Pharmacogenomics Technology Market Size Analysis

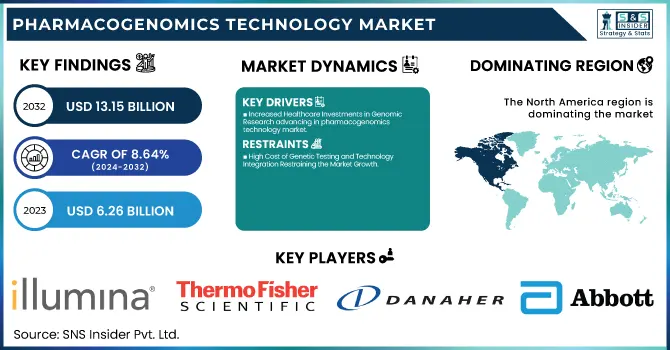

The Pharmacogenomics Technology Market was valued at USD 6.26 billion in 2023 and is expected to reach USD 13.15 billion by 2032, growing at a CAGR of 8.64% from 2024-2032.

This report provides statistical insights into the Pharmacogenomics Technology Market by offering comprehensive incidence and prevalence figures for genetic variations affecting drug metabolism and response in top regions. Furthermore, we compare prescription trends on a regional basis, indicating the adoption of pharmacogenomic testing within clinical environments and its influence on prescribing patterns. The report contains statistics on the volume of testing devices used worldwide and the forecast growth, and also a segmentation of healthcare expenditure, with emphasis on government, commercial, private, and out-of-pocket spending for pharmacogenomic testing and services. These parameters give an extensive overview of market forces beyond the conventional drivers.

To Get more information on Pharmacogenomics Technology Market - Request Free Sample Report

Pharmacogenomics Technology Market Dynamics

Drivers

-

Rising Adoption of Personalized Medicine propelling the market growth

Personalized medicine is revolutionizing healthcare with the application of genetic data to personalize treatments for individuals, strongly propelling the pharmacogenomics technology market. The FDA has approved more than 150 drugs that include pharmacogenomic information, highlighting the trend toward genetics-based healthcare. This trend has a strong influence in oncology, cardiology, and neurology, where genetic differences have an impact on treatment outcomes. With increasing focus on targeted treatments and companion diagnostics, the pharmacogenomics market is poised for rapid growth. The application of pharmacogenomics in clinical practice also enables better drug prescriptions, minimizing adverse drug reactions and maximizing therapeutic effects, making healthcare more efficient and patient-oriented.

-

Increased Healthcare Investments in Genomic Research advancing in pharmacogenomics technology market

Genomic research investments are driving innovation in pharmacogenomics technology, speeding up drug development and genetic testing advancements. For instance, the US Precision Medicine Initiative and genomic research grant funding are powering swift advances in genomics. Firms such as Thermo Fisher Scientific are reacting by developing innovative products such as the Axiom PangenomiX Array to aid population-scale disease research. These investments play a crucial role in developing pioneering pharmacogenomics technologies, as increasing partnerships among biotech companies and research institutes broaden the spectrum of genetic investigation.

Restraint

-

High Cost of Genetic Testing and Technology Integration Restraining the Market Growth

One of the significant impediments in the pharmacogenomics technology market is that genetic testing is expensive, as well as implementing new technologies within healthcare systems. Sophisticated equipment, highly skilled individuals, and extensive data analysis are needed for advanced genomic testing, making the implementation of pharmacogenomics expensive, particularly in resource-limited environments. This cost pressure can restrict the availability of pharmacogenomics technologies to a larger patient population, preventing their large-scale adoption. Further, reimbursement policies for genetic testing are still heterogeneous across different regions, preventing the large-scale adoption of personalized medicine in the clinic. Further, the implementation of pharmacogenomics within the current healthcare infrastructure necessitates substantial investment in training, regulatory clearances, and re-engineering clinical workflows, which can slow down its large-scale implementation.

Opportunities

-

The growth of Pharmacogenomics in Drug Development offers significant opportunities for the market.

The growing incorporation of pharmacogenomics in drug development presents tremendous opportunities for the market. Through the use of genetic testing at the beginning of the drug discovery process, pharmaceutical firms can develop more targeted and efficient therapies as well as limit potential side effects. As the demand for safer and more effective drugs continues to grow, pharmacogenomics can simplify clinical trials, lower their costs, and increase their success rate. The need for personalized medicine will keep fueling drug development, particularly in the oncology, neurology, and cardiovascular fields, providing a positive climate for pharmacogenomics technology companies to expand their services and impact the pharmaceutical market.

Challenges

-

A significant challenge for the pharmacogenomics technology market is navigating the complex regulatory and ethical landscape.

The process of approval for pharmacogenomic treatments and tests is long and unpredictable, and regulations are different across different regions. Moreover, there are issues concerning privacy, data security, and informed consent that can make it difficult for genetic testing to be incorporated into a clinical setting. The ambiguity regarding the ethical consequences of the use of genetic data, particularly about possible abuse or discrimination, also holds up the large-scale implementation of pharmacogenomics technology in healthcare. These regulatory obstacles and ethical considerations must be cleared to realize the full potential of the market. As regulatory frameworks mature, better guidelines might ease the process, but the sector still has to deal with issues of public confidence in genetic data.

Pharmacogenomics Technology Market Segmentation Analysis

By Therapeutic Area

The oncology segment dominated the market and accounted for 40.12% of the market share of the pharmacogenomics technology market in 2023 as genetic testing began to be increasingly incorporated into cancer treatment protocols. Pharmacogenomics has a significant impact in oncology through personalized treatment strategies depending on genetic mutations and tumor profiles. Being able to customize cancer treatments to individual patients by choosing targeted therapies and immunotherapies has resulted in more effective treatment and fewer side effects. Additionally, the increasing incidence of cancer worldwide and the rising emphasis on precision medicine have greatly accelerated the demand for pharmacogenomic testing in oncology, thus positioning it as the top therapeutic area in 2023.

The oncology segment is likely to exhibit the fastest growth during the forecast period, owing to ongoing developments in personalized cancer treatments. Continuous advances in genomic sequencing technologies and the increasing number of targeted therapies on the market are driving the rapid growth of pharmacogenomics in oncology. With more cancers diagnosed with a particular genetic mutation, clinical decision-making incorporating pharmacogenomic testing will become more widespread. Further, with new cancer drug approvals and the increasing number of clinical trials that incorporate genetic profiling, the oncology segment is likely to witness huge growth due to the demand for more accurate and efficient treatments.

By Technology

The PCR (Polymerase Chain Reaction) segment dominated the pharmacogenomics technology market with a 31.25% market share in 2023 as it plays a pivotal role in amplifying and analyzing genetic material, thus serving as a cornerstone of genomic research and diagnostics. PCR-based tests are used extensively in pharmacogenomics to detect genetic variations that affect an individual's response to drugs. The precision, scalability, and economical nature of the technique have resulted in its preferred application in the field of genetic testing in therapeutic applications of great variety, more notably in cancer, cardiovascular illness, and neurologic conditions. The growth of the use of PCR-based tests within the clinic, as well as expanded demands for the implementation of personal medicine, have reaffirmed it to be the strongest segment of the market.

The immunohistochemistry (IHC) segment is anticipated to grow at the fastest rate in the forecast period with 10.40% CAGR because of its growing use in cancer diagnosis and targeted treatment. IHC is a critical instrument in the detection of certain proteins in tissue samples, which assists in evaluating the expression of biomarkers that determine drug responses. The increase in cancer therapies that depend on biomarker detection and the increased emphasis on targeted therapies are fueling the demand for IHC. The development of IHC technology, including multiplexing and automated platforms, is also contributing to its rising growth. With precision medicine increasingly gaining acceptance, the IHC segment can anticipate experiencing vigorous growth in the future.

Pharmacogenomics Technology Market Regional Insights

North America dominated the pharmacogenomics technology market with 39.25% of the market share in 2023 with its well-developed healthcare infrastructure, strong research abilities, and substantial healthcare expenditures. Precision medicine and individualized health are a core focus area of the region, resulting in vast usage of pharmacogenomic technology. The high presence of pioneering pharmaceutical firms, research facilities, and biotechnology corporations also resides in North America, triggering considerable advancement and growth in the field of pharmacogenomics. Support by the government, for example, through the Precision Medicine Initiative, has also promoted pharmacogenomics uses. These influences, coupled with extensive awareness of individualized therapy, make the region the global leader in terms of market leadership.

Asia Pacific is expected to witness the fastest growth in the pharmacogenomics technology market, with a 10.84% CAGR throughout the forecast period, fueled by increasing investment in healthcare, increasing access to healthcare, and increased awareness about personalized medicine. The market is experiencing rising uptake of sophisticated medical technology, such as pharmacogenomics, as a result of enhanced healthcare infrastructure, favorable economic conditions, and an emerging middle class. Nations such as Japan, India, and China are experiencing a growth spurt in genetic studies and personalized medicine programs, further fueling the market. Further, the growing incidence of chronic diseases and the rising need for targeted drugs in the region are anticipated to drive the growth of pharmacogenomics adoption, leading Asia Pacific to be the fastest-growing market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in Pharmacogenomics Technology Market

-

Illumina, Inc. (Infinium Global Screening Array, TruSeq Custom Amplicon)

-

Thermo Fisher Scientific, Inc. (Ion AmpliSeq Pharmacogenomics Panel, QuantStudio 12K Flex System)

-

QIAGEN N.V. (QIAseq Targeted DNA Panels, therascreen EGFR RGQ PCR Kit)

-

F. Hoffmann-La Roche Ltd. (Cobas 4800 System, AmpliChip CYP450 Test)

-

Abbott Laboratories (Alinity m Assay, Vysis ALK Break Apart FISH Probe Kit)

-

Myriad Genetics, Inc. (myRisk Hereditary Cancer, GeneSight Psychotropic)

-

Bio-Rad Laboratories, Inc. (CFX96 Real-Time PCR System, QX200 Droplet Digital PCR System)

-

Danaher Corporation (Cepheid GeneXpert System, Beckman Coulter DxH 900)

-

PerkinElmer, Inc. (LABChip GX Touch, NEXTFLEX Rapid DNA-Seq Kit)

-

Agilent Technologies, Inc. (SureSelect Custom Panels, Magnis NGS Prep System)

-

Hologic, Inc. (Aptima HPV Assay, Panther Fusion System)

-

GenMark Diagnostics, Inc. (ePlex System, XT-8 System)

-

Asuragen, Inc. (AmplideX PCR/CE FMR1 Kit, QuantideX qPCR BCR-ABL IS Kit)

-

Invitae Corporation (Invitae Pharmacogenomics Panel, Invitae Carrier Screening)

-

BGI Genomics (BGISEQ-500, Real-Time PCR Kit for Pharmacogenomics)

-

Luminex Corporation (xTAG CYP2C19 Kit, ARIES System)

-

PacBio (Pacific Biosciences of California, Inc.) (Sequel II System, HiFi Sequencing)

-

23andMe, Inc. (23andMe Pharmacogenetics Report, Health + Ancestry Service)

-

Eurofins Scientific (Eurofins PGxOne Plus, Clinical Genetic Testing Services)

-

Oxford Nanopore Technologies (GridION System, MinION Sequencing Device)

Recent Development in the Pharmacogenomics Technology Market

-

January 2024 – researchers released the first draft of the pangenome, built from the complete genetic blueprints of 47 individuals globally, representing a more representative sample of the human genome. In response to this innovation, Thermo Fisher Scientific has introduced the Axiom PangenomiX Array, its most comprehensive and ethnically representative array to date. This groundbreaking instrument provides the best available genetic coverage for disease studies and pharmacogenomic research on a large scale and further elucidates human genomic variation.

-

October 2024 – QIAGEN Digital Insights (QDI), QIAGEN's bioinformatics arm and bioinformatics software and biomedical knowledge content market leader, announced the introduction of Pharmacogenomic Insights (PGXI), an advanced knowledgebase. This new tool will help scientific and translational researchers better understand how a patient's genetic characteristics influence how he or she will respond to medication.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.26 Billion |

| Market Size by 2032 | US$ 13.15 Billion |

| CAGR | CAGR of 8.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Therapeutic Area (Oncology, Neurological Disorders, Cardiovascular Disease, Immunological Disorders, Infectious Diseases, Others) • By Technology (PCR, In-situ Hybridization, Immunohistochemistry, Sequencing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Illumina, Inc., Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche Ltd., Qiagen N.V., Danaher Corporation, Laboratory Corporation of America Holdings, Abbott Laboratories, CeGaT GmbH, Myriad Genetics, Inc., PerkinElmer, Inc., Eurofins Scientific, Helix, Inc., PathAI, Guardant Health, Inc., Invitae Corporation, NantHealth, Inc., Gene by Gene, Ltd., Thermo Fisher Scientific, Inc., Synnovis, and other players. |