 Billion |

| Market Size by 2033 | USD 1.76 Billion |

| CAGR | CAGR of 13.73% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software & Solutions, Services) • By Enterprise Type (Small & Medium Sized Enterprise, Large Enterprise) • By Deployment Model (Cloud, Hybrid, On Premise) • By End-use (Manufacturing, Oil & Gas, Utilities, Transport, BFSI, IT & Telecomm, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Intel Corporation, Qualcomm, Texas Instruments, Bosch, Siemens AG, STMicroelectronics, Hewlett Packard Enterprise (HPE), Juniper Networks, Nokia, 3M Company, Amazon Web Services (AWS), Microsoft Corporation, Google Cloud, Oracle Corporation, PTC Inc., SAP SE, IBM Corporation, Cisco Systems Inc., Accenture, Deloitte, and Others. |