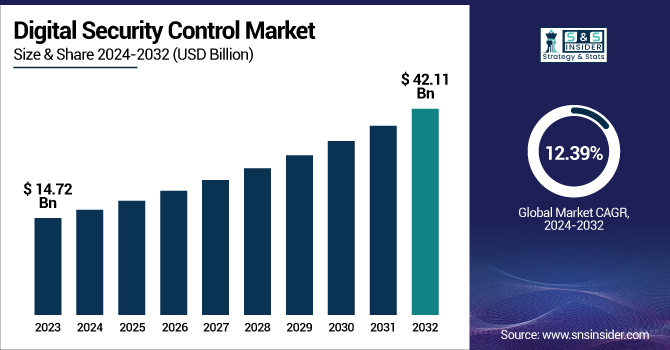

Digital Security Control Market Size Analysis:

The Digital Security Control Market was valued at USD 14.72 billion in 2023 and is projected to reach USD 42.11 billion by 2032, growing at a CAGR of 12.39 % from 2024 to 2032.

To Get more information on Digital Security Control Market - Request Free Sample Report

This growth is driven by increasing adoption rates of advanced security solutions in response to rising cybersecurity threats across various industries. The integration of AI and machine learning enhances threat detection and response, further boosting demand for sophisticated security systems.

Additionally, the growing focus on consumer data protection, fueled by stricter data privacy regulations and heightened consumer concerns about data breaches, is a key factor driving the market’s expansion in the U.S. These factors collectively contribute to the market's robust growth outlook. In the U.S. was valued at USD 4.07 billion in 2023 and is expected to reach USD 10.26 billion by 2032, growing at a CAGR of 10.32% from 2024 to 2032.

Digital Security Control Market Dynamics:

Drivers:

-

Enhancing Digital Security with AI and Machine Learning for Advanced Threat Detection and Response

The Adoption of AI and Machine Learning in digital security is revolutionizing threat detection, response, and prevention by leveraging advanced algorithms and data analytics. They can also adapt to the changing methods used by cyber attackers, allowing organizations to respond in real time, which dramatically increases security effectiveness. By automating processes like threat detection, risk assessment, and incident response, there is less reliance on humans, the potential for less human error and increased effectiveness in security operations. AI and machine learning empower predictive security, helping businesses get ahead of more advanced threats. This integration is also emerging as a significant growth driver in the market, as companies look for more sophisticated, proactive security solutions capable of efficiently managing the complexity and scale of modern cyber risks, thus becoming integral to the future of digital security.

Restraints:

-

Overcoming Integration Challenges in Implementing Digital Security Solutions

The complexity of integration in digital security control systems is a significant challenge for many organizations. consuming and technically challenging when implementing new security solutions. From legacy to cloud systems and everything in between, organizations are hard-pressed to integrate them together smoothly. A skilled workforce is needed to ensure compatibility, prevent disruption and minimize downtime. Additionally, combining numerous security products — firewalls, encryption, endpoint protection, etc. — may also require significant customization to serve distinct organizational requirements. These integration issues often require additional time and resources, monetary and technical, to resolve before deployment. This could lead to businesses struggling to fully leverage the advantages of digital security solutions, which could impact an overall the effectiveness of security.

Opportunities:

-

Growing Demand for Endpoint Security with the Rise of Remote Work and IoT

The increased demand for endpoint security is driven by the growing adoption of remote work, the widespread use of mobile devices, and the expansion of the Internet of Things (IoT). With employees able to access corporate networks from multiple locations and across multiple devices, securing those endpoints has become paramount. Such endpoints may include laptops, smartphones, tablets, or even IoT devices, and are often susceptible to cyber threats such as malware, ransomware, and phishing attacks. To mitigate these risks, organizations are turning to strong endpoint security solutions that offer capabilities like real-time protection, threat detection, and prevention of unauthorized access. Endpoint himself and any susceptible group members are on any particular activity system.

Challenges:

-

Data privacy concerns are a major challenge in digital security, as storing sensitive information increases the risk of breaches and non-compliance.

Data privacy concerns arise as digital security systems collect, store, and process large volumes of sensitive personal information to protect against cyber threats. While these systems are essential for safeguarding data, they also present significant risks if not properly managed. Unauthorized access, data breaches, or misuse of personal information can lead to serious privacy violations, legal consequences, and reputational damage for businesses. Additionally, with stringent data protection regulations like GDPR and CCPA, organizations face increased pressure to comply with privacy laws, ensuring that customer data is handled securely and transparently. As the volume of data grows, companies must invest in advanced encryption, access controls, and regular audits to mitigate privacy risks and protect user trust.

Digital Security Control Industry Segment Outlook:

By Hardware

The Biometric Technologies segment dominates the Digital Security Control Market, accounting for approximately 56% of the total revenue in 2023. Biometric technologies, including fingerprint scanning, facial recognition, and iris scanning, have become integral to modern security systems due to their ability to provide accurate, user-friendly authentication methods. These technologies offer robust protection against unauthorized access, making them highly attractive to organizations seeking to enhance security. With the increasing demand for secure and convenient identity verification in sectors like banking, healthcare, and government, biometrics has seen widespread adoption. The growing focus on improving user authentication and reducing fraud is expected to drive further growth in the biometric segment, cementing its dominance in the digital security landscape.

The Smart Card segment is expected to experience the fastest growth in the Digital Security Control Market from 2024 to 2032. As digital transactions and secure access systems become increasingly prevalent, the demand for smart cards, which store encrypted data and provide secure authentication, is rapidly rising. These cards are widely used in banking, healthcare, government services, and access control, offering a secure and efficient solution for verifying identities. The shift toward contactless payments and digital wallets is also fueling smart card adoption, as they provide added security against fraud. With advancements in chip technology and integration with mobile and digital platforms, the smart card segment is poised for significant growth throughout the forecast period.

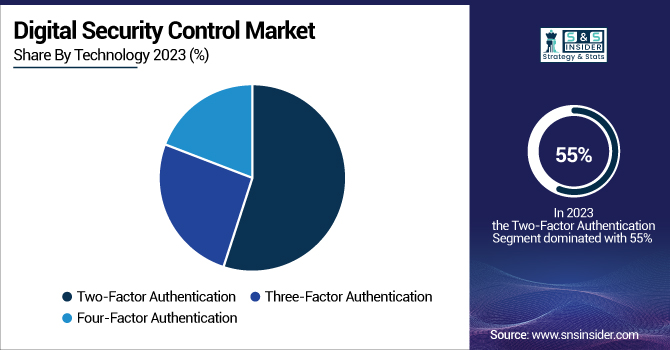

By Technology

The Two-Factor Authentication (2FA) segment dominated the Digital Security Control Market in 2023, capturing around 55% of the market share. 2FA is widely adopted due to its enhanced security features, which require users to provide two forms of identification before gaining access to sensitive systems or data. This method typically combines something the user knows (like a password) with something the user has (such as a one-time passcode sent to a mobile device). With the rise in cyberattacks, including phishing and credential stuffing, 2FA has become a vital security layer for businesses and individuals. Its effectiveness in preventing unauthorized access, combined with increasing regulatory requirements for stronger security protocols, continues to drive its widespread implementation across various sectors, including finance, healthcare, and government.

The Three-Factor Authentication (3FA) segment is experiencing the fastest growth in the Digital Security Control Market over the forecast period from 2024 to 2032. 3FA adds an extra layer of security by requiring users to verify their identity through three distinct factors: something they know (password), something they have (smartphone or token), and something they are (biometric data). As cyber threats become more sophisticated, 3FA provides enhanced protection, particularly for high-security applications like financial transactions and access to sensitive data. This growing demand for stronger, multi-layered security solutions across industries like banking, government, and healthcare is driving the rapid expansion of the 3FA segment.

By Application

The User Authentication segment led the Digital Security Control Market in 2023, accounting for approximately 54% of the total revenue. User authentication technologies are crucial for ensuring that only authorized individuals can access secure systems, data, or networks. These solutions include a range of methods such as passwords, biometrics (fingerprint and facial recognition), smart cards, and two-factor authentication (2FA). With the rise in cyberattacks and data breaches, businesses are increasingly investing in robust user authentication systems to safeguard sensitive information and enhance security. This segment is driven by the growing demand for secure access to digital platforms, particularly in industries like finance, healthcare, and e-commerce, where user data protection is paramount. The continued focus on privacy and regulatory compliance further strengthens the demand for advanced user authentication solutions.

he Network Monitoring segment is the fastest growing in the Digital Security Control Market from 2024 to 2032. As cyber threats become more sophisticated and networks grow increasingly complex, the need for real-time monitoring and threat detection has never been more critical. Network monitoring solutions provide continuous surveillance of network activity, helping organizations detect unusual behavior, potential vulnerabilities, and security breaches. With the rise of remote work, cloud computing, and IoT devices, securing network infrastructure is a top priority for businesses. These tools enable quick identification of threats, ensuring prompt responses to prevent data loss or system downtime. The growing adoption of digital transformation and the increasing volume of cyber threats are key drivers fueling the demand for network monitoring solutions.

By End Use

The Finance & Banking segment dominated the Digital Security Control Market in 2023, capturing approximately 44% of the total revenue. The financial sector is highly vulnerable to cyber threats such as fraud, hacking, and data breaches, making robust security measures critical. Digital security solutions, including multi-factor authentication (MFA), encryption, and secure payment gateways, are widely implemented to protect sensitive financial data, transactions, and customer accounts. As online banking and digital financial services continue to grow, so does the need for advanced security systems to safeguard against evolving cyber threats. Strict regulatory requirements and increasing concerns over data privacy further drive the demand for secure, reliable financial security solutions.

The Commercial segment is the fastest growing in the Digital Security Control Market from 2024 to 2032. With ever more complex and sophisticated helping of new cyber, coupled with a proliferation of interrelated systems, the demand for real-time threat detection and monitoring on systems span around the globe have reached a historic high. Network monitoring solutions offer ongoing monitoring and analysis of network activity, enabling organizations to identify abnormal activity, potential weaknesses, and security breaches. The growing trend of remote work, cloud computing, and IoT devices have made securing network infrastructure a business imperative. These tools help the expert quickly identify the threat and respond immediately to avoid data loss or system downtime. Rapid adoption of digital transformation and growing amount of cyber threatening are some of the major drivers soaring the need for Network Monitoring Solutions.

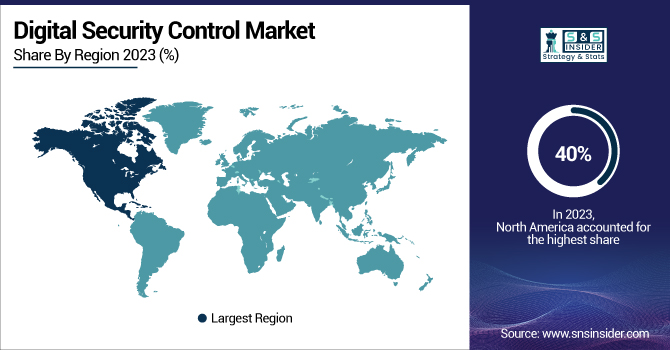

Digital Security Control Market Regional Analysis:

The North America region dominated the Digital Security Control Market in 2023, accounting for around 40% of the total revenue. This dominance is driven by the region's advanced technological infrastructure, high adoption of digital security solutions, and the presence of major cybersecurity companies. North American businesses, especially in sectors like finance, healthcare, and government, are highly invested in safeguarding sensitive data and complying with stringent regulations. The increasing frequency of cyberattacks, along with the rapid adoption of cloud computing, IoT, and digital transformation, further fuels the demand for advanced security solutions. Additionally, government initiatives and a robust regulatory framework contribute to the region's strong market presence.

The Asia-Pacific region is the fastest growing in the Digital Security Control Market over the forecast period from 2024 to 2032. The rapid digital transformation across countries like China, India, Japan, and South Korea is driving the demand for advanced security solutions. With the increasing adoption of cloud computing, IoT, and mobile technologies, businesses in the region are prioritizing robust security systems to protect sensitive data and ensure regulatory compliance. The rise in cyberattacks, coupled with growing concerns about data privacy, has prompted governments and enterprises to invest heavily in digital security. Additionally, the expansion of e-commerce, fintech, and smart city projects further accelerates the need for comprehensive digital security solutions in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Digital Security Control Market Key Players:

Some of the Major Players in Digital Security Control Market along with their Products:

-

Cisco Systems, Inc. (USA) - Cisco Umbrella, Cisco SecureX, Cisco Firepower, Cisco AnyConnect, Cisco Meraki

-

Digital Security Concepts (USA) - Cybersecurity consulting, Managed security services

-

Fortinet, Inc. (USA) - FortiGate, FortiAnalyzer, FortiSIEM, FortiWeb

-

Hadrian Security (USA) - Vulnerability assessments, Penetration testing, Consulting

-

Linked Security NY (USA) - Managed security services, Network monitoring

-

McAfee, LLC (USA) - McAfee Total Protection, Advanced Threat Defense, Cloud Security

-

Microsoft (USA) - Microsoft Defender, Azure Security Center, Microsoft Sentinel

-

Orbit Security Systems (USA) - Security monitoring, Access control, Surveillance systems

-

Palo Alto Networks (USA) - Next-Generation Firewalls (NGFW), Prisma Cloud, Cortex XSOAR

-

RSA Security LLC (USA) - RSA SecurID, NetWitness, RSA Archer

-

IBM Corporation (USA) - IBM Security QRadar, IBM Identity Governance, IBM MaaS360

-

Check Point Software Technologies (Israel) - Check Point Firewall, Threat Prevention, Security Management

-

Juniper Networks, Inc. (USA) - Juniper SRX, Sky ATP, Contrail Security

-

Trend Micro Inc. (Japan) - Trend Micro Apex One, Trend Micro Deep Security

-

CrowdStrike, Inc. (USA) - Falcon Endpoint Protection, Falcon OverWatch, Falcon XDR

List of suppliers that provide raw materials and components for the Digital Security Control market:

-

Intel Corporation (USA)

-

Advanced Micro Devices (AMD) (USA)

-

Qualcomm Technologies, Inc. (USA)

-

Broadcom Inc. (USA)

-

NXP Semiconductors (Netherlands)

-

STMicroelectronics (Switzerland)

-

Infineon Technologies (Germany)

-

Microchip Technology Inc. (USA)

-

Gemalto (now Thales Group) (France)

-

Texas Instruments (USA)

Recent Development:

-

On June 4, 2024, Cisco announced AI-powered innovations at Cisco Live 2024, alongside the launch of a USD 1 Billion Global AI Investment Fund to enhance digital resilience, security, and observability across organizations.

-

On March 24, 2025, Microsoft introduced the next evolution of Microsoft Security Copilot, featuring AI agents designed to autonomously assist with critical security tasks, such as phishing, data security, and identity management, in response to the increasing complexity of cyberattacks.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 14.72 Billion |

| Market Size by 2032 | USD 42.11 Billion |

| CAGR | CAGR of 12.39% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Hardware (Smart Card, Sim Card, Biometric Technologies, Others) • By Technology (Two-Factor Authentication, Three-Factor Authentication, Four-Factor Authentication) • By Application (Anti-Phishing, User Authentication, Network Monitoring, Security Administration, Web Technologies) • By End Use (Mobile Security & Telecommunication, Finance & Banking, Healthcare, Commercial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco Systems, Inc. (USA), Digital Security Concepts (USA), Fortinet, Inc. (USA), Hadrian Security (USA), Linked Security NY (USA), McAfee, LLC (USA), Microsoft (USA), Orbit Security Systems (USA), Palo Alto Networks (USA), RSA Security LLC (USA), IBM Corporation (USA), Check Point Software Technologies (Israel), Juniper Networks, Inc. (USA), Trend Micro Inc. (Japan), CrowdStrike, Inc. (USA). |