Tetanus Toxoid Vaccine Market Analysis:

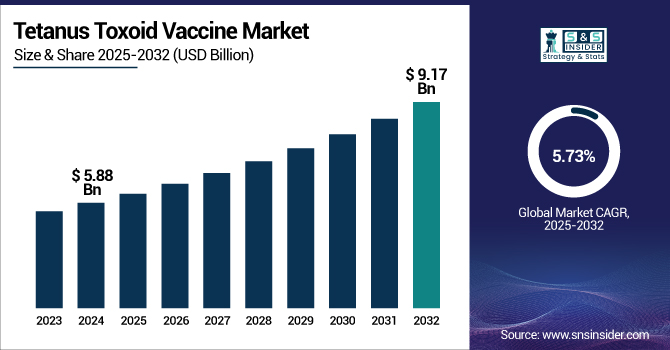

The Tetanus Toxoid Vaccine Market size was valued at USD 5.88 billion in 2024 and is expected to reach USD 9.17 billion by 2032, growing at a CAGR of 5.73% over the forecast period of 2025-2032.

To Get more information on Tetanus Toxoid Vaccine Market - Request Free Sample Report

Increasing global focus on vaccine coverage, especially among disadvantaged communities, is compelling a definite increase in the tetanus toxoid vaccine market growth. WHO and UNICEF estimates indicate that 84% of the globe's DTP (diphtheria, tetanus, pertussis) vaccination is covered globally, and more than 120 countries have at least 90% country coverage. WHO, however, points out that annually, there are approximately 73,000 tetanus deaths, most of which are maternal and neonatal cases in middle- and low-income countries.

Global health partnerships, such as UNICEF and Gavi, which purchased millions of doses alone in 2023, have been very much in support of this, thus making the availability of tetanus toxoid vaccines stronger globally. Government, non-governmental, and commercial sector spending, backed by national health budgets and multilateral partnerships, is investing considerable funds toward the purchase of vaccinations. Although pediatric tetanus immunization continues as a core area of public health intervention, growing adult vaccination needs, particularly for travel, occupational, and military use, are fueling tetanus booster doses. Increased R&D budgets are propelling advancements in tetanus toxoid vaccines production capacity and thermostability, and combination forms.

Further, revision of tetanus vaccine regulatory approvals according to WHO and CDC guidelines is making market access easier and hence supporting immunization campaigns everywhere. With a sharp emphasis on market growth, market dynamics, and market research, emphasizing the importance of tetanus toxoid vaccine producers and innovative trends, these developments are consolidating the foundation of the global tetanus toxoid vaccine market.

Highlighted by Gavi co-financing in low-income countries, UNICEF agreed on a multi-year procurement agreement with leading tetanus vaccination companies in 2024 to ensure consistent global supply through to 2027, thus fundamentally altering the tetanus vaccine business analysis.

Tetanus Toxoid Vaccine Market Dynamics:

Drivers:

-

Rising Global Immunization Initiatives and High Demand for Booster Doses Augments Market Expansion

Growing demand for booster doses, growing global immunization campaigns, and tremendous investments in vaccine production and R&D are driving the growth in the tetanus toxoid vaccine market. Global coverage against the third dose of DTP (Diphtheria, Tetanus, Pertussis) vaccines was at 84% in 2023, which reflects a mindful effort toward universal immunization. Reflecting a strong and relentless demand. According to UNICEF, procurement channel demand for Tetanus-Diphtheria (Td) vaccines is projected to level off at 130–140 million doses per year over 2023–2027.

The higher tetanus toxoid production capacity helps to sustain this peak as manufacturers increase activity to supply global demand. Apart from this, the CDC advises individuals to take a Td or Tdap booster every ten years, thereby highlighting the significance of the booster doses for tetanus in sustaining immunity. These reasons confirm the increasing trend of the market and are factors in explaining the increase in the tetanus toxoid vaccine market size.

For instance, in order to assist in outbreak responses in Nigeria, UNICEF distributed 10.8 million doses of Tetanus-Diphtheria vaccinations in 2023, therefore underscoring the vital part foreign organizations play in maintaining the global tetanus vaccine supply.

Restraints:

-

Addressing the Coverage Gap Challenges Impede Market Growth

The market growth is impeded due to challenges such as uneven vaccination coverage, logistical challenges, and vaccine hesitancy. As a result of such aspects as conflict and interrupted healthcare, nearly 14.5 million children missed critical immunizations, including tetanus ones, in 2023. Cold chain supply continues to be a significant challenge; for instance, UNICEF has been attempting to improve cold chain structures in South Sudan by procuring and installing required tools to ensure vaccine effectiveness.

In addition, vaccination rates among adults are less than optimal; as of 2022, according to the CDC, only 28.6% of individuals above 19 years old received Tdap vaccination, indicating a lack of demand for adult tetanus toxoid vaccines. These issues, combined with misinformation and low awareness, constrain the tetanus toxoid vaccine market size immensely and prevent the realization of its entire potential.

Global Tetanus Toxoid Vaccine Market Segmentation Overview:

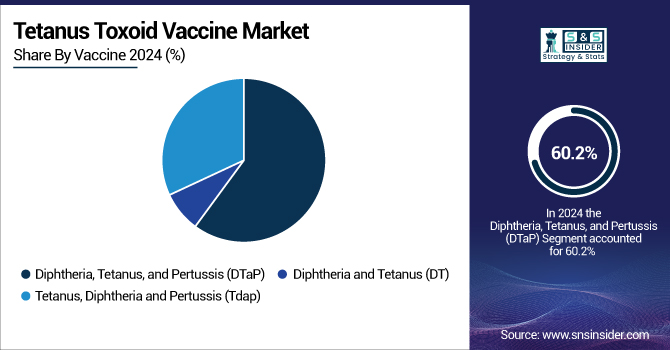

By Vaccine

The diphtheria, tetanus, and pertussis (DTaP) vaccination segment dominated the tetanus toxoid vaccine market in 2024, accounting for a substantial 60.2% share. The global healthcare initiatives, such as GAVI and WHO's Expanded Program on Immunization, along with the wide acceptance of DTaP vaccinations in children's immunization programs globally, drive the segment’s expansion in the market. The high effectiveness, combination protection, and listing in national immunization programs greatly contribute to the overall size of the market segment.

Stablepharma LTD. and BB-NCIPD LTD. reported in September 2022 that their thermally stable tetanus-diphtheria (Td) vaccine, StablevaX-Td, remained constant after 12 months at +45°C. This breakthrough addresses cold chain challenges and enhances vaccination access in regions lacking refrigerated facilities.

During the forecast period, it is anticipated that the tetanus, diphtheria, and pertussis (Tdap) vaccine market will increase at the highest growth rate. The segment’s growth is driven by the high demand for booster immunizations in adolescents, adults, pregnant women, and healthcare workers, which is growing significantly, especially in nations with strong adult immunization infrastructures.

By Disease

With 63.5% market share in 2024, tetanus was the most frequently occurring illness indication from a disease perspective. The problem is largely a function of its high mortality rate if left untreated, and the widespread policy utilization of the tetanus vaccine at birth and during pregnancy. The dominance of tetanus-related immunizations unequivocally demonstrates the intentional strategy governments and global health organizations employ to eliminate maternal and neonatal tetanus.

Diphtheria is expected to be the fastest-growing segment in the market, fueled by the increasing global outbreaks and improved preventive strategies. Increased awareness and demand in this area are rising owing to the increased public health focus and improved diagnostics and tetanus toxoid immunization trends.

Merck and Sanofi announced in June 2021 that VAXELIS, the first and sole six-in-one pediatric combination vaccine in the United States, protects against diphtheria, tetanus, pertussis, polio, Haemophilus influenzae type B, and hepatitis B. This collaboration enhances the distribution and production of vaccines to manage rising cases of diphtheria.

By End-Use

The hospitals segment held the largest tetanus toxoid vaccine market share of 42.7% in 2024 due to its key position in regular immunization, emergency prophylaxis, and maternal care programs. Hospital centralization of vaccine storage, administration, and record-keeping lends weight to their dominance in the market.

Specialty clinics are projected to expand at the highest rate, fueled by improved accessibility, decentralized vaccine administration, and adult-focused, travel, and occupational health-based targeted immunization services. This pattern indicates that individuals prefer faster and more convenient access to vaccines outside of traditional hospitals, which will fuel the growth of the market tremendously.

Tetanus Toxoid Vaccine Market Regional Insights:

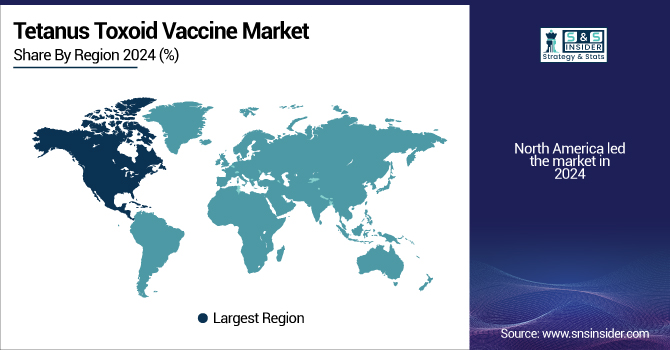

North America led the market for tetanus toxoid vaccine, driven by robust healthcare infrastructure, government-backed immunization programs, and increasing awareness around vaccine-preventable diseases. The U.S. tetanus toxoid vaccine market size was valued at USD 1.49 billion in 2024 and is expected to reach USD 2.04 billion by 2032, growing at a CAGR of 4.04% over the forecast period of 2025-2032, spurred by enhanced healthcare infrastructure, high immunization awareness, and high healthcare spending, is the region's most influential country. Robust support from federal immunization programs, high demand for tetanus vaccines among adults, and well-established cold chain systems are factors that drive the U.S. market growth. The market in the U.S. is also increased by the existence of major tetanus toxoid vaccine players and constant industry research on tetanus vaccines. By national immunization activities and increasing booster doses among adults for tetanus, Mexico and Canada are witnessing steady tetanus toxoid vaccine market growth.

Europe has a large market share with a high rate of DTP (diphtheria, tetanus, pertussis) vaccine coverage and a high trend in tetanus toxoid immunization. High rates of vaccination and government campaigns benefit countries such as Germany and the UK in becoming pioneers. For instance, France mandates DTP vaccination of children at schools, thus boosting pediatric tetanus immunization. In addition, the stringent tetanus vaccination regulatory approvals of the EU ensure high-quality standards among tetanus vaccine manufacturers, favoring the development of the market.

Asia Pacific is projected to be the fastest-growing region in the market, propelled by growing birth rates, expanded public health investments, and expanding healthcare access. India and China have become prominent donors due to large pediatric populations and extensive national immunization programs. For instance, India has enhanced the DTP vaccination supply through its Universal Immunization Program (UIP), thus enhancing tetanus vaccination coverage. Adult tetanus vaccine demand is increasing in Australia and Japan, especially among older adults and travelers. Government funding and vaccine procurement strategies assist in fueling healthy tetanus toxoid market trends across the region.

The LAMEA tetanus vaccine market is experiencing a steady increase due to improved healthcare access, public-private partnerships, and support from international bodies such as UNICEF and GAVI. Brazil takes the lead in Latin America due to its strong country immunizing programs and vaccine awareness. Saudi Arabia, among other nations, is investing in the Middle Eastern healthcare facilities, thus allowing improved vaccination levels. Africa is receiving international assistance to improve tetanus toxoid immunization coverage, especially for maternal and neonatal tetanus, despite healthcare disparities posing challenges.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major players operating in the market are GlaxoSmithKline plc (GSK), Sanofi S.A., Merck & Co., Inc., Pfizer Inc., Grifols S.A., Emergent BioSolutions Inc., Virbac S.A., Zoetis Inc., Ceva Santé Animale, and Abbott Laboratories.

Recent Developments:

-

In June 2024, the U.S. Centers for Disease Control and Prevention’s (CDC) Advisory Committee on Immunization Practices (ACIP) unanimously voted to add VAXELIS, a pediatric hexavalent combination vaccine co-developed by Merck and Sanofi, to its preferred recommendation for American Indian and Alaska Native infants. This decision underscores the vaccine's role in preventing invasive Haemophilus influenzae type b (Hib) disease within these communities.

-

In May 2024, ILiAD Biotechnologies published encouraging intermediate results from a Phase 2b trial of the intranasal pertussis vaccine BPZE1 in school children. The research indicated that improved vaccination techniques may be achievable by testing BPZE1 alone and in combination with the Tdap vaccine, Boostrix.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.88 Billion |

| Market Size by 2032 | USD 9.17 Billion |

| CAGR | CAGR of 5.73% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vaccine [Diphtheria, Tetanus, and Pertussis (DTaP), Diphtheria and Tetanus (DT), Tetanus, Diphtheria and Pertussis (Tdap)] • By Disease [Tetanus, Diphtheria, Others] • By End Use [Hospitals, Specialty Clinics, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | GlaxoSmithKline plc (GSK), Sanofi S.A., Merck & Co., Inc., Pfizer Inc., Grifols S.A., Emergent BioSolutions Inc., Virbac S.A., Zoetis Inc., Ceva Santé Animale, and Abbott Laboratories. |