AI in Precision Medicine Market Size & Trends:

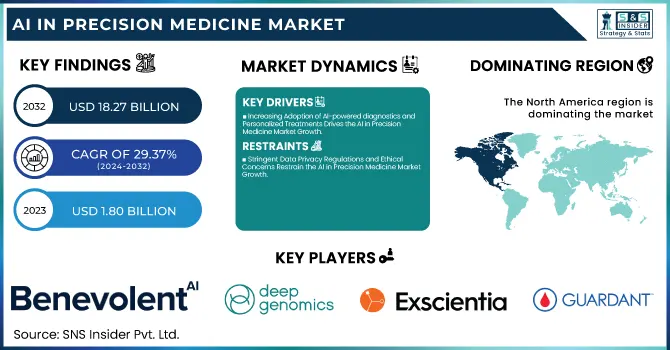

The AI in Precision Medicine Market Size was valued at USD 1.80 Billion in 2023 and is expected to reach USD 18.27 Billion by 2032 and grow at a CAGR of 29.37% over the forecast period 2024-2032.

To Get more information on AI in Precision Medicine Market - Request Free Sample Report

The AI in Precision Medicine Market is growing rapidly, driven by advancements in AI, big data analytics, and genomics. AI enhances precision medicine by enabling accurate diagnosis, personalized treatments, and predictive analytics. Key growth drivers include the adoption of AI-powered diagnostics, rising demand for personalized healthcare, and increased investments in AI-driven research. Statistical insights extend to AI adoption rates, drug discovery success rates, patient outcome improvements, and clinical trial efficiencies. Challenges such as data privacy and regulatory compliance also impact growth. With increasing AI patents and government funding, AI’s role in improving healthcare efficiency and patient-centric treatments is expanding.

AI in Precision Medicine Market Dynamics

Key Drivers:

-

Increasing Adoption of AI-powered diagnostics and Personalized Treatments Drives the AI in Precision Medicine Market Growth

The growing adoption of AI-powered diagnostic tools and personalized treatment approaches is a significant driver of the AI in Precision Medicine Market. AI enhances precision medicine by analyzing vast datasets, identifying patterns, and providing accurate diagnoses faster than traditional methods. Machine learning algorithms assist in predicting disease progression, enabling early intervention and reducing healthcare costs. AI-driven drug discovery is accelerating the development of targeted therapies, improving treatment efficacy. The rising demand for personalized medicine, fueled by advancements in genomics and biomarker identification, further propels market growth.

Additionally, AI integration in medical imaging and predictive analytics is improving patient outcomes. The increasing collaboration between healthcare providers, pharmaceutical companies, and AI technology firms is fostering innovation in precision medicine. Government initiatives supporting AI adoption in healthcare and rising investments in AI-driven research further contribute to market expansion. As AI technologies evolve, their role in enhancing precision medicine and optimizing treatment strategies will continue to grow.

Restrain:

-

Stringent Data Privacy Regulations and Ethical Concerns Restrain the AI in Precision Medicine Market Growth

Stringent data privacy regulations and ethical concerns pose significant restraints to the growth of the AI in Precision Medicine Market. The integration of AI in healthcare involves handling vast amounts of sensitive patient data, raising concerns about data security, patient confidentiality, and potential misuse. Regulations such as HIPAA, GDPR, and other region-specific data protection laws impose strict compliance requirements on AI-driven precision medicine solutions. Ethical concerns regarding biased AI algorithms, transparency in decision-making, and the risk of AI-driven misdiagnosis also hinder market adoption. Healthcare organizations face challenges in ensuring AI models are fair, unbiased, and comply with ethical guidelines.

Additionally, resistance from healthcare professionals due to concerns about AI replacing human expertise slows down implementation. Addressing data privacy, ethical considerations, and regulatory compliance is crucial for the widespread adoption of AI in precision medicine.

Opportunities:

-

Advancements in AI-Driven Drug Discovery and Genomics Create Lucrative Opportunities for the AI in Precision Medicine Market

Advancements in AI-driven drug discovery and genomics present significant growth opportunities for AI in the Precision Medicine Market. AI-powered algorithms are transforming drug discovery by accelerating the identification of potential drug candidates, reducing research costs, and enhancing the efficiency of clinical trials. AI models analyze vast genomic datasets, identifying genetic mutations linked to diseases, and enabling the development of targeted therapies. The increasing use of AI in precision oncology, rare disease treatment, and personalized drug development is driving market expansion.

AI-powered predictive analytics also help in selecting optimal treatment plans and improving patient outcomes. Biopharmaceutical companies are investing heavily in AI-driven research to streamline drug development and improve success rates. The rising integration of AI with next-generation sequencing (NGS) technologies further strengthens precision medicine applications. With continuous innovations in AI algorithms and bioinformatics, the potential for developing breakthrough treatments and revolutionizing personalized healthcare is expanding, offering immense market growth prospects.

Challenges:

-

Integration Challenges and High Implementation Costs Limit the AI in Precision Medicine Market Expansion

The integration of AI in precision medicine faces significant challenges due to high implementation costs and complex infrastructure requirements. Developing and deploying AI-powered healthcare solutions require substantial investments in advanced computing resources, data storage, and AI model training. Many healthcare organizations, particularly in developing regions, struggle with budget constraints and lack the necessary technological infrastructure.

Additionally, integrating AI with existing electronic health record (EHR) systems, medical imaging platforms, and genomic databases presents interoperability challenges. Healthcare providers also require extensive training to effectively use AI-driven tools, adding to implementation barriers. Resistance from traditional healthcare professionals, concerns over AI replacing human expertise, and difficulties in validating AI algorithms further slow adoption. Moreover, the need for continuous updates, regulatory approvals, and maintenance adds to the overall cost. Overcoming these challenges requires strategic investments, cross-industry collaborations, and regulatory support to enhance AI adoption and maximize its benefits in precision medicine.

AI in Precision Medicine Market Segmentation Analysis

By Component

The Software segment dominated the AI in Precision Medicine Market in 2023, accounting for 58% of the total revenue, driven by increasing adoption of AI-powered platforms for diagnostics, drug discovery, and patient management. AI-based software solutions enable advanced data analysis, predictive modeling, and real-time clinical decision support, enhancing precision medicine applications. Companies are investing in AI-driven platforms to improve healthcare outcomes and streamline workflows.

For instance, IBM Watson Health continues to expand its AI-driven oncology solutions, helping doctors tailor cancer treatments based on genetic and clinical data. Tempus AI launched new AI-powered software for genomic sequencing and predictive analytics, enhancing personalized treatment plans.

NVIDIA Clara, a healthcare AI platform, is empowering researchers with deep learning models for medical imaging and genomics. Additionally, Microsoft’s Project InnerEye leverages AI for precision radiotherapy, improving accuracy in cancer treatment planning. The rise in AI software adoption is further fueled by cloud-based platforms that integrate electronic health records (EHRs) and real-world patient data, allowing seamless AI deployment across healthcare institutions.

By Technology

The Deep Learning segment dominated the AI in Precision Medicine Market in 2023, accounting for 49% of the total revenue, driven by its superior ability to analyze complex medical data, recognize patterns, and enhance clinical decision-making. Deep learning algorithms power AI-driven diagnostics, drug discovery, and personalized treatment plans by processing vast datasets, including medical imaging, genomic sequences, and patient histories. Leading companies are leveraging deep learning to improve precision medicine applications.

For instance, Google DeepMind’s AlphaFold revolutionized protein structure prediction, accelerating drug discovery and disease modeling. IBM Watson Health has integrated deep learning into oncology solutions, aiding in cancer diagnosis and treatment recommendations. PathAI launched AI-powered deep learning models for pathology image analysis, improving diagnostic accuracy.

Additionally, NVIDIA’s MONAI framework enhances medical imaging AI models, enabling more precise disease detection. Deep learning’s role in genomics is also expanding, with Illumina utilizing AI-powered sequencing tools to identify genetic mutations linked to diseases. The integration of deep learning in precision medicine is improving patient outcomes by enabling real-time, data-driven insights.

By Deployment

The Cloud-Based segment dominated the AI in Precision Medicine Market in 2023, accounting for 69% of the total revenue, driven by the increasing demand for scalable, flexible, and secure AI solutions in healthcare. Cloud-based AI platforms enable seamless integration of vast medical datasets, including electronic health records (EHRs), genomic sequences, and imaging data, facilitating real-time analysis and personalized treatment recommendations. Companies are continuously innovating in this space to enhance AI-driven precision medicine applications.

Additionally, NVIDIA’s Clara Parabricks utilizes cloud-based AI for accelerating genomic sequencing and analysis. Cloud deployment enhances collaboration between research institutions, hospitals, and pharmaceutical companies, allowing AI algorithms to access diverse datasets for improved predictive accuracy. The cost-effectiveness, real-time accessibility, and data security of cloud-based AI solutions are driving their widespread adoption in precision medicine.

By Therapeutic Area

The Oncology segment dominated the AI in Precision Medicine Market in 2023, accounting for 48% of the total revenue, driven by the rising prevalence of cancer and the growing need for AI-powered solutions in early detection, diagnosis, and personalized treatment. AI is revolutionizing oncology by analyzing vast datasets, including medical imaging, genomic profiles, and clinical records, to identify cancer patterns and recommend targeted therapies. Leading companies are leveraging AI to enhance oncology precision medicine. IBM Watson for Oncology uses AI to provide evidence-based treatment recommendations, assisting oncologists in personalized decision-making.

Additionally, Paige AI has introduced deep learning-powered pathology solutions to assist in diagnosing complex cancer cases with higher accuracy. AI-driven advancements in liquid biopsy analysis, predictive analytics for tumor progression, and AI-assisted radiotherapy planning are further optimizing cancer treatment. The increasing adoption of AI in oncology is enhancing survival rates, minimizing treatment side effects, and reducing diagnostic errors. As AI continues to evolve, its role in precision oncology will be crucial in transforming cancer care, improving patient outcomes, and driving further growth in the AI Precision Medicine Market.

By Application

The Drug Discovery & Development segment dominated the AI in Precision Medicine Market in 2023, accounting for 44% of the total revenue, driven by the increasing adoption of AI to accelerate drug identification, optimize clinical trials, and develop personalized therapies. AI-powered platforms are revolutionizing the pharmaceutical industry by analyzing vast biological datasets, predicting drug-target interactions, and reducing the time and cost associated with traditional drug development. Leading companies are integrating AI to enhance precision medicine approaches in drug discovery. BenevolentAI has developed AI-driven drug discovery models that identify novel therapeutic targets for complex diseases.

Additionally, Exscientia has launched AI-designed drug candidates that have entered clinical trials, showcasing AI’s ability to streamline precision drug development. AI is also transforming biomarker discovery, allowing pharmaceutical companies to develop targeted therapies based on genetic profiles. The increasing integration of AI in precision medicine is improving drug repurposing, optimizing treatment efficacy, and minimizing adverse reactions.

By End-User

The Healthcare Providers segment dominated the AI in Precision Medicine Market in 2023, accounting for 38% of the total revenue, driven by the increasing adoption of AI-powered solutions for disease diagnosis, treatment planning, and patient management. Healthcare providers, including hospitals, clinics, and research institutions, are leveraging AI to enhance precision medicine by integrating vast amounts of patient data, genomic insights, and medical imaging for personalized care. AI-driven clinical decision support systems assist physicians in making accurate diagnoses and selecting targeted treatments. Several companies are innovating AI solutions to support healthcare providers in precision medicine.

Additionally, GE Healthcare’s AI-enabled medical imaging technologies are advancing precision diagnostics, reducing diagnostic errors, and improving workflow efficiency. AI-powered predictive analytics is enabling healthcare providers to anticipate disease progression, reducing hospital readmissions and improving patient outcomes. The growing integration of AI with electronic health records (EHRs) and telemedicine platforms further strengthens the role of AI in healthcare. As AI adoption continues to rise, healthcare providers will remain at the forefront of precision medicine, driving improved patient care and fueling market growth.

Regional Insights

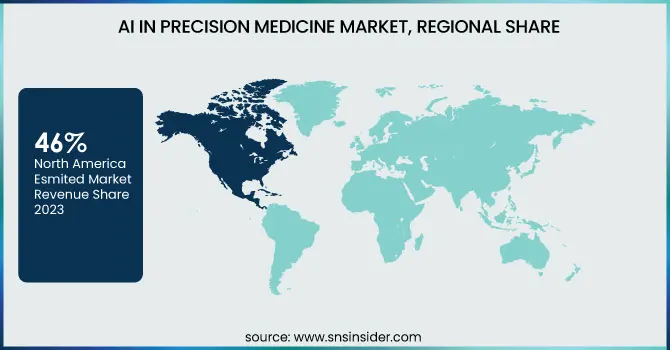

North America led the AI in Precision Medicine Market in 2023, accounting for the largest market share, estimated to be around 46%. The dominance of this region is driven by advanced healthcare infrastructure, significant investments in AI-driven healthcare technologies, and widespread adoption of precision medicine solutions. The presence of leading AI and healthcare companies, such as IBM Watson Health, NVIDIA, and Tempus AI, has accelerated AI integration in diagnostics, drug discovery, and personalized treatment planning.

Additionally, the high adoption of electronic health records (EHRs), cloud-based AI platforms, and AI-powered genomics research strengthens the region’s leadership in precision medicine. The increasing demand for AI-driven oncology solutions, predictive analytics, and real-time clinical decision support has cemented North America’s position as the market leader.

Europe emerged as the fastest-growing region in the AI in Precision Medicine Market in 2023, with an estimated CAGR of 36.13%. This rapid growth is fueled by increasing government funding, advancements in AI-driven healthcare research, and rising adoption of personalized medicine. The European Union’s Horizon Europe Program is actively supporting AI-driven innovations in healthcare, accelerating precision medicine applications.

Additionally, AI is being increasingly integrated into genomics research, digital pathology, and radiology solutions, enhancing disease detection and treatment planning. Countries like Germany, the UK, and France are at the forefront of AI adoption in healthcare, driven by favorable regulations and increasing collaborations between healthcare providers and AI developers. The rapid digitalization of healthcare infrastructure and rising awareness of AI’s potential in personalized treatments are expected to sustain Europe’s strong growth momentum in the precision medicine market.

Get Customized Report as per Your Business Requirement - Enquiry Now

AI in Precision Medicine Market Key Players

Some of the major players in the AI in Precision Medicine Market are:

-

BenevolentAI (Benevolent Platform, Optibrium)

-

Deep Genomics (AI Workbench, Genetic Medicine Program)

-

Exscientia (Centaur Chemist, Centaur Biologist, Personalized Drug Discovery Platform)

-

Foundation Medicine, Inc. (FoundationOne CDx, FoundationOne Liquid CDx)

-

Grail, Inc. (Galleri, Lunar-2)

-

Guardant Health, Inc. (Guardant360, Guardant Reveal, GuardantOMNI)

-

Insilico Medicine (Pharma.AI, PandaOmics, Chemistry42)

-

PathAI, Inc. (PathExplore, AIM-PD-L1, AIM-HER2)

-

Tempus AI, Inc. (Tempus Lens, Tempus xT, Tempus One)

-

Verge Genomics (CONVERGE, AI-Driven Drug Discovery Pipeline)

-

Zephyr AI (Zephyr Oncology, Zephyr Insights)

-

Flatiron Health (OncoEMR, Flatiron Assist)

-

Paige AI, Inc. (Paige Prostate, Paige Breast, Paige Lymph Node)

-

Proscia Inc. (Concentriq for Research, Concentriq for Clinical Diagnostics)

-

Predictive Oncology (PeDAL, Helomics D-CHIP)

-

Nucleai, Inc. (AI-Powered Spatial Biology Platform, Precision Oncology Biomarker Discovery)

-

Densitas Inc. (intelliMammo, Densitas Risk, Densitas Density AI)

-

Valar Labs (Valar Pathology AI, AI-Driven Oncology Biomarker Platform)

-

Berg LLC (Interrogative Biology Platform, BPM 31510)

-

Owkin (Owkin Platform, Owkin Loop, Owkin Substra)

Recent Developements in the AI in Precision Medicine Market

-

In February 2025, Tempus AI reported a fourth-quarter loss of $0.18 per share on revenues of $200.7 million, leading to a 17% drop in stock value. The company attributed increased operating expenses to an expanded sales force and growth in testing volume.

-

In November 2023, Exscientia entered into a multi-year strategic collaboration with Tempus to advance biomarker-driven therapeutic development using a data-first approach. This partnership allows Exscientia access to Tempus' extensive library of de-identified, multimodal data to further its therapeutic development efforts.

-

In January 2025, BenevolentAI announced plans to delist from Euronext Amsterdam and is considering relisting in London from 2026. This decision follows significant job cuts and cost reductions after founder Ken Mulvany regained control of the board, aiming to refocus on developing AI technology for drug discovery.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.80 Billion |

| Market Size by 2032 | USD 18.27 Billion |

| CAGR | CAGR of 29.37% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Software, Hardware, Services) •By Technology (Deep Learning, Querying Method, Natural language processing, Context aware processing, Others) •By Deployment (Cloud Based, On-Premise, Hybrid) •By Therapeutic Area (Oncology, Rare Diseases, Infectious Diseases, Neurology, Cardiology, Hematology, Others) •By Application (Drug Discovery & Development [Drug Discovery, Drug Repurposing, De Novo Drug Design, Drug Optimization, Safety & Toxicity, Clinical Development], Diagnostics & Screening [Risk Assessment & Patient Stratification, Disease Screening, Disease Diagnosis, Disease Progression, Staging, And Prognosis], Therapeutics [Therapy Selection & Planning, Therapy Monitoring, Post-Treatment Surveillance & Follow-Up]) •By End-User (Healthcare Providers, Pharmaceutical & Biotechnology Companies, Medical Device & Equipment Companies, Research Centers, Academic Institutes, And Government Organizations, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tempus AI, Inc., Exscientia, BenevolentAI, Deep Genomics, Insilico Medicine, PathAI, Inc., Verge Genomics, Guardant Health, Inc., Grail, Inc., Foundation Medicine, Inc. and other key players |