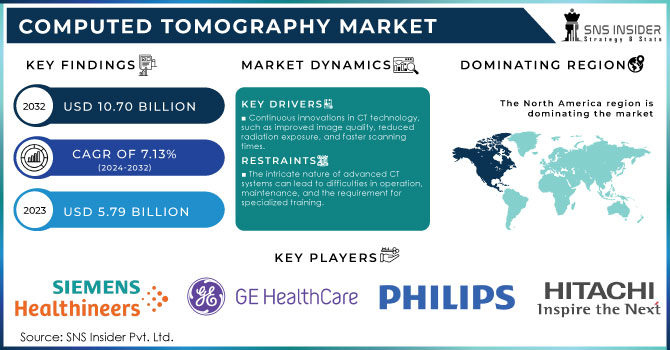

Computed Tomography Market Size:

The Computed Tomography Market was worth USD 5.79 billion in 2023 and is predicted to be worth USD 10.70 billion by 2032, growing at a CAGR of 7.13% between 2024 and 2032.

Get More Information on Computed Tomography Market - Request Sample Report

Technological advancements in computed tomography (CT) technology, in combination with the growing prevalence of chronic disorders, such as cancer, orthopedics, and cardiovascular & neurological conditions, are expected to drive market growth. Additionally, increasing awareness and focus on preventive healthcare measures have led to a surge in routine diagnostic procedures, contributing to the expanding market for computed tomography. The advent of CT has significantly enhanced medical care. This technology enhances diagnostic accuracy, reduces the need for unnecessary procedures, aids in better treatment by offering detailed anatomical images, and serves as a cost-effective imaging method.

It is a vital diagnostic tool, particularly for simultaneously scanning bones, soft tissues, and blood vessels. Because CT imaging is fast and straightforward in emergencies, internal injuries can be detected promptly, potentially saving lives. Thus, increasing demand for advanced assessment tools in the emergency department and the rising number of ambulatory emergency care units are the factors anticipated to have a positive impact on market growth.

Numerous private and government organizations are making significant investments in R&D. For example, in 2022, Siemens Healthineers launched a new CT production facility in India to meet the increasing demand for CT devices and strengthen its market position.

The NCBI reports that over 70 million CT scans are conducted annually in the U.S. and 7.1 million in the UK, with a yearly increase of 10%, highlighting the Substantial growth potential of CT in the broader medical imaging market. The rapid expansion of CT scan applications, along with the increasing trend of using CT scans for effective lung cancer screening, is anticipated to drive the demand for CT scanners in both developed and developing countries.

Computed Tomography Market Dynamics

Drivers

-

The expanding elderly population, which is more prone to medical conditions that necessitate CT imaging.

-

Continuous innovations in CT technology, such as improved image quality, reduced radiation exposure, and faster scanning times.

-

Risan spending on healthcare services, particularly in emerging markets, drives the demand for advanced diagnostic tools like CT scanners.

The demand for advanced diagnostic tools, such as computed tomography scanners, rises all over the world. In particular, it can be witnessed in developing countries and certain parts of the world. The demand for the equipment is heavily impacted by the increase in healthcare spending. As countries develop their economies, they are likely to experience an increase in the healthcare budget. The phenomenon is also driven by the shift in people’s perception and behavior. As such, developing countries have observed a rise in chronic diseases, an aging population, and related issues. Healthcare providers are more interested in modern imaging technologies. CT scanners are essential because they provide clear images of the inside of the body. They allow identifying and diagnosing a broad array of conditions. The demand for the equipment is also increased by technological developments that make the scanners more efficient in terms of radiation exposure, quality of images, etc.

The market for sophisticated imaging technologies is boosted by the increasing emphasis on the acquisition of innovative tools worldwide. In particular, healthcare providers in emerging markets are interested in modernizing their imaging devices and capabilities. At the same time, the upward pressure is imposed by the shift in the volume of money invested into healthcare in the corresponding areas. At this point, the demand for CT scanners will keep increasing as emerging markets prioritize investments in diagnostic imaging. The interest in modern devices is likely to motivate small clinics and rural hospitals to upgrade their equipment. The demand will be further boosted by the increasing healthcare spending in the corresponding regions. A rise in the sales of the CT scanners is expected to lead to an improvement in healthcare outcomes and patient care.

Furthermore, Continuous advancements in CT technology are significantly improving diagnostic accuracy and patient safety. Enhanced image clarity allows for more detailed scans, leading to more precise diagnoses, while reduced radiation exposure minimizes risks, ensuring patient safety without compromising diagnostic quality. Faster scan times also enhance efficiency, enabling quicker diagnoses and treatments, particularly in emergency situations. These innovations collectively boost the reliability of CT imaging, making it an indispensable tool for diagnosing a wide range of medical conditions and meeting the growing demand for safe, accurate diagnostic solutions.

Restraints

-

The intricate nature of advanced CT systems can lead to difficulties in operation, maintenance, and the requirement for specialized training.

-

The substantial investment required for purchasing and maintaining advanced CT equipment can limit market growth.

-

Increasing concerns about the security of patient data and compliance with data protection regulations can affect market dynamics.

Growing concerns about the security of patient data and adherence to data protection regulations can significantly impact the CT market. As healthcare systems handle more sensitive information, stringent regulations are imposed to safeguard patient privacy and ensure data security. Meeting these regulations usually necessitates the implementation of sophisticated security measures and systems, which can raise costs and add complexity for healthcare providers. Furthermore, breaches or failures in data protection can result in legal consequences and harm to reputation. These issues can impact market dynamics by influencing the adoption of new technologies, increasing operational expenses, and affecting the overall demand for CT scanners and associated services.

The high cost associated with acquiring and maintaining advanced CT equipment can restrict market growth. This significant financial outlay includes not only the initial purchase price but also ongoing expenses for upkeep, repairs, and upgrades. For healthcare providers, especially in budget-constrained environments or developing regions, these costs can be excessive, limiting their ability to invest in and adopt new CT technology. As a result, this financial barrier can slow the overall expansion of the CT market.

Computed Tomography Market Segmentation Insights

By Technology

In 2023, The high-end slice CT segment dominated the market and accounted for the maximum revenue share of 35.2%. High-end slice scanners are used in patients with arrhythmia, pediatric patients who tend to move more during scans, and overweight individuals. They cover a larger scanning area within less time. Some of the opretional scanner can scan the whole body in 0.3 sec/per rotation (Siemens 700 Slice), which can enable healthcare providers to offer customized solutions and even produce real-time images. A 320-slice CT scan provides an imaging coverage of 16 cm per rotation. Furthermore, the procedure does not require patients to hold their breath, enhancing patient comfort, particularly for children.

The cone-beam segment is anticipated the fastest CAGR over the forecast period due to an increase in the use of cone-beam CTs in areas, such as dental, orthopedic, ENT, oral surgery, and interventional radiology. The technique offers several benefits, including its compact size, reduced radiation exposure, and lower cost compared to traditional CT systems.

By Application

The oncology segment dominated the market and held the largest revenue share of 27.28% in 2023, and anticipated that expand at the fastest CAGR over the forecast period. CT scans are frequently employed to identify and track tumors, assess the success of cancer treatments, and design radiation therapy plans. They assist oncologists in determining the size, shape, and position of tumors, as well as whether they have metastasized to other areas. The rising incidence of cancer and the expanding use of CT scans for diagnosing various cancers, including lumps and tumors, are anticipated to fuel growth in this segment.

The neurology & musculoskeletal segment is expected to witness a substantial growth rate over the forecast period. Driven by rising prevalence of neurological disorders and musculoskeletal conditions. Increasing demand for advanced imaging techniques for early and accurate diagnosis, combined with technological advancements like 3D imaging and AI integration, are driving this growth. The future forecast points to increased adoption of CT scans for brain, spine, and orthopedic imaging, with continued innovation enhancing diagnostic precision and patient outcomes.

By End-Use

In 2023, The hospital segment dominated the market and accounted for the maximum revenue share of 42.32%. The increased number of emergency patients in hospitals and the high number of yearly surgeries have facilitated the segment’s share. Hospitals are routinely installing or upgrading medical imaging equipment. Imaging systems like CT, MRI, and ultrasound within hospitals can positively impact several factors, including the length of hospital stays, overall healthcare costs, quality of care, and the availability of emergency services.

The diagnostic imaging centers segment is projected to experience substantial growth during the forecast period. CT scans are essential for diagnosing many medical conditions. Diagnostic imaging centers are often chosen over hospitals because they focus only on imaging services. This focus gives them greater expertise and experience, resulting in improved care and a more positive overall experience for patients.

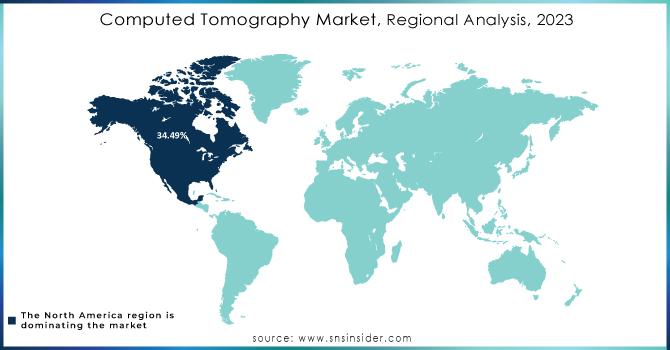

Computed Tomography Market Regional Analysis

In 2023, North America's computed tomography market held the largest share of 34.49%. and is expected to continue its dominance throughout the forecast period. Key factors driving the region's growth include an increasing elderly population, high rates of obesity, and widespread chronic conditions such as breast cancer, cardiovascular issues, and neurological diseases, all of which boost the demand for imaging services. Additionally, advancements in technology are expected to further enhance market expansion.

The Asia Pacific computed tomography market is led by China & Japan and is expected to exhibit the fastest CAGR of 8.79% during the forecast period. The rapid population growth and the surge in R&D activities in this region have contributed to this trend. Moreover, there is a significant demand for advanced devices in the Asia-Pacific region.

Need Any Customization Research On Computed Tomography Market - Inquiry Now

Key Players in the Computed Tomography Market

The major key players are

-

Siemens Healthineers - (Somatom Definition Edge, Somatom Force)

-

GE Healthcare - (Revolution CT, Discovery CT750 HD)

-

Canon Medical Systems - (Aquilion ONE, Aquilion Prime SP)

-

Philips Healthcare - (IQon Spectral CT, Incisive CT)

-

Hitachi Medical Systems - (Supria CT, Scenaria View)

-

Neusoft Medical Systems - (NeuViz 128, NeuViz Glory)

-

United Imaging Healthcare - (uCT 760, uCT 550)

-

Samsung Neurologica - (CereTom, BodyTom)

-

Shenzhen Anke High-tech - (ANATOM 16, ANATOM 64)

-

Planmed Oy - (Planmed Verity, Planmed Clarity)

-

Fujifilm Holdings Corporation - (FCT Speedia, FCT Embrace)

-

Carestream Health - (OnSight 3D Extremity System, DRX-CT)

-

Medtronic - (StealthStation S8, O-arm Surgical Imaging System)

-

Koning Corporation - (Koning Breast CT, KBCT 1000)

-

Shimadzu Corporation - (Trinias F12 Unity Edition, RadSpeed Pro CT)

-

Neurologica Corporation - (Portable CT Scanner, OmniTom CT)

-

Analogic Corporation - (BK Medical Flex Focus, CT Scanner System)

-

CurveBeam - (InReach CT Imaging, PedCAT CT Imaging)

-

Bruker Corporation - (SkyScan 1276 Micro-CT, BioSpec MRI/CT)

-

Esaote SpA - (O-scan, S-scan)

Recent Developments

In January 2024, GE HealthCare announced its acquisition of MIM Software, a leading provider of AI-driven solutions for medical imaging analysis.

In January 2023, GE HealthCare signed an agreement to acquire IMACTIS, a France-based company known for its innovative work in the rapidly growing field of Computed Tomography (CT) interventional guidance across various healthcare settings.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.79 Billion |

| Market Size by 2032 | USD 10.70 Billion |

| CAGR | CAGR of 7.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (High-end Slice CT, Mid-end Slice CT, Low-end Slice CT and Cone Beam CT (CBCT)) • By Application (Oncology, Cardiology, Vascular, Neurology, Musculoskeletal and Others) • By End-Use (Hospitals, Diagnostic Imaging Centers and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | CST Industries, Inc., Balmoral Tanks Ltd, McDermott International Inc., Containment Solutions, Inc., DN Tanks, Caldwell Tanks, Sintex Industries Ltd, Emiliana Serbatoi S.r.l., Carbery Plastics Limited, Nova Plastic Industries L.L.C,PermianLide, Superior Tank Co., Inc, Wheeler Tank Manufacturing, T.F. Warren Group, Highland Tank & Manufacturing Company, Belding Tank Technologies, Inc, Plascore, Inc, Hughes Tank Company, ModuTank, Inc, ZCL | Xerxes |

| Key Drivers | • The expanding elderly population, which is more prone to medical conditions that necessitate CT imaging. • Continuous innovations in CT technology, such as improved image quality, reduced radiation exposure, and faster scanning times. |

| RESTRAINTS | • The intricate nature of advanced CT systems can lead to difficulties in operation, maintenance, and the requirement for specialized training. • The substantial investment required for purchasing and maintaining advanced CT equipment can limit market growth. |