Dermatology Drugs Market Size & Overview:

To Get More Information on Dermatology Drugs Market - Request Sample Report

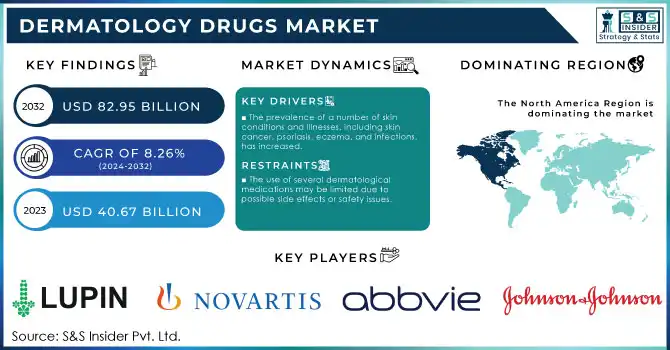

The Dermatology Drugs Market was valued at USD 20.34 billion in 2023 and is expected to reach USD 51.14 billion by 2032, growing at a CAGR of 10.71% from 2024-2032.

The dermatology drugs market report highlights the incidence and prevalence of dermatological conditions, focusing on skin diseases like psoriasis, eczema, acne, and alopecia. Prescription trends by region reveal varying treatment patterns, while healthcare spending breakdown by government, private, and commercial sectors shows how spending influences access to dermatological treatments. The report further covers trends in drug development, such as innovation and recent FDA approvals, while underlining patient demographics and treatment adherence, thereby providing a holistic view of patient behavior and drug usage patterns across regions and age groups.

Market dynamics

Drivers

-

The prevalence of Skin Conditions is Rising and propelling the Dermatology Drugs Market growth

One of the major drivers in the dermatology drugs market is rising conditions such as psoriasis, acne, eczema, and skin cancers. According to the World Health Organization (WHO), nearly 900 million people are affected with diseases affecting the skin, while about 125 million people worldwide suffer from psoriasis alone. About 85% of people experience acne at some point in their lives. In addition, the geriatric population, which is prone to skin disorders, adds more demand for dermatology treatments. The increased prevalence of chronic conditions has led to a growing requirement for more complex and long-term treatments.

-

Advancements in Drug Development and Innovation driving the Dermatology Drugs Market

In recent times, innovations in drug development have contributed considerably towards the growth of the dermatology drugs market. Recently approved products by the FDA include biologics from AbbVie like Rinvoq for atopic dermatitis, and those of Pfizer called VYsali for plaque psoriasis that significantly show clinical response. Growth was fast-paced among the biologics category and this can be attributed to treatments that involve interference in certain specific pathways linked to inflammation and an immune response. More convenient topical formulations, such as fast-absorbing creams and advanced delivery systems, have revolutionized treatment regimens, leading to better patient compliance. The continuous advancements in dermatology drugs are crucial for improving outcomes and addressing unmet needs in the treatment of skin diseases.

Restraint

-

High cost associated with advanced treatments, particularly biologics and specialty drugs.

Dermatology treatments are expensive for the advanced treatment, especially for biologics and specialty drugs. These drugs, though they work well, are expensive since their production involves a complex procedure, and even the administration itself, such as injection or infusion, requires professional service. For instance, Humira and Stelara are some of the drugs that treat psoriasis and eczema; their annual costs for patients are thousands of dollars, thus challenging access and adherence in many areas with lower healthcare funding. This is a limitation on the growth potential of the market, especially in emerging economies, as the healthcare systems in such areas face the problem of affordability.

These high costs thus exert tremendous pressure on healthcare systems, which should be able to provide these expensive treatments since this is also the case in most public health service setups. In addition, the financial burden placed on patients translates into lower adherence to treatment, with overall therapeutic outcomes lowered and the efficacy of dermatology drugs in treating chronic conditions limited.

Opportunities

-

Expanding Adoption of Telemedicine and Digital Health Solutions in Dermatology make space in the market.

The growing use of telemedicine and digital health platforms may act as the biggest growth opportunity for the dermatology drugs market. Teledermatology, which offers remote consultations and virtual care services, is gaining popularity, giving patients easier access to dermatological expertise, especially in rural or underserved areas. This trend enables early diagnosis and timely prescription of dermatology drugs. Moreover, the use of digital health tools, including AI-based skin imaging devices, aids in increasing the accuracy of diagnosing skin conditions, and this, in turn, is expected to drive the demand for targeted treatments. This technology combination is expected to fuel the growth of the market during the forecast period.

Challenges

-

A significant challenge in the dermatology drugs market is the regulatory hurdles and delays in the approval process for new treatments.

Regulatory hurdles also create significant financial burdens for pharmaceutical companies, as they must invest substantial resources in clinical trials, regulatory submissions, and compliance with varying international standards. Furthermore, the complexity of gaining approvals for specialized dermatological treatments, such as gene therapies or combination therapies, adds another layer of difficulty. Delays not only affect the availability of cutting-edge treatments but also limit competitive advantage, as other companies may introduce similar treatments more quickly. Consequently, the market's growth potential may be constrained as these factors increase development costs and prolong the time to market for innovative dermatology drugs.

Segmentation Analysis

By Therapy

The psoriasis segment dominated the dermatology drugs market with 49.23% market share in 2023 on account of a high prevalence, as well as growing awareness about better treatment options. Psoriasis is a chronic autoimmune disease characterized by red, itchy, and scaly skin that affects millions of people globally, with a significant number dealing with moderate or severe forms, that require chronic medical treatment. The introduction of new biologics and oral drugs, along with significant advancements in treatment options like targeted therapies, has improved patient outcomes. This demand for specialized psoriasis treatments has fueled the growth of this segment, making it the leading therapy in the dermatology drugs market.

The Acne segment is expected to witness the fastest growth in the forecast years. This is primarily due to increased awareness of treatment for acne among the younger generation. Acne is a prevalent condition among millions of teenagers and adults, creating a demand for fast and efficient treatment. High levels of over-the-counter (OTC) medicines and advancements in topical and oral therapies are among the factors seen to drive higher market growth, and the use of skincare is on the increase with a shift in focus more toward self-grooming as well as concern for dermatology, which raises the demand for acne treatments-high growth rate through the fastest increasing segment in this market.

By Type

The prescription segment dominated the dermatology drugs market with a 60% market share in 2023, given the rising demand for more targeted, effective, and specialized treatments for various dermatological conditions. Prescription drugs in the form of biologics, corticosteroids, retinoids, and immunosuppressants are often required in the management of moderate to severe skin disorders, such as psoriasis, eczema, and acne. These drugs have been designed for more accurate and potent outcomes in comparison to drugs available over the counter, serving the specific demands of patients affected by chronic or advanced diseases under the care of a professional health provider. With the awareness to take care of dermatological well-being and with the emphasis laid on personalized therapy, the prescription segment has come to dominate this market. Moreover, healthcare providers often prescribe prescription medications for more serious conditions, thereby creating a higher demand in the clinical environment.

By Route of Administration

The topical administration segment dominated the dermatology drugs market in 2023 due to its direct application to the affected skin areas, hence showing a high effectiveness for various dermatological conditions. Topical treatments that include creams, ointments, and gels are preferred for conditions that include acne, psoriasis, eczema, and dermatitis due to the delivery of the active ingredients directly to the site of action, thereby reducing systemic side effects. The convenience and ease of application of topical formulations further enhance their popularity among patients and healthcare providers. Moreover, these drugs are acceptable for long-term use and have even better compliance, particularly in chronic skin diseases, which has contributed to the segment's dominance in the market. The preference for non-invasive treatments and the efficacy of topical therapies have made this administration route the first choice for treating a wide array of skin disorders.

By Drug Class

The corticosteroids segment dominated the dermatology drugs market in 2023, followed by their widespread established efficacy across a wide array of inflammatory dermatological conditions including psoriasis, eczema, and dermatitis. This class of drug is known for its anti-inflammatory properties, and reduces itching and redness, hence making it an integral part of dermatological therapies. Their well-established long success history, accessibility, and variability across different dermatological conditions account for their significant market share. Other variants of corticosteroids include creams, ointments, and lotions, thus easily customizable depending on the severity of the condition and patient preference, which is another reason for their high usage in the market.

The Antifungals segment is projected the fastest growth with 11.63% CAGR, accounting for the incidence rates of various fungal skin infections. Examples include athlete's foot, ringworm, and candidiasis. The increasing awareness and diagnosis of fungal infections, particularly in the warm and humid climate, have led to higher demand for antifungal treatments. In addition, innovations in antifungal drug formulations and the development of more targeted therapies with fewer side effects have also been contributors to the faster growth of the segment. The growing number of patients looking for effective solutions against fungal infections is bound to promote the Antifungals segment significantly in the years ahead.

By Distribution Channel

The retail pharmacies segment dominated the dermatology drugs market in 2023. The high demand for over-the-counter (OTC) dermatology treatments explains the segment's dominance. The drugs for common skin conditions, such as acne, psoriasis, and eczema, are accessible at retail pharmacies. The facilitation of convenience combined with an increased level of awareness among consumers about self-care made a lot of people prefer buying drugs for dermatology over-the-counter and not prescribed. Other than this, the increased availability of OTC drugs for dermatological conditions in chain pharmacies as well as online channels also supported the market dominance maintained by this segment.

The hospital Pharmacies segment is projected to show the fastest growth throughout the forecast period with a 10.55% CAGR. Severe dermatological disorders are more widespread, which drives the use of biologics and systemic drugs, prescribed from hospital settings only. Due to the high and increasing demands made on individual, advanced, high-quality care at the bedside from patients with very severe forms of dermatological disease, hospitals remain critical centers that distribute therapies accordingly. Besides, the demand for new prescription dermatology drugs, such as biologics for psoriasis and atopic dermatitis, will be in high demand in hospitals, thereby fueling this segment's growth. The scope for specialized treatment tailored to each patient's need will drive this trend shortly.

Key regional analysis

North America dominated the dermatology drugs market with 37.46% of the market share in 2023, where the U.S. is the leading entity owing to its advanced healthcare ecosystem, high healthcare spending, and greater prevalence of dermatological disorders. Innovative dermatology drugs leading the pipeline for the region and some of the leading pharmaceutical companies are targeting their investments towards R&D. The strong insurance coverage, including government programs like Medicare and Medicaid, allows access to dermatology treatment. In addition, the approval process of the U.S. Food and Drug Administration (FDA) is very efficient which encourages novel dermatology drugs to enter the US market, bolstering North American dominance.

Asia Pacific region is at growing the fastest rate in the dermatology drugs market due to increasing disposable incomes, rapid urbanization, and a rising focus on the accessibility of healthcare services. Due to the changing lifestyles, pollution, and genetics, the region is witnessing an increase in dermatological problems including acne, eczema, psoriasis, and others. Countries such as China and India are putting significant investments in their healthcare infrastructure, and their middle class is expanding quickly, all of which is driving demand for dermatology treatments. In addition, governments of these nations are enhancing health infrastructure policies and expanding insurance coverage, resulting in increased adoption of advanced dermatology drugs. With increasing awareness of skin health Asia Pacific is in the lead among the fastest-growing regions for this market.

Do You Need any Customization Research on Dermatology Drugs Market - Enquire Now

Some of the major key players in the Dermatology Drugs Market

-

AbbVie (Humira, Rinvoq)

-

Johnson & Johnson (Stelara, Tremfya)

-

Amgen (Enbrel, Aimovig)

-

Novartis (Cosentyx, Xolair)

-

Merck & Co. (Keytruda, Zepatier)

-

Pfizer (Soolantra, Tofacitinib)

-

Bristol-Myers Squibb (Orencia, Otezla)

-

Sanofi (Dupixent, Kevzara)

-

Gilead Sciences (Biktarvy, Veklury)

-

Lilly (Taltz, Olumiant)

-

UCB Pharma (Cimzia, Bimzelx)

-

AstraZeneca (Fasenra, Imfinzi)

-

Dermira (Qbrexza, Exelderm)

-

Almirall (Ilumetri, Actikerall)

-

Galderma (Restylane, Soolantra)

-

Leo Pharma (Enstilar, Taclonex)

-

Meda Pharma (Daktarin, Bepanthen)

-

Bayer (Dr. Scholl's, Canesten)

-

Sun Pharmaceutical (Taro, Desowen)

-

Cipla (Cipla Anti-Dandruff Shampoo, Betnovate)

Suppliers in the Dermatology Drugs Market

-

BASF

-

Lonza Group

-

Evonik Industries

-

Mylan Pharmaceuticals

-

Sandoz (Novartis)

-

Teva Pharmaceuticals

-

Amgen

-

Fagron

-

AbbVie

-

Viatris

Recent development

-

March 2024 AbbVie and Allergan Aesthetics, an AbbVie company, announced that they will present 29 abstracts, including three late-breaking presentations, at the 2024 American Academy of Dermatology (AAD) Annual Meeting, taking place from March 8-12 in San Diego, California. The data presented will showcase the companies' commitment to advancing medical dermatology and aesthetic treatments, aiming to redefine the standard of care for patients through their extensive product portfolios.

-

August 2024 Amgen announced that Otezla (apremilast) is now approved by the U.S. Food and Drug Administration (FDA) for use in pediatric patients. The approval covers children and adolescents ages 6 and older who weigh at least 20 kg (44 lb) and are candidates for phototherapy or systemic therapy for moderate to severe plaque psoriasis. Otezla is now the first and only oral medication FDA-approved for this patient population.

-

June 2023, Pfizer Inc. announced that the U.S. Food and Drug Administration (FDA) approved LITFULO (ritlecitinib), a once-daily oral treatment for individuals aged 12 years and older with severe alopecia areata. The recommended dose is 50 mg. LITFULO becomes the first and only FDA-approved treatment for adolescents with severe alopecia areata, marking a significant milestone in treating this condition.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 20.34 Billion |

| Market Size by 2032 | US$ 51.14 Billion |

| CAGR | CAGR of 10.71% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Therapy (Acne, Psoriasis, Rosacea, Alopecia, Others) • By Type (Prescription, Over-the-counter (OTC)) • By Route of Administration (Topical Administration, Oral Administration, Parenteral Administration) • By Drug Class (Corticosteroids, Retinoids, Antibiotics, Antifungals, Calcineurin Inhibitors, Others) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AbbVie, Johnson & Johnson, Amgen, Novartis, Merck & Co., Pfizer, Bristol-Myers Squibb, Sanofi, Gilead Sciences, Lilly, UCB Pharma, AstraZeneca, Dermira, Almirall, Galderma, Leo Pharma, Meda Pharma, Bayer, Sun Pharmaceutical, Cipla, and other players. |