Dental Prosthetics Market Report Scope & Overview:

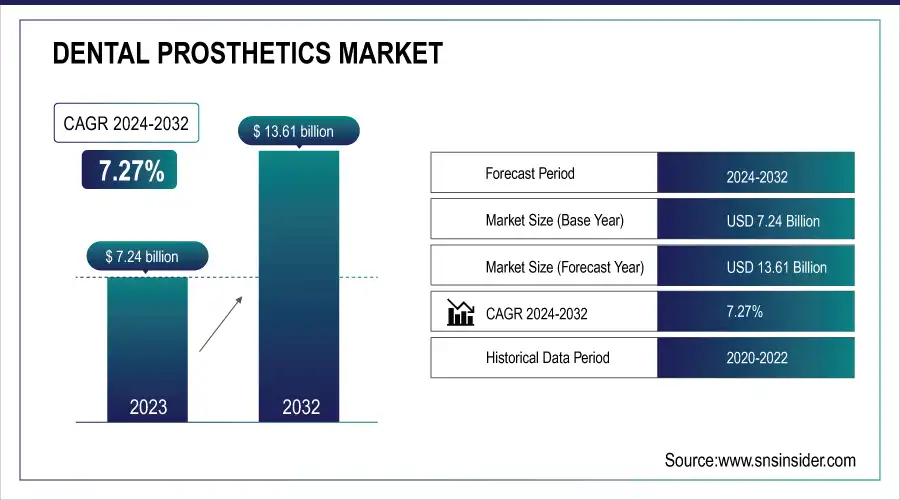

The Dental Prosthetics Market Size was valued at USD 7.24 Billion in 2023 and is expected to reach USD 13.61 Billion by 2032, growing at a CAGR of 7.27% over the forecast period of 2024-2032.

Get More Information on Dental Prosthetics Market - Request Sample Report

The Dental Prosthetics Market is evolving, driven by technological advancements and shifting demographics. Our report explores the impact of 3D printing on prosthetic production, noting how it has lowered costs and enabled greater customization. As the aging population increases, so does the demand for dental prosthetics, fueling market growth. Economic factors, including disposable income and insurance, significantly influence patient access to dental care, shaping overall demand. The popularity of cosmetic dentistry continues to expand the market, as consumers seek aesthetically appealing and durable prosthetic solutions. Additionally, regulatory approvals for new dental prosthetics products are critical for market entry, and our report provides insights into the approval process, detailing how new innovations are integrated into the industry.

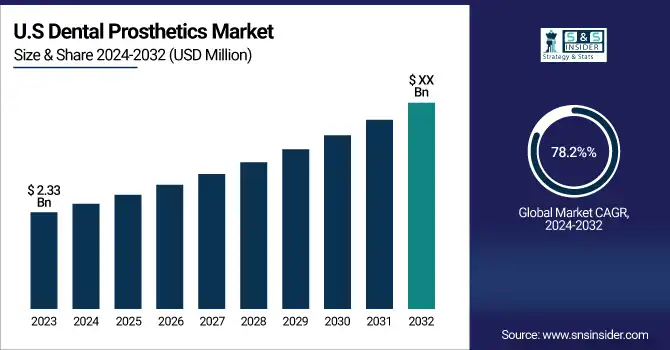

The US Dental Prosthetics Market Size was valued at USD 2.33 Billion in 2023 with a market share of around 78.2% and growing at a significant CAGR over the forecast period of 2024-2032.

The US Dental Prosthetics Market is experiencing robust growth, driven by factors such as an aging population, increasing awareness of oral health, and advancements in technology. The demand for dental prosthetics is rising as more people require restorative dental solutions, particularly with the growing geriatric population. The adoption of digital technologies, including CAD/CAM systems, and the rise of 3D printing in prosthetic production are also major contributors to the market's expansion. Organizations like the American Dental Association (ADA) highlight the growing need for innovative and high-quality dental solutions, further accelerating market growth. Leading companies such as Dentsply Sirona and 3M Company are driving technological innovation, enhancing treatment options and accessibility.

Market Dynamics

Drivers

-

Rising Focus on Aesthetic Dental Procedures Promotes Increased Demand for High-Quality Dental Prosthetics Solutions

The growing focus on cosmetic dentistry is significantly driving the demand for high-quality dental prosthetics. As consumers increasingly seek aesthetic enhancements, including teeth whitening, veneers, and tooth replacement, the demand for prosthetic solutions is expected to rise. Dental implants, crowns, and bridges are being viewed not only as functional solutions but also as cosmetic treatments that improve one’s appearance and confidence. Additionally, the rise of social media and celebrity culture has made aesthetics a more prominent factor in dental health, further driving the trend. Companies like 3M Company and Ivoclar Vivadent AG are responding to this demand by developing materials and products that combine both functionality and aesthetic appeal. The influence of cosmetic procedures, coupled with rising consumer awareness, is resulting in a shift towards premium dental prosthetics solutions that offer improved longevity and appearance. This evolving preference is expected to continue propelling the market forward, encouraging innovation and the development of new dental prosthetics technologies.

Restraints

-

High Cost of Advanced Dental Prosthetics Limits Accessibility for Lower-Income Populations in the United States

Despite technological advancements and increased demand, the high cost of dental prosthetics remains a major restraint, limiting accessibility for many individuals, particularly in lower-income brackets. Advanced dental prosthetics, such as dental implants and custom-made crowns, can be prohibitively expensive for those without sufficient dental insurance or out-of-pocket funds. The cost includes not only the prosthetics themselves but also related procedures, such as consultations, fittings, and the use of specialized technologies like 3D imaging and CAD/CAM systems. While dental insurance covers some aspects of these treatments, many policies do not fully cover the cost of high-end prosthetics, leaving a significant financial burden on patients. This disparity in access is particularly evident among vulnerable populations such as the elderly, who may require extensive dental restoration but face financial challenges. The high cost of dental prosthetics can deter many potential patients from seeking necessary treatments, thus slowing market growth, especially for products targeted at lower-income segments.

Opportunities

-

Expansion of Tele-dentistry Services Opens New Avenues for Dental Prosthetics Providers to Reach Remote Areas

The rise of tele-dentistry presents an exciting opportunity for dental prosthetics providers to expand their services, particularly to underserved or remote populations. Tele-dentistry allows patients to consult with dental professionals remotely, making it easier for individuals in rural areas or those with mobility issues to access dental care. By leveraging digital technologies, dental practitioners can evaluate the need for prosthetics through video consultations, share images and x-rays, and even guide patients through the process of getting prosthetics. This can significantly increase access to high-quality dental care for people who may otherwise not be able to visit a dentist regularly. The growth of tele-dentistry can open new markets for dental prosthetics manufacturers, enabling them to serve a broader and more diverse customer base, including those in remote regions of the United States and beyond. Additionally, this trend may reduce the overall cost of dental care by improving efficiency and reducing the need for in-person consultations.

Challenge

-

Ensuring Long-Term Durability and Performance of Dental Prosthetics Under Varying Patient Conditions

One of the key challenges in the Dental Prosthetics Market is ensuring the long-term durability and performance of prosthetic devices. Dental prosthetics, including implants, crowns, and bridges, are subject to wear and tear due to daily use and exposure to different environmental factors, such as temperature fluctuations and chewing forces. The challenge is ensuring that these products perform consistently over extended periods, particularly when patients have specific oral conditions, such as bruxism (teeth grinding) or periodontal disease, which can compromise the integrity of the prosthetics. Additionally, the materials used in prosthetics must be resilient enough to withstand the stresses of daily chewing, while also being biocompatible to prevent adverse reactions. Manufacturers must continuously improve material quality and design to meet these demands, a challenge that requires constant innovation and rigorous testing.

Segmental Analysis

By Type

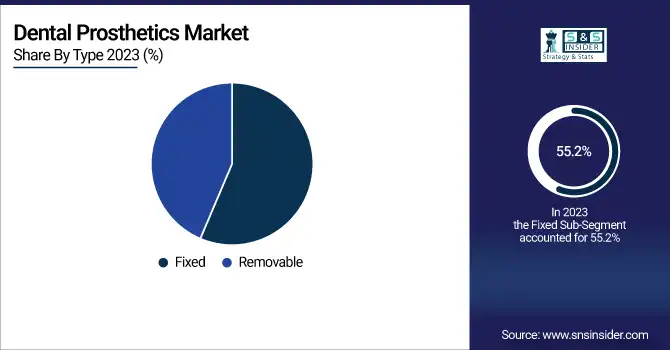

In 2023, the fixed dental prosthetics segment dominated the Dental Prosthetics Market, holding a market share of 55.2%. This dominance is primarily due to the increasing preference for dental implants and bridges, which are more durable and aesthetically appealing than removable options. Fixed dental prosthetics are commonly used in cases of tooth loss, as they offer long-term solutions that are more stable and comfortable for patients. The American Dental Association (ADA) supports the use of fixed prosthetics for their superior fit and functionality, which has contributed to their rising demand. Furthermore, advancements in materials and technology, such as titanium implants, have made fixed prosthetics more reliable and affordable, further driving their popularity. This trend is expected to continue as the adoption of advanced dental treatments grows in North America and Europe, where dental care infrastructure is well-established, and patients seek more permanent, high-quality solutions.

By Material Type

In 2023, ceramics material type dominated the Dental Prosthetics Market with a market share of 52.4%. The preference for ceramic materials is driven by their excellent aesthetic properties, including their ability to closely mimic the appearance of natural teeth. Ceramic prosthetics, such as crowns, bridges, and veneers, are highly favored by patients due to their natural look, strength, and durability. In addition, they are biocompatible and do not cause allergic reactions, making them suitable for a wide range of patients. Organizations such as the American Academy of Implant Dentistry (AAID) endorse ceramics for their functional benefits and long-lasting results. The rise in aesthetic dentistry, especially in regions like North America and Europe, further bolsters the demand for ceramic-based dental prosthetics. With the growing focus on cosmetic dental treatments and technological advancements in material science, ceramics are expected to continue leading the market in the forecast period.

By End User

In 2023, dental hospitals and clinics dominated the Dental Prosthetics Market, accounting for 51.3% of the market share. The dominance of this segment can be attributed to the widespread availability of advanced dental prosthetic treatments in professional clinical settings. These facilities offer state-of-the-art technology, including CAD/CAM systems, digital imaging, and 3D printing, ensuring precise and customized prosthetic solutions for patients. The increasing number of dental professionals opting for advanced tools and the growing demand for high-quality, personalized dental care in clinical environments have fueled the market's growth in this segment. According to the American Dental Association, dental clinics and hospitals remain the primary hubs for dental prosthetic treatments due to the comprehensive range of services and expertise they provide. As more people seek professional dental services, particularly in urban areas, dental hospitals and clinics are expected to maintain their dominance in the market.

Regional Analysis

North America dominated the Dental Prosthetics Market in 2023, with a market share of 41.1%. The region's dominance is largely driven by the high demand for advanced dental treatments, supported by a well-established healthcare infrastructure and high disposable incomes. The United States, in particular, is the largest market for dental prosthetics, with a strong emphasis on both functional and aesthetic dental solutions. Organizations like the American Dental Association (ADA) and the American Academy of Cosmetic Dentistry (AACD) are actively promoting advancements in dental prosthetics, boosting demand. Moreover, the prevalence of dental insurance coverage in the United States makes dental prosthetic procedures more accessible to a broader population. Canada also contributes to the market’s growth, with a focus on advanced materials and techniques. Mexico, however, remains a price-sensitive market with increasing adoption of affordable dental prosthetic solutions. The market is expected to continue growing as technological innovations and demand for cosmetic dental procedures rise.

Need any customization research on Dental Prosthetics Market- Enquiry Now

Moreover, the Asia Pacific region emerged as the fastest-growing segment of the Dental Prosthetics Market, with a significant CAGR during the forecast period. This growth is primarily attributed to rapid economic development, increasing disposable income, and growing awareness of oral health in emerging countries such as China and India. The expanding middle-class population in these nations is increasingly seeking high-quality dental prosthetics, often driven by rising demand for cosmetic dental procedures. According to the Indian Dental Association, the demand for dental prosthetics in India has surged as more people invest in dental treatments. China, being a leading healthcare provider in the region, is seeing rapid advancements in dental care infrastructure, leading to a higher adoption of prosthetics. Additionally, countries in Southeast Asia are experiencing increased dental tourism, with patients traveling to major cities for affordable, high-quality dental treatments. The overall expansion of dental care facilities in this region is expected to continue driving market growth.

Key Players

-

3Shape (TRIOS 3, TRIOS 4, Dental System)

-

Anthogyr SAS (Axiom Implant System, Axiom Connect Abutments)

-

Bicon, LLC (Bicon Dental Implants, Bicon Abutments)

-

BioHorizons (Tapered Plus Implants, Prevest Dental Prosthetics)

-

Cortex (Cortex Implant System, Cortex Abutments)

-

Dentsply Sirona Inc. (CEREC, Atlantis Abutments)

-

Envista Holding Corporation (Nobel Biocare Implants, Nobel Biocare Restorations)

-

Glidewell (BruxZir Solid Zirconia, Glidewell Restorations)

-

Henry Schein Inc. (Implant Restorations, Dental Prosthetics)

-

Ivoclar Vivadent AG (IPS e.max, PrograMill)

-

Mitsui Chemicals Inc. (Mitsui Zirconia, Mitsui Dental Ceramics)

-

Polident D.O.O. (Polident Denture Adhesive Cream, Polident Denture Cleanser)

-

Straumann AG (BLX Implant System, Variobase Abutments)

-

Thommen Medical AG (Thommen Implant System, Thommen Abutments)

-

VITA Zahnfabrik H. Rauter GmbH & Co. KG (VITA Zahnfabrik, VITA Enamic)

-

Zimmer Biomet (ZimVie Inc.) (Tapered Screw-Vent Implants, Tapered Implants)

-

Zircon Medical (Zirconia Crowns, Zirconia Restorations)

-

ZimVie Inc. (Tapered Screw-Vent Implants, Apex Plus)

-

3M Company (3M Lava Crowns, 3M True Definition Scanner)

-

Merz Dental GmbH (Merz Dental Implants, Merz Prosthetics)

Recent Developments

-

February 2025: 3Shape introduced a major upgrade to dental laboratory workflows with AI-powered crown design automation in its Dental System 2024 software. This innovation allows dental labs to receive AI-generated, editable design proposals for crowns, inlays, and onlays, improving efficiency. The system promises faster case management and cloud-based licensing, eliminating the need for physical dongles. The update will be available starting April 2025 in select countries.

-

June 2024: BioHorizons launched the Tapered Pro Conical implant, enhancing its Tapered Pro portfolio with a conical connection for improved surgical efficiency. The implant features Laser-Lok microchannels for better tissue attachment and crestal bone retention. Its design allows for primary stability and offers both free-hand and guided surgical approaches. The Tapered Pro Conical is suitable for single-to-full-arch treatments, aiming to improve clinical and esthetic outcomes.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.24 Billion |

| Market Size by 2032 | USD 13.61 Billion |

| CAGR | CAGR of 7.27% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Fixed [Crowns, Bridges, Abutments, Dentures, Others], Removable [Dentures, Partial Dentures, Dental Implants, Veeners]) •By Material Type (Ceramics, Cement, Composites, Others) •By End User (Dental Laboratories, Dental Hospitals & Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Straumann AG, Ivoclar Vivadent AG, VITA Zahnfabrik H. Rauter GmbH & Co. KG, BioHorizons, Cortex, 3Shape, Thommen Medical AG, Bicon, LLC, ZimVie Inc. (Zimmer Biomet), Anthogyr SAS and other key players |