Dental Chair Market Overview

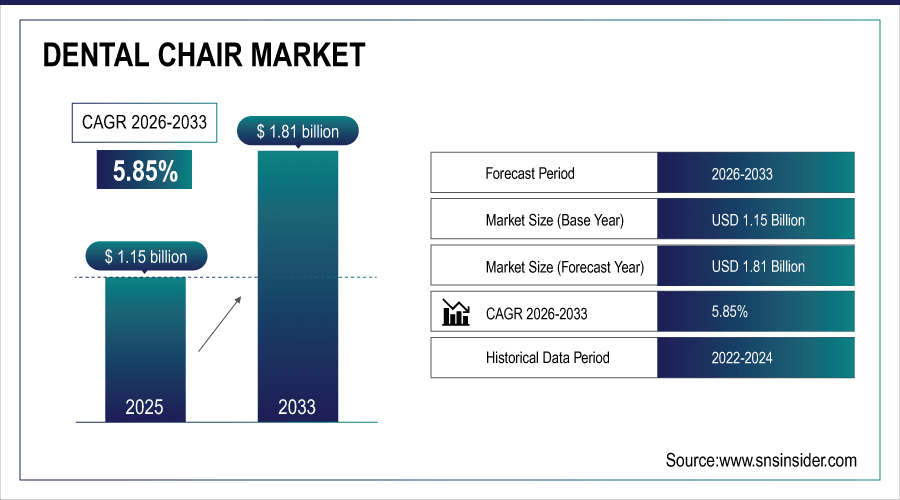

The Global Dental Chair Market size was valued at USD 1.15 billion in 2025E and is projected to reach USD 1.81 billion by 2033, growing at a CAGR of 5.85% during the forecast period 2026–2033.

The worldwide market for dental chairs is growing with more than 2.1 million different types of dental clinics and growing requirement for sophisticated oral treatment. Electric chairs are more popular because of efficiency, but hydraulic is still used in budget areas. The growth is attributed to increasing dental tourism, cosmetic dentistry and minimally invasive surgeries. Prominent uptake in hospitals and dental clinics as well as direct & distributor sales continue to support market growth through 2033.

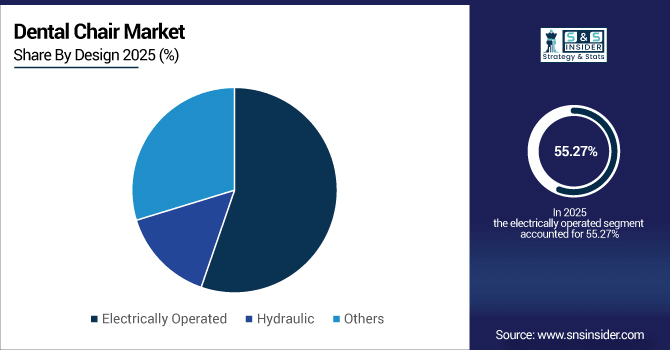

Electrically operated dental chairs accounted for over 55% of the global dental chair market demand in 2025, driven by rising adoption in modern dental clinics and hospitals.

To Get More Information On Dental Chair Market - Request Free Sample Report

Dental Chair Market Size and Forecast

-

Market Size in 2025: USD 1.15 Billion

-

Market Size by 2033: USD 1.81 Billion

-

CAGR: 5.85% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Dental Chair Market Trends

-

Electric dental chairs accounted for over 55% of market share in 2025 and will record almost two out of three units as practices update with digital or ergonomic additions by the decade’s end.

-

Hydraulic chairs comprised about 4 in 10 units sold in the year 2025, but their share is predicted to dip below and less than 3 of every ten sales by the year 2033 with adoption of sophisticated systems.

-

Pediatric & orthodontic chairs are expected to grow by nearly 2x between 2025 to 2033 with increasing acceptance of early age dental care.

-

Dental tourism-based implants are projected to grow substantially, and this would result in a procedure volume growth rate of more than 1.5x during 2025 – 33.

-

Intelligent dental chairs with imaging, sensors and features for patient comfort are projected to rise from under 5% of sales in 2025 to more than 15% by 2033.

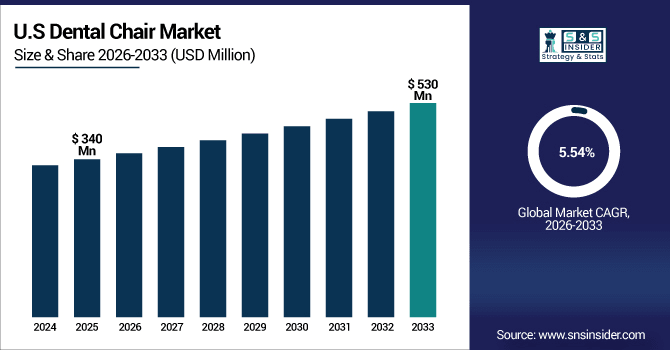

U.S. Dental Chair Market Insights

U.S. Dental Chair Market was valued USD 340 million in 2025E and is forecasts to reach USD 530 million by 2033, growing at a CAGR of 5.54% from 2026-33. The country is home to over 185,000 practicing dentists and more than 150,000 dental clinics that conduct 65+ million procedures each year. Its leading position is supported by strong cosmetic dentistry requirements, fast growth in ergonomic stool/charges use, and generous dental insurance.

Dental Chair Market Growth Drivers

-

Rising Dental Tourism and Cosmetic Procedures Propel Advanced Dental Chair Adoption Across Emerging Global Markets.

Increasing dental tourism and cosmetic surgeries is driving demand for innovative dental chairs across the globe. Asia-Pacific and Eastern Europe will also drive-up chair installations, with dental tourists to number more than 1.5 million annually by 2033. Cosmetic dentistry is already 28% of dental chair use in 2025, and it will approach 40% by the year 2033. This up-tic causes clinics to explore ergonomic, digital chairs, which not only increase patient comfort but also facilitate specialized procedures.

In 2026, electrically operated dental chairs are projected to grow by nearly 18% year-on-year, making them the fastest-growing product type in the sector.

Market Restraints:

-

High Equipment Costs and Maintenance Requirements Limit Wider Adoption of Advanced Dental Chairs in Cost-Sensitive Markets.

High cost of equipment and need for its maintenance is hindering the growth of sophisticated dental chairs. If it is an electric version, the chair will need to be serviced two times a year as opposed to 18–24 months for hydraulics. Switching electronic parts can also prolong the downtime to 20% compared and ref practice model. This has led to almost 42% of the small and medium size dentists in delaying upgrades, restricting faster adoption of next-level dental chair technologies across the globe.

Dental Chair Market Opportunities

-

Integration of Smart Imaging and Ergonomic Features in Dental Chairs Creates New Opportunities for Enhanced Patient-Centric Care.

Smart imaging and ergonomic design in dental chairs are leading to novel approaches for patient-focused care. By 2033 over 30% of installed new chairs anticipate having integrated imaging as part of the chair, resulting in an estimated nearly 25% decrease in diagnostic incrementality during procedures. Ergonomic design increases patient comfort as survey results indicate 40% preferred treatment experience vs. conventional model. This combination facilitates the adoption in contemporary treatment centers, contributing to an enhanced treatment efficiency and better treatment outcomes.

By 2026, smart dental chairs with integrated imaging will represent nearly 15% of new installations, streamlining diagnostic workflows.

Dental Chair Market Segmentation Analysis

-

By Design, Electrically Operated chairs contributed the highest market share of 55.27% in 2025E and are also projected to grow at the fastest CAGR of 6.12%.

-

By Product Type, Dental Chair-Mounted held the largest market share of 42.35% in 2025E, while Ceiling-Mounted is expected to grow at the highest CAGR of 6.47%.

-

By Application, Examination held a share of 36.41% in 2025E, while Orthodontics is anticipated to expand at the highest CAGR of 6.58%.

-

By End User, Dental Clinics accounted for the largest market share of 48.72% in 2025E, while Ambulatory Surgical Centers are expected to record the fastest growth with a CAGR of 6.39%.

-

By Distribution Channel, Direct Sales comprised 41.25% in 2025E, while Online Retail is projected to grow at the fastest CAGR of 6.71%.

By Design, Electrically Operated Dominate and Expand the Fastest

Electrically operated dental chairs dominate through 2025, accounting for over by 400,000 working units globally and provide precise, multi-positioning and patient comfort. Clinics have these models because of connectivity with digital imaging and CAD/CAM systems. There is a total demand of approximately 400,000 machines with hydraulic drives especially in cost-effective nations. Electrically power-driven equipment is expected to exceed 1.1 million units by 2033, which illustrates the trend toward dental practice environments that are digitalized and automated.

By Product Type, Dental Chair-Mounted Dominate While Ceiling-Mounted Grow Rapidly

Dental chair-mounted units will continue to lead in terms of adoption, with more than 500,000 installations worldwide in 2025, as they enable full treatment requirements at clinics. Their all-in-one delivery systems optimize both examination and surgery workflows. There are fewer ceiling-mounted chairs (180,000 installations by 2025), but they’re gaining traction in advanced hospitals and specialty centers. Ceiling-mounted will surpass 320,000 units by 2033 driven by the preference for small footprint designs that are adaptable to more contemporary clinical settings.

By Application, Examination Dominates While Orthodontics Expands the Fastest

Examination chairs continue to be the foundation of demand and will account for more than 700,000 chair uses annually in 2025, mostly due to general oral health visits. Their acceptance in prophylactic, diagnostic use ensures superiority. Orthodontics, though, are growing the fastest with 300,000 ortho-specific treatments on speciality chairs in 2025. Projected orthodontic use by 2033 is predicted to be in excess of 500,000 treatments per year helped on by corrective care at a younger age and increasing demand for aesthetic dental alignment remedies.

By End User, Dental Clinics Dominate While Ambulatory Surgical Centers Expand Fastest

In Installation type, Dental clinics lead installation, and there will be 1.2 million dental chairs installed worldwide by 2025 that serve general, cosmetic and orthodontic treatments. The position of leaders in dental care provides them with an ongoing advantage. Ambulatory surgical centers (ASCs), though smaller with approximately 150,000 chairs in 2025, are growing quickly as more procedures go outpatient. ASCs are anticipated to hold up to more than 280,000 chairs by 2033 as minimally invasive surgeries continue outside of the traditional hospital setting.

By Distribution Channel, Direct Sales Dominate While Online Retail Expands Fastest

Direct sales are the main channel of purchase, distributing over 650 thousand chairs directly to the clinics and hospitals in 2025 for quality control and after-sale maintenance. But online retail is set to be the fastest growing route, with almost 200,000 chairs bought digitally within sought by the procurement platforms of 2025. Internet sales are expected to exceed 400,000 units by the year 2033 and demonstrates significant change in e-commerce and efficient distribution channels for dental equipment.

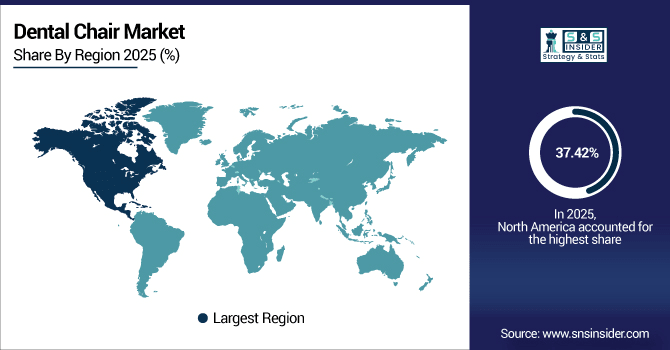

Dental Chair Market Regional Insights

North America

North America leads the global dental chair market with a 37.42% share in 2025E, supported by advanced dental infrastructure and high treatment volumes. More than 200,000 practicing dentists in the region along with more than 190,000 dental clinics make for a consistent demand of new chairs. In the United States, over 65 million dental treatments are done each year and much of those require sophisticated exam and surgical chair. This robust procedural foundation drives continued expansion, solidifying North America as the leading market through 2033.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Market Insights

The U.S. has 190,000+ active dental practices providing in excess of 60 million treatments each year and is a key dental chair adoption stronghold. Almost a third of the new chairs skied upon are electronic, underlining rapid modernization. Increasing cases of cosmetic and orthodontic treatments, coupled with high insurance penetration make the U.S. the key force behind dental chair innovations.

Asia-Pacific Market Growth

The Asia-Pacific dental chair market is projected to grow at a CAGR of 6.61% during 2026–2033, making it the fastest-growing region worldwide. The area serves over 500,000 dental offices in China, India, Japan and South Korea that perform more than 120 million dental procedures each year. Growing dental tourism, growing demand for cosmetic dentistry and government support in healthcare infrastructure are the factors driving this trend. Asia-Pacific is projected to contribute over a third of all new dental chair installs by 2033.

China Dental Chair Market Insights

China leads the Asia-Pacific dental chair market, with over 130,000 dental clinics and more than 40 million procedures annually. Oral care infrastructure investment is increasing quickly, with support from the “Healthy China 2030” project. Increasing cosmetic dentistry clients and urban middle-class preference further solidify China supremacy accounting for regional leadership in installing advanced dental chair.

Europe Market Outlook

Europe commands strong growth in the dental chair market, performing more than 420 million dental procedures annually. Markets like Italy, Spain and Poland continue to increase capacity for oral care services as patient volumes increase and modernization programmes take place. More than 70% of Western European practices have been modernised with ergonomic or digital chairs. The EU-funded projects towards oral health and the demand for cosmetic dentistry also make Europe at the forefront in advanced dental equipment uptake.

Germany Dental Chair Market Insights

Germany dominates Europe’s dental chair market, representing over 28% of regional demand in 2025E. Its 72,000+ dental clinics will active, and high orthodontics and surgery procedure rate indicate the country is application modernization. Good insurance and EU-supported innovation programs speed up the adoption, positioning Germany as a hub for European dental infrastructure expansion.

Latin America Market

The Latin American dental chair market is steadily expanding, projected to surpass USD 210 million by 2027. Brazil is the leading market with close to 58% share of regional revenue driven by over 20,000 active dental clinics and increasing demand for cosmetic dentistry. Mexico and Argentina rank close behind in fast-paced adoption, fueled by public/private funding of dental care infrastructure modernization and the growing availability of cost-effective treatment options.

Middle East and Africa Market

The Middle East & Africa dental chair market is expanding, with over 12,000 dental clinics operating regionally by 2027. Saudi Arabia is the front-runner in adoption with over 1,500 of Vision 2030’s state-of-the-art dental facilities are backing this up. South Africa also closely trails behind, as with increasing urbanization and prevalence of oral diseases, demand for advanced dental care will increase.

Dental Chair Market Competitive Landscape:

A-dec dominates the global dental chair market, with installations in over 100,000 dental offices worldwide. In North America, 85 percent of U.S. dental schools rely on A-dec equipment. Famous for ergonomics and cutting-edge infection control, the company sells in more than 100 countries. Insistence on patient comfort and integration of dental chair with digital dentistry workflows has led A-dec to becoming the world’s most trusted brand for premium dental chairs.

-

In August 2025, A-dec introduced an extended 10-year warranty on its core dental equipment, including chairs, delivery systems, and lights.

Planmeca is Europe’s largest dental chair manufacturer, with distribution in more than 120 countries and a global installed base exceeding 60,000 dental units. The firm is at the forefront of integrated dentally connected dental chairs directing imaging, CAD/CAM, and chair functions into a single computer platform. Its leadership in the DACH region, France, and the Nordics highlights strong R&D and EU-supported innovation. And with more than 3,000 research partnerships working quite hard at Planmeca we are redefining the intelligent dental clinic through connectivity and AI-driven diagnostic integration.

-

In March 2025, Planmeca launched its new “Pro” dental chair family (Pro50, Pro40, Pro50 S) at IDS 2025 in Cologne, enhancing ergonomics and infection control.

Dentsply Sirona ranks among the top global players, selling to 150+ countries with a strong dealer network. Its position in the dental furniture realm is also complemented by its status as the world’s largest manufacturer of dental equipment, which includes chairs and imaging, CAD/CAM and treatment centres. Dentsply Sirona chairs are used in more than 90% of DSOs in the U.S. and Europe. Its large development budget for digital workflow integration and ergonomic customization solidifies its status as the industry leader in total dental treatment concepts.

-

In September 2025, Dentsply Sirona highlighted its integrated dental treatment centers with upgraded chair features during DS World Las Vegas, emphasizing digital workflow compatibility and patient comfort.

Dental Chair Market Key Players

-

A-dec Inc.

-

Planmeca Oy

-

Dentsply Sirona

-

Danaher Corporation (KaVo Dental)

-

Midmark Corporation

-

Yoshida Dental Mfg. Co., Ltd.

-

DentalEZ, Inc.

-

Belmont Equipment (Takara Belmont)

-

Ritter Concept GmbH

-

Chirana Medical A.S.

-

XO CARE A/S

-

Cefla S.C. (Anthos)

-

Medidenta Group, LLC

-

Ajax Dental Supplies Pty Ltd.

-

SMT (Shinhung Co., Ltd.)

-

Fedesa (Fábrica Española de Sillas y Aparatos Dentales S.A.)

-

NSK Nakanishi Inc.

-

Fimet Oy

-

Boyd Industries, Inc.

-

BPR Swiss GmbH

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.15 Billion |

| Market Size by 2033 | USD 1.81 Billion |

| CAGR | CAGR of 5.85% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Ceiling-Mounted, Mobile-Independent, Dental Chair-Mounted, Others) • By Design (Electrically Operated, Hydraulic, Others) • By Application (Examination, Surgery, Orthodontics, Endodontics, Others) • By End User (Hospitals, Dental Clinics, Ambulatory Surgical Centers, Academic & Research Institutes, Others) • By Distribution Channel (Direct Sales, Distributors, Online Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | A-dec Inc., Planmeca Oy, Dentsply Sirona, Danaher Corporation (KaVo Dental), Midmark Corporation, Yoshida Dental Mfg. Co., Ltd., DentalEZ, Inc., Belmont Equipment (Takara Belmont), Ritter Concept GmbH, Chirana Medical A.S., XO CARE A/S, Cefla S.C. (Anthos), Medidenta Group, LLC, Ajax Dental Supplies Pty Ltd., SMT (Shinhung Co., Ltd.), Fedesa (Fábrica Española de Sillas y Aparatos Dentales S.A.), NSK Nakanishi Inc., Fimet Oy, Boyd Industries, Inc., BPR Swiss GmbH. |