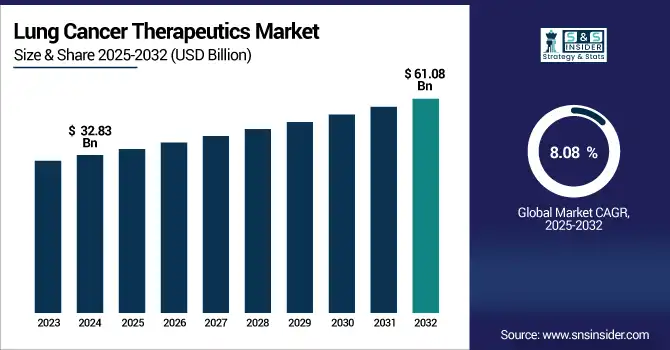

Lung Cancer Therapeutics Market Size & Growth Forecast:

The lung cancer therapeutics market size was valued at USD 32.83 billion in 2024 and is expected to reach USD 61.08 billion by 2032, growing at a CAGR of 8.08% over 2025-2032.

The global lung cancer therapeutics market is gaining attraction as the prevalence of non-small cell lung cancer (NSCLC) and small cell lung cancer (SCLC) continues to increase, the growing awareness of the early diagnosis of lung cancer, and various technological advancements. Targeted therapies, immunotherapies (PD-1/PD-L1 inhibitors), and companion diagnostics continue to redefine treatment paradigms.

To Get more information on Lung Cancer Therapeutics Market - Request Free Sample Report

In May 2025, the promising Phase III data of Tagrisso for early-stage NSCLC (released by AstraZeneca) contributed to further shifting the move toward adjuvant targeted therapy.

The ageing population globally, along with more widespread exposure to risk factors, such as air pollution and smoking, is contributing to a growing burden of disease and increasing demand for care. Investments in R&D by pharmaceutical companies are substantial, and global spending on oncology R&D is expected to exceed USD 90 billion in 2024, with a substantial proportion for lung cancer.

Regulatory agencies, such as the FDA and EMA have expedited approval of breakthrough therapies (Tepmetko, Lumakras, and Enhertu). Moreover, biotech collaborations and licensing agreements are also stoking those innovation pipelines. The improved clinical trials' success rates are raising patient access to novel therapies and are also providing high exposure global lung cancer therapeutics market.

In April 2025, Roche Ventana launched a 3rd-generation blood-based companion diagnostic for EGFR mutations, furthering trends of personalized medicine in the lung cancer therapeutics market analysis.

Lung Cancer Therapeutics Market Dynamics:

Drivers:

- Rising Innovation, Demand for Precision Medicine, and Regulatory Support Propel Market Expansion

The lung cancer therapeutics market is expected to grow due to the rising prevalence of lung cancer, demand for personalized medicine, and growing R&D focus on the development of innovative technologies. Lung cancer is one of the most common and lethal cancers globally, and the need for better therapy has led to progress. The arrival of biomarker-based therapies and NGS tools is making personalized treatment strategies a reality.

For instance, Pfizer and EMD Serono’s Lorbrena and Novartis’ Tabrecta have already presented impressive effectiveness in ALK- and MET-altered NSCLCs, respectively.

Global investment in Oncology R&D has been increased by USD 91 billion in 2024, featuring more than 500 trials targeting lung cancer. Moreover, fast-track mechanisms, such as breakthrough therapy designation by the FDA and the EMA’s PRIME scheme, are making the path to market even quicker for potential game-changing therapies including antibody-drug conjugates, bispecific T-cell engagers. Further, a surge in public and private funding, the emergence of new clinical trial infrastructure, and rising collaboration between pharma and biotech players are expected to drive robust lung cancer therapeutics market growth. Furthermore, increasing patient awareness, acceptance of immunotherapy in first-line therapy, and use of AI in clinical development are some factors assisting in defining the emerging global lung cancer therapeutics market trends.

Restraints:

- High Cost, Drug Resistance, and Limited Access in Developing Nations Hamper Market Growth

The growth of the lung cancer therapeutics market is expected to grow owing to the surging prevalence of lung cancer, high demand for personalized medicine, and surging focus on R&D for the development of innovative technologies. At or above USD 150,000 annually per patient on average, these immunotherapies, such as nivolumab and pembrolizumab, are prohibitively expensive, and their costs are not covered by insurance in many markets. In addition, the emergence of acquired resistance to EGFR and ALK inhibitors continues to be a significant clinical hurdle. It has been reported that as many as 60% of patients treated with first-generation EGFR tyrosine kinase inhibitors (TKIs) are resistant after 12 months.

Supply chain limitations and insufficient cold-chain infrastructure in the developing world limit access to sophisticated therapeutics. Additionally, regulatory obstacles in certain countries, unstandardized testing of actionable mutations, and a lack of uniform healthcare reimbursement policies are barriers to its full penetration. The multiplicity and duration of clinical trials also contribute to the expense of development and lengthen the time to launch the drug. All these obstacles affect the lung cancer therapeutics market size and hinder equitable patient access, particularly in areas with low investment in diagnostic and treatment infrastructure.

Lung Cancer Therapeutics Segmentation Insights:

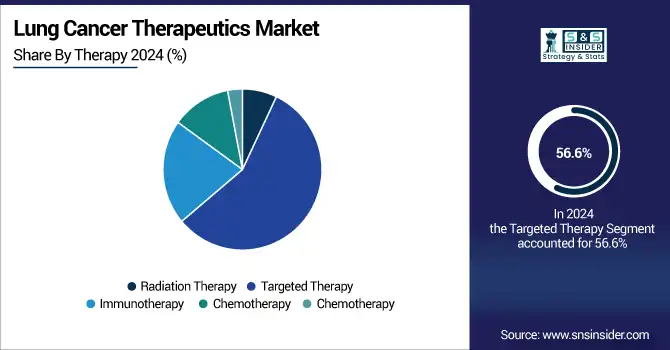

By Therapy

Targeted therapy was the largest therapy segment in 2024, contributing to more than 56.6% of the global lung cancer therapeutics market share. The segment's dominance is propelled by its high efficacy, relative lack of side effects compared to traditional therapies, and surging adoption of precision medicine, which selectively targets genes including EGFR, ALK, and ROS1. These treatments have led to an increase in progression-free survival in patients with NSCLC.

The immunotherapy segment is projected to grow at the fastest rate. As indications continue to expand for ICIs and combination strategies become increasingly standard of care in the front-line setting, immunotherapy is revolutionizing treatment paradigms for both NSCLC and SCLC.

By Lung Cancer Type

Based on prevalence, non-small cell lung cancer (NSCLC) led the market in 2024, making up almost 85% of total lung cancer incidences, and its increased responsiveness to targeted and immunotherapies.

The small cell lung cancer (SCLC) market is anticipated to be the fastest-growing segment due to recent therapeutic advancements, such as immunotherapy-based regimens (atezolizumab with chemotherapy) and emerging biomarker-based strategies, are improving historically poor outcomes.

By Distribution Channel

In 2024, hospital pharmacies were the leading distribution channel owing to the direct availability of specialty drugs and treatment provision infrastructure. Hospitals are important sites of delivery, where therapies such as infusions and complex treatment schedules can be modified.

The online source is expected to be the fastest growing segment owing to the growing trend toward digitalization of the healthcare industry, preference of patients for home delivery, rising availability of oral targeted therapy and maintenance drugs via digital channels.

By Type of Molecule

In 2024, small molecules were leading the market due to their ease of consumption (primarily oral) and lower manufacturing costs, and they can cross cell membranes for intracellular targets. These are the EGFR, ALK, and BRAF inhibitors, which are standard in advanced NSCLC therapy.

The biologics segment is witnessing the fastest CAGR as a result of the increasing usage of monoclonal antibodies and immune checkpoint inhibitors. The trend is also supported by the introduction of new biologic formats, for instance, bispecific antibodies and antibody-drug conjugates.

By Drug Class

By drug class, EGFR inhibitors accounted for the most revenues in 2024 since EGFR mutations were highly prevalent in patients with NSCLC, particularly in the Asian region. Osimertinib and such drugs have established themselves as the standard first-line treatments as they work better and are better tolerated. Multikinase inhibitors are estimated to be the most rapidly growing class as they can target several pathways at the same time, and therefore can be used against resistant or heterogeneous tumors. Their use is increasing in the second-line and refractory settings, and the demand is increasing.

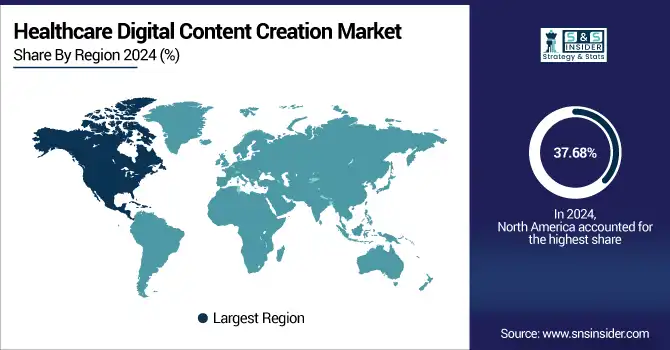

Lung Cancer Therapeutics Regional Analysis:

North America led the lung cancer therapeutics market due to the high prevalence and diagnosis rate of lung cancer (as compared to other regions), increasing demand for target therapy & chemotherapy, personalized medicines, and strong presence of leading players in this region.

The U.S. lung cancer therapeutics market size was valued at USD 9.51 billion in 2024 and is expected to reach USD 15.86 billion by 2032, growing at a CAGR of 6.65% over 2025-2032.

By country, the U.S. is dominant owing to its strong pharmaceutical presence, high per capita healthcare expenditure, and central drug approvals by the FDA. In the U.S. in 2023, there were more than 238,000 new cases of lung cancer, and the growing number of these cases is increasing demand for both immunotherapy and drugs targeting specific genetic mutations. Moreover, the increasing use of next-generation sequencing and companion diagnostics further boosts the proliferation of personalized medicine. There is an increasing number of clinical trials and government support for oncology innovation in Canada in turn leads to steady market growth. National cancer control programs in Mexico have started to improve access, and however, the infrastructure is still a limiting factor in comparison to its northern neighbors.

Europe holds a considerable share in the lung cancer therapeutics market on account of high awareness, and government-funded healthcare systems, and increasing adoption of biologics and target therapies. The up-front test region is dominated by the UK, which has high uptake of NHS-approved immunotherapies, lung cancer screening programs, and a healthy academix–industry partnership in oncology trials. The European Medicines Agency (EMA) has authorised several treatments for lung cancer in the past few years, such as nivolumab and osimertinib, improving patients' access. Germany and France are also leading donors by virtue of generous reimbursement policies and early implementation of combined therapy protocols. Poland and Turkey are proving to be particularly important second-tier markets, with the former experiencing rapid growth due to incremental clinical trial participation and the latter developing oncology infrastructure.

The fastest-growing market in the lung cancer therapeutics market is Asia Pacific, on the back of growing lung cancer incidents, increasing healthcare spending, diagnostics penetration, and pharmaceutical R&D centers. China dominates the region, with the largest global burden of lung cancer, and over 800,000 new cases were reported in 2024, and significant government support for domestic innovation through its Healthy China 2030 initiative. Local companies, such as BeiGene and Innovent are attracting attention around the world for their innovative immunotherapies. India is also growing, as it sees an increase in patients with cancer, government mandates around the use of biosimilars, and higher uptake of digital health platforms.

Japan, a country with high healthcare standards and an ageing population, has high uptake of approved targeted therapies and predictable reimbursement pathways. South Korea and Singapore are new biotech innovation hubs contributing to the regional development and growth of drug development and clinical trials.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Lung Cancer Therapeutics Market:

Leading lung cancer therapeutics companies operating in the market comprise AstraZeneca, Boehringer Ingelheim, Bristol-Myers Squibb, Eli Lilly and Company, Hoffmann-La Roche, Merck & Co., Pfizer Inc., Allergan Inc., Teva Pharmaceutical Industries Ltd., AbbVie Inc., Johnson & Johnson, Amgen Inc., and Novartis AG.

Recent Developments in the Lung Cancer Therapeutics Market:

-

In May 2025, NHS England rolled out a nationwide liquid biopsy for lung cancer patients, enabling tumor DNA profiling via a simple blood test. This “liquid biopsy–first” approach delivers results up to 16 days faster, boosting early access to targeted therapies and saving the NHS approximately USD 13.9 million annually.

-

In May 2025, U.S. FDA grants accelerated approval to AbbVie’s Emrelis (telisotuzumab vedotin), an antibody-drug conjugate targeting c–Met–overexpressing NSCLC. Based on a mid-stage trial with a 35% overall response rate, this approval paves the way for late-stage efficacy testing.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 32.83 billion |

| Market Size by 2032 | USD 61.08 billion |

| CAGR | CAGR of 8.08% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Therapy (Radiation Therapy, Targeted Therapy, Immunotherapy, Chemotherapy, and Others) • By Lung Cancer Type (Small Cell Lung Cancer, Non-Small Cell Lung Cancer, and Lung Carcinoid Tumor) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) • By Type of Molecule (Small Molecules, Biologics) • By Drug Class (Alkylating Agents, Antimetabolites, EGFR Inhibitors, Mitotic Inhibitors, Multikinase Inhibitors, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | AstraZeneca, Boehringer Ingelheim, Bristol-Myers Squibb, Eli Lilly and Company, Hoffmann-La Roche, Merck & Co., Pfizer Inc., Allergan Inc., Teva Pharmaceutical Industries Ltd., AbbVie Inc., Johnson & Johnson, Amgen Inc., and Novartis AG. |