DevSecOps Market Report Scope & Overview:

Get more information on DevSecOps Market - Request Sample Report

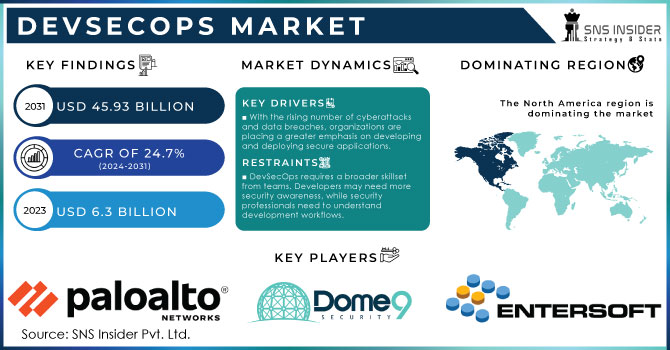

The DevSecOps Market Size was valued at USD 6.3 billion in 2023, projected to reach USD 45.93 billion by 2032 and grow at a CAGR of 24.7% over the forecast period 2024-2032.

The key factor is due to the ever-growing incidences of cybercrime that have seen the DevSecOps market grow exponentially. In a 2022 report by the Federal Bureau of Investigation (FBI’s) Internet Crime Complaint Centre (ICCC), it notes that for the year 2021, the complaint of cybercrimes rose 68% from the year 2020 with a record of 0.8 Mn cases. This means a business is likely to experience a cybersecurity attack at least every 40 seconds truly showing that the threat environment is persistent. In addition, a recent industry study done in 2023 established that the global average of a data breach hit an all-time high of USD 4.35 million, of which 60% of all breaches stemmed from an application weakness. These serious figures are forcing organizations regardless of their size apply DevSecOps practices into their workflows. Thus, with the help of DevSecOps, incorporating security aspects across the SDLC, potential threats are mitigated, cutting down on the costly losses from data breaches and interrupted operations.

The growing adoption of cloud-native technologies, according to a 90% increase in cloud spending documented by the International Data Corporation (IDC) in 2023, necessitates DevSecOps for automating security processes within cloud environments. Moreover, 60% of organizations still struggle with siloed security teams, highlighting a gap that DevSecOps bridges by promoting collaboration between development, security, and operations teams.

DevSecOps Market Dynamics:

KEY DRIVERS:

-

With the rising number of cyberattacks and data breaches, organizations are placing a greater emphasis on developing and deploying secure applications.

-

DevSecOps helps automate security processes and integrate them into the development pipeline, enabling faster and more secure deployments.

-

The growing adoption of cloud computing necessitates secure development practices. DevSecOps solutions can be seamlessly integrated with cloud platforms to automate security testing and ensure compliance with cloud security standards.

Indeed, while traditional approaches to development arrange security as an add-on at the termination of the development process, DevSecOps is distinct in that it incorporates security into the SDLC optimally and systematically. Such automation transforms the work of security teams related to interaction with developers. Think of security scans that are part of developers’ workflows and, as soon as new code is pushed to the repository, identify newly added risks. This also enables the developers to fix the problems when they are still small so that they do not develop into major problems.

A recent industry survey conducted in 2022 revealed that 73% of enterprises with DevSecOps practices reported that the number of security breaches in their organizations have reduced. Also, a study that was conducted by Veracode in 2023 showed that 84% of organizations which embrace the DevSecOps practices saw an improvement in the release of code while portraying the benefits of efficiency. Because it cuts across security in processes and enhances collaboration in development, DevSecOps enables faster and well-protected deliveries to the market, which many businesses need in today’s security threats.

RESTRAINTS:

-

DevSecOps requires a broader skillset from teams. Developers may need more security awareness, while security professionals need to understand development workflows.

-

Regulatory requirements add complexity to the DevSecOps process. Organizations need to ensure their tools and workflows adhere to relevant data security standards.

These compliance requirements such as HIPAA, PCI DSS, and GDPR increase the DevSecOps complexity. All organizations have to pay strict attention to understanding DevSecOps tools and processes to determine whether it meets these regulations. This might include, applying compliance control relating to a particular compliance framework, applying compliance trails to show compliance and or regular scanning for compliance risks.

In addition, the data localization requirements specified within certain regulations may limit where the software and data can be hosted thus, causing changes to the cloud-based DevSecOps line. Although attempting to negotiate this maze prolongs the process and makes the process more complicated, omitting it will cost a company monetary penalties, loss of face, and in particular cases, legal consequences.

DevSecOps Market Segment Overview:

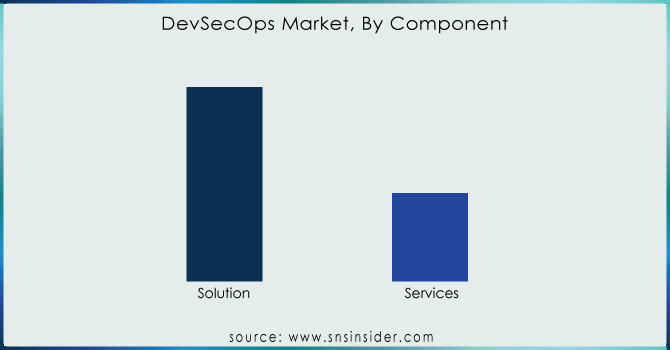

By Component

Security solutions that imply various security tools and platforms embedded in the development life cycle occupy the leading position with the share of nearly 60%. This dominance is a clear indication of the increasing demand for AST and vulnerability scanning across the SDLC. However, services which include consulting, training and implementation services stand at about 40% of the overall market. This segment targets organizations that may not have the internal talent necessary to extract the complete potential of DevSecOps solutions to underline the significance of personnel with DevSecOps experience.

Need any customization research/data on DevSecOps Market - Enquiry Now

By Service

Professional services with approximately 60% market share provide strategy definition and execution as well as training for organizations who are entering the DevSecOps revolution. This segment targets ventures that do not have an in-house security team or those that need help beginning with the integration of security to their development process. Regarding the latter market segment, we can talk about managed services that refer to the constant use of DevSecOps tools and processes, which accounts for 40% of the market share. This option is suitable for organizations that would wish to manage the least when it comes to security testing, vulnerability management, and pipeline management as this will be provided by the MSPs.

By Deployment Type

Currently, cloud deployment is estimated to capture around 70% of the DevSecOps market share by 2032, with on-premises solutions held at roughly 30% in 2023. This trend is driven by the numerous advantages cloud offers, including scalability, agility, and readily available security features. Cloud-based DevSecOps empowers organizations to automate security processes seamlessly throughout the development lifecycle, promoting faster deployments and enhanced application security. However, on-premises solutions still hold value for enterprises with strict regulatory compliance requirements or those hesitant to migrate sensitive data to the cloud.

By Organization Size

Approximately 65% of users are expected to be small and Medium-sized Enterprises (SMEs) by 2032. PHEAA has proven that it is possible for SMEs to implement DevSecOps on a large scale, at the same rate and speed as larger and well-funded organizations and this is due to the cost-effective and easily accessible cloud-based solutions that are available. On the other hand, large enterprises taking 35% of the user base, ensure heavy investment in firm and secured on-preface infrastructure. This means that their focus is on incorporating DevSecOps in more intricate processes, which requires more specific, as well as agile, solutions.

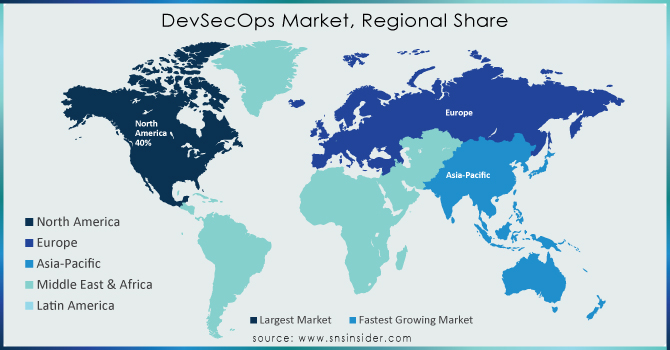

DevSecOps Market Regional Analysis

North America dominated the DevSecOps market in 2023 with 42% global market share due to various key factors. An impressive 78% of companies in the area opt for proactive monitoring of application security, showing their dedication to detecting threats early. The core principle of DevSecOps, which involves incorporating security into every stage of development, is completely in line with this emphasis. Furthermore, North America boasts an impressive 82% cloud adoption rate, creating a conducive setting for DevSecOps solutions that are compatible with cloud-supported development environments. Cloud and DevSecOps technologies coalesce to help companies speed up development cycles while maintaining security standards. In conclusion, approximately 65% of North American businesses are seeking DevSecOps solutions to meet strict regulations, particularly in sectors like healthcare and finance.

APAC will be witnessing the highest CAGR of 26.01% over the period of 2024-2032, a significant factor is the thriving technology industries in countries such as India where 45% of IT professionals are implementing DevSecOps practices and China with 38% according to industry surveys. This results in a quickly expanding group of developers who value security and focus on secure coding during the entire development process. Additionally, the growing startup community in the area, with 62% of startups implementing DevSecOps from the start, drives the need for agile and secure development practices. Furthermore, the need for strong security measures due to government regulations on data privacy is driving organizations to adopt DevSecOps for easier compliance, with PCI DSS compliance rates increasing by 27% annually.

KEY PLAYERS

The major key players are Entersoft (Australia), Dome9 (US), PaloAlto Networks (US), Qualys (US), Chef Software (US), Threat Modeler (US), Contrast Security (US), CyberArk (Israel, Rough Wave Software (US), Splunk (US), 4Armed (UK), Aqua Security (Israel), Check Marx (Israel), Continuum Security (Spain), Whitehat Secunty (US), Sumologic (US), Puppetlabs (UK), and Algo Sec (US), and other key players.

RECENT DEVELOPMENT

In May 12, 2024, Aqua Security, a leading provider of cloud-native security solutions, announced a collaboration with Palo Alto Networks, a cybersecurity giant, to integrate Aqua's DevSecOps platform with Prisma Cloud, Palo Alto's cloud security platform.

In March 28, 2024, Black Duck by Synopsys, a leader in software composition analysis (SCA) solutions, announced its acquisition of CloudPassage, a cloud security posture management (CSPM) provider.

In February 15, 2024, Amazon Web Services (AWS) announced the launch of Amazon Security Lake, a new service that simplifies security data collection, analysis, and investigation. This service integrates seamlessly with existing AWS security tools and DevSecOps workflows, enabling organizations to gain a unified view of their security posture and identify potential threats more effectively.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.3 Billion |

| Market Size by 2032 | US$ 45.93 Billion |

| CAGR | CAGR 24.7 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution And Services) • By Service (Professional Services, Manages Services) • By Deployment Type (On-Premises And Cloud) • By Organization Size (Small And Medium Enterprise And Large Enterprise) • By Industry Vertical (BFSI, IT & Telecommunication, Healthcare & Lifescience, Government, Media & Entertainment, Retail & Consumer Goods, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Entersoft (Australia), Dome9 (US), PaloAlto Networks (US), Qualys (US), Chef Software (US), Threat Modeler (US), Contrast Security (US), CyberArk (Israel, Rough Wave Software (US), Splunk (US), 4Armed (UK), Aqua Security (Israel), Check Marx (Israel), Continuum Security (Spain), Whitehat Secunty (US), Sumologic (US), Puppetlabs (UK), and Algo Sec (US) |

| Key Drivers |

|

| Market Restraints |

|