Infection Surveillance Solutions Market Size

Get more information on Infection Surveillance Solutions Market - Request Sample Report

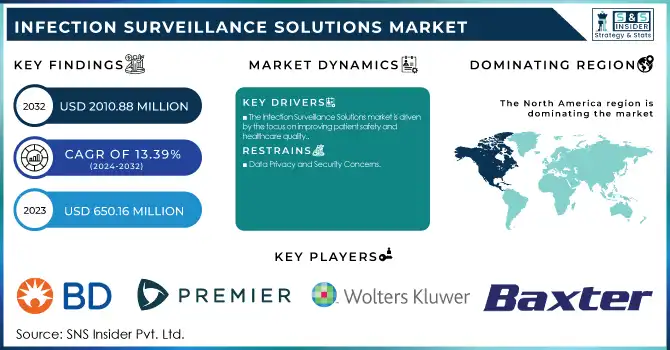

The Infection Surveillance Solutions Market was valued at USD 650.16 million in 2023 and is expected to reach USD 2010.88 million by 2032, growing at a CAGR of 13.39% over the forecast period 2024-2032.

The Infection Surveillance Solutions market is witnessing robust growth, fueled by the increasing prevalence of healthcare-associated infections (HAIs) and the need for efficient infection prevention measures in healthcare facilities. According to the CDC, approximately one in 31 hospitalized patients in the U.S. contracts an HAI daily, leading to severe patient safety concerns, extended hospital stays, and higher healthcare costs. Globally, the WHO reports that 7% of patients in high-income countries and 15% in low- and middle-income countries are affected by at least one HAI during their hospital stay.

These infections contribute to significant healthcare burdens, with studies showing that infection surveillance systems can reduce HAI rates by up to 30% when integrated with electronic health records (EHRs). Moreover, the implementation of advanced technologies, such as AI-driven analytics and machine learning algorithms, has enhanced the capabilities of infection surveillance tools. These advancements enable real-time data analysis, early detection of potential outbreaks, and better resource allocation, empowering healthcare providers to act swiftly.

Regulatory bodies such as the WHO, CDC, and Joint Commission continue to emphasize the importance of infection prevention and control (IPC) programs. A recent WHO report highlights that well-implemented IPC strategies can lower infection rates by up to 70%, especially in under-resourced settings. These mandates have encouraged the adoption of surveillance solutions across hospitals, long-term care facilities, and outpatient clinics. Additionally, the growing integration of digital technologies, including cloud-based platforms, has expanded the accessibility and scalability of these systems. Research underscores their effectiveness in improving patient outcomes and reducing operational costs, making them a critical component of modern healthcare strategies.

As awareness about HAIs increases and healthcare facilities prioritize infection prevention, the market for infection surveillance solutions is expected to grow steadily. This growth reflects the global commitment to enhancing patient safety and combating the persistent challenge of infections in healthcare environments.

Market Dynamics

Drivers

-

The Infection Surveillance Solutions market is driven by several key factors, including the growing emphasis on improving patient safety and enhancing healthcare quality.

One significant driver is the increasing awareness among healthcare providers about the importance of preventing healthcare-associated infections (HAIs). With rising scrutiny from regulatory bodies and a greater focus on patient outcomes, hospitals and healthcare systems are prioritizing infection control measures to reduce complications, avoid penalties, and improve public trust.

Another driver is the rapid advancements in healthcare technologies, which have led to the development of more sophisticated and efficient infection surveillance solutions. The integration of artificial intelligence (AI) and machine learning allows for enhanced data analytics, enabling real-time infection tracking, early detection, and predictive insights. This technological progress is critical in managing the complex nature of infections, especially in large healthcare facilities.

The increasing adoption of electronic health records (EHRs) and digital health technologies has also contributed to market growth. These systems facilitate seamless integration with infection surveillance tools, allowing healthcare providers to access real-time data and improve coordination across departments. Moreover, the rising prevalence of chronic diseases and the aging population, which are associated with higher risks of infection, are further accelerating the demand for infection surveillance solutions.

Restraints

-

High Implementation Costs

The adoption of advanced infection surveillance solutions often requires significant upfront investments in technology, infrastructure, and training, which may limit the affordability for smaller healthcare facilities or those in developing regions.

-

Data Privacy and Security Concerns

The integration of digital technologies and cloud-based platforms raises concerns about the security and confidentiality of patient data, potentially hindering the adoption of infection surveillance systems due to regulatory and privacy issues.

Key Segmentation

By Component

In 2023, the Software segment was the dominant force in the Infection Surveillance Solutions market, accounting for the largest share. Software solutions provide healthcare institutions with essential tools for real-time data analysis, automated reporting, and infection monitoring, making them a crucial part of infection prevention and control efforts. The growing need for automation, real-time tracking, and data-driven insights has driven the adoption of these solutions. Software's dominance, making up around 70.0% of the market in 2023, can be attributed to its ability to integrate seamlessly with electronic health records (EHRs) and other healthcare management systems, improving operational efficiency and patient safety.

The Services segment emerged as the fastest-growing component in the market. This growth is fueled by the increasing demand for consulting, implementation, and support services that help healthcare facilities effectively integrate and optimize their infection surveillance systems. As infection control becomes more complex and technology-driven, hospitals and healthcare providers are seeking expert guidance on system deployment, maintenance, and performance optimization. Additionally, services like data analytics, training, and risk assessment are becoming crucial for tailoring solutions to specific healthcare environments, further boosting the segment's expansion.

By End-use

In 2023, Hospitals were the largest end-user segment, representing a significant portion of the infection surveillance solutions market. Hospitals are the primary setting for healthcare-associated infections (HAIs) and thus the largest consumers of infection surveillance systems. The need to reduce HAIs, comply with stringent regulatory requirements, and improve patient safety has led hospitals to prioritize the adoption of advanced infection surveillance technologies. Hospitals accounted for over 65.0% of the market share in 2023, reflecting their critical role in infection control efforts and the large-scale adoption of digital health solutions.

Long-Term Care Facilities (LTCFs) have emerged as the fastest-growing segment in the infection surveillance solutions market. With an aging population more vulnerable to infections, LTCFs are increasingly adopting infection surveillance solutions to enhance patient care and prevent outbreaks. The rising awareness of infection risks in long-term care settings and the growing focus on infection prevention and control within these facilities are driving their rapid adoption of surveillance technologies. This sector's growth is accelerating as LTCFs recognize the need for comprehensive infection monitoring systems to safeguard their residents' health and comply with new healthcare regulations.

Regional Analysis

North America held the largest share of the market in 2023, primarily due to the well-established healthcare systems in the U.S. and Canada. The region is highly focused on infection prevention and control, driven by stringent regulations and increasing awareness of healthcare-associated infections (HAIs). The U.S. alone accounts for a significant portion of the global market, with hospitals and long-term care facilities investing heavily in advanced infection surveillance technologies. The adoption of electronic health records (EHRs) and integration with AI-driven surveillance tools are some of the key drivers of growth in North America.

In Europe, the market is also experiencing strong growth, fueled by similar healthcare challenges related to HAIs. The region benefits from robust healthcare systems and is seeing an increase in government initiatives aimed at improving infection control in hospitals and long-term care settings. Countries such as the UK, Germany, and France are leading the charge in adopting infection surveillance solutions, driven by regulatory mandates and an aging population.

The Asia-Pacific region is the fastest-growing market, with countries like China, India, and Japan showing rapid adoption of infection surveillance solutions. The increasing healthcare infrastructure, rising awareness about HAIs, and growing focus on improving patient safety are driving this growth. Additionally, the region's large population and healthcare challenges make infection prevention and control a top priority.

Need any customization research on Infection Surveillance Solutions Market - Enquiry Now

Key Players

1. Becton, Dickinson and Company (BD)

-

BD Infectious Disease Diagnostic Solutions

-

BD Synapsys Infection Surveillance Solution

2. Premier, Inc.

-

Premier SafetyCheck

-

Premier Infection Control Solutions

-

UpToDate (Clinical Decision Support)

-

Wolters Kluwer Health Infection Control Solutions

-

Baxter Infection Prevention Solutions (e.g., SafeSource)

5. Cerner Corporation (Oracle)

-

Cerner Infection Surveillance and Analytics Solution

-

PowerChart Infection Prevention

6. Clinisys

-

Clinisys Lab Management & Infection Surveillance Solutions

7. GOJO Industries

-

PURELL Infection Prevention Solutions

-

GOJO Hand Hygiene Compliance Solutions

8. Merative (formerly Truven Health Analytics)

-

Merative Infection Surveillance Solutions

-

Truven Health Analytics

9. Truven Health Analytics

-

Infection Control and Surveillance Systems (part of Merative now)

10. Vigilanz Corporation

-

VigiLanz Infection Surveillance and Management Solutions

11. RL Datix Ltd

-

RLDatix Infection Control Solutions

-

RL Datix Safety Management Systems

12. Deb Group Ltd. (UK)

-

Deb Hand Hygiene Solutions

13. BioVigil Healthcare Systems

-

BioVigil Hand Hygiene Compliance Monitoring System

14. Vecna Technologies, Inc.

-

Vecna Infection Prevention Solutions

15. Ecolab

-

Ecolab Infection Prevention and Control Solutions

-

Ecolab Hygiene Solutions for Healthcare

16. Harris Healthcare

-

Harris Infection Prevention Technologies

17. PeraHealth

-

PeraHealth Infection Surveillance Solutions

18. Medexter Healthcare

-

Medexter Infection Surveillance System

19. CenTrak, Inc.

-

CenTrak Infection Prevention and Control Solutions

20. bioMerieux SA

-

bioMerieux Infectious Disease Testing Solutions

-

VITEK 2 System for Infection Surveillance

21. CKM Healthcare

-

CKM Infection Control Solutions

22. Asolva Inc.

-

Asolva Infection Control Management System

23. PointClickCare

-

PointClickCare Infection Surveillance Solutions

24. STANLEY Healthcare

-

STANLEY Healthcare Infection Prevention Solutions

25. Vitalacy Inc.

-

Vitalacy Infection Control Solutions

26. VIZZIA Technologies

-

VIZZIA Infection Prevention Solutions

Recent Development

-

In June 2024, Becton, Dickinson, and Company (BD) announced its acquisition of Edwards Lifesciences' Critical Care Product Group for USD 4.2 billion. This strategic move aims to expand BD's smart connected care solutions and strengthen its position as a leader in advanced monitoring technologies, unlocking new growth opportunities in the critical care space.

-

In May 2024, Premier Inc. declared its partnership with AstraZeneca to leverage real-world data, AI-driven technologies, and scalable solutions to improve health outcomes and provide cost-effective solutions for patients.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 650.16 million |

| Market Size by 2032 | USD 2010.88 million |

| CAGR | CAGR of 13.39% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By End-use (Hospitals, Long-Term Care Facilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Becton, Dickinson and Company, Premier, Inc., Wolters Kluwer N.V., Baxter International Inc., Cerner Corporation (Oracle), Clinisys, GOJO Industries, Merative, Truven Health Analytics, Vigilanz Corporation, RL Datix Ltd, Deb Group Ltd., BioVigil Healthcare Systems, Vecna Technologies, Inc., Ecolab, Harris Healthcare, PeraHealth, Medexter Healthcare, CenTrak, Inc., bioMerieux SA, CKM Healthcare, Asolva Inc., PointClickCare, STANLEY Healthcare, Vitalacy Inc., VIZZIA Technologies. |

| Key Drivers | • The Infection Surveillance Solutions market is driven by several key factors, including the growing emphasis on improving patient safety and enhancing healthcare quality. |

| Restraints | • High Implementation Costs • Data Privacy and Security Concerns |