Exposure Management Market Report Scope & Overview:

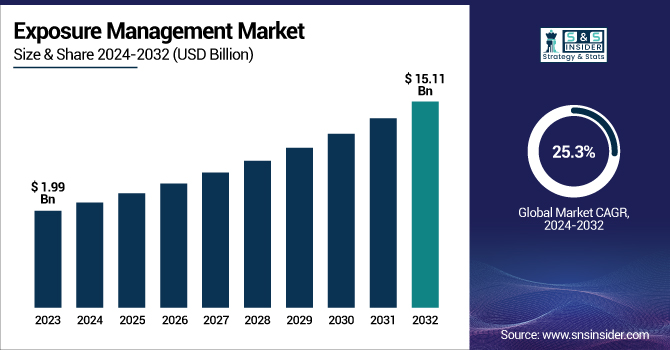

The Exposure Management Market Size was valued at USD 1.99 billion in 2023 and is expected to reach USD 15.11 billion by 2032 and grow at a CAGR of 25.3% over the forecast period 2024-2032.

To Get more information on Exposure Management Market - Request Free Sample Report

The Exposure Management Market is experiencing significant growth, driven by the rising adoption of advanced security solutions to combat cyber threats. Organizations worldwide are focusing on risk mitigation strategies to identify and address security vulnerabilities proactively. With the increasing sophistication of cyber-attacks, exposure management solutions are gaining traction across multiple industries, including BFSI, IT & ITES, healthcare, and manufacturing. Companies are leveraging AI, machine learning, and automation to enhance threat detection and response mechanisms.

The U.S. Exposure Management Market size was USD 0.46 billion in 2023 and is expected to reach USD 3.08 billion by 2032, growing at a CAGR of 23.7% over the forecast period of 2024-2032.

The U.S. Exposure Management Market is experiencing significant growth, driven by the increasing adoption of cyber risk management solutions across industries such as finance, healthcare, and government. Organizations are prioritizing proactive threat detection and vulnerability assessment to mitigate cyber risks amid rising security breaches. The market is also benefiting from strict regulatory frameworks and advancements in AI-driven cybersecurity technologies, enabling businesses to strengthen their security posture against evolving threats.

Exposure Management Market Dynamics

Key Drivers:

-

Growing Integration of AI and Automation Enhances Exposure Management Market Growth

The incorporation of AI and automation in exposure management solutions is revolutionizing cybersecurity. Organizations are increasingly leveraging AI-driven analytics to identify potential threats and vulnerabilities in real time. Automated solutions provide continuous monitoring, proactive risk assessment, and rapid incident response, reducing human intervention and enhancing efficiency. The rise in sophisticated cyber-attacks, including ransomware and zero-day exploits, is pushing enterprises to adopt AI-powered exposure management tools. Market leaders such as Palo Alto Networks, IBM, and Microsoft are continuously innovating in AI-driven security solutions, enabling enterprises to enhance risk mitigation strategies. The demand for intelligent security solutions that offer predictive analytics and automated remediation is propelling market growth.

Restrain:

-

High Implementation Costs Hinder the Widespread Adoption of Exposure Management Solutions

Despite its growing demand, the exposure management market faces significant restraints due to the high costs of implementation. Enterprises, especially small and medium-sized businesses (SMBs), struggle with the financial burden of adopting advanced security solutions. The deployment of AI-driven exposure management systems requires substantial investment in infrastructure, skilled workforce, and integration with existing security frameworks.

Additionally, frequent updates and maintenance costs add to the overall expenditure, making it difficult for budget-constrained organizations to adopt these solutions. Companies must strategize cost-effective models, such as cloud-based exposure management services, to enhance market penetration and cater to cost-sensitive businesses.

Opportunities:

-

Expansion of Cloud-Based Security Solutions Creates New Growth Opportunities in the Market

The rapid adoption of cloud computing and hybrid work environments has led to an increasing demand for cloud-based exposure management solutions. Enterprises are shifting towards cloud-driven security frameworks that offer scalable, real-time, and automated threat detection capabilities. Cloud-based exposure management solutions provide businesses with flexibility, lower operational costs, and seamless integration with existing security infrastructure. Cybersecurity firms, including AWS, Microsoft Azure, and Google Cloud, are investing in cloud-native security solutions to enhance their offerings. The growing inclination toward remote work and digital transformation presents lucrative opportunities for market players to develop innovative cloud security solutions tailored to the evolving threat landscape.

Challenge:

-

Evolving Cyber Threats and Sophisticated Attack Tactics Pose a Major Market Challenge

The exposure management market faces a major challenge due to the constant evolution of cyber threats. Hackers are deploying advanced attack techniques, including AI-powered malware, deepfake phishing, and supply chain attacks, making it difficult for enterprises to stay ahead of cyber risks. Traditional security approaches are becoming obsolete, necessitating the adoption of dynamic and adaptive exposure management frameworks. Organizations must invest in advanced threat intelligence, behavioral analytics, and real-time monitoring solutions to combat emerging cyber threats. Continuous innovation and strategic collaborations between cybersecurity firms and enterprises are critical to addressing this growing challenge in the exposure management market.

Exposure Management Market Segment Analysis

By Component

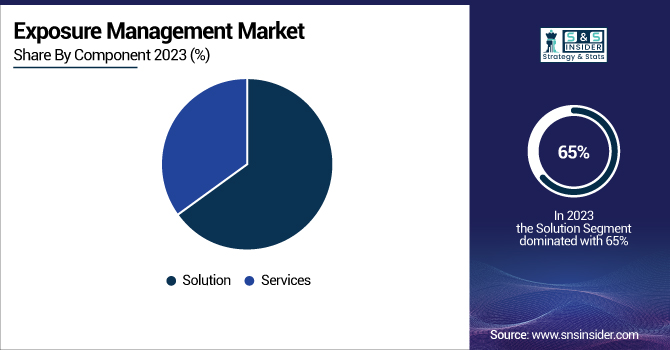

The solution segment holds the largest revenue share, accounting for 65% of the exposure management market in 2023. The surge in demand for AI-driven risk assessment and vulnerability management tools has significantly propelled this segment. Leading cybersecurity firms such as Tenable, Qualys, and Palo Alto Networks have introduced innovative solutions to enhance exposure management. For instance, Tenable launched its advanced risk-based vulnerability management solution, providing real-time insights to minimize cyber threats. The growing reliance on automated exposure detection tools to mitigate risks in complex IT environments is fueling the dominance of this segment.

The services segment is witnessing the fastest growth, with a CAGR of 26.4% during the forecasted period. Enterprises are increasingly relying on managed security services, consulting, and risk assessment solutions to strengthen their cybersecurity posture. Companies like IBM and Accenture are investing in professional services to help organizations enhance their exposure management strategies. The rising adoption of third-party security services due to the lack of in-house cybersecurity expertise is driving market expansion. Additionally, the increasing demand for customized security services tailored to industry-specific threats is propelling the growth of this segment.

By Application

The vulnerability management segment is dominating the exposure management market due to the growing emphasis on proactive threat identification and risk prioritization. Organizations are leveraging advanced vulnerability assessment tools to detect security weaknesses before exploitation. Companies like Rapid7 and Qualys have introduced AI-powered vulnerability management solutions to automate threat detection and remediation. The increasing frequency of cyber-attacks targeting enterprise infrastructure is driving market demand for robust vulnerability management frameworks.

Attack surface management is experiencing the highest CAGR, driven by organizations' expanding digital footprints. Businesses are implementing exposure management solutions to monitor and secure cloud environments, IoT devices, and third-party integrations. Companies like Palo Alto Networks and Microsoft have launched AI-driven attack surface management tools to provide real-time insights into security gaps. The rapid proliferation of remote work and digital transformation initiatives is boosting the adoption of attack surface management solutions.

By End-Use

The BFSI sector dominates the exposure management market, holding a 32% revenue share. Financial institutions are prioritizing exposure management solutions to protect sensitive data from cyber threats. Regulatory compliance requirements, including PCI-DSS and GDPR, are further driving the adoption of risk assessment frameworks. Leading firms like JPMorgan Chase and Citibank are investing in AI-driven exposure management solutions to fortify their security infrastructure.

The IT and ITES segment is growing at the highest CAGR of 26.6%, fueled by the rising cyber risks associated with cloud-based operations. The increasing number of cyber incidents targeting IT service providers is accelerating the adoption of exposure management solutions. Companies like Google, Microsoft, and Amazon are launching cloud-native security solutions to enhance exposure management capabilities.

Regional Analysis

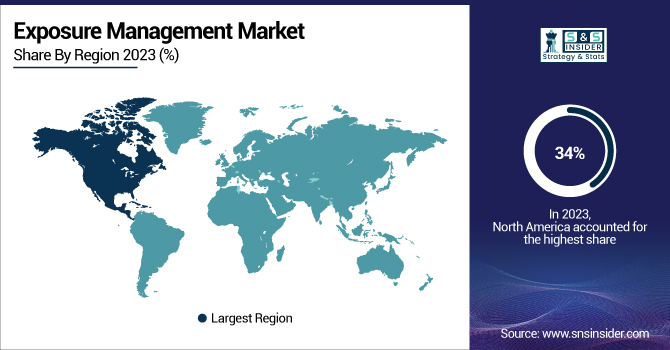

North America dominated the Exposure Management Market in 2023, holding an estimated market share of around 34%. This dominance is primarily driven by the region’s advanced cybersecurity infrastructure, stringent regulatory frameworks, and increasing cyber threats across industries such as finance, healthcare, and government. Organizations in North America are actively investing in proactive risk assessment and exposure management solutions to mitigate vulnerabilities before cyberattacks occur. Leading companies like CrowdStrike and Palo Alto Networks are playing a significant role in shaping the market by offering AI-driven threat exposure solutions. Additionally, the rising number of ransomware attacks and data breaches has compelled businesses to prioritize risk-based vulnerability management, further fueling market growth.

Asia Pacific is the fastest-growing region in the Exposure Management Market, with an estimated CAGR of around 26.2% from 2023 to 2032. The rapid adoption of cloud computing, IoT, and digital transformation across key economies such as China, India, Japan, and Australia have significantly increased the demand for cyber risk exposure management solutions. Governments in the region are tightening cybersecurity regulations, prompting enterprises to enhance their security posture. For instance, India’s Digital Personal Data Protection Act (DPDPA) 2023 and China’s cybersecurity compliance requirements have accelerated investments in exposure management technologies. Additionally, as cyber threats continue to rise in Asia Pacific, businesses are increasingly focusing on real-time risk assessment and proactive security measures, making it the fastest-growing region in this market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

CrowdStrike (CrowdStrike Falcon Exposure Management, Falcon X Threat Intelligence)

-

Ernst & Young Global Limited (EY) (EY Cyber Threat Management, EY Attack Surface Management)

-

eSentire, Inc. (eSentire Exposure Management, eSentire MDR for Threat Intelligence)

-

Forescout Technologies, Inc. (Forescout Continuum Exposure Management, Forescout Risk & Exposure Management)

-

International Business Machines Corporation (IBM) (IBM Security Randori Recon, IBM X-Force Threat Intelligence)

-

Mandiant (Mandiant Attack Surface Management, Mandiant Threat Intelligence Platform)

-

Palo Alto Networks (Prisma Cloud Attack Surface Management, Cortex Xpanse)

-

Tenable, Inc. (Tenable One Exposure Management Platform, Tenable.asm)

-

Verisk Analytics, Inc. (Verisk Cyber Risk Solutions, Verisk SecurityScorecard)

-

VIAVI Solutions Inc. (VIAVI Observer Exposure Management, VIAVI Network Threat Intelligence)

Recent Trends

-

November 2023: CrowdStrike was recognized as a Leader in the IDC MarketScape: Worldwide Risk-Based Vulnerability Management Platforms 2023 Vendor Assessment. The company's Falcon Exposure Management platform was highlighted for its comprehensive visibility into potential attack paths, enabling proactive risk mitigation.

-

October 2023: EY launched a new tagline, "Shape the future with confidence," accompanied by an international advertising campaign and a refreshed brand image. This initiative aimed to unify its workforce and enhance client engagement following the previous year's unsuccessful attempt to split its auditing and consulting businesses.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.99 Billion |

| Market Size by 2032 | US$ 15.11 Billion |

| CAGR | CAGR of 25.3 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Deployment (Cloud, On-Premises) • By Application (Vulnerability Management, Threat Intelligence, Attack Surface Management, Assets Management, Others) • By End-Use (BFSI, Healthcare & Life Sciences, Retail & E-Commerce, Government & Defense, Energy and Utilities, IT and ITes, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | CrowdStrike, Ernst & Young Global Limited, eSentire, Inc., Forescout Technologies, Inc., International Business Machines Corporation, Mandiant, Palo Alto Networks, Tenable, Inc., Verisk Analytics, Inc., VIAVI Solutions Inc. |