Laboratory Informatics Market Report Scope & Overview:

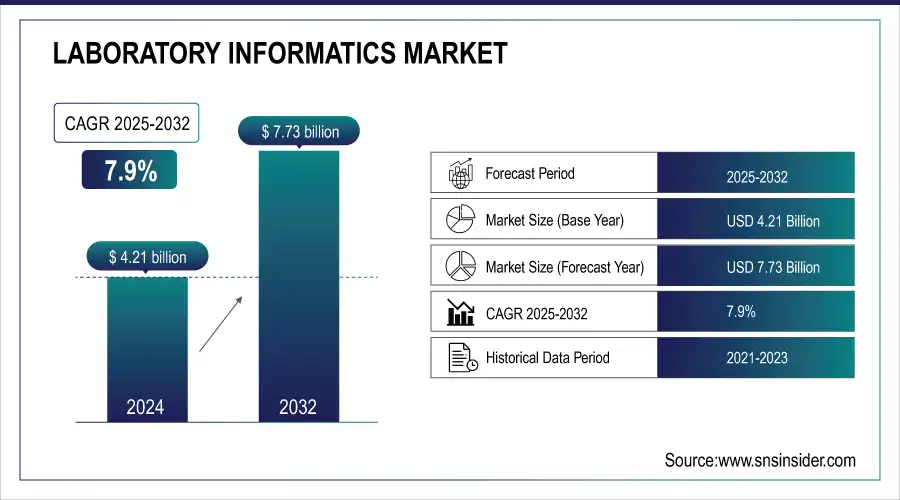

The Laboratory Informatics Market was valued at USD 4.21 billion in 2025E and is expected to reach USD 7.73 billion by 2033, growing at a CAGR of 7.9% from 2026-2033.

The laboratory informatics market report provides the comprehensive statistical insights and emerging trends globally over all major aspects, including developments, global compliance assessment, adoption rates, cost analysis, etc. The report highlights the growing adoption of LIMS, ELN, and SDMS solutions across industries including pharmaceuticals, biotechnology, clinical research, and environmental testing. The report analyzes the trends in data integration with a focus on cloud-based solutions, AI analytics, and ERP/EHR interoperability. It also offers a cost-comparative analysis of licensing models and evaluates benefits in terms of ROI. It also discusses the growing importance of AI and automation in improving lab efficiency and predictive analytics, paving the way for future market growth.

Market Size and Forecast

-

Market Size in 2025E: USD 4.21 Billion

-

Market Size by 2033: USD 7.73 Billion

-

CAGR: 7.9% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Laboratory Informatics Market - Request Sample Report

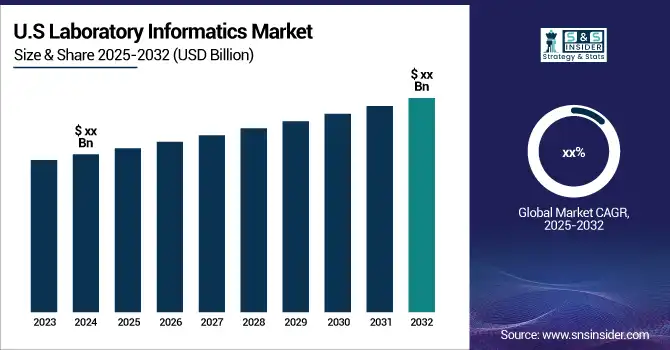

The U.S. Laboratory Informatics market size was valued at an estimated USD 1.65 billion in 2025 and is projected to reach USD 3.05 billion by 2033, growing at a CAGR of 7.4% over the forecast period 2026–2033. Market growth is driven by increasing adoption of digital solutions for laboratory data management, rising demand for automation and workflow optimization, and growing use of informatics platforms in pharmaceutical, biotechnology, and clinical laboratories. Expanding applications in drug discovery, genomics, and personalized medicine, along with integration of laboratory informatics systems with cloud computing and AI-based analytics, are accelerating market expansion. Additionally, stringent regulatory requirements for data integrity and compliance, coupled with continuous advancements in laboratory software solutions, further support the steady growth outlook of the U.S. laboratory informatics market during the forecast period.

Laboratory Informatics Market Trends

-

Rising demand for digital solutions to manage laboratory data is driving the laboratory informatics market.

-

Integration with LIMS, ELN, and CDS systems is enhancing workflow automation, data accuracy, and compliance.

-

Growing adoption in pharmaceuticals, biotechnology, food & beverage, and environmental testing is boosting market growth.

-

Increasing focus on regulatory compliance, data integrity, and quality management is shaping adoption trends.

-

Expansion of R&D activities and high-throughput testing is fueling software and informatics deployment.

-

Advancements in cloud-based and AI-enabled laboratory informatics solutions are improving scalability and efficiency.

-

Collaborations between software providers, laboratory equipment manufacturers, and research institutions are accelerating innovation.

Laboratory Informatics Market Growth Drivers:

-

The increasing need for efficient data management and operational efficiency is propelling the adoption of automated laboratory systems.

Growing demand for laboratory automation is significantly reshaping laboratory operations, led by the need for increased efficiency, accuracy, and throughput. Contemporary laboratories have large quantities of data and complex workflows; thus, manual work becomes time-consuming and error-prone. Automation addresses these challenges by streamlining operations and minimizing human intervention. An interesting case in point is the biotech startup Cellares, which has created a robot for speeding up the manufacturing process of cell therapies, dubbed the "Cell Shuttle." As a result of this innovation, up to 2,800 therapies can be produced on a single platform each year, incorporating fewer manual steps and thus minimizing opportunities for human error.

Scientists have developed an Autonomous Hyperspectral Characterisation Station that combines robot-assisted hyperspectral imaging with autonomous data analysis in a materials science context. The system provides a comprehensive and non-destructive method of performing material characterization, improving accuracy and throughput over traditional manual approaches. In addition, growing implementations of Laboratory Information Management Systems (LIMS) The automation of processes such as sample tracking, data management as well as workflow is expected to increase the efficiency and reduce human errors in laboratory settings and this, in turn, is anticipated to fuel the adoption of LIMS software during the forecast period. Each of these developments again highlights the trend towards laboratory automation due to the need for efficiency, and data consistency as well as the rapidly expanding needs of modern-day scientific research and diagnostics.

Laboratory Informatics Market Restraints:

-

The substantial initial investment required for deploying laboratory informatics solutions poses a significant barrier, especially for small and mid-sized laboratories.

Implementing laboratory informatics systems entails substantial initial investments, in terms of software licenses, hardware, and training personnel. A laboratory information system for example may cost between USD 4,000 to USD 100,000, and the annual operating cost between USD 1,000 and USD 5,000. These include continuous software licensing fees, training personnel to work the software, and upkeep of the system. Such financial demands can be prohibitive, particularly for small to mid-sized laboratories, potentially deterring them from adopting these advanced systems.

Beyond the financial aspects, the second most important industry pain point involves the integration of new informatics solutions with existing laboratory workflows and legacy systems. This integration process can be time-consuming and may disrupt established procedures, leading to potential resistance from laboratory personnel accustomed to traditional methods. Also, the requirement for ongoing updates release and governance directions can add long-term maintenance fees and complexity, further discouraging some organizations from investing in these technologies.

Laboratory Informatics Market Opportunities:

-

The shift towards cloud-based laboratory informatics offers enhanced data accessibility, scalability, and cost-effectiveness, presenting significant growth prospects.

The laboratory informatics market is experiencing a significant shift towards cloud solutions, primarily due to the need for increased availability of data for scientists, scalability, and a reduction in overall costs. Cloud-based Laboratory Information Management Systems (LIMS) provide laboratories with the benefit of minimizing physical data storage and ensuring easier off-site data storage and accessibility. There are several types of systems which include Platform as a Service (PaaS), Infrastructure as a Service (IaaS), and Software as a Service (SaaS) which can fit different lab requirements. Cloud-based laboratory informatics is also gaining momentum in emerging nations like China, India, Japan, Singapore, Brazil, and the Middle East. The advantages offered by cloud deployments and growing data volumes in laboratories are driving this trend. As an example, Revvity, Inc. recently introduced Signals Research Suite which is an integrated suite of cloud-based SaaS applications to facilitate drug development process.

Laboratory Informatics Market Challenges:

-

As laboratories increasingly adopt digital solutions, ensuring the security and privacy of sensitive data remains a critical challenge.

Data security and privacy are major concerns in laboratory informatics due to the large volumes of this type of sensitive data passed into and out of laboratories. This vulnerability was demonstrated most recently in September 2024 when U.S. healthcare firm, Confidant Health, accidentally exposed up to 120,000 files and 1.7 million logs online due to an unsecured database. Zylofon exposed therapy session audio and video, medical histories, national identification documents, and direct identifiers. While the company quickly secured the database when it was discovered and claimed that no malicious access was reported, this also highlights the huge risks creators of highly sensitive health data face in terms of privacy.

Laboratory Informatics Market Segment Analysis

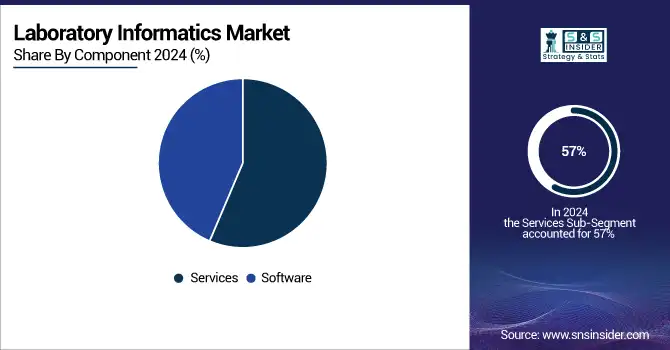

By Component, Services hold the largest share in the laboratory informatics market, fueled by demand for implementation, training, and ongoing support.

The services segment held the highest revenue share of 57% in 2025. Such a large contribution to this software market share is because users are looking for more specialized support due to the increasing complexity of laboratory informatics systems, implementation and training services are also gaining importance. The U.S. Bureau of Labor Statistics estimated a 15% increase in employment between 2023 and 2025 for computer systems analyst-related professions for services such as laboratory informatics, pointing to a growing need for expertise in this area. Additionally, the National Science Foundation (NSF) found that 72% of research institutions cited the need for ongoing support and customization services as a critical factor in their laboratory informatics investments.

The services segment covers system implementation, data migration, custom software development, training, and support. Comprehensive training and support services associated with informatics systems were correlated with a 40% reduction in data integrity issues and a 25% increase in overall operational efficiency at laboratories using these models, according to a report by the U.S. Food and Drug Administration (FDA). In addition, the National Institute of Standards and Technology (NIST) showed that laboratories that used professional services for system integration and customization achieved complete regulatory compliance 30% faster than those that tried in-house implementations. The growing services segment has been further propelled by these factors along with the relentless pace of technological developments in laboratory informatics.

By Product, LIMS dominates the laboratory informatics market, driven by widespread adoption in algorithm development and data management.

LIMS (Laboratory Information Management Systems) held a leading market with 48% of revenue in 2025. The Algorithm Development is the largest contributor to the market share, which is due to the growing adoption of automated and efficient data management approaches, leading to Algorithm Development in laboratories implemented in healthcare, pharmaceuticals, biotechnology, and environmental testing industries. In 2024, 89% of hospitals had adopted electronic health record systems according to the U.S. Department of Health and Human Services, further increasing the need for integrated laboratory information systems. LIMS is an integral part of modern laboratories and provides extensive solutions for sample management, workflow automation, and regulatory compliance.

The National Institute of Standards and Technology (NIST) implemented a standardized LIMS across its laboratories, resulting in a 35% increase in productivity and a 40% reduction in data entry errors. This success story pushed other government agencies and private sector laboratories to start using LIMS. Concurrently, the data integrity focus on pharmaceutical manufacturing by the FDA has resulted in a 28% increase in the adoption of LIMS for FDA-regulated industries having LIMS sales increases from 2024 to 2025. These features also have played an important role in the widespread acceptance of LIMS as providing data traceability, audits and compliance ability of LIMS software enables tracking of service history and adherence to regulations such as those supported by 21 CFR, Part 11, etc.

By Delivery Mode, Web-based solutions lead the laboratory informatics market, offering flexibility, remote access, and enhanced collaboration.

The web-based segment led the market and generated 41% revenue share in 2025. The growing need for flexible, scalable, and accessible laboratory informatics solutions is a major factor behind this dominance. Based on 2024 survey data from the U.S. National Institute of Standards and Technology (NIST), reported that 78% of these laboratories who responded indicated that they preferred solutions delivered using a web-based architecture because of the greater collaboration and remote access capabilities that such an arrangement helps enable. In 2023, the Centers for Disease Control and Prevention (CDC) reported that the number of web-based laboratory systems used among public health laboratories increased by 56% from 2024-2025.

This Web-based laboratory informatics solution provides multiple benefits, such as decreased investment in IT infrastructures, simple updates and maintenance, and higher data sharing. Statement from the U.S. Department of Energy, Office of Science, "Reduction in IT-related downtime by 42%, increase in cross-facility collaboration by 30% between our laboratories using web-based informatics systems. Additionally, National Institutes of Health (NIH) research concluded that web-based laboratory informatics solutions enabled research institutions to initiate multi-site clinical trials 35% faster than those using traditional on-premise systems. Consequently, this has fueled use growth in multiple fields such as pharmaceutical, and biotechnology along academic research institutes.

By End Use, Life science companies are the leading end users of laboratory informatics, driven by R&D investment and data-driven drug development needs.

In 2025, the life science companies segment held the largest market share of 27% in terms of revenue. The large market share is because of more investment in R&D activities in the pharmaceutical and biotechnology sectors and the growing need for data-driven decision-making during drug discovery and development procedures. As an example, between 2023 and 2024 the U.S. National Institutes of Health (NIH) reported an increase from USD 40 billion to USD 45 billion, a gain of 12% in funding for life sciences research. This is directly fueling the adoption of laboratory informatics, as more resources in lab methods equals more resources for informatics. In 2024, the Food and Drug Administration (FDA) also approved 53 new drugs, 15% more than in 2023, further emphasizing the need for enhanced informatics solutions to help the drug development pipeline.

Lab informatics is being used for higher productivity and collaboration and faster time to new therapies by life science companies. According to the BIO (Biotechnology Innovation Organization); companies that used integrated laboratory informatics systems experienced a 30% decrease in timelines for drug development and a 25% increase in successful clinical trials. Furthermore, the U.S. Bureau of Labor Statistics projected a 7% growth in life sciences research jobs between 2023 and 2028, indicating a continued demand for sophisticated laboratory informatics solutions in this sector. These systems have become essential for life science companies wanting to be at the competitive forefront of such a rapidly changing industry due to their capacity to control complex data sets, provide regulatory compliance, and foster cross-functional collaboration.

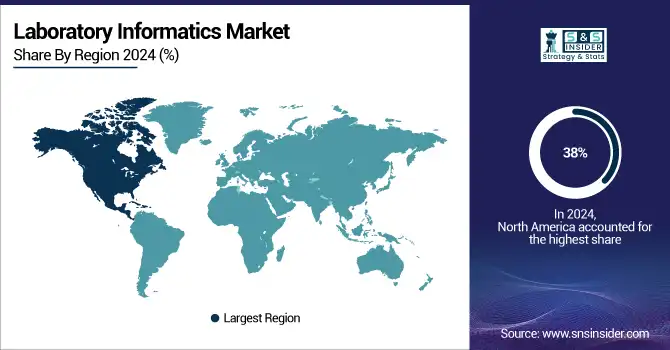

Laboratory Informatics Market Regional Analysis

North America Laboratory Informatics Market Insights

The laboratory informatics market was led by North America, accounted for a 38% share in 2025. This dominance can be ascribed to the strong healthcare infrastructure, high R&D investments, and early adoption of quality and advanced technologies in the region. In 2024, the U.S. National Science Foundation announced that North American countries spent a total of USD 667 billion on R&D activities, 5.2% more than the previous year. Such a massive investment has fueled the requirement of advanced laboratory informatics solutions in a number of verticals, such as pharmaceuticals, biotechnology, and academic research.

Need any customization research on Laboratory Informatics Market - Enquiry Now

Asia Pacific Laboratory Informatics Market Insights

The Asia Pacific is anticipated to be the highest CAGR between 2026 and 2033. The rapid growth is due to the increasing government initiatives for the modernization of healthcare and research facilities, increasing investments in life sciences, and the rising focus on precision medicine. Emerging markets are also seeing a rise in the need for advanced laboratory informatics systems capable of managing enormous amounts of data in 2024 alone, the National Medical Products Administration (NMPA) in China reported a 25% increase in the number of new clinical trials. Further, USD 1.8 billion was announced for its National Digital Health Mission by the Indian government in 2025, which presented considerable funding for healthcare information technology and data systems.

Europe Laboratory Informatics Market Insights

Europe in the Laboratory Informatics Market is witnessing steady growth, driven by increasing adoption of LIMS, ELN, and laboratory automation solutions across pharmaceutical, biotechnology, and research sectors. Key players such as Thermo Fisher Scientific, LabVantage Solutions, and Dassault Systèmes contribute through advanced software and cloud-based platforms. Strong R&D investments, regulatory compliance requirements, and collaborations with global pharmaceutical firms are enhancing Europe’s position as a significant hub for laboratory informatics solutions.

Middle East & Africa and Latin America Laboratory Informatics Market Insights

Middle East & Africa and Latin America in the Laboratory Informatics Market are experiencing gradual growth due to expanding pharmaceutical, biotechnology, and academic research sectors. Increasing adoption of LIMS, ELN, and cloud-based laboratory solutions is driven by regulatory compliance requirements, quality assurance needs, and modernization of laboratory workflows. Collaborations with global software providers and growing investments in healthcare and life sciences infrastructure are further supporting the adoption of laboratory informatics solutions in these regions.

Laboratory Informatics Market Competitive Landscape:

Sapio Sciences

Sapio Sciences, founded in 2013, is a provider of advanced laboratory informatics solutions for life sciences, biotechnology, and pharmaceutical sectors. The company develops unified platforms that integrate electronic lab notebooks (ELN), laboratory information management systems (LIMS), and data analytics tools. By enabling seamless data management, automation, and knowledge extraction, Sapio Sciences helps laboratories improve efficiency, compliance, and decision-making, supporting innovation and productivity across research, development, and clinical workflows.

-

January 2024: Sapio Sciences announced the full GxP validation of its unified laboratory informatics platform, including advanced data analysis and knowledge extraction modules. This enhancement aims to streamline laboratory workflows and improve data management across various life sciences applications.

Thermo Fisher Scientific

Thermo Fisher Scientific, founded in 1956, is a global leader in laboratory equipment, analytical instruments, and software solutions. The company provides integrated technologies for research, clinical, and industrial laboratories, including LIMS, ELN, and lab automation systems. Thermo Fisher focuses on improving workflow efficiency, data traceability, and operational compliance, enabling scientists to make faster, more informed decisions while ensuring high-quality results across life sciences, pharmaceutical, and biotechnology applications.

-

November 2024: Thermo Fisher Scientific integrated Labguru’s ELN into its LIMS and lab operations software, aiming to provide scientists better data traceability, security, and streamlined workflows across various laboratory areas to create a unified lab management experience.

Key Players

Some of the Laboratory Informatics Market Companies

-

Thermo Fisher Scientific

-

PerkinElmer

-

Waters Corporation

-

LabVantage Solutions

-

Dassault Systèmes

-

Bio-Rad Laboratories

-

Labcorp Drug Development

-

Medrio

-

Pfizer

-

Novartis

-

Johnson & Johnson

-

Roche

-

GlaxoSmithKline (GSK)

-

Merck & Co.

-

Bayer

-

Eli Lilly

-

AbbVie

- Sanofi

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.21 Billion |

| Market Size by 2033 | USD 7.73 Billion |

| CAGR | CAGR of 7.9% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Laboratory Information Management Systems (LIMS), Scientific Data Management Systems (SDMS), Laboratory Execution Systems (LES), Electronic Lab Notebooks (ELN), Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS), Chromatography Data Systems (CDS), Enterprise Content Management (ECM)) • By Component (Software, Services) • By Delivery Mode (Web-based, On-Premise, Cloud Based) • By End Use (Life Sciences, CROs, Chemical Industry, Environmental Testing Laboratories, Food & Beverage and Agriculture Industries, Petrochemical Refineries and Oil & Gas Industry, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Thermo Fisher Scientific, PerkinElmer, Agilent Technologies, Abbott Laboratories, Waters Corporation, LabVantage Solutions, Dassault Systèmes, Bio-Rad Laboratories, Labcorp Drug Development, Medrio, Pfizer, Novartis, Johnson & Johnson, Roche, GlaxoSmithKline (GSK), Merck & Co., Bayer, Eli Lilly, AbbVie, Sanofi |