Dental Bone Grafts and Substitutes Market Report Scope & Overview:

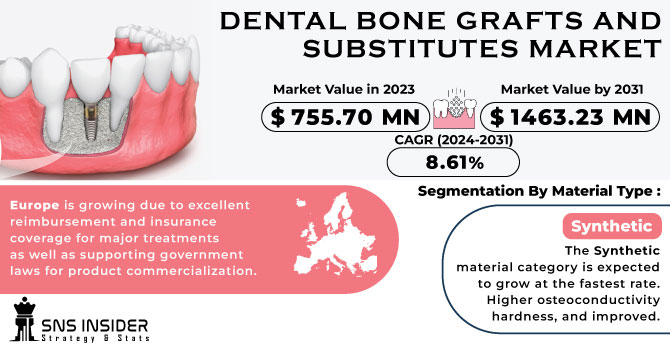

The Dental Bone Grafts and Substitutes Market Size was valued at USD 1.24 billion in 2023 and is expected to reach USD 2.42 billion by 2032 and grow at a CAGR of 7.72% over the forecast period 2024-2032. This report gives an overview of the prevalence and incidence of bone deficiencies, the increasing demand for dental procedures requiring grafting materials, and adoption and prescription patterns by region. It covers regional variations in treatment approaches and the growing preference for dental bone grafts and substitutes. It also examines trends in healthcare spending and insurance coverage, especially the significant investment in dental health and the role of insurance in facilitating access to advanced treatments. Additionally, the report reviews emerging technologies and innovations in grafting materials, focusing on biocompatible and synthetic material advancements, including improvements in outcomes for patients and the restructuring of the landscape of dental procedures.

Get more information on KEYWORD Market - Request Sample Report

Market Dynamics:

Drivers

-

The increasing demand for dental implants and the rising need for bone regeneration procedures.

The aging global population contributes heavily to the rise in conditions like periodontal diseases, bone resorption, and injuries, which increase the demand for bone grafting procedures. For instance, severe periodontitis, the major cause of bone loss, affects millions across the globe and continues to grow with age. Technological advances, such as synthetic bone graft materials, stem cell therapies, and 3D printing, have significantly improved the efficiency and effectiveness of bone graft treatments. These innovations make the procedures more personalized, less invasive, and faster in recovery, which contributes to increased adoption. Cosmetic dental procedures are also becoming increasingly popular, further adding to the market's growth. With increasing numbers of individuals looking for aesthetic enhancements, including implants and dental restorations, the requirement for bone grafts to support these procedures increases. Increased awareness about oral health, coupled with greater access to dental care, also contributes to the growth of the market. Together, these factors aging population, constant technological advancements, and the growing demand for cosmetic dentistry drive the increased adoption of bone graft procedures worldwide.

Restraints

-

High costs, complications like graft failure, limited availability of materials, and insufficient awareness

in emerging markets.

The high price of dental bone graft procedures, especially in developed countries, would make them inaccessible to many patients, thus constraining the market's growth. Complications, such as graft failure, infections, and extended recovery periods, may also prevent patients from seeking surgery. Even though autografts and allografts are used most often, their availability may be limited, and ethical considerations or compatibility problems with animal-derived grafts can be a significant problem. In addition, the unawareness of the benefits and availability of advanced bone grafting solutions in emerging markets can slow the adoption of these treatments in those regions.

Opportunities

-

Advancements in regenerative medicine, stem cell therapies, 3D printing, and the rise of dental tourism,

all contribute to the market's growth.

Ongoing research and development in regenerative medicine and new biomaterials pave the way for more efficient and affordable bone substitutes. Innovations such as stem cell-based therapies and the increasing adoption of 3D printing technologies are revolutionizing bone regeneration methods. Additionally, the rising trend of dental tourism is making it possible for patients from regions with higher costs of healthcare to access more affordable treatments, which increases the demand for bone graft procedures. Strategic partnerships between dental implant companies and bone graft manufacturers could also increase the availability of advanced solutions, thus further fueling market growth.

Challenges

-

The adoption of dental bone grafts, including ethical concerns, procedural complexity, economic factors,

and inconsistent outcomes.

The use of animal-derived grafts raises ethical concerns, and their approval is regulated, thereby limiting their acceptance. Furthermore, the complexity of bone grafting procedures that require highly qualified practitioners limits access in areas less populated by specialists. Patient confidence is challenged by the risk of graft failure, which might call for a series of revision surgeries. These would include the overall economic climate, which may see recessions occurring and can affect the ability of patients to afford elective procedures such as dental bone grafting, thus lessening demand for the treatment. Finally, poor results with certain grafts failing to integrate properly into natural bone constitute a challenge requiring further research and innovation.

Key Segmentation:

By Material Type

In 2023, the xenograft segment accounted for the largest revenue share of 49.3%. Xenografts are widely used due to their high availability, biocompatibility, and cost-effectiveness compared to autografts and allografts. Moreover, xenografts do not require a secondary surgical site, thus reducing patient morbidity and accelerating recovery times, making them a preferred choice for bone grafting procedures.

On the other hand, a synthetic bone graft is likely to grow the fastest. With growing trends of synthetic grafts, the increasing demand is mainly attributed to the advancement in biomaterials, such as hydroxyapatite and bioactive glass, that support bone regeneration while reducing the risk associated with disease transmission. In addition to this, ethical issues related to using animal-based grafts are pushing healthcare providers to use synthetic grafts.

By Application

Socket preservation dominated the application segment in 2023 with a market share of 37.3%. This segment will continue to dominate the market because the number of tooth extractions is increasing and patients are opting for dental implants, which require bone volume for proper placement. Procedural socket preservation maintains the structure of alveolar bone, allowing it from undergoing resorption and hence can lead towards more successful implant placement.

The sinus lift segment is likely to grow the fastest. It is driven by the growing atrophic maxilla cases and growing demand for dental implants, mainly among the aging population. This procedure elevates the bone in the upper jaw, creating a solid base on which to insert an implant; this is being done more often as the popularity of implants rises.

By End-use

The largest market share was recorded for the dental clinics segment in 2023, accounting for 80.3% of total revenue. Dental clinics obtain a leading position primarily due to an increasing number of independent dental practitioners offering bone grafting procedures among others. Clinics also serve as a relatively cost-effective and accessible alternative to hospitals thus involving a greater patient population.

Conversely, the hospital segment is expected to experience the highest growth rate. Reasons for this trend are expanding complex dental surgeries requiring multiple specialty care, the addition of enhanced hospital infrastructure with highly advanced surgical facilities, and cases of severe bone defects, which require added levels of medical monitoring, thereby leading to increased hospital-based dental bone graft treatments.

Regional Analysis:

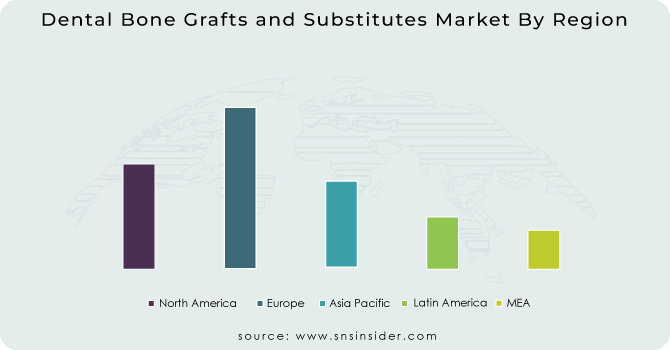

In 2023, North America accounted for the largest share of the global dental bone grafts and substitutes market, with a revenue share of 38.23%. This is due to its well-developed healthcare infrastructure, widespread adoption of dental implants, and a rising elderly population susceptible to bone loss and periodontal diseases. The presence of major industry players, supportive reimbursement policies, and growing awareness of oral health also contribute to the region's market leadership. There is a high demand for bone grafting procedures in the United States and Canada because of their highly developed dental care systems and a preference for implant-supported restorations.

However, the Asia-Pacific region will have the highest growth rate because of the increased incidence of dental diseases, improved disposable incomes, and increased awareness about dental aesthetics. The countries of China, India, and Japan are experiencing rapid progress in healthcare infrastructure, thereby increasing access to dental treatments. The region has also become a destination for dental tourism, which attracts international patients seeking high-quality yet cost-effective procedures. Cosmetic dentistry market growth, along with initiatives by governments to improvise healthcare services, is further driving expansion in Asia-Pacific.

Need any customization research on KEYWORD Market - Enquiry Now

Key Players and Products Offered by Them Related to Dental Bone Grafts and Substitutes:

-

Dentsply Sirona Inc.: Symbios

-

Envista Holdings Corporation: Creos

-

Johnson & Johnson: DePuy Synthes' chronOS

-

Stryker Corporation: Vitoss

-

Medtronic Plc: Mastergraft

-

Institut Straumann AG: Straumann BoneCeramic

-

ZimVie Inc.: Puros

-

Henry Schein Inc.: BioPure

-

RTI Surgical Holdings Inc.: BioSet

-

LifeNet Health: OraGraft

-

Dentium Co., Ltd.: OsteoGen

-

Geistlich Pharma AG: Bio-Oss

-

Integra LifeSciences Holdings Corporation: DuraGen

-

Tissue Regenix Group: BioRinse

-

Kuraray Co. Ltd.: Calcitek

-

BEGO GmbH & Co. KG: BEGO OSS

-

Young Innovations: SynOss

-

Keystone Dental: DynaGraft

-

Novabone LLC: NovaBone

-

Biotiss Biomaterials LLC: Biotiss Bone

-

Collagen Matrix Inc.: OssiMend

-

Osteogenics Biomedical: Cytoplast

-

Hannox International Corp.: Hannox Bone

-

Meyer Haake GmbH: OsteoGraft

-

Arora Biosurgery Ltd.: AroraGraft

Recent Developments:

In Jan 2025, NovaBone Products partnered with BEGO to distribute its advanced Dental Putty with MIS Dispenser in Europe, marking a significant development in the dental bone graft market. This collaboration will enhance access to innovative bioactive synthetic bone graft solutions for practitioners at the IDS 2025 event.

In March 2024, the US Food and Drug Administration (FDA) released draft guidance for sponsors of dental bone grafting devices, advising on the use of animal studies to fulfill special control requirements. This guidance aims to supplement, and in certain cases, replace earlier related guidelines.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 1.24 Billion |

|

Market Size by 2032 |

USD 2.42 Billion |

|

CAGR |

CAGR of 7.72% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Material Type [Autograft, Allograft (Demineralized Bone Matrix, Others), Xenograft, Synthetic] |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Dentsply Sirona Inc., Envista Holdings Corporation, Johnson & Johnson, Stryker Corporation, Medtronic Plc, Institut Straumann AG, ZimVie Inc., Henry Schein Inc., RTI Surgical Holdings Inc., LifeNet Health, Dentium Co., Ltd., Geistlich Pharma AG, Integra LifeSciences Holdings Corporation, Tissue Regenix Group, Kuraray Co. Ltd., BEGO GmbH & Co. KG, Young Innovations, Keystone Dental, Novabone LLC, Biotiss Biomaterials LLC, Collagen Matrix Inc., Osteogenics Biomedical, Hannox International Corp., Meyer Haake GmbH, Arora Biosurgery Ltd. |