Schizophrenia Drugs Market Size Analysis:

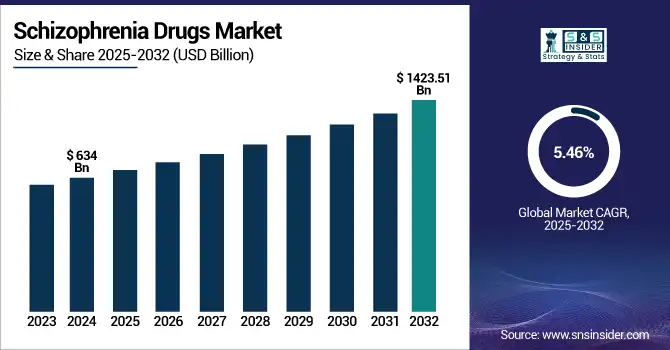

The Schizophrenia Drugs Market size was valued at USD 8.36 billion in 2024 and is expected to reach USD 12.78 billion by 2032, growing at a CAGR of 5.46% over the forecast period 2025-2032.

Rising global prevalence, government-supported mental health campaigns, and continuous pharmaceutical innovation are driving a sustained expansion in the schizophrenia drugs market. For instance, the World Health Organization estimates that 24 million people globally suffer from schizophrenia, with the U.S. Centers for Disease Control and Prevention (CDC) and the National Library of Medicine noting a prevalence rate in the American population between 0.25% and 0.64%.

To Get more information on Schizophrenia Drugs Market - Request Free Sample Report

The U.S. schizophrenia drugs market was valued at USD 2.84 billion in 2024 and its growing with a CAGR of 5.36% and is projected to reach USD 4.31 billion by 2032. The growth is driven by the improved healthcare infrastructure, high diagnosis rates, and strong research investments. Early diagnosis and access to care have been improved by enhanced mental health screening, public awareness campaigns, and regulatory changes, such as parity rules for mental health reimbursement, therefore stimulating market demand. Key forces behind the schizophrenia drugs market growth and trends include these government initiatives and the inclusion of psychiatric services into main healthcare.

Men's schizophrenia usually starts in the late teens to early 20s, and in women it starts from late 20s to early 30s. It's rare before age 12 or after 40. People with the disorder can have fulfilling lives with appropriate care.

According to the British Columbia Schizophrenia Society, in Canada, 30.9% of psychiatric hospital stays and 19.9% of general hospital admissions are related to schizophrenia. Early identification and access to treatment are being improved globally by government projects, including enhanced mental health financing in China and the NHS Long Term Plan in the U.K. Governments are responding by giving mental health top priority through legislative changes, supporting research, and including psychiatric care into the main healthcare systems, all of which are extending schizophrenia treatment options for patients.

Global Schizophrenia Drugs Market Dynamics:

Drivers:

-

Escalating Global Prevalence and Diagnostic Advancements Propel Demand for Schizophrenia Therapies

With higher rates among adults (1 in 222), schizophrenia affects around 24 million people globally, or 1 in 300 persons overall. Although the disorder's lifetime effects on cognitive function, social behaviour, and mortality-reducing life expectancy by 10–20 years generate a vital need for efficient therapies, even if its relative frequency is minor compared to other mental disorders.

For instance, recent statistics show that only 31.3% of individuals with psychosis get specialized mental health services, and over 50% of mental hospitalizations entail a schizophrenia diagnosis, therefore highlighting systematic flaws in the provision of treatment.

Awareness campaigns and better diagnostic instruments help to solve these issues. For instance, Media-led mental health campaigns have helped young people seek treatment by 20–30%, therefore lowering stigma and supporting early intervention. Reflecting both socioeconomic vulnerability and enhanced public health system detection, schizophrenia prevalence in medicaid populations in the U.S. is higher than in employer-insured groups. These elements together create demand for pharmaceutical breakthroughs addressing the complex symptomatology of the condition, including cognitive deficits and treatment-resistant instances impacting 30% of patients.

-

Novel Drug Development and Targeted R&D Funding Transform Treatment Possibilities

Advances in understanding schizophrenia’s neurobiological mechanisms have spurred investment in next-generation therapies. Aiming to reduce adverse effects, such as metabolic syndrome and tardive dyskinesia, the more modern medications target glutamate pathways and serotonin receptors, whereas conventional antipsychotics concentrate on dopamine regulation. Given 80% of patients have ongoing cognitive deficiencies affecting everyday functioning and clinical trials give patient-centric outcomes, including cognitive improvement, essential unmet requirements, and top priority. With governments' funding to address the 26%–28% increase in mental health issues following COVID-19, public-private collaborations is speeding R&D.

For instance, the WHO's mental health action plan stresses fair access to new treatments, especially in low-resource areas where 70% of schizophrenia cases remain untreated.

With studies pointing out over 100 genetic positions linked with schizophrenia, research on biomarkers and genetic predictors is now gathering steam and allowing individualized treatment methods. Digital health solutions, such as AI-driven diagnostic platforms, which improve early detection accuracy by 15%–20% in pilot programs, complement these efforts. Combining scalable care models with scientific discoveries will enable the market to provide safer and more efficient treatments that fit with global mental health priorities.

Restraints:

-

Side Effects and Safety Concerns of Antipsychotic Drugs Remain a Major Barrier to Market Expansion

Despite significant progress in drug development, the side effects and safety issues related to both approved and newly approved antipsychotic treatments still provide major obstacles to the schizophrenia drug market. With continuous monitoring essential to evaluate long-term hazards, including liver damage, common adverse effects described for newer medications, such as COBENfy, which include nausea, constipation, vomiting, hypertension, and gastrointestinal problems.

Often leading to poor patient adherence and frequent relapses, traditional antipsychotics are also well-known for metabolic changes, weight gain, and neurological adverse effects. These safety and tolerability problems not only affect patient’s quality of life but also limit the willingness of healthcare professionals to prescribe these medications, therefore restricting more general market expansion. Although post-marketing surveillance and real-world data are still highlighted by regulatory authorities to better grasp and reduce these hazards, the difficulty of juggling efficacy with safety remains a major obstacle for the schizophrenia medications market.

Schizophrenia Drugs Market Segmentation Analysis:

By Class

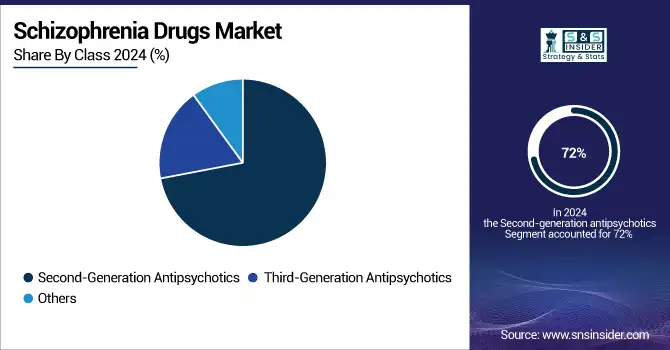

Second-generation antipsychotics, also known as atypical antipsychotics, dominated the global schizophrenia drugs market with 72% of market revenue in 2024. Their enhanced efficacy and safety profile over first-generation drugs help to explain this dominance. Among doctors and patients, typical antipsychotics, including risperidone, olanzapine, and quetiapine, are recommended first-line treatment for schizophrenia since they efficiently control both positive and negative symptoms of the illness while lowering the risk of severe side effects.

SGAs have become more easily available due to the government reimbursement regulations, such as U.S. federal and state parity rules, therefore increasing their acceptance.

For instance, the U.S. government's focus on mental health parity guarantees that insurance coverage for SGAs corresponds with that of physical health therapies, therefore encouraging broad use.

The third-generation antipsychotic segment is expected to grow at the fastest CAGR over the forecast period of 2025-2032, driven by the introduction of drugs such as brexpiprazole and cariprazine. Acting as partial dopamine agonists, these drugs have been effective with fewer metabolic and movement-related side effects. Recent approvals by the U.S. FDA, including the 2024 release of Cobenfy, a new oral treatment aimed at cholinergic receptors, highlight the change in the market toward creative ideas and tailored medicine. Research sponsored by governments help to confirm this tendency.

For instance, the European Medicines Agency (EMA) announced new grants in August 2024 for the development of advanced antipsychotics in August 2024. Recent National Library of Medicine research highlights how well third-generation medications alleviate unpleasant symptoms and enhance quality of life, hence driving demand for them.

By Treatment

The injectable antipsychotics held the largest schizophrenia drugs market share in 2024. Their popularity results from better patient adherence, lower relapse rates, and persistent therapeutics, which affects critical elements in the therapy of chronic diseases. To help with adherence issues, government entities, including the U.S. Department of Health and Human Services (HHS) have included LAIs into community mental health initiatives.

For instance, in line with patterns in outpatient and community-based treatment, the U.S. National Institute of Mental Health has funded research supporting the efficacy of LAIs in lowering hospital readmissions.

Driven by new drug approvals and continuous innovation, the oral antipsychotics segment is likely to show substantial growth in the schizophrenia drugs market. For instance, the September 2024 FDA clearance of Cobenzy-an oral medicine with a unique mechanism-illustrates the market's emphasis on expanding oral treatment choices with greater safety and efficacy. With the U.S. National Center for Health Statistics noting a consistent rise in prescriptions, government figures demonstrate that oral antipsychotics remain the first-line treatment in outpatient environments. Early intervention and adherence have been encouraged even more by public health campaigns and digital health projects, therefore supporting market growth.

By Distribution Channel

Hospital pharmacies accounted for 46% of the global schizophrenia drugs market share in 2024 due to the great demand for acute care and inpatient management of severe mental disease. Government programs include increased Medicare and Medicaid coverage for antipsychotic medications in hospital environments have helped to ease access to these treatments.

To control acute psychotic episodes and stabilize patients before moving them to outpatient treatment, hospitals need immediate access to a variety of oral and injectable antipsychotics, including both oral and injectable formulations. National health initiatives in the U.S., U.K., and Canada, which guarantee rapid treatment for acute psychotic episodes, largely support the integration of mental health services into hospital systems.

Retail pharmacies are seeing strong schizophrenia drug market growth owing to the patient inclination for convenience and the growth of community-based mental health care. Medication access and adherence have been enhanced by government alliances with retail pharmacy chains in nations including Australia and the U.K. Approved by regulatory authorities, telepharmacy programs have also helped retail pharmacies, particularly in rural and underserved areas.

Regional Insights:

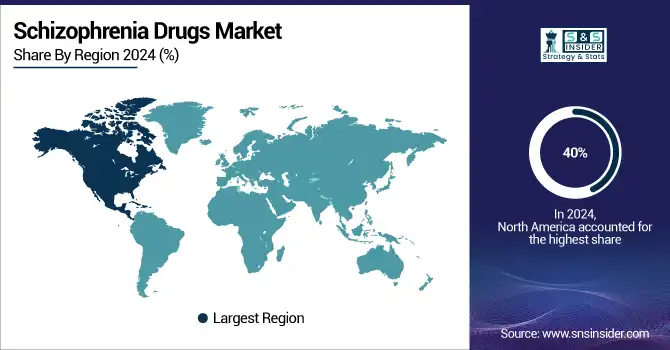

With 40% of the schizophrenia medications market share, North America dominated in 2024. This dominance is attributed to high awareness and diagnosis rates, strong healthcare infrastructure, and government and private sector’s major mental health investment. Advanced screening programs and public awareness initiatives help the region since they have resulted in early and more frequent identification of schizophrenia and related disorders. As older people seek treatment for long-standing or recently discovered diseases, the aging population, especially in the U.S., is also driving higher demand.

Leading pharmaceutical companies and a strong pipeline of creative ideas help to support the U.S. schizophrenia drugs market expansion. Major players, such as Johnson & Johnson, Bristol-Myers Squibb, and Pfizer are actively involved in the research, development, and commercialization of both second-generation and emerging third-generation antipsychotics. Government programs, including parity rules and increased funding for mental health services, have enhanced access to antipsychotic medication payment and treatment.

With a predicted CAGR of 5.99% during 2025-2032, the Asia Pacific is the fastest-growing region in the market for schizophrenia drug market. Rapid schizophrenia drug market growth is driven by Many regional aspects, such as broad healthcare changes implemented in China have enhanced mental health service availability, further increasing diagnosed cases and demand for pharmacological treatments. Particularly among older individuals, Japan's aging population is showing increasing rates of schizophrenia, which calls for ongoing pharmacological treatments. All of this boost the demand for efficient schizophrenia drugs, governments throughout Asia Pacific are giving top priority to mental health, funding for services, and public awareness campaigns.

Europe is a mature and significant market for schizophrenia drugs, with a strong emphasis on comprehensive care and innovation. The region’s growth is driven by a high frequency of schizophrenia, sophisticated healthcare infrastructure, and extensive insurance coverage for mental health treatments. New long-acting injectable formulations, notably UZEDY (risperidone), which provide better adherence and patient outcomes, have lately been approved in Europe. Significant clinical research work is also underway in the area and businesses, such as Celon Pharma in Poland have reported positive outcomes for experimental medicines aiming at acute schizophrenia. These developments help to explain consistent schizophrenia drug market growth in Europe, together with supportive regulatory settings and continuous public health campaigns.

The LAMEA region is seeing a consistent increase in the schizophrenia drugs market driven by rising awareness, slow expansion of healthcare infrastructure, and government measures to lower stigma and enhance access to mental health services. Countries in this region are concentrating on raising diagnosis rates and guaranteeing the supply of necessary antipsychotic drugs, therefore supporting more market development.

Get Customized Report as per Your Business Requirement - Enquiry Now

Schizophrenia Drugs Market Key Players:

The key Schizophrenia Drugs companies are Allergan, Johnson & Johnson, Acadia Pharmaceuticals, Karuna Therapeutics, Bristol-Myers Squibb/Otsuka Pharma, AstraZeneca, Sumitomo Dainippon, Takeda Pharmaceuticals, Eli Lilly & Company, Merck KGaA, Alkermes, Vanda Pharma, Pfizer, H. Lundbeck A/S, AbbVie, and others.

Recent Developments in the Schizophrenia Drugs Market

-

Spinogenix Inc. started a Phase 2 study in September 2024 to evaluate, in adults, the safety and efficacy of its schizophrenia medication candidate, SPG302.

-

AbbVie partnered with Gedeon Richter in March 2022 to co-develop and license novel dopamine receptor modulators meant to treat neuropsychiatric disorders.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 8.36 Billion |

| Market Size by 2032 | USD 12.78 Billion |

| CAGR | CAGR of 5.46% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Treatment (Injectable Antipsychotics and Oral Antipsychotics) • By Therapeutic Class (Second-Generation Antipsychotics, {Risperdal (Risperidone), Seroquel (Quetiapine), Invega (Paliperidone), Geodon (Ziprasidone), Latuda (Lurasidone), Saphris (Asenapine), Aristada (Aripiprazole Lauroxil), Fanapt (Iloperidone), Zyprexa (Olanzapine), Vraylar (Cariprazine)}, Third-Generation Antipsychotics, {Abilify (Aripiprazole)}, Others, {First-Generation Antipsychotics, Generics}) • By Distribution Channel (Online Pharmacies, Hospital Pharmacies, Retail Pharmacies, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Allergan, Johnson & Johnson, Acadia Pharmaceuticals, Karuna Therapeutics, Bristol-Myers Squibb/ Otsuka Pharma, AstraZeneca, Sumitomo Dainippon, Takeda Pharmaceuticals, Eli Lilly & Company, Merck KGaA, Alkermes, Vanda Pharma, Pfizer, H. Lundbeck A/S, AbbVie |