Optoelectronics Market Report Scope & Overview:

Get More Information on Optoelectronics market - Request Sample Report

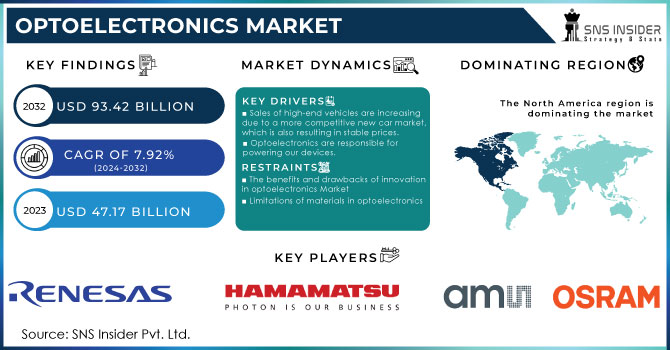

The Optoelectronics market size was valued at USD 47.17 Billion in 2023 and is expected to reach a market size of USD 93.42 billion by the end of 2032 at CAGR about 7.92% during the forecast period of 2024-2032.

The optoelectronics market is thriving due to the strong influence of the consumer electronics industry. Optoelectronic components are essential for the advanced features on our smartphones and impressive display quality on our TVs. Consider Light-Emitting Diodes (LEDs) as an example. These efficient machines light up the backlights of our devices. Major consumer electronics firms such as Samsung use LEDs in their QLED TVs to achieve better brightness, color accuracy, and energy efficiency when compared to older LCD models. Optical electronics excel in displays as well. OLED displays, which are recognized for their deep black levels and expansive viewing angles, utilize OLED materials to transform electricity into light. LG, a major competitor, is leading the way in OLED technology by incorporating it into their smartphones and TVs. Optoelectronic sensors are integrated into our devices, allowing for functions such as adjusting screen brightness automatically, activating sleep mode based on proximity detection, and recognizing faces. Photo detectors enable these sensors to function by transforming light into electrical signals. Broadcom, a leading player in the semiconductor industry, showcases this through its wide range of optoelectronic sensors created especially for use in consumer electronics. The endless consumer demand for increasingly higher resolution screens, feature-packed functions, and energy-saving devices will lead to a definite increase in the demand for optoelectronic components. The close connection between consumer electronics and optoelectronics guarantees a mutually advantageous future. With the advancement of display technology, we anticipate seeing innovative uses of optoelectronics in future consumer electronics.

The constantly increasing need for quicker and more effective optoelectronic devices such as LEDs, lasers, and photo detectors is driving an exciting competition for the next major advancement. Scientists are exploring new areas such as ultrafast optics and 2D materials to expand the limits of potential outcomes. In the field of ultrafast optics, researchers are pursuing the fastest speed possible by controlling light at quadrillions of cycles per second. Picture lasers shooting brief femtosecond pulses. These ultrafast lasers, led by companies such as Menlo Microsystems, could transform industries like telecommunications, data processing, and medical imaging. Fast data transmission through fiber optic cables may become achievable, allowing for the rapid transfer of large quantities of data instantaneously. The exciting realm of 2D materials is found beyond the boundaries of speed. These extremely thin substances, with a thickness of just one atom, have distinct characteristics that show great potential for the advancement of optoelectronics in the future. Their outstanding conductance of electricity and interaction with light could result in the creation of revolutionary devices. Picture LEDs that are not just efficient but also capable of being flexible and see-through. This has the potential to lead to new display technologies and possibly light-emitting textiles Samsung and other companies are currently conducting research on 2D materials to develop advanced displays that are brighter, more energy-efficient, and possibly foldable for upcoming mobile devices. The constant drive for speed and effectiveness in optoelectronics is creating a vibrant research environment, with ultrafast optics and 2D materials at the forefront.

Market dynamics

Drivers

-

Sales of high-end vehicles are increasing due to a more competitive new car market, which is also resulting in stable prices.

With prices increasing quickly, the new-car market is currently experiencing a period of reevaluation. Although there was a rise in total sales compared to last year, retail sales are declining due to elevated retail prices and rising loan rates. This development is leading manufacturers to focus on luxury and high-end models, which saw the highest sales in January 2023. This trend can be seen in the average transaction price (ATP), which remains elevated compared to the manufacturer's suggested retail price (MSRP) but is beginning to decline. These changes in the market are being driven by a big trend in expensive cars. Their portion of overall sales hit an all-time high of 19.6% in January, driving up the average industry ATP even with a small drop in luxury ATP. It is intriguing that some luxury car buyers are still willing to pay above MSRP for certain models, although the difference is decreasing. This pattern is also seen in the non-luxury sector, with average transaction prices (ATPs) decreasing slightly each month, possibly because of higher incentives provided by manufacturers. Electric cars (EVs) are also a topic of interest. Despite still being more expensive than the industry norm, the average cost of purchasing a new EV decreased significantly in January due to Tesla's major price reductions as the leading competitor in the market. The drop in price probably helped boost Tesla's sales by more than 30% compared to the previous year. The market for new vehicles is changing. Although luxury car sales are increasing and prices are leveling off, worries about affordability persist among price-conscious shoppers. With supply chain problems improving and manufacturers adapting incentives, the market is projected to reach a new balance in the upcoming months.

-

Optoelectronics are responsible for powering our devices.

The flourishing optoelectronics market is heavily influenced by the consumer electronics industry. Optoelectronic components, from our TVs' crystal-clear displays to our smartphones' feature-packed functionality, are the unsung heroes enabling it all. Consider Light-Emitting Diodes (LEDs) as an example. These efficient machines provide light for the screens of our devices, guaranteeing bright colors and clear images. Major companies such as Samsung utilize LEDs in their QLED televisions to achieve superior brightness, color accuracy, and energy efficiency in comparison to conventional LCD models. The screens also showcase the capabilities of optoelectronics. OLED displays, well known for their rich blacks and expansive viewing angles, utilize OLED materials to transform electricity into light. LG and other companies are leading the way in OLED technology by incorporating it into their advanced smartphones and televisions. Optoelectronic sensors are integrated into our gadgets, allowing for various functions such as adjusting screen brightness automatically, triggering sleep mode with proximity detection, and implementing facial recognition technology. These sensors depend on photo detectors, which are optoelectronic devices transforming light into electrical signals. Broadcom, a well-known company in the semiconductor sector, demonstrates this by offering a wide range of optoelectronic sensors tailored for use in consumer electronics.

Restraints

-

The benefits and drawbacks of innovation in optoelectronics Market

Innovation drives the optoelectronics market, yet the rapid pace of advancement can present difficulties. The fast development of display and electronic information instrument technology brings both opportunities and challenges for the optoelectronics industry. Advancements in displays and instruments contribute to the need for enhanced optoelectronic components. Customers desire increasingly higher resolution, slimmer gadgets, and additional features - all of which are crucial areas where advanced optoelectronics are essential. This fast speed may also impede market expansion in the immediate future. The push towards smaller electronics is posing challenges for companies designing components used in light transmission within electronics. Not only does this raise production expenses, but it also poses a threat of products becoming outdated rapidly with the emergence of newer technologies.

-

Limitations of materials in optoelectronics

Despite its ability to transform different industries, optoelectronics is held back by limitations in materials. Certain optoelectronic components require specialized materials that are not as easy to obtain as silicon, which is commonly used in traditional electronics. Such limitations can have a notable effect on the ability to expand production and can impede the widespread use of optoelectronic technologies. One major issue is the reliance on rare earth elements (REEs). Even though their name sounds fancy, these components are actually quite common in the Earth's crust. The extraction and processing are frequently concentrated in specific geographical locations, with only a few countries controlling the global REE supply chain. This focus results in a weakness for the optoelectronics sector.

Segment Analysis

By Device

Light-emitting Diodes (LEDs) held a significant market share of 30% in the optoelectronics market in 2023. This increased energy efficiency results in reduced electricity expenses and a more environmentally friendly impact. LEDs, unlike large incandescent bulbs, are available in a wide range of sizes and colors, making them suitable for a variety of uses, from commercial lighting to small indicator lights. Their impressive longevity leads to lower maintenance expenses and less frequent changing of bulbs. LEDs offer advantages that extend further than just being good for the environment. Their ability to adapt to various situations is also a significant asset they have. LEDs come in many different sizes and colors, making them perfect for a wide variety of purposes, unlike traditional big incandescent bulbs. LEDs are useful in a range of situations, from illuminating commercial structures to functioning as small indicator lights in electronic gadgets. Their extended duration leads to substantial reductions in expenses. Samsung, a leading player in the LED market, showcases its supremacy through offering a diverse range of LED choices that lessen the necessity for frequent replacements. New creative applications to drive the growth of LED technology, solidifying its leadership in the ever-evolving optoelectronics industry.

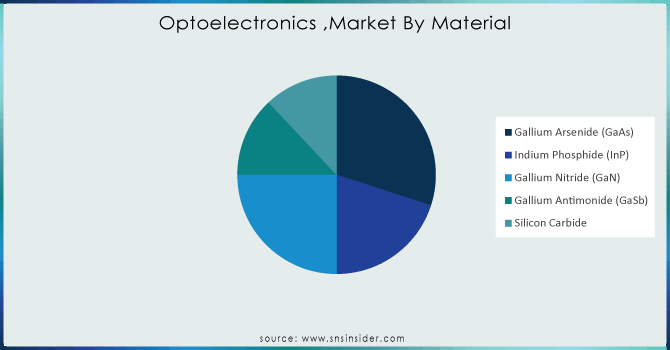

In terms of material, Gallium Arsenide (GaAs) is projected to dominate the optoelectronics market in 2023, holding a 30% market share. This material possesses numerous distinctive characteristics which make it perfect for various optoelectronic gadgets.A key benefit of GaAs is its capability to support the seamless movement of electrons. This results in more effective and brighter LEDs, which are the light-emitting diodes that light up our devices and structures. GaAs is distinguished from other materials by its possession of a "direct bandgap," making it ideal for producing and detecting superior quality light. This feature is essential for GaAs to be an important element in solar cells and fiber optic sensors, where effective light conversion is critical. GaAs also excels in terms of its speed. Its crucial role in mobile networks and data centers is due to its high-speed signal transmission capability, which is vital for rapid data processing. Companies including TriQuint Semiconductor utilize the high-speed capabilities of GaAs to produce high-performance components for these challenging applications.With the increasing need for quicker data transfer, higher quality screens, and effective solar options, GaAs's distinct features make it an essential material. The efficient emission of light, detection, and high-speed signal transmission capabilities of GaAs ensure its continued importance in the constantly changing optoelectronics market.

Need any customization research on optoelectronics market- Enquiry Now

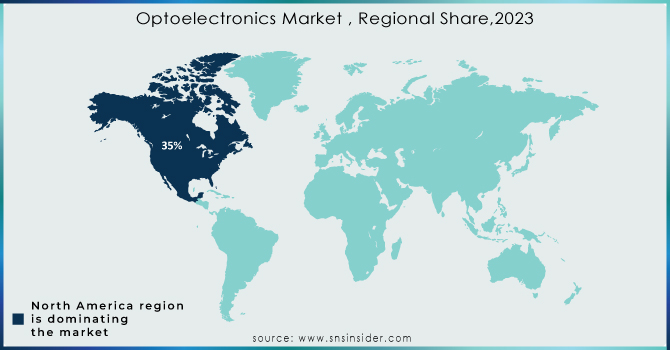

Regional Analysis

In 2023, North America dominates the optoelectronics market with a 35% share. This control is powered by various important factors including the thriving automotive industry in the area. The increasing need for premium vehicles equipped with cutting-edge functions, such as autonomous driving capabilities and complex lighting systems, requires creative optoelectronic parts. North American car makers are leading the way in integrating these innovations, which is driving growth in the optoelectronics industry. Automotive, North America has a strong foundation of industry participants. These companies invest heavily in research and development, continuously pushing the limits of optoelectronic technology. This emphasis on creativity helps North America maintain its position as a frontrunner in the industry. The area gives priority to improvements in intelligent infrastructure and automation technologies. Optical and electrical components are vital in such projects, from smart traffic control systems to automated manufacturing processes. The increasing number of specialized facilities in the US focused on manufacturing advanced optoelectronic devices demonstrates this dedication. These amenities will continue to reinforce North America's dominance in the optoelectronics market for years to come.

In 2023, the Asia Pacific region dominates with a 31% market share and is witnessing the fastest growth in optoelectronics market. Countries such as China and India have strong economies and a growing consumer electronics sector, which fuels the demand for optoelectronic components used in displays and LEDs. Governments actively encourage domestic industries by implementing supportive policies and investing in research and development (R&D). China's robust electronics sector and expanding manufacturing industry led to increased need for these parts. South Korea's strong automotive sector, which accounts for more than 10% of manufacturing, is expanding thanks to investments in automation that depend on optoelectronic components. Increasing vehicle manufacturing and consumption throughout Asia Pacific indicate a substantial market potential.

Key Players

Some of major key Players in optoelectronics market are Renesas Electronics Corporation, ams-OSRAM AG, Hamamatsu Photonics K.K., ROHM Co., Ltd., Samsung Electronics Co., Ltd., Jenoptik AG, Semiconductor Components Industries LLC, Sharp Corporation, Sony Semiconductor Solutions Corporation, TT Electronics, Vishay Intertechnology, Inc., Toshiba Electronic Devices & Storage Corporation and others

Recent Development

-

In February 2024, TSMC, Sony Semiconductor Solutions Corporation, DENSO Corporation, and Toyota Motor Corporation revealed additional funding for Japan Advanced Semiconductor Manufacturing, Inc. ("JASM"), TSMC's majority-owned subsidiary in Kumamoto Prefecture, Japan. The investment aims to establish a new fab, set to be operational by the end of 2027. With the Japanese government's strong backing, JASM's total investment will surpass $20 billion when its initial fab starts operating in 2024.

-

In January 2024, Osram Licht AG introduced a new range of side-looking, low-power LEDs that make design easier, easier to implement, and allow for a uniform look in long light bars and other car rear lighting uses. Automotive manufacturers can achieve a uniform appearance throughout the width of the vehicle by substituting toplooker LEDs with SYNIOS P1515 sidelookers. An RCL or turn indicator can be made with a thinner and simpler optical assembly using the same amount of LEDs found in a top-looker-based arrangement.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 47.17 Billion |

| Market Size by 2032 | US$ 93.42 Billion |

| CAGR | CAGR of 7.92% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device (Light-emitting Diodes (LEDs), Laser Diodes, Solar Cells, Photodiodes, Image Sensors, Others (Optoisolators, Phototransistors, etc.)) • By Material (Gallium Arsenide (GaAs), Indium Phosphide (InP), Gallium Nitride (GaN), Gallium Antimonide (GaSb) ,Silicon Carbide) • By End User (Automotive, Aerospace & Defense, Consumer Electronics, IT & Telecommunication, Healthcare, Energy & Power, Others (Research & Academia, Industrial, etc.)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Renesas Electronics Corporation , ams-OSRAM AG, Hamamatsu Photonics K.K. ,ROHM Co., Ltd., Samsung Electronics Co., Ltd. ,Jenoptik AG ,Semiconductor Components Industries LLC , Sharp Corporation, Sony Semiconductor Solutions Corporation ,TT Electronics ,Vishay Intertechnology, Inc. , Toshiba Electronic Devices & Storage Corporation and others. |

| Key Drivers | • Sales of high-end vehicles are increasing due to a more competitive new car market, which is also resulting in stable prices. • Optoelectronics are responsible for powering our devices. |

| RESTRAINTS | • The benefits and drawbacks of innovation in optoelectronics Market • Limitations of materials in optoelectronics |