Digital Risk Protection Platform Market Report Scope & Overview:

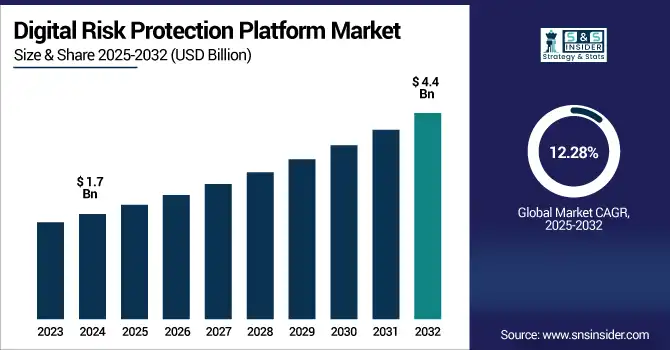

The Digital risk protection platform market size was valued at USD 1.7 billion in 2024 and is expected to reach USD 4.4 billion by 2032, growing at a CAGR of 12.28% during 2025-2032.

To Get more information on Digital-Risk-Protection-Platform-Market - Request Free Sample Report

The digital risk protection platform market growth is driven by the rising number of cyberattacks, growing digitalization, and increasing demand for real-time threat intelligence. All organizations from various industries have begun to adopt these platforms to identify, monitor, and mitigate external threats, including phishing, data leaks, and brand impersonation. The digital risk protection platform market analysis reveals strong interest from the BFSI, healthcare, and government sectors, the small and medium enterprises also adopt cost-effective cloud-based solutions. The last one is a key digital risk protection platform market trends that includes the AI-powered threat detection, integration with larger cybersecurity frameworks, and regional threat intelligence. The market is expected to grow significantly during the forecast period due to increasing investments in cybersecurity infrastructure and changing regulatory requirements, providing solutions for scalable management of digital threats.

The U.S. market is valued at USD 11.6 billion in 2023 and is poised to grow at a CAGR of 12.9% and reach USD 34.2 billion by 2032. Some of the major factors driving the growth are rapid digital transformation, a greater need for automation, rising adoption of cloud-based solutions, an increase in the number of mobile devices, and advancement in analytics, among others. Enterprises across industries are further benefiting from market expansions, aided by supportive government initiatives and robust tech infrastructure.

Market Dynamics:

Drivers:

-

Rising Incidents of Cyber Threats Drive Adoption of DRP Platforms

Due to the impending projection of the global cost of cybercrime surpassing USD 10 trillion by the year 2025, organizations are flocking to DRP platforms to protect their digital footprint. The stakes are high because company phishing threats, dark web exposure, brand impersonation, and data leaks are on the rise. DRP platforms also deliver real-time visibility into outside threats against assets out of reach of the firewall, such as social media accounts, domains, and third-party vendors. Companies are more focused on proactive monitoring and threat intelligence as cybercriminals update their modus operandi, and hence DRP solutions will become a key element of modern security stacks. There is a high demand for this in BFSI, healthcare, and retail verticals in particular, where data sensitivity and compliance are non-negligible.

For instance, according to Research, global cyberattacks rose by 38% in 2024 compared to 2023, with organizations facing an average of 1,258 attacks per week.

Restraints:

-

High Deployment Costs Limit Adoption Among SMEs

SMEs are deterred by the high implementation and operational costs of DRP platforms, despite high demand. DRP tools typically include some level of customization (probably not included in any pricing you see), integration with security tools you might already have, and threat analysts who may not be focused on your company or industry full time, increasing the total cost of ownership. Additionally, qualified individuals need to analyze the threat intelligence and manage the responses. This price tag can prevent adoption for cost-sensitive organizations with slim cybersecurity budgets. It is both complex and difficult to deploy DRP across global operations and digital touchpoints. This leads to a lot of SMEs either postponing adoption or endorsing low-impact, limited-reach solutions that simply do not do justice to the potential of this development.

For instance, A 2024 survey by CSO Online found that 58% of small and medium-sized enterprises identified high implementation and licensing costs as the main reason for not adopting advanced cybersecurity solutions, such as DRP.

Opportunities:

-

AI-Powered Automation Expands DRP Efficiency and Market Reach

The rise of Artificial Intelligence and automation is driving evolution in DRP functionality and is a major growth opportunity. Primarily, DRP Tools can use machine learning to review millions of data points from open, deep, and dark web, find risks faster and more accurately. Automated alerts and response mechanisms alleviate some of the pressure on cybersecurity teams and facilitate faster incident response. Predictive threat modelling through advanced analytics enhances the ability of businesses to foresee attacks before they are even manifested. Rather, this digital evolution elevates DRP platforms to not only be more valuable than ever before, but also more accessible to a wider swath of enterprises across industries due to cloud-hosted delivery models that are scalable.

In Splunk’s 2024 State of Security report, 76% of companies using AI automation in their DRP stack noted a significant decrease in alert fatigue, improving team productivity and response precision.

Challenges:

-

Evolving Threat Tactics Increase False Positives and Operational Strain

The need to maintain accurate detection and prioritize threats in the face of the evolving threat landscape is one of the key challenges in the DRP market. These rapid advances in technology are making it increasingly difficult for DRP systems to have accuracy rates above 75%, as cybercriminals are always using new approaches, deepfakes, generative AI attacks, and multi-vector campaigns, among others. However, this dynamic aspect results in false positives, inundating security teams with unnecessary alerts and decreasing overall efficiency. This is a cycle that can eat resources, too, as it involves continuous adjustment of algorithms and threat models to cater to attacks. This may result in organizations getting alert fatigue, which may potentially overlook an actual threat. Finding DRP sensitivity and accuracy balance remains an everlasting challenge for all DRP vendors.

Segmentation Analysis:

By Solutions

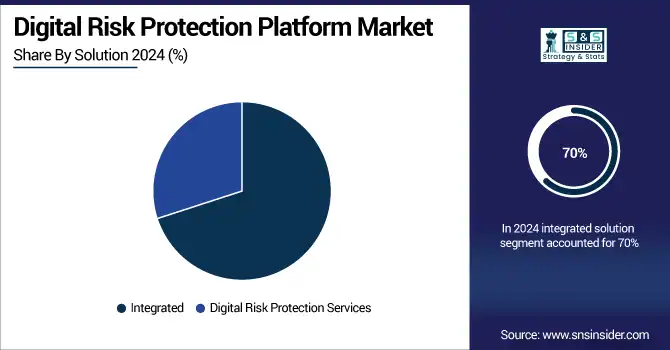

The integrated solution segment dominated the market in 2024 and accounted for 70% of the digital risk protection platform market share, as it provides threat intelligence, takedown, and brand monitoring in a single platform. Most enterprises that are looking to simplify their operations and reduce complexity choose a single-vendor strategy. As the demand for secure accessibility grows exponentially, the availability of integrated security in the connected building will continue to dominate the market until 2032 across the BFSI, healthcare, and retail verticals.

The DRP services are expected to register the fastest CAGR during the forecast period, owing to the absence of cybersecurity professionals in-house and the need for 24/7 external threat monitoring. This alleviates internal teams and focuses on bespoke threat intelligence as a service. Driven by the growing trend of outsourcing and subscription-based delivery, this segment is expected to register the highest CAGR through 2032, in developed countries and emerging markets.

By Enterprise Size

The large enterprises segment dominated the digital risk protection platform market in 2024 and accounted for 68% of revenue share, due to high-value digital assets, complex attack surfaces, and regulatory pressure. These companies shell out top dollar for enterprise-level DRP platforms for brand protection, dark web monitoring, and threat intelligence. Due to the growing number of incidents of corporate espionage and reputational attacks, demand among the Fortune 1000 firms is anticipated to remain high, particularly within finance, telecom, and healthcare industries through 2032.

SMEs are expected to grow with the highest CAGR during the forecast period, owing to increasing awareness about cyber threats coupled with increasing accessibility to affordable, AI-driven, and subscription-based DRP services. With limited defense against cyberattacks, SMEs are giving preference to external threat communications via cyberattacks by targeting smaller firms. The rise of affordable cloud-based, managed DRP models is making uptake increasingly affordable, especially in the education, retail, and regional service sectors, out through 2032.

By End-Use

The BFSI segment dominated the digital risk protection platform market and accounted for a significant revenue share in 2024, as it is the most pronounced vertical for phishing, credential theft, and brand impersonation. High adoption is driven by strict compliance standards (PCI-DSS and GLBA) and frequent cyberattacks on financial assets. Banks and insurers also spend a lot on real-time threat monitoring and takedown services. The high share of the non-cash transactions segment is likely to remain until 2032 as digitalization and the risk of fraud in cash transactions increase.

The healthcare sector is expected to register the fastest CAGR during the forecast period, driven by rising ransomware attacks, patient data leaks, and phishing attacks against hospitals and providers. The digitalization of patient records, along with regulatory mandates including HIPAA, has increased the need for visibility over external threats. Among them, envisage robust DRP platforms that provide protection, real-time monitoring, and are predicted to quickly gain adoption through 2032 on public and private systems, considering their robust built-in capabilities for protecting medical data exposure.

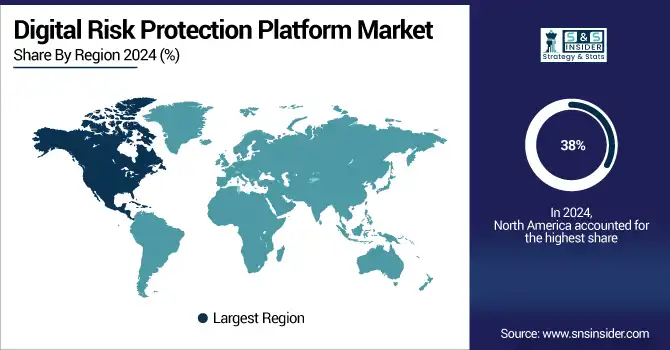

Regional Analysis:

In 2024, North America led the DRP market and held a revenue share of more than 38%, due to early technology adoption, high instances of targeted cyberattacks, and regulatory frameworks, such as CCPA and HIPAA. Solid external threat monitoring solutions, brand protection, and data leak prevention are essentially demanded by the region’s large base of Fortune 500 companies.

Asia Pacific is anticipated to witness the fastest CAGR during the forecast period, owing to a rapidly transforming digital environment, increasing cybercrime incidences, and burgeoning awareness of the benefits of security among the segments, including SMEs and large enterprises. Faced with the cascade of ransomware attacks, along with cyber laws supported by governments, India, China, and Singapore are investing heavily in cybersecurity. Digital banking, e-commerce, and healthcare platforms are expanding throughout the region, pushing the demand for DRP solutions.

China is the leader in the Asia Pacific DRP market, owing to its large-scale digital economy, frequency of cyberattacks, coupled with strict government mandates on data protection. The demand for integrated and AI-powered DRP platforms will remain through 2032, driven primarily by rapid enterprise digitalization, the rise of fintech, and state-driven cybersecurity initiatives.

The DRP market in Europe is expected to flourish with stringent data privacy laws, such as GDPR, increasing cyberattacks on vital sectors, and expanding deployment of cloud technology. DRP is one of the major investments in maintaining compliance and the security of enterprises’ digital assets. The growth of the market will be constant, with BFSI and government verticals showing robust adoption.

In Europe, Germany dominated the digital risk protection platform market, with its established industrial base, significant cyber risk exposure, and strict regulatory enforcement, is the leading European market for DRPs. Renewed digital risk awareness across organizations from manufacturing to finance is boosting adoption of advanced risk visibility and takedown solutions among domestic firms, with continued expansion forecast through 2032 through integration with AI-entrenched DRP platforms.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major digital risk protection platform market companies are ZeroFox, Broadcom, Rapid7, CybelAngel, Digital Shadows, Proofpoint, CrowdStrike, Darktrace, FireEye, LookingGlass Cyber and other.

Recent Developments:

-

In July 2024, FireEye, now operating under the Trellix brand, launched an integrated digital risk protection suite combining threat intelligence, incident response, and external attack surface management to enhance organizational resilience.

-

In May 2024, Digital Shadows expanded its digital risk protection platform to include real-time monitoring of emerging threats, providing organizations with proactive alerts and mitigation strategies.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 1.7 Billion |

| Market Size by 2032 | US$ 4.4 Billion |

| CAGR | CAGR of 12.28% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2024-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Integrated, Digital Risk Protection Services) • By Enterprise Size (Small and Medium-sized Enterprises, Large Enterprises) • By End-User (IT & Telecom, BFSI, Automotive, Healthcare, Manufacturing, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ZeroFox, Broadcom, Rapid7, CybelAngel, Digital Shadows, Proofpoint, CrowdStrike, Darktrace, FireEye, LookingGlass Cyber and others in the report |