Artificial Intelligence (AI) in Biotechnology Market Size & Trends:

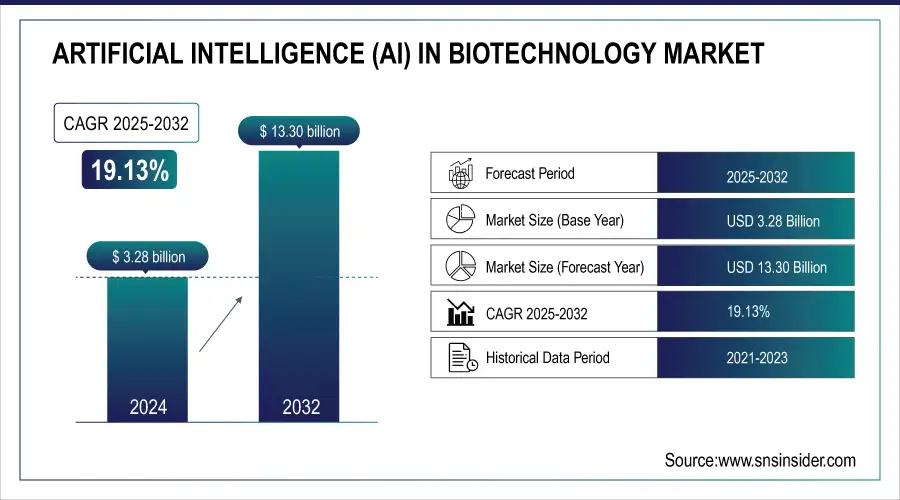

The Artificial Intelligence (AI) in Biotechnology Market size was valued at USD 3.28 billion in 2024 and is expected to reach USD 13.30 billion by 2032, growing at a CAGR of 19.13% over 2025-2032.

The artificial intelligence (AI) in biotechnology market has undergone rapid change in recent years, and it is projected to exhibit even higher growth soon, driven by innovative developments, investments in research and development, and growing demand.

In April 2025, Plex Research launched a collaboration with Ginkgo Bioworks, which uses AI to identify new disease mechanisms and pathways for increased precision in drug targeting.

Companies at the forefront of using artificial intelligence (AI) in Biotech, such as Ginkgo Bioworks, Insilico Medicine, and Isomorphic Labs, are all leading developments for drug discovery with AI, drastically reducing the timeline and cost to develop new drugs. The boom in public and private investments, including Nestlé’s deep-tech hub in Switzerland and M42’s collaboration with Juvenescence, is a sign of the AI in Biotechnology market growth. These include strategic partnerships (Illumina and NVIDIA’s AI-based genomics partnership) and the U.S. export control regulations, which indicate increasing international attention and regulatory control.

To Get more information on Artificial Intelligence (AI) in Biotechnology Market - Request Free Sample Report

R&D spending hikes are also catalysts that fashion the global artificial intelligence (AI) in biotechnology market, for instance, the AI-driven biotech funding projects from DARPA. These forces are helping to fuel burgeoning demand for faster drug pipelines, personalized medicine, and biosecurity preparedness. The artificial intelligence (AI) in biotechnology market is gaining traction, and the market is expanding and generation of highly advanced AI-powered platforms for protein engineering and disease modeling, taking the market to which next level, favoring artificial intelligence (AI) in biotechnology market growth.

In May 2025, Isomorphic Labs raised USD 600 million for next-gen drug design models, showcasing the growing investment appeal of AI-driven biotech innovation.

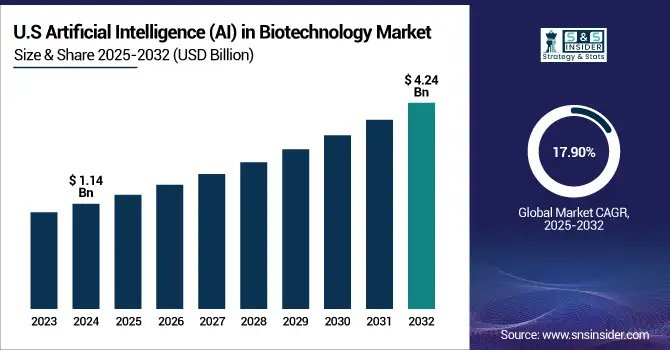

The U.S. artificial intelligence (AI) in biotechnology market size was valued at USD 1.14 billion in 2024 and is expected to reach USD 4.24 billion by 2032, growing at a CAGR of 17.90% over 2025-2032. The U.S. held the highest share in the region owing to the high implementation of AI technology in drug development, the presence of major players (NVIDIA, Illumina, and Tempus) headquartered in the country, and significant investment by the government. More than 60% of AI biotech startups globally in 2024 were U.S.-based, indicating the country’s technology leadership and robust VC environment. Canada is quickly establishing a foothold, with AI hubs in Toronto and Montreal, and government programs including the Pan-Canadian AI Strategy. Among developing countries, Mexico has increasingly begun to adopt AI tools for health research, as academic and private partnerships have risen rapidly.

| Collaborating Entities | Year & Objective | AI Application | Strategic Value |

|---|---|---|---|

| Amgen & AI Startups | 2024 – Tumor vaccine development | Immune profiling, antigen prediction | Accelerated immunotherapy design |

| XtalPi & CK Life Sciences | 2024 – Protein-based drug discovery | Protein folding prediction | Shortened early-stage development |

| Exscientia & Sanofi | 2023 – Precision oncology pipeline | Personalized drug design | Enhanced targeting in oncology trials |

| BenevolentAI & AstraZeneca | 2023 – Target discovery for kidney diseases | AI-based pathway identification | Broader pipeline expansion |

| Tempus & Cleveland Clinic | 2024 – Real-time clinical data modeling | AI-guided treatment recommendations | Improved patient care and clinical outcomes |

Market Dynamics:

Drivers:

-

Accelerated R&D, Strategic Alliances, and Automation in Biotech Innovation Fuel the Market Forward

The artificial intelligence (AI) in biotechnology market is heavily influenced by increasing AI penetration across genomics, pharmaceuticals, and bioengineering. Pharmaceutical and biotech industry leaders are using AI to improve drug development time frames and lab operations. Cradle Bio, for instance, has applied generative AI to protein engineering, speeding up development processes by more than 40%. Meanwhile, the U.S. Department of Defense’s 2024 budget directed a large experiment for AI-fueled biotech efforts as part of the BioMADE initiative, suggesting robust institutional buy-in.

By early 2025, over 60% of early-stage biotech pipelines will leverage AI. Growing demand for precision medicine and automated solutions is driving strong partnerships, such as Bristol Myers Squibb’s USD 400 million drug discovery partnership with AI Proteins. Overall, these efforts collectively drive the artificial intelligence (AI) in biotechnology market growth, boosting the artificial intelligence (AI) in biotechnology market share across different applications. A growing number of AI-based biotech incubators and increasing venture capital investments for automation technologies fuel the growth of the global artificial intelligence (AI) in biotechnology market. The continued development of personalized medicine and artificial intelligence (AI) based biologics is playing a significant role in shaping the artificial intelligence (AI) in biotechnology market trends.

Restraints:

-

Data Fragmentation, IP Issues, and Regulatory Complexities Hinder Market Growth

Although innovative development is happening rapidly, there are key constraints to the artificial intelligence (AI) in biotechnology market that could prevent growth. Foremost among these are the hurdles of regulatory uncertainty and standardization of data. The absence of harmonized global frameworks for AI deployment in clinical research and synthetic biology presents challenges for compliance.

In late 2024, the U.S. placed export controls on advanced biotech equipment associated with AI, resulting in fears over limited international supply chains. These were policies that affected multiple AI in biotech companies working with global partnerships for scale solutions. Furthermore, a lack of common datasets and divided databases results in the low precision of AI, especially in the fields of genomics and proteomics.

Intellectual property (IP) disputes also slow innovation. AI-created molecules frequently do not have an obvious IP owner, creating challenges for commercialization. Approval of AI-based treatments is still a plodding process, despite pilot projects from the FDA and EMA. These factors act as market barriers to artificial intelligence (AI) in biotechnology entry. As such, issues associated with artificial intelligence (AI) in biotechnology market analysis and commercialization globally may challenge the artificial intelligence (AI) in biotechnology market companies. However, it is still a hard task to sustainable grow the market of artificial intelligence (AI) in biotechnology in the dynamic marketplace of the global artificial intelligence (AI) in biotechnology.

Artificial Intelligence (AI) in Biotechnology Market Segmentation Insights:

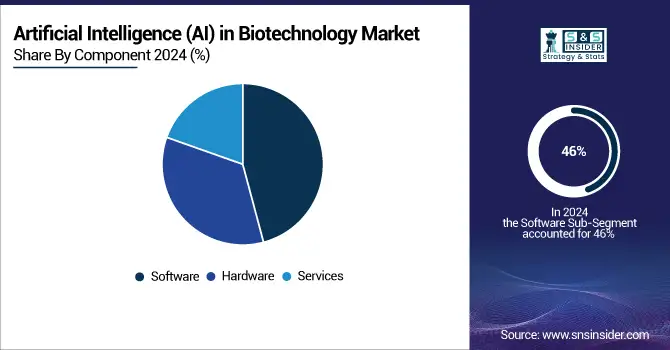

By Component

The software segment dominated the artificial intelligence (AI) in biotechnology market, with a revenue share of 46% in 2024. This domination is mainly due to the increasing use of AI platforms in computational drug design, genomic analysis, and predictive models in biotechnology processes. Solutions including Schrödinger’s software and DeepMind’s AlphaFold have facilitated a high-throughput simulation and protein folding prediction that drastically improve the productivity of R&D. Additionally, cloud-based systems and AI-based technology are becoming integrated into laboratory informatics system technologies, allowing scalable analysis.

However, services became the fastest-growing segment as demand increased for AI consulting, customization, and deployment services. Biotech companies and research organizations are increasingly investing in AI solutions to technology providers, harvesting the benefits of focused solutions and increasing operational effectiveness and time-to-market.

By Application

In 2024, the drug discovery and development segment had the highest artificial intelligence (AI) in biotechnology share, with 42% and it was the dominant segment in 2024. This growth was driven by the fast application of AI algorithms in molecular target identification, compound screening, and lead optimization activities. Firms are employing AI to cut the costs of R&D, shrink discovery timelines, and raise the rate of success for drug candidates. These include the employment of generative AI for de novo drug design and AI-based machine learning to predict compound efficacy and toxicity.

On the other hand, in terms of artificial intelligence (AI) in biotechnology growth, the clinical trials and optimization segment was identified as the fastest segment due to the rising adoption of AI for patient screening, real-time monitoring of the trials, and designing protocols. Artificial intelligence’s power to compute huge volumes of health data and forecast trial results is streamlining and demystifying the process of clinical research.

| Application Area | Description | AI Contribution | Key Benefits |

|---|---|---|---|

| Drug Discovery & Development | Screening, molecule design, target ID | In silico simulations, target prediction, and compound modeling | Reduces timelines & cost by up to 40% |

| Precision Medicine | Personalized treatment based on genetics | Patient-specific modeling, treatment recommendation engines | Improved efficacy and reduced adverse effects |

| Diagnostics | Disease identification using biological and imaging data | AI-enabled imaging, biomarker detection | Faster and more accurate diagnostics |

| Agriculture | Crop yield, disease detection, genomics | Predictive models, soil & genome analytics | Higher yield, better resistance |

| Environmental & Forensics | Bioremediation, genetic forensics | Pattern recognition, bio-trace analysis | Efficient environmental monitoring |

By End-User

Pharmaceutical companies dominated the market share of artificial intelligence (AI) in biotechnology in 2024, with a share of 38.3% of the market. It’s being driven largely by big pharma companies making significant investments in AI technologies to transform drug discovery pipelines, lower costs associated with clinical trials, and optimize precision medicine approaches. AI is also being used by companies to automate the process of target validation and to accelerate biomarker discovery. The trend is also supported by a recent spate of pharma deals with AI providers, such as the ones between Valo Health and Tempus.

Meanwhile, CROs and CDMOs were the fastest-growing type of end-user. Pharma is also now outsourcing more and more of its R&D, and they too are onboarding AI tools for preclinical and clinical services at a faster pace purely to tap into these insights and operational scale, as well as the deep technical expertise that AI implementations require.

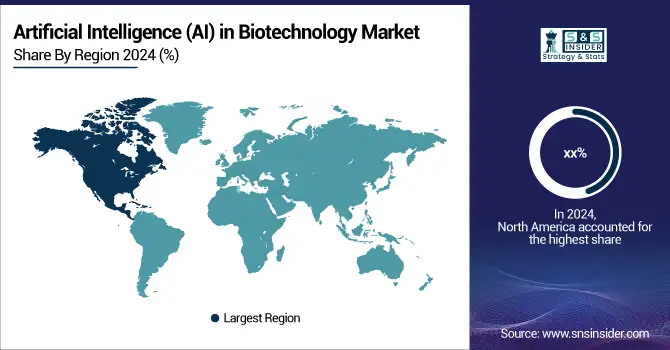

Artificial Intelligence (AI) in Biotechnology Market Regional Analysis:

North America held artificial intelligence (AI) in biotechnology market share in 2024, owing to the presence of robust R&D facilities, a well-established healthcare system, and large investments by biotech and pharmaceutical companies.

Get Customized Report as per Your Business Requirement - Enquiry Now

Artificial intelligence (AI) in biotechnology market in Europe was the second dominant and is projected to witness considerable growth, led by highly developed innovation-centric economies and robust regulatory support for the ethical use of AI in life sciences. Germany prevailed in the region due to its strong base in pharmaceutical manufacturing, substantial government contributions, and collaborations between academia and biotech companies. There are over 80 AI-biotech joint ventures in Germany nowadays. The U.K. is growing more quickly than any other country in the region, boosted by companies such as Exscientia and Benevolent AI, and government support through NHS-linked genomic and drug discovery programmes.

The Asia Pacific AI in biotechnology market is projected to register the highest CAGR in the coming years, primarily due to growing investments, favorable government initiatives, and the rapid digitalization of healthcare. China dominated the region, supported by an ambitious state-funded biotech expansion and AI development initiative in the context of “Healthy China 2030” and AI national strategies. In 2024, China filed over 300 biotech patents that referenced AI, which was the largest number of patents of any APAC country. It also has rapid growth in AI-wellness convergence and precision medicine, with national initiatives including BIRAC and iHub-Data. Japan is turning its tech-savvy ecosystem and aging population toward AI-powered diagnostics and therapeutics. Growing partnerships with Western biotech companies and uptake of AI platforms in genomics, imaging, and drug development are driving the region’s push, especially in Singapore and South Korea, which are regional AI-health innovation hubs.

| Influence Level | Region & Country | Key Strengths |

|---|---|---|

| High | United States | Strongest global leader with highest AI-biotech integration, R&D funding, and startup density. |

| High | China | Aggressive government-led AI and biotech investments; fastest-growing patent activity. |

| Strong | Germany | Deep-rooted pharma industry with AI compliance and ethical integration. |

| Strong | India | Emerging biotech hubs, AI research initiatives, and a strong talent pool. |

| Strong | Japan | Advanced imaging diagnostics and AI-health tech innovation. |

| Moderate | Canada | Government-backed AI frameworks and rising AI-biotech collaborations. |

| Moderate | South Korea | National focus on biotech AI R&D and startup acceleration programs. |

| Low | Brazil | Growing AI use in diagnostics and genomic medicine: an emerging ecosystem. |

| Low | Saudi Arabia | Vision 2030 is driving AI in biotech healthcare transformation. |

| Emerging | South Africa | Nascent development in AI-biotech, mainly through academic initiatives. |

Key Players:

Leading artificial intelligence (AI) in biotechnology companies in the market include Tempus, NVIDIA, Insilico Medicine, Schrödinger, Deep Genomics, SOPHiA GENETICS, Exscientia, Recursion Pharmaceuticals, Illumina, and BenevolentAI.

Recent Developments in the Artificial Intelligence (AI) in Biotechnology Market:

In May 2025, Insilico Medicine reported via Nature Communications the AI-enabled design of ISM5939, a next-gen ENPP1 inhibitor tackling immune checkpoint resistance, demonstrating AI’s growing efficacy in fast-tracking drug candidate development.

In January 2025, Illumina integrated its DRAGEN multi-omics analysis platform with NVIDIA’s BioNeMo and MONAI AI frameworks to accelerate large-scale genomic data processing for drug discovery and clinical research.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.28 billion |

| Market Size by 2032 | USD 13.30 billion |

| CAGR | CAGR of19.13% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Hardware, and Services) |

| • By Application (Drug Discovery & Development, Clinical Trials & Optimization, Medical Imaging, Diagnostics, and Others) | |

| • By End User (Pharmaceutical Companies, Biotechnology Companies, Academic & Research Institutes, Healthcare Providers, CRO & CDMO, and Others) | |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Tempus, NVIDIA, Insilico Medicine, Schrödinger, Deep Genomics, SOPHiA GENETICS, Exscientia, Recursion Pharmaceuticals, Illumina, and BenevolentAI. |