De-identified Health Data Market Report Scope & Overview:

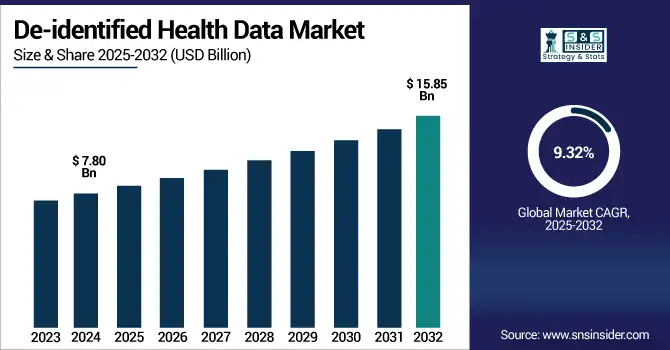

De-identified health data market size was valued at USD 7.80 billion in 2024 and is expected to reach USD 15.85 billion by 2032, growing at a CAGR of 9.32% over the forecast period of 2025-2032.

To Get more information on De-identified Health Data Market - Request Free Sample Report

The surge in demand for de-identified health data due to compliance with privacy regulations in clinical research, AI training, population health management, and value-based care is fueling to growth in the global de-identified health data market. Market growth is being driven by the increasing adoption of EHR, enhanced analytics, and RWE platforms. Regulatory frameworks such as HIPAA and GDPR are promoting de-identification practices that make it easier to share data while maintaining patient privacy. Digitization of healthcare, rising partnerships, and the evolving role of precision medicine and artificial intelligence (AI) continue to bolster market momentum.

The U.S. De-identified health data market size was valued at USD 1.94 billion in 2024 and is expected to reach USD 3.97 billion by 2032, growing at a CAGR of 9.46% over the forecast period of 2025-2032.

The North American de-identified health data market is led by the U.S., which is attributable to its advanced healthcare infrastructure, increased usage of electronic health records (EHRs), and growing investment in real-world evidence and AI-based analytics. The supportive regulations (HIPAA, etc.), coupled with the presence of a robust ecosystem of data analytics firms, health-care providers, and research institutions, help solidify its position as the global leader. The U.S. remains ahead in using data to drive innovation in clinical research, population health management, and precision medicine, based on such de-identification.

Market Dynamics:

Drivers

-

The Expanding Need for Real-World Evidence (RWE) in Clinical Research is Driving the Market Growth

Real-world evidence (RWE) is a form of clinical insight that is based on real-world data (RWD), such as patient health records, insurance claims, and pharmacy data, that can be obtained outside traditional randomized controlled trials. The heart of RWE is the ability to study large and well-characterized patient populations with de-identified health data—the data cannot be linked to specific patients, so privacy is kept intact. There is an increasing use of RWE by pharmaceutical companies, regulators, and healthcare organisations in areas such as drug development, the post-marketing surveillance of drugs, and health technology assessment. Such a shift is driven by the demand to expedite clinical research, lower expenses, and bring therapies to market more quickly with regulatory compliance. Easier trial design, rapid patient recruitment, and real-world assessment of treatment effectiveness are all possible with access to de-identified data.

A public–private partnership was established during the COVID-19 pandemic in a new PMC Open Medicine publication, and this partnership has enabled the collection of near real-time access to real-world data (RWD) to allow near real-time high-quality epidemiological research with the use of de-identified datasets.

-

Market Growth is Being Driven by Increasing Focus on Data Privacy and Compliance

As the data security and patient confidentiality issues surge, guidelines for treating personal health information have been created in the form of laws such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. and the General Data Protection Regulation (GDPR) in Europe. Such laws promote the use of de-identified data by enabling the sharing and analysis of this data for research and public policy, and the enhancement of care, bypassing violations of patient rights. In the pursuit of a more generalizable usage of health data, healthcare organizations, research institutions, and tech companies are investing more in assurance technologies and services that anonymize data and mitigate risk when utilizing sensitive data sets. This regulatory focus not only acts as a limitation but also continues to stimulate growth for the de-identified health data market by making sure that sensitive information can be followed and used ethically and legally at scale.

Restraint

-

Lack of Awareness About Re-Identification Risk Is Preventing the Market from Growing

The risk of re-identification is one of the most prominent constraints of the de-identified health data market. Datasets that have been reduced to their simplest form and stripped of obvious identifiers (such as name, address, or Social Security number) may still have quasi-identifiers (age, ZIP code, or health status) in them. This data, when matched with public data—such as voter records, social media, or other public databases—may allow individuals to be re-identified.

With machine learning and other sophisticated data mining techniques to identify patterns and correlations that human analysts might miss, this threat is compounded, leading to growing concerns about patient privacy violations and creating bottom-line risks in the form of legal, ethical, and reputational consequences for both healthcare organizations and data aggregators.

This leads many institutions to take overly conservative de-identification approaches that, while safer, reduce the utility of the data and ultimately slow innovation in research, AI, and precision medicine.

Segmentation Analysis:

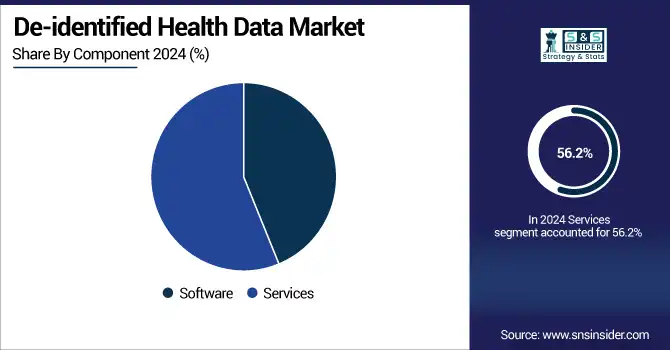

By Component

The services segment held the highest share in the deidentified health data market with a 56.2% owing to high demand for consulting services in data anonymization, risk assessment, compliance auditing, and secure data exchange among organizations. Healthcare providers, pharmaceuticals, and research institutions use third-party service providers more frequently to effectively comply with stringent privacy regulations such as HIPAA and GDPR. The services segment is further characterized by intensive resource-consuming processes such as data aggregation, standardization, and real-world evidence, and requires domain-specific competencies, which contribute to its largest share.

During the forecast period, the software segment is anticipated to register a significant CAGR owing to the increasing trend of employing advanced analytics, artificial intelligence, and machine learning tools for automated data de-identification and privacy risk reduction. With healthcare organizations moving from third-party data handling and real-time analytics to in-house, the need for increasingly robust, secure, and flexible software platforms has been growing. Furthermore, the capability to integrate software into current health IT ecosystems allows for tighter control, more efficiency, and a lower cost setting, becoming the go-to strategy for data stewardship over the long term.

Type of Data

In 2024, the clinical data segment dominated the de-identified health data market share with 21.5% owing to its key role in the basis of supporting real-world evidence clinical trials and patient outcome analysis. De-identified clinical data—extracted from electronic health records (EHRs), laboratory results, and treatment histories—are essential to assessing therapeutic efficacy, safety vigilance, and regulatory submission. Due to their predominant use and high commercial value, clinical datasets are the most commercially used type of de-identified health data, with pharmaceutical companies and healthcare institutions leveraging such data for essential use cases, including promising accelerated drug development and optimizing the delivery of care.

The epidemiological data segment is anticipated to show the fastest growth in the forecast period, due to increased interest in public health surveillance, pandemic preparedness, and chronic disease monitoring. The collection and analysis of population-level, de-identified data to help identify trends in disease and guide preventative measures is favorable among research bodies, governments, global health organizations, and advocates. As technological advancements in big data and geospatial analytics continue to further increase the utility of epidemiological datasets, they are slowly but steadily becoming indispensable tools for health policy and intervention program design.

By Application

In 2024, the clinical research and trials segment held the largest share of the de-identified health data market with a 22.1% market share, as pharmaceutical companies, contract research organizations (CROs), and academic institutions use de-identified patient data to conduct large-scale studies with aggregated data, without sacrificing the privacy of the individual. Such data is critical for patient stratification, site selection, protocol, and outcome measurements. This application represents a pillar of market activity, and demand for de-identified clinical datasets has been driven further by the newer focus on real-world data (RWD) and real-world evidence (RWE) as a complement to classical trials.

The drug discovery and development segment is anticipated to witness the fastest growth in the forecast years, owing to increased traction concerning the adoption of AI, machine learning, and bioinformatics tools for early-stage research. By analyzing health data that is devoid of personal information, researchers get access to invaluable information about disease mechanisms, target validation, and biomarkers, which can be used to expedite the drug development process, making it more efficient and targeted. The segment is expected to grow rapidly due to the increasing use of de-identified datasets for preclinical modeling and predictive analytics, as pharma and biotech firms ramp up efforts to make R&D timelines shorter and cost-effective.

By End Use

The 2024 de-identified health data market was led by the healthcare providers segment, as they serve as the central locus for the collection and storage of patient health data. By definition, hospitals, clinics, and integrated health systems generate large volumes of clinical data through electronic health records (EHRs), diagnostic tests, and treatment plans. Such organizations are applying more and more de-identifying of data to facilitate research partnerships, population health endeavors, and quality improvement activities while maintaining compliance with privacy regulations such as HIPAA and GDPR. They are at the center of the de de-identified data ecosystem due to their capacity to offer real-time, heterogeneous, and longitudinal datasets.

In the forecast period, the pharmaceutical companies segment is expected to be the fastest-growing segment as the industry is adopting data-driven approaches across the product lifecycle, including drug discovery, clinical trial optimization, and market access planning. Moreover, pharma firms can use it to create real-world evidence, examine treatment pathways, and pinpoint medical unmet needs in a shorter time and with a lower cost by using de-identified health data. Increased pressure to shorten timelines in drug development and increase the quality of regulatory submissions is leading pharma to invest heavily in de-identified datasets, accessing to have high-motility de-identified datasets readily available and functionally performing using those datasets.

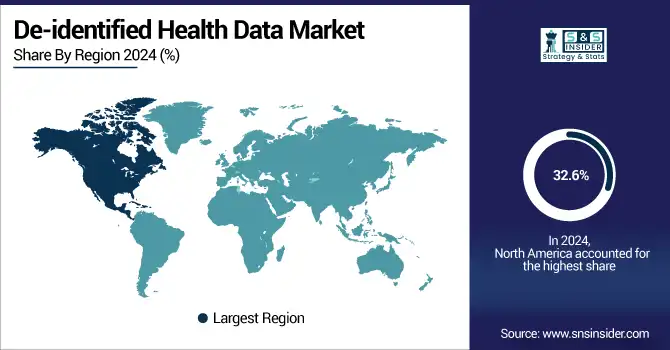

Regional Analysis:

The de-identified health data market trend is dominated by North America with a 32.6% market share, which is attributed to a developed healthcare infrastructure, the adoption of electronic health records (EHRs), and stringent regulatory requirements such as HIPAA for data privacy and secondary use of data. The region also boasts the presence of key players, including Oracle Health, IQVIA, Optum, and Veradigm, and high investment in healthcare IT infrastructure and data-driven research, consolidating its position in the global market. In addition to this, academic centres and pharmaceutical companies operating across the U.S. and Canada are leveraging these types of de-identified datasets for the purposes of real-world evidence generation and clinical trials, maintaining steady market momentum.

By region, Asia Pacific is projected to witness the highest growth rate with a 10.11% CAGR over the forecast period, primarily due to the rapid digitalization of healthcare systems, supportive government initiatives for health data infrastructure, and expanding clinical research activities. In many nations, including China, India, and more recently Japan, the growth of AI applications in healthcare is rising rapidly, forcing privacy-compliant, de-identified datasets to be used at scale. The regional growth is attributed to the increasing burden of chronic diseases, increasing pharmaceutical markets, and increasing cross-border collaborations in data science. The emerging regulatory environment is also increasingly aligning with international data privacy standards, making the market more scalable.

The de-identified health data market growth analysis in Europe has been majorly driven by the increasing adoption of digital health technologies, strong regulatory backing with frameworks, such as the General Data Protection Regulation (GDPR), in place, rising investments in real-world data initiatives across the region, and widely fosters data sharing and interoperability initiatives. To reinforce patient privacy and, at the same time, foster innovation in health research, the use of de-identified datasets for clinical trials, public health surveillance, and personalized medicine has been encouraged throughout the region. In addition, initiatives between government agencies, healthcare providers, and technology companies are creating a data-driven healthcare ecosystem throughout Europe.

De-identified health data market analysis within Latin America and the Middle East & Africa (MEA) is demonstrating steady growth, ushered by gradual and stable upgrades in terms of infrastructure in healthcare, coupled with increasing interest in digital health solutions. Though some of these regions have been slower than others in the adoption of electronic health records and data analytics tools, governments and healthcare organizations in these regions are just now beginning to realize the value of using de-identified data to help improve population health and research outcomes.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

De-identified health data market companies are Cerner Corporation (Oracle Health), IBM Watson Health (now Merative), IQVIA, SAS Institute Inc., Veradigm, Optum (UnitedHealth Group), HealthVerity, Clarify Health Solutions, Tempus Labs, Flatiron Health (a Roche company), Truveta, Komodo Health, Aetion, H1 Insights, TriNetX, Verantos, Privacy Analytics (an IQVIA company), Mendel.ai, Mayo Clinic Platform, ARC Research (Aetion’s research arm), and other players.

Recent Developments:

-

February 2025 – Veradigm, a top healthcare data and technology solution provider, announced the release of its disease-specific Cardiometabolic Clinical Data Registry datasets. The datasets consist of de-identified patient health and treatment data for those with targeted cardiometabolic diseases, to accelerate clinical research and enhance care outcomes.

-

2022 – Oracle Corporation finalized its acquisition of Cerner Corporation, creating Oracle Health. Through this strategic consolidation, Cerner's strong clinical systems are combined with Oracle's enterprise software, analytics, and automation capabilities to drive a revolutionary model in the delivery of healthcare and population health management.

-

July 2022 – Merative launched as a new, independent healthcare data analytics company. Emerging from the healthcare analytics businesses of IBM Watson Health, Merative was created after private equity firm Francisco Partners acquired these assets. Merative is now headquartered in Ann Arbor, Michigan, and is dedicated to providing data-driven solutions to enhance health outcomes.

De-identified Health Data Market Report Scope:

Report Attributes Details Market Size in 2024 USD 7.80 Billion Market Size by 2032 USD 15.85 Billion CAGR CAGR of 9.32 % From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Component (Software, Services)

• By Type of Data (Clinical Data, Genomic Data, Patient Demographics, Prescription Data, Claims Data, Behavioral Data, Wearable and Sensor Data, Survey and Patient-Reported Data, Imaging Data, Laboratory Data, Hospital and Provider Data, Social Determinants of Health (SDoH) Data, Pharmacogenomic Data, Biometric Data, Operational and Financial Data, Epidemiological Data, Healthcare Utilization Data)

• By Application (Clinical Research and Trials, Public Health, Precision Medicine, Health Economics and Outcomes Research (HEOR), Population Health Management, Drug Discovery and Development, Healthcare Quality Improvement, Insurance Underwriting and Risk Assessment, Market Access and Commercial Strategy, Business Intelligence and Operational Efficiency, Telemedicine and Remote Monitoring, Patient Engagement and Support Programs)

• By End Use (Pharmaceutical Companies, Biotechnology Firms, Medical Device Manufacturers, Healthcare Providers, Insurance Companies/Healthcare Payers, Research Institutions, Government Agencies)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles De-identified health data market companies are Cerner Corporation (Oracle Health), IBM Watson Health (now Merative), IQVIA, SAS Institute Inc., Veradigm, Optum (UnitedHealth Group), HealthVerity, Clarify Health Solutions, Tempus Labs, Flatiron Health (a Roche company), Truveta, Komodo Health, Aetion, H1 Insights, TriNetX, Verantos, Privacy Analytics (an IQVIA company), Mendel.ai, Mayo Clinic Platform, ARC Research (Aetion’s research arm), and other players.