Drug Delivery Devices Market Report Scope & Overview:

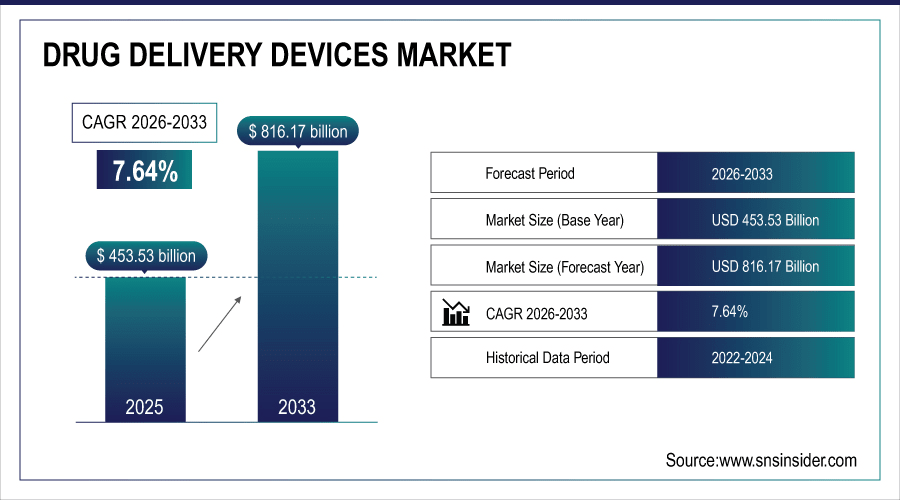

The Drug Delivery Devices Market size was estimated at USD 453.53 billion in 2025 and expected to reach USD 946.98 billion by 2035, growing at a CAGR of 7.64% during the forecast period 2026–2035.

The global market for drug delivery devices is growing rapidly due to the more than 3.5 billion annual medications dispensed around the world. Growing incidence of chronic diseases including diabetes, and respiratory issues along with demand for self-administration devices will drive the business growth. Injectors and inhalers also predominate for diabetes and respiratory care, infusion pumps and transdermal patches in oncology and cardiovascular therapy segment. Market growth is also driven by technological advances and home care trends.

Injectable devices captured 57% of the global market in 2025, inhalers and nebulizers held 23%, and transdermal patches with infusion pumps accounted for 20%.

To Get More Information On Drug Delivery Devices Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 453.53 Billion

-

Market Size by 2035: USD 946.98 Billion

-

CAGR: 7.64% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

Drug Delivery Devices Market Trends:

-

In 2025, more than 1.2 billion injectable drugs were administered globally and is estimated to exceed over 2 billion by the year 2033, on account of increasing trends of diabetes and oncology treatments.

-

Inhalers and nebulizers were used in more than 450 million respiratory therapy sessions during 2025, with adoption anticipated to nearly double by 2033 due to a growing number of respiratory disorders.

-

Home care patients received approximately 300 million transdermal patch and infusion pump doses in 2025, with the number of doses expected to surpass 600 million through 2033.

-

Speciality clinics delivered approximately 200 million injectable treatments in 2025, with this figure expected to double by 2033.

-

Hospitals globally performed over 1 billion drug delivery procedures in 2025 and the demand is expected to cross 1.8 billion by 2033.

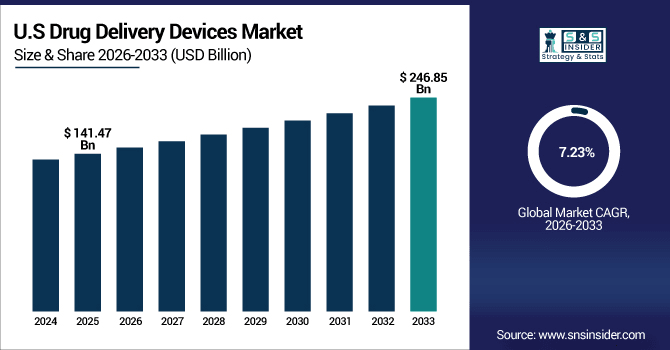

U.S. Drug Delivery Devices Market Insights:

The U.S. Drug Delivery Devices Market was valued at USD 141.47 billion in 2025 and is forecast to reach USD 284.33 billion by 2035, growing at a CAGR of 7.23% from 2026–2035. Drug administrations in the country exceeded 450 million in 2025, underpinned by developed hospital infrastructure, widespread management of chronic disease and growth in patients utilizing self-administered and smart devices. Hospitals and home care are still significant growth drivers.

Drug Delivery Devices Market Drivers:

-

Expanding Diabetes and Oncology Patient Base Fuels Adoption of Injectable and Home-Based Drug Delivery Devices.

Increasing number of diabetes and oncology cases would favours the growth of advanced drug delivery devices. Over 460 million people with diabetes and 12 million new cancer patients required regular therapies in 2025, due to which hospitals and clinics utilized injectors, infusion pumps, as well as home-use devices. This is driving uptake, while advances in technology make treatment more convenient and accurate for health systems.

In 2026, home-use infusion pumps and injectable devices are projected to surpass 500 million annual administrations, becoming the fastest-growing segment globally.

Drug Delivery Devices Market Restraints:

-

Complex Device Handling and Lack of Patient Training Limit Adoption of Self-Administered Drug Delivery Devices Globally.

The high regulatory burden and complexity of the device limits access to advanced drug delivery devices. By 2025, close to one-third of small and mid-sized clinics found it difficult to safely administer injectable, infusion or patch-based therapies. Hospitals doing more than 4,000 treatments a year had issues with machine setup and monitoring. These obstacles retard the admixture of novel delivery systems, thereby preventing patients from having access to precise, user-friendly treatments and impeding more rapid adoption in less developed and resource-limited healthcare environments.

Drug Delivery Devices Opportunities:

-

Increasing Chronic Disease Burden Creates Opportunities for Smart, Patient-Friendly Drug Delivery Devices Enhancing Treatment Adherence Globally.

Rising prevalence of self-administered drug devices is also supplementing the market opportunities for enhanced delivery systems. In 2025, there were more than 150 million cardiovascular and over 500 million respiratory treatments with inhalers, nebulisers or infusion pumps administrated. A quarter of these patients would require better ease of use devices. By 2033, next-generation smart injectable devices are anticipated to drive improved adherence and safety in over 250 million patients increasing chances of successful treatments within hospitals, clinics and home care.

By 2026, smart self-administered drug delivery devices are projected to account for nearly 18% of new device adoption, improving treatment adherence globally.

Drug Delivery Devices Market Segmentation Analysis:

-

By Product Type, Injectors held the largest market share of 55.42% in 2025, while Infusion Pumps are expected to grow at the highest CAGR of 8.85%.

-

By Application, Diabetes contributed the highest market share of 50.35% in 2025, while Oncology is anticipated to expand at the fastest CAGR of 8.90%.

-

By End User, Hospitals accounted for the largest market share of 45.50% in 2025, while Home Care Settings are expected to record the fastest growth with a CAGR of 8.50%.

-

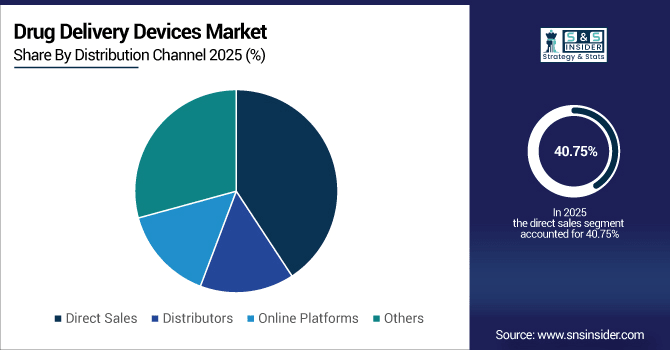

By Distribution Channel, Direct Sales comprised 40.75% in 2025, while Online Platforms are projected to grow at the fastest CAGR of 9.00%.

By Distribution Channel, Direct Sales Lead While Online Platforms Grow Fastest:

Direct sales channels led with more than 1.2 billion drug delivery procedures in 2025 at hospitals, clinics and specialty centers. On-line channels accounted for about 180 million units in 2025, rising to a forecasted more than 350 million by 2033, driven largely by increasing adoption of e-commerce providing home care solutions and patient demand for delivery product forms, including injectors, inhalers, infusion pumps, and transdermal patches that can be delivered with greater ease globally.

By Product Type, Injectors Dominate While Infusion Pumps Grow Rapidly:

Injectable drug delivery continues to dominate as the primary route of delivery, with more than 650 million administrations in 2025 for diabetes, oncology and other chronic disease therapies. In 2025, infusion pumps being applied in almost 150 million therapies are forecasted to have exceeded 300 million applications by 2033. Their use forms an integral part of home care and hospital settings for accurate and controlled delivery of drugs especially in oncology, cardiovascular, and intensive care areas worldwide.

By Application, Diabetes Leads While Oncology Expands Fastest:

Diabetes is still the most important application of drug delivery devices, with more than 460 million patients needing insulin injections and self-administered therapies on regular basis in 2025. Oncotherapies accounted for about 12 million targeted drug applications in 2025, and such use is expected to more than double by 2033 as cancer grows and personalized treatment strategies increase. The market is fueled by growth in hospitals, specialty clinics and home care with sophisticated injectors, killing veins pumps and smart delivery systems.

By End User, Hospitals Dominate While Home Care Settings Grow Rapidly:

There were over 1 billion drug delivery procedures performed in Hospitals other injectors, infusion pumps and inhalers would remain as the major end-users. The scale of therapies delivered in home care environments (estimated to surpass 400 million procedures in 2033) is being led by the patient’s desire to self-administer, managing of chronic diseases and an increase in smart devices enabling safe and convenient treatment away from healthcare premises.

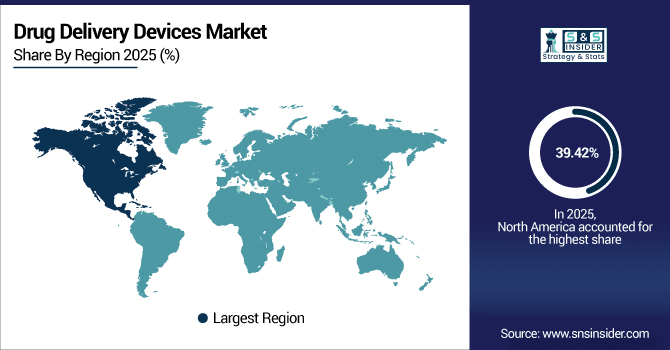

Drug Delivery Devices Regional Analysis:

North America Drug Delivery Devices Market Insights:

North America leads the global drug delivery devices market with a 39.42% share in 2025, supported by advanced healthcare infrastructure and widespread chronic disease management. There were more than 550 million drug administrations through injectors, infusion pumps and inhalers in the region in 2025. Hospitals executed over 1 billion procedures in diabetes, oncology and cardiovascular treatments, fueling use of improved patient-friendly devices. Solid healthcare backing means growth is set to continue to 2033.

In 2025, more than 6,500 hospitals and some 12,000 clinics in the U.S. used injectors, infusion pumps and inhalers to administer 450 million therapies. Increasing incidence of chronic diseases, penetration rate of smart devices and inflexible diagnosis schemes are pushing the market. Hospitals and home care providers dominate, and the U.S. is the single largest regional market worldwide.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia-Pacific Drug Delivery Devices Market Insights:

The Asia-Pacific drug delivery devices market is projected to grow at a CAGR of 8.67% during 2026–2035, making it the fastest-growing region globally. In 2025, more than 5,500 hospitals and nearly 18,000 clinics conducted close to 220-million therapies via injectors, infusion pumps and inhalers. Growth is attributed to the increasing prevalence of chronic disease, the rapid expansion of home care adoption and rising government health initiatives. By 2033, the Asia-Pacific will also make up about a quarter of worldwide drug delivery device use.

China Drug Delivery Devices Market Insights:

The Chinese market for drug delivery devices is the largest in Asia-Pacific, with over 3,500 hospitals and 12,000 clinics providing more than 120 million treatments per year. China Fast growth of healthcare infrastructure, growing incidence of chronic diseases and high uptake of smart injectors, infusion pumps and inhalers have made China one among the leading consumers within the advanced drug delivery technology market.

Europe Drug Delivery Devices Market Insights:

Europe has a strong presence in the drug delivery devices market, with 5,800 hospitals and 11,000 clinics serving over 200 million treatments each year by 2025. Germany, France and UK are key adopters of injectors, infusion pumps and inhalers. Increasing prevalence of chronic diseases, mouth-watering treatment protocol, and increasing preference for home care are fueling the demand for sophisticated and patient-friendly devices in Europe which is one of the most lucrative regional markets across the world.

Germany Drug Delivery Devices Market Insights:

Germany will dominate European drug delivery devices market in 2025 More than 1,800 hospitals and 4,200 clinics deliver over 75 million therapies each year. Strong healthcare system, high prevalence of the chronic diseases and strong uptake of injectors, infusion pumps and inhalers makes Germany as the drug delivery innovation hotspot in Europe.

Latin America Drug Delivery Devices Market Insights:

The Latin American drug delivery devices market is steadily expanding, projected to grow at a strong pace through 2033. Brazil leads the region, and over 35 million therapies are administered annually in more than 1,500 hospitals and 3,200 clinics. Behind, Mexico and Argentina will remain close behind due to the increasing prevalence of chronic diseases, expanding outpatient care and government-sponsored introduction of more sophisticated injectors, infusion pumps and inhalers.

Middle East and Africa Drug Delivery Devices Market Insights:

The Middle East & Africa drug delivery devices market is growing steadily, with over 1,200 hospitals and 2,500 clinics operating regionally by 2025. The adoption of telecardiology is high in Saudi Arabia, which can be attributed to its developed healthcare infrastructure and chronic disease management programs. South Africa is in the wake, where demand for injectors, infusion pumps and inhalers are increasing in hospitals and home care.

Delivery Devices Market Competitive Landscape:

Medtronic leads the global drug delivery devices market, particularly in targeted and infusion therapies. As of 2025, more than 2.5 million SynchroMed™ III intrathecal drug delivery systems were available globally. Its products are used to treat chronic pain, cancer-related pain and severe spasticity by directly dispensing medicine into the spine. With 5,000-plus installations in over 5,000 hospitals worldwide, Medtronic is known for experience and leadership in drug delivery technology.

- In June 2025, FDA approved the SynchroMed™ III intrathecal drug delivery system for targeted chronic and cancer pain management.

Market Leaders Johnson & Johnson is very well positioned, with over 1.8 million advanced infusion pumps and surgical delivery systems installed worldwide in 2025. Its MedTech business supplies injectors, infusion devices and surgical delivery systems. With a portfolio to close of 4200 + specialty centers/hospitals that use its devices around the globe, J&J’s vast reach and new product pipeline will support continued leadership in drug delivery devices.

- In September 2025, FDA approved INLEXZO™ for bladder cancer, enabling extended local drug delivery directly into the bladder.

BD, the third key player, will have deployed more than 1.2 million Alaris™ infusion systems and smart injectors worldwide by 2025. With applications in ambulatory infusion pumps, large volume infusions, syringe pumps and patient-controlled analgesia (PCA), these devices are integrated into more than 3800 hospitals & clinics around the world. Its focus on safety, accuracy and innovation firmly establishes BD as an industry leader in the drug delivery devices.

- In July 2025, BD launched the first pharma-sponsored trial using BD Libertas™ Wearable Injector for biologic drugs.

Drug Delivery Devices Market Key Players:

-

Novo Nordisk

-

Eli Lilly and Company

-

Sanofi

-

Gerresheimer AG

-

West Pharmaceutical Services

-

Ypsomed AG

-

Insulet Corporation

-

Aptar Pharma

-

Teva Pharmaceuticals

-

Baxter International Inc.

-

3M Health Care

-

B. Braun Melsungen AG

-

Terumo Corporation

-

Cardinal Health

-

Sandoz (a Novartis division)

-

GlaxoSmithKline

-

Pfizer Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 453.53 Billion |

| Market Size by 2035 | USD 946.98 Billion |

| CAGR | CAGR of 7.64% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Injectors, Inhalers, Nebulizers, Transdermal Patches, Infusion Pumps, Others) • By Application (Diabetes, Respiratory, Oncology, Cardiovascular, Dermatology, Others) • By End User (Hospitals, Clinics, Home Care Settings, Specialty Centers, Others) • By Distribution Channel (Direct Sales, Distributors, Online Platforms, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Medtronic, Johnson & Johnson, Becton, Dickinson and Company (BD), Novo Nordisk, Eli Lilly and Company, Sanofi, Gerresheimer AG, West Pharmaceutical Services, Ypsomed AG, Insulet Corporation, Aptar Pharma, Teva Pharmaceuticals, Baxter International Inc., 3M Health Care, B. Braun Melsungen AG, Terumo Corporation, Cardinal Health, Sandoz (a Novartis division), GlaxoSmithKline, Pfizer Inc. |