Diesel Particulate Filter Market Report Scope & Overview

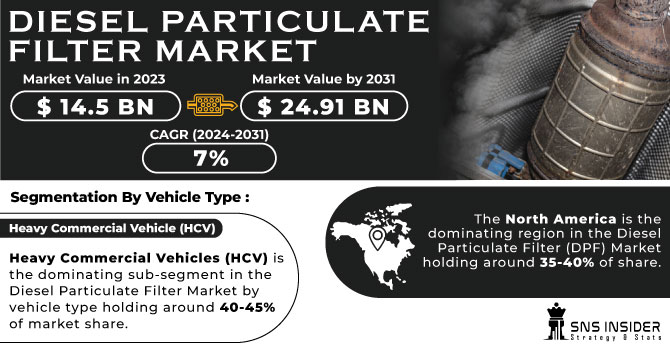

The Diesel Particulate Filter Market size was valued at USD 14.5 billion in 2023 and is expected to reach USD 24.91 billion by 2031 and grow at a CAGR of 7% over the forecast period 2024-2031.

Diesel particulate filters (DPFs) are playing an increasingly crucial role in combating air pollution. These devices act as guardians against harmful particulate matter (PM) spewed by diesel engines. They achieve this by trapping these microscopic particles, like soot and ash, within their porous structure as exhaust gases flow through.

Get more information on Diesel Particulate Filter Market - Request Sample Report

This significantly reduces the amount of PM released into the air, leading to cleaner air and a healthier environment. DPFs not only benefit the environment but also contribute to improved engine efficiency and ensure compliance with stricter emission regulations. The governments around the world are implementing stricter emission regulations to tackle the issue of harmful exhaust from diesel engines. This creates a strong market push for DPFs as a proven solution. The growing environmental awareness has heightened public concern about air quality, leading to a greater demand for effective PM reduction solutions, which DPFs effectively provide. The expanding use of diesel engines across various sectors like automotive, construction, and industrial machinery further fuels market growth.

MARKET DYNAMICS:

KEY DRIVERS:

-

Rising diesel engine use across industries drives demand for diesel particulate filters as an effective solution for cleaner emissions.

The global market for diesel particulate filters (DPFs) is thriving due to the widespread use of diesel engines. These engines are valued for their fuel efficiency and power, making them crucial for powering vehicles, industrial machinery, and construction equipment. However, their emissions have become an environmental concern. DPFs provide a solution by trapping and eliminating harmful particulates from exhaust gases. As industries and individuals continue to rely on diesel-powered equipment, the demand for efficient emission control solutions like DPFs is steadily increasing.

-

Advancement in Filter Technology Drives Diesel Particulate Filter Market Growth and Environmental Progress

RESTRAINTS:

-

High upfront costs may limit diesel particulate filters (DPF) adoption in budget-conscious markets.

Integrating DPFs into new vehicle designs or retrofitting existing cars can be expensive. This can deter car manufacturers and owners, particularly in regions with lower purchasing power or where financial priorities outweigh environmental concerns. For these individuals and companies, the upfront cost of DPFs might outweigh their long-term benefits, potentially hindering wider adoption of this crucial emission control technology.

OPPORTUNITIES:

-

Rising adoption of diesel engines in new sectors like construction and power generation creates a new market for DPFs.

-

Advancements in DPF technology like improved efficiency and durability can attract cost-conscious customers.

CHALLENGES:

-

High upfront costs for DPF systems can discourage adoption, especially in budget-conscious regions.

-

Integrating DPFs into new vehicles or retrofitting older ones can be complicated due to compatibility issues and space limitations.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has impacted the Diesel Particulate Filter (DPF) market, disrupting supply chains and causing price fluctuations. Disruptions began with the immediate reduction in automotive production due to sanctions and parts shortages. This resulted in a lower demand for new DPFs as fewer new diesel vehicles were being manufactured. The conflict significantly impacted global energy prices, including a rise in diesel fuel costs. This unexpected expense could lead to fleet owners delaying non-essential maintenance, like DPF replacements, to reduce operational costs. The sanctions on Russia, a major supplier of raw materials like palladium used in DPF catalysts, have caused a shortage and driven up material prices. Thus, there is a potential decline in DPF demand by around 5-10% in war-affected regions due to production slowdowns and fleet maintenance delays.

IMPACT OF ECONOMIC SLOWDOWN

Economic slowdowns can disrupt the diesel particulate filter (DPF) market. As consumer spending lowers, investments in new vehicles and maintenance often decreases. This translates to a potential decline of 5-10% in DPF sales. Industries, especially those reliant on diesel-powered machinery, might delay equipment upgrades or repairs, further impacting DPF demand. Reduced freight movement due to lower economic activity can also lead to a decrease in DPF replacements for commercial vehicles. The budget constraints faced by governments during economic downturns can lead to delays or reduced enforcement of emission regulations. This could provide temporary relief for industries that might otherwise prioritize DPF adoption for compliance purposes.

KEY MARKET SEGMENTS:

By Vehicle Type

-

Passenger Vehicles

-

Light Commercial Vehicle (LCV)

-

Heavy Commercial Vehicle (HCV)

-

Off-Highway Vehicle

Heavy Commercial Vehicles (HCV) is the dominating sub-segment in the Diesel Particulate Filter Market by vehicle type holding around 40-45% of market share. Stringent emission regulations for commercial vehicles, particularly in developed regions, are driving the demand for DPFs in HCVs. These regulations aim to reduce pollution from long-haul trucks and buses, which contribute significantly to overall emissions.

By Product Type

-

Regenerating Type Filters

-

Disposable Type Filters

Regenerating Type Filters is the dominating sub-segment in the Diesel Particulate Filter Market by product type holding around 70-75% of market share. Regenerating DPFs offer a more sustainable and cost-effective solution compared to disposable filters. They can be cleaned and reused multiple times through regeneration cycles, eliminating the need for frequent replacements.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Material Type

-

Cordierite Wall Flow Filters

-

Silicon Carbide Wall Flow Filters

-

Ceramic Fiber Filters

-

Other Substrates

Cordierite Wall Flow Filters is the dominating sub-segment in the Diesel Particulate Filter Market by material type. CWLFFs offer a balance of affordability, efficiency, and durability. They are relatively inexpensive to produce, demonstrate high filtration efficiency for particulate matter capture, and can withstand high operating temperatures within the exhaust system.

By Sales Channel

-

Original Equipment Manufacturer (OEM)

-

Aftersales

Original Equipment Manufacturer (OEM) is the dominating sub-segment in the Diesel Particulate Filter Market by sales channel. New vehicles are increasingly manufactured with DPFs integrated into their exhaust systems to comply with emission regulations right from the start. This trend is expected to continue as regulations become more stringent.

By Material Type

-

Cordierite Wall Flow Filters

-

Silicon Carbide Wall Flow Filters

-

Ceramic Fiber Filters

-

Other Substrates

Cordierite Wall Flow Filters is the dominating sub-segment in the Diesel Particulate Filter Market by material type. CWLFFs offer a balance of affordability, efficiency, and durability. They are relatively inexpensive to produce, demonstrate high filtration efficiency for particulate matter capture, and can withstand high operating temperatures within the exhaust system.

By Sales Channel

-

Original Equipment Manufacturer (OEM)

-

Aftersales

Original Equipment Manufacturer (OEM) is the dominating sub-segment in the Diesel Particulate Filter Market by sales channel. New vehicles are increasingly manufactured with DPFs integrated into their exhaust systems to comply with emission regulations right from the start. This trend is expected to continue as regulations become more stringent.

REGIONAL ANALYSES

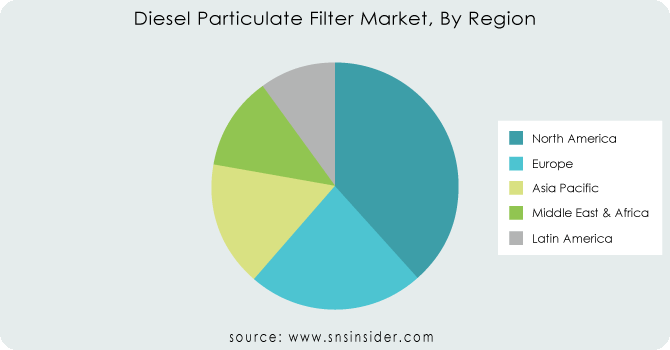

The North America is the dominating region in the Diesel Particulate Filter (DPF) Market holding around 35-40% of share. This dominance stems from stringent emission regulations by the EPA, mandating DPF use in vehicles. It boasts a well-developed infrastructure for both OEM and aftermarket DPF sales.

Europe is the second highest region in this market due to their strict Euro emission standards and a mature automotive industry prioritizing environmental sustainability.

The Asia Pacific is the fastest growing region in this market driven by rapidly developing economies with rising disposable income, leading to a significant increase in vehicle ownership. Stricter emission regulations in countries coupled with growing government investments in cleaner public transportation infrastructure, are significantly propelling the DPF market.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Delphi (US), Tenneco Inc. (US), NGK Insulators, LTD. (Japan), Faurecia (France), Johnson Matthey (UK), BASF (Germany), Bosal International (Belgium), MANN+HUMMEL (Germany), Denso (Japan), Donaldson Company Inc. (US), Continental AG (Germany) and other key players.

Delphi (US)-Company Financial Analysis

RECENT DEVELOPMENT

-

In March 2024: Intangles, a digital twin solutions company, launched an AI-powered DPF solution for commercial vehicles. This tech promises better DPF regeneration, improved fuel efficiency, and cleaner emissions. It analyses engine exhaust data to predict regeneration needs and recommend optimal modes, ensuring performance and compliance with regulations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 14.5 Billion |

| Market Size by 2031 | US$ 24.91 Billion |

| CAGR | CAGR of 7% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Substrate Type (Cordierite, Silicon carbide, Others) • by Product Type (Regenerating type filters, Disposable type filters) • by Regeneration Catalyst (Platinum-rhodium, Palladium-rhodium, Platinum-palladium-rhodium) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | elphi (US), Tenneco Inc. (US), NGK Insulators, LTD. (Japan), Faurecia (France), Johnson Matthey (UK), BASF (Germany), Bosal International (Belgium), MANN+HUMMEL (Germany), Denso (Japan), Donaldson Company Inc. (US), and Continental AG (Germany) |

| Key Drivers | • The implementation of rigorous laws regarding emissions. • Demand for diesel engines is growing in countries that are still developing. |

| RESTRAINTS | • Light-duty automobiles are increasingly being powered by gasoline and hybrid systems. • Governments encouraging consumers to purchase electric-powered automobiles, there has been a slowdown. |