Dental Suction Systems Market Report Scope & Overview:

Get more information on Dental Suction Systems Market - Request Free Sample Report

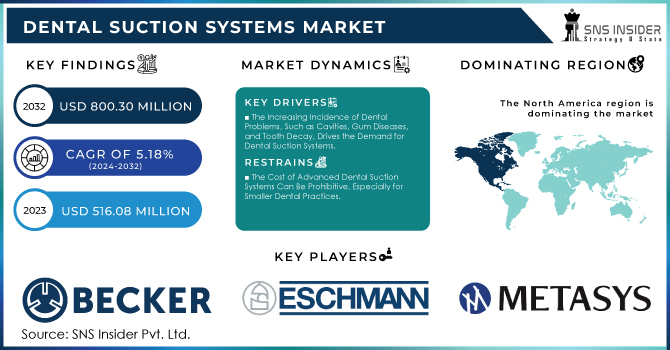

The Dental Suction Systems Market Size was valued at USD 516.08 Million in 2023 and is expected to reach USD 800.30 Million by 2032 and grow at a CAGR of 5.18% Over the forecast period of 2024-2032.

The prevalence of periodontal disease, dental caries, and oral cancer worldwide is on the rise. According to the World Health Organization (WHO), 3.5 billion people are affected by oral diseases globally, of which dental caries is one of the most common diseases in many countries. Therefore, there is a growing need for dental surgeries and with that increased requirement for dental suction systems. In addition, with people moving towards dental aesthetics, the demand for cosmetic dentistry has significantly risen. Physicians need a suction system for procedures such as tooth whitening, dental implants, or orthodontic adjustments to remove saliva, blood, and debris. These suction systems are commonly used in hospital environments for a variety of dental tasks. The growth in the revenue of the market is propelled by an increased number of dental clinics and hospitals across the globe coupled with advanced products available for oral suction. The latest versions of these suction systems are now designed to provide dental professionals with better levels of performance, cleanliness, and quiet operation.

Dentistry is increasingly consumed, particularly by an aging demographic. Specifically, projections from the U.S. Census Bureau suggest that those aged 65 and older in America will nearly double between 2018 (52 million) and 2060 (95 million). The aging population is facing a boom in the number of age-related dental diseases like periodontal disease and cavities, which has resulted in sustaining a continuous massive demand for superior suction equipment. Similarly, an article in the Journal of the American Dentist Association (ADA) illustrated the increasing patient demands for minimally invasive procedures needing accuracy and reliable suction systems. Finally, the ADA itself reports that Americans spent over USD 165 billion on dental health services and equipment in 2022.

MARKET DYNAMICS:

Key Drivers:

-

The Increasing Incidence of Dental Problems, Such as Cavities, Gum Diseases, and Tooth Decay, Drives the Demand for Dental Suction Systems.

-

The Increasing Focus on Healthcare Infrastructure Development, Coupled with Rising Awareness of Oral Health, is Driving Demand for Dental Suction Systems.

Restraints:

-

The Cost of Advanced Dental Suction Systems Can Be Prohibitive, Especially for Smaller Dental Practices.

-

Dental Equipment, Including Suction Systems, Must Adhere to Strict Regulatory Standards to Ensure Safety and Efficacy.

Opportunity:

-

The Integration of Smart Technologies, Such as IoT & AI, Into Dental Suction Systems Presents a Promising Opportunity for Market Growth.

-

Technological Advancements in Dental Equipment Are Enhancing the Efficiency and Effectiveness of Dental Suction Systems.

KEY MARKET SEGMENTATION:

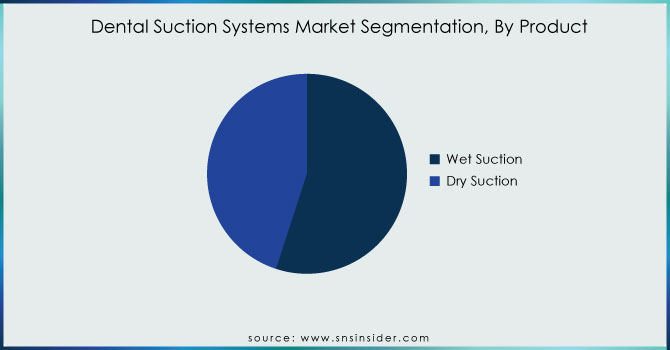

By Product

Wet Suction was the leading segment and accounted for a revenue share of 55% in 2023. Wet suction units are more reliable than dry systems. They also consist of a reverse flow regulator and central mix separation in advanced systems, thus driving the increased demand for this advanced system and indirectly contributing to the growth of dental suction systems on a global scale. Furthermore, wet suction units deliver the most important benefit by preventing flow-back of fluid and reducing the risk of contamination, hence expanding this segment.

The dry Suction is anticipated to grow at the highest CAGR of 5.0% from 2024 to 2032 as they are energy-efficient and exert varying speed motors to ensure sustained extraction power. Moreover, the convenience of not being connected to a water source and temporarily reconnecting to a shop vacuum in times of motor failure is an additional advantage. The use of an alternate mechanism or air compression does not require water usage or disposal, thus ensuring environmental friendliness.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS:

North America dominated the region in the global dental suction systems market as of 2023 with 40% of the market share. Several factors including the high inclination towards technology has in turn resulted in the adoption of advanced dental solutions into the market. In addition, this trend is because the prominent companies in the dental suction systems market are counting this continent home. There are many dental clinics and offices across the region which created a high demand for the services and thus the equipment used. The population in the United States is getting old each day and age which has been associated with dental issues such as gum issues and policy decay increasing the demand for suction equipment in this market.

Financially, the arenas one among affluent areas across the globe, and the healthcare systems have been so advanced with almost everything in the sector being accessible. This has facilitated the integration of high-quality suction systems across the region following the demand for high-class services. Here, some of the primary dental equipment producers have adopted the standards of the region and even in setting standards in the global market. The population of the United States is getting older day by day thus the demand for dental suction systems tends to increase over the years to come. Technology is a dynamic aspect and new machines keep turning into the market hastening the expansion of the market for suction systems.

KEY PLAYERS:

The key market players are Becker Pumps Australia., Eschmann Technologies Ltd., Dental International, A-dec Inc., Metasys Dental, ADS Dental System., Dentsply Sirona, CATTANI S.P.A., DENTALEZ, Inc., Ko-max Co., Ltd., and other players.

RECENT DEVELOPMENTS

-

Ko-max Co., Ltd. launched a new quieter suction system for ashtrays in a series of ‘Silence’ in March 2021, and the series seems to be extended, with many models, purposes, and practicality in performance. The invention is less noisy and offers a more silent operation.

-

In January 2021, Dentsply Sirona acquired Byte, a direct-to-consumer clear aligner company. The acquisition expands Dentsply Sirona’s product offerings and helps the company capitalize on its growth opportunity within the orthodontic market.

| Report Attributes | Details |

| Market Size in 2023 | US$ 516.08 Million |

| Market Size by 2032 | US$ 800.30 Million |

| CAGR | CAGR of 5.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Wet Suction, Dry Suction) •By End Use (Hospitals, Dental Offices) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Becker Pumps Australia., Eschmann Technologies Ltd., Dental International, A-dec Inc., Metasys Dental, ADS Dental System., Dentsply Sirona, CATTANI S.P.A., DENTALEZ, Inc., Ko-max Co., Ltd., and other players. |

| Key Drivers | •The Increasing Incidence of Dental Problems, Such as Cavities, Gum Diseases, and Tooth Decay, Drives the Demand for Dental Suction Systems. •The Increasing Focus on Healthcare Infrastructure Development, Coupled with Rising Awareness of Oral Health, is Driving Demand for Dental Suction Systems. |

| RESTRAINTS | •The Cost of Advanced Dental Suction Systems Can Be Prohibitive, Especially for Smaller Dental Practices. •Dental Equipment, Including Suction Systems, Must Adhere to Strict Regulatory Standards to Ensure Safety and Efficacy. |