In-app Advertising Market Report Scope & Overview:

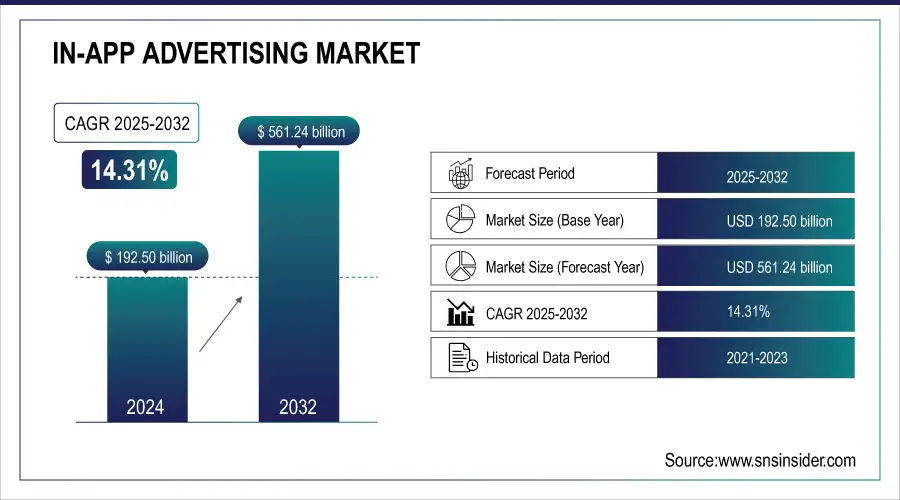

The In-app Advertising Market Size was valued at USD 192.50 Billion in 2024 and is expected to reach USD 561.24 Billion by 2032 and grow at a CAGR of 14.31% over the forecast period 2025-2032.

To Get more information on In-app Advertising Market - Request Free Sample Report

The Ad format performance metrics (CTR, conversion rates, viewability) assess ad effectiveness, while user engagement stats (session duration, interaction rates) measure consumer response. Programmatic ad spending trends reveal AI-driven ad placement growth, and monetization metrics (ARPU, in-app purchase conversions) show revenue streams. Fraud detection rates track invalid traffic, while device-based analytics compare Android vs. iOS ad performance. CPM and CPC pricing trends highlight cost fluctuations, and advertiser spending by industry reveals key investment sectors, offering deeper market insights and revenue potential.

Market Size and Forecast:

-

In-app Advertising Market Size in 2024: USD 192.50 Billion

-

In-app Advertising Market Size by 2032: USD 561.24 Billion

-

CAGR: 14.31% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key In-app Advertising Market Trends

• Increasing use of programmatic and real-time bidding (RTB) for personalized in-app ads.

• Growing demand for rewarded video ads and interactive ad formats to enhance user engagement.

• Expansion of gaming apps and social media platforms as high-revenue in-app ad channels.

• Integration of AI and machine learning for targeted ad delivery and predictive analytics.

• Rising focus on privacy-compliant advertising due to regulations like GDPR and CCPA.

• Adoption of location-based and hyper-local targeting for better ad relevance.

• Growth in in-app e-commerce and m-commerce fueling contextual advertising opportunities.

• Increasing popularity of native ads that blend seamlessly with app content.

• Expansion of AR/VR and immersive ad experiences within apps to improve engagement.

In-app Advertising Market Growth Drivers

-

Increasing Smartphone Penetration and Mobile App Usage Accelerates the Growth of the In-app Advertising Market

The rapid increase in smartphone adoption and mobile app usage worldwide has significantly driven the In-app Advertising Market. With billions of users actively engaging with mobile apps across various categories such as gaming, social media, entertainment, and e-commerce, advertisers leverage in-app ads to reach highly targeted audiences. The rise of mobile-first economies, particularly in emerging markets, has further fueled the demand for app-based advertising.

Moreover, the shift towards digital consumption, rising internet penetration, and advancements in AI-driven ad placements have enhanced the effectiveness of in-app ads. Businesses are increasingly investing in programmatic in-app advertising to deliver personalized and interactive ad experiences to users, improving engagement rates and conversion. The seamless integration of video ads, native ads, and interactive formats within apps enhances user engagement, making it a preferred choice for marketers. This trend is expected to sustain market growth in the coming years.

In-app Advertising Market Restraints

-

Rising Concerns Over Data Privacy and Stringent Regulations Hinder the Growth of the In-app Advertising Market

As in-app advertising heavily relies on user data for personalized ad targeting, growing concerns over data privacy and increasing government regulations have emerged as major barriers to market growth. Stringent laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) restrict the way companies collect, store, and use consumer data.

Additionally, the elimination of third-party cookies and Apple’s App Tracking Transparency (ATT) framework have significantly impacted ad targeting capabilities, making it harder for advertisers to track user behavior. Consumers are becoming more aware of their digital privacy rights and are increasingly opting out of data tracking, reducing the effectiveness of targeted in-app advertising. Ad blockers and privacy-focused browsing tools further limit the reach of in-app ads. To address these challenges, companies must adopt privacy-compliant ad strategies while ensuring transparency and trust among users.

In-app Advertising Market Opportunities

-

Advancements in AI and Machine Learning Enhance Personalization and Drive Growth in the In-app Advertising Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) in in-app advertising presents significant growth opportunities for the market. AI-powered ad targeting enables real-time audience segmentation, predictive analytics, and automated bidding, ensuring higher ad relevance and engagement. Machine learning algorithms analyze user behavior, preferences, and interaction history to deliver personalized ad experiences, increasing conversion rates. The use of AI in programmatic advertising optimizes ad placements and enhances return on investment (ROI) for advertisers.

Additionally, conversational AI, chatbots, and voice search-enabled ads are reshaping the in-app advertising landscape, providing interactive and engaging ad formats. AI-driven fraud detection mechanisms also help in identifying and reducing ad fraud, click fraud, and invalid traffic, improving ad efficiency. As AI continues to evolve, businesses leveraging advanced ad personalization and automation technologies will gain a competitive edge, making AI a key driver of future growth in the in-app advertising market.

In-app Advertising Market Challenge:

-

Ad Fatigue and Intrusive Advertising Reduce User Engagement and Pose a Challenge for the In-app Advertising Market

One of the biggest challenges in the In-app Advertising Market is ad fatigue and user frustration due to excessive and repetitive ads. As consumers spend more time on mobile apps, they are exposed to numerous ads, leading to banner blindness, lower engagement rates, and increased app uninstalls. Poorly designed or irrelevant ads disrupt the user experience, causing negative brand perception and decreased ad effectiveness. Intrusive ad formats such as full-screen interstitials, autoplay video ads, and forced ad interactions further contribute to user dissatisfaction. To combat this challenge, advertisers must focus on non-intrusive, interactive, and engaging ad formats like rewarded ads, native ads, and playable ads that provide value to users. Implementing frequency capping, AI-driven ad personalization, and optimizing ad placements can help maintain a balance between monetization and user experience. Brands that prioritize seamless ad integration and user engagement strategies will retain customer attention and drive better ad performance.

In-app Advertising Market Segment Analysis

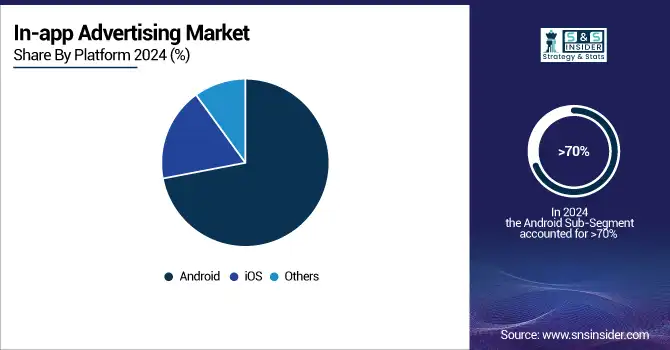

By Platform

The Android platform held the largest revenue share in the In-app Advertising Market in 2024, driven by its global market dominance, higher user base, and extensive app ecosystem. Android accounts for over 70% of the global smartphone market, making it the preferred platform for in-app advertising. The Google Play Store hosts millions of apps across various categories, providing advertisers with a vast audience for targeted ad placements.

Additionally, ironSource launched new monetization tools for Android developers, enabling better ad engagement through interactive and rewarded ads. Android’s open-source nature and flexibility allow for advanced ad customization and programmatic ad integration, making it an attractive platform for advertisers.

The iOS segment is projected to grow at the highest CAGR in the forecasted period, driven by higher ad engagement rates, premium user demographics, and advancements in privacy-focused ad solutions. Despite having a smaller market share compared to Android, iOS users tend to generate higher ad revenue per user (ARPU) due to increased spending on in-app purchases and subscriptions. Apple’s App Store ecosystem provides a more controlled environment, leading to better ad visibility and engagement.

In 2023, Apple introduced enhanced privacy-friendly ad targeting tools via its SKAdNetwork 4.0 update, enabling advertisers to measure campaign effectiveness while maintaining user privacy.

By Type

The Banner Ads segment held the largest share in the In-app Advertising Market, accounting for 38% of total revenue in 2024. Banner ads remain a popular and cost-effective choice for advertisers due to their wide reach, ease of implementation, and compatibility with various mobile apps. These static or animated ad formats are typically placed at the top or bottom of the app screen, ensuring non-intrusive advertising while maintaining visibility.

In 2023, Google AdMob introduced advanced machine learning algorithms to improve ad relevance and engagement, increasing click-through rates (CTR) for advertisers.

Additionally, Apple’s SKAdNetwork updates helped advertisers measure banner ad performance more effectively in a privacy-compliant manner. With the growing adoption of programmatic advertising and AI-powered ad placements, banner ads are expected to sustain their dominance in the market, offering high impressions and cost-efficient marketing solutions for brands.

The Interstitial Ads segment is projected to grow at the highest CAGR of 15.7% during the forecasted period, driven by its full-screen immersive experience and higher engagement rates compared to other ad formats. These ads appear during natural transition points in mobile apps, such as between game levels or before a video load, making them highly effective in grabbing user attention. Leading ad networks like AppLovin, Unity Ads, and AdMob have been innovating interstitial ad formats to improve user engagement and reduce ad fatigue.

In 2023, Unity Ads launched interactive and gamified interstitial ads, enhancing ad performance in gaming apps. Additionally, InMobi introduced AI-powered predictive analytics, allowing advertisers to serve contextually relevant interstitial ads based on user behavior.

By Application

The Entertainment segment held the largest share in the In-app Advertising Market in 2024, accounting for 27% of total revenue, driven by the rising consumption of streaming services, social media apps, and video content platforms. As mobile entertainment apps attract millions of active users daily, advertisers have leveraged video ads, native ads, and interactive ad formats to engage audiences effectively.

In 2023, Google introduced AI-powered ad targeting for YouTube, improving ad personalization based on user preferences. Additionally, TikTok launched new interactive ad formats, such as gesture-based and gamified ads, increasing engagement rates.

The Gaming segment is projected to grow at the fastest CAGR of 16.1%, fueled by the mass adoption of mobile gaming, in-game ad monetization strategies, and the rise of rewarded ads. With mobile gaming apps generating high user engagement and playtime, advertisers have prioritized in-game ads, rewarded video ads, and interstitial ads to maximize revenue. With the growing popularity of hyper-casual and multiplayer games, advertisers are increasingly investing in immersive ad formats and interactive promotions to enhance user engagement. As gaming continues to dominate mobile app usage, the In-app Advertising Market is set to witness strong revenue growth from this segment.

In-app Advertising Market Regional Analysis

Asia Pacific In-app Advertising Market Insights

The Asia Pacific region led the In-app Advertising Market in 2024, capturing an estimated 42% market share, driven by the rapid growth of mobile internet users, increased smartphone penetration, and high engagement with mobile applications. Countries like China, India, and Japan have seen massive growth in mobile app usage, with platforms such as TikTok, WeChat, and Flipkart leveraging in-app ads for monetization.

Additionally, Bytedance expanded its ad offerings in TikTok, boosting revenue through immersive ad experiences. The presence of large mobile-first populations and high digital ad spending by brands has further fueled market growth. With 5G adoption and increasing mobile transactions, the Asia Pacific region remains the dominant hub for in-app advertising investments.

North America In-app Advertising Market Insights

The North American region emerged as the fastest-growing market for in-app advertising in 2024, with an estimated CAGR of 14.6%, fueled by rising programmatic ad spending, advanced AI-driven ad targeting, and high adoption of premium mobile applications. The United States and Canada have witnessed significant growth in digital ad investments, with platforms such as Facebook, Instagram, and Snapchat driving in-app advertising revenues.

Additionally, Google expanded its AI-powered advertising features in AdMob, enhancing ad relevance across mobile apps. The strong presence of tech giants, premium app ecosystems, and increasing investments in mobile-first ad strategies have positioned North America as the fastest-growing market for in-app advertising.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe In-app Advertising Market Insights

The Europe In-app Advertising Market is experiencing steady growth in 2024, driven by widespread smartphone penetration, mature digital infrastructure, and high adoption of mobile apps across gaming, social media, and e-commerce sectors. Key markets such as the U.K., Germany, and France are witnessing increasing investment in programmatic and native ad formats to enhance user engagement. Stringent data privacy regulations like GDPR are shaping ad targeting strategies, pushing advertisers to adopt privacy-compliant solutions. Moreover, the integration of AI-driven analytics and interactive ad formats is further fueling market growth across the region.

Latin America (LATAM) In-app Advertising Market Insights

The LATAM In-app Advertising Market is expanding gradually in 2024, supported by growing mobile device usage, rising internet penetration, and increasing adoption of social media and gaming apps. Countries such as Brazil, Mexico, and Argentina are emerging as major markets for in-app advertising, with demand for rewarded video, native, and interactive ads rising sharply. Digital marketing agencies and local publishers are leveraging programmatic platforms and analytics tools to optimize ad performance. Government initiatives to improve digital connectivity and smartphone access are further driving market penetration in the region.

Middle East & Africa (MEA) In-app Advertising Market Insights

The MEA In-app Advertising Market is gaining momentum in 2024, fueled by rapid smartphone adoption, expanding mobile internet infrastructure, and growth in digital entertainment and social media platforms. Countries like the UAE, Saudi Arabia, and South Africa are increasingly leveraging in-app advertising for gaming, e-commerce, and lifestyle apps. Regional marketers are adopting AI-enabled and hyper-local targeting strategies to improve ad relevance and engagement. Furthermore, rising investments in programmatic advertising platforms and mobile marketing solutions are accelerating the adoption of advanced in-app ad formats across the region.

In-app Advertising Market Competitive Landscape

AnyMind Group

AnyMind Group is a technology platform providing solutions for digital marketing, influencer marketing, and in-app advertising.

-

In March 2024, AnyMind Group supported 1,741 web and app publishers through its media and mobile app growth platform, AnyManager, delivering over 20 billion monthly ad impressions. The initiative aimed to enhance publisher growth by integrating Google’s tools with proprietary technology for better ad performance.

Amobee

Amobee is a digital marketing technology firm specializing in programmatic advertising, data analytics, and cross-channel marketing solutions.

-

In April 2024, Amobee completed the acquisition of ad tech company Turn for $310 million. The acquisition strengthened Amobee’s capabilities in data management, programmatic buying, and cross-device marketing, enabling marketers to optimize customer engagement across mobile, video, and display channels.

In-app Advertising Market Key Players

Some of the major players in the In-app Advertising Market are:

-

ironSource (Unity Software Inc.) (ironSource Aura, ironSource LevelPlay)

-

Google AdMob (Google LLC) (AdMob Mobile Ads Platform, Google Ads for Apps)

-

BYYD Inc. (BYYD Programmatic In-App Advertising, BYYD Mobile DSP)

-

Flurry (Yahoo Inc.) (Flurry Analytics, Flurry Ad Monetization)

-

TUNE, Inc. (TUNE Partner Marketing Platform, TUNE Attribution Analytics)

-

Amobee, Inc. (Amobee In-App Advertising, Amobee Advanced AI Targeting)

-

InMobi (InMobi Exchange, InMobi Audiences)

-

Glispa GmbH (Glispa Performance Platform, Glispa Connect)

-

AppLovin (AppLovin MAX, AppLovin AXON AI)

-

Chartboost, Inc. (Chartboost Mediation, Chartboost DSP)

-

Smaato, Inc. (Smaato Publisher Platform, Smaato Demand Platform)

-

Leadbolt (Leadbolt App Discovery, Leadbolt Mobile Advertising)

-

Apple Inc. (Apple Search Ads, SKAdNetwork)

-

Facebook Inc. (Meta Audience Network, Facebook App Ads)

-

MoPub Inc. (Twitter) (MoPub Marketplace, MoPub Mediation)

-

One by AOL (AOL) (One Mobile, One Display)

-

Tapjoy Inc. (Tapjoy Offerwall, Tapjoy Interplay)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 192.50 Billion |

| Market Size by 2032 | US$ 561.24 Billion |

| CAGR | CAGR of 14.31 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Banner Ads, Interstitial Ads, Rich Media Ads, Video Ads, Native Ads) • By Platform (Android, iOS, Others) • By Application (Entertainment, Gaming, Social, Online Shopping, Payment & Ticketing, News, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | ironSource (Unity Software Inc.), Google AdMob (Google LLC), BYYD Inc., Flurry (Yahoo Inc.), TUNE, Inc., Amobee, Inc., InMobi, Glispa GmbH, AppLovin, Chartboost, Inc., Smaato, Inc., Leadbolt, Apple Inc., Facebook Inc., MoPub Inc. (Twitter), One by AOL (AOL), Tapjoy Inc. |