Digital Thread Market Report Scope & Overview:

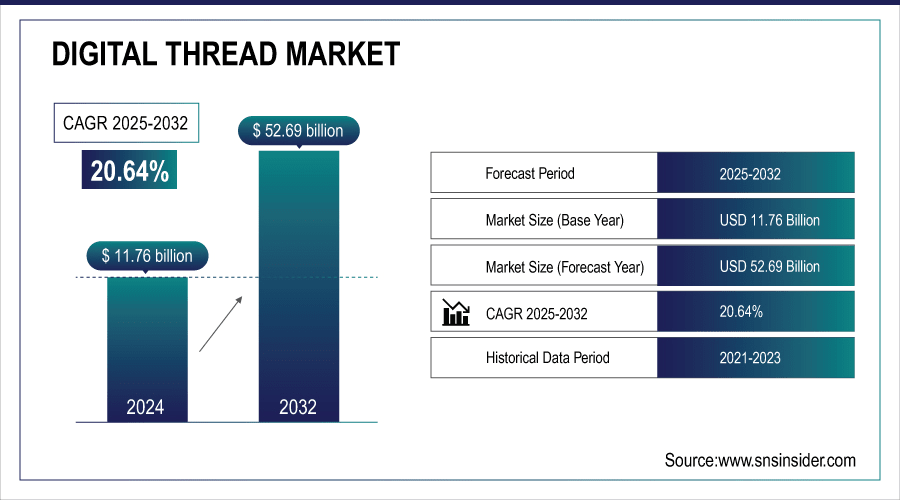

The Digital Thread Market size was valued at USD 11.76 Billion in 2024 and is projected to reach USD 52.69 Billion by 2032, growing at a CAGR of 20.64% during 2025-2032.

The Digital Thread Market is expanding due to adoption of Industry 4.0 technologies such as IIoT, AI, and cloud-based solutions is driving the Digital Thread Market. Growing need for end-to-end product lifecycle visibility and real-time data analytics is escalating the integration in manufacturing, automotive, aerospace, and other consumer good sectors. Digital thread adoption enables enterprises to optimize operational efficiency, shorten time-to-market, and improve product quality. Moreover, the connected supply chain and the predictive maintenance is driving more the market.

AI and machine learning are embedded in over 50% of new Digital Thread deployments to enable predictive analytics and autonomous decision-making.

To Get More Information On Digital Thread Market - Request Free Sample Report

Key Digital Thread Market Trends

-

Growing Adoption of Connected Supply Chains, the use of connected supply chain is the best way by which manufacturers have planned to improve visibility and improve their efficiency.

-

The increasing acceptance of predictive maintenance solutions is supporting industries in minimizing their downtime and optimizing their asset efficiency.

-

Technological advancements in the integration of AI, IoT, and cloud are creating new more institutions for innovation in the digital thread market.

-

Adoption plans are being driven by sustainability targets and cost considerations in many sectors.

-

Embedding the PLM, ERP, and MES systems changing the number of cycles in developing and enhancing the product around the world.

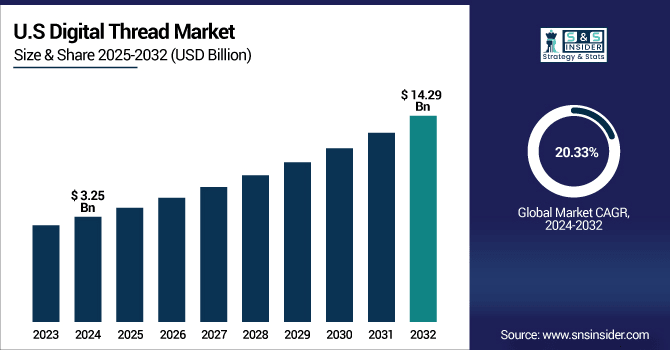

The U.S. Digital Thread Market size was valued at USD 3.25 Billion in 2024 and is projected to reach USD 14.29 Billion by 2032, growing at a CAGR of 20.33% during 2025-2032. Digital Thread Market growth is driven by increasing implementation of the smart manufacturing and the industry 4.0 technologies in the automotive, the aerospace, and industrial sectors. Growing investments in IoT, AI and cloud solutions facilitate real-time product lifecycle tracking and data-driven decision-making. Organizations are working on increasing operational efficiency for faster production cycles and improved product quality driven by an integrated digital thread platform.

The Digital Thread Market trends include the Rapid growth of the market is also attributed to governmental support for advanced manufacturing projects, and increasing demand for connected supply chain.

Digital Thread Market Segment Analysis

-

By technology, ERP (Enterprise Resource Planning) led the market with approximately 31.67% share in 2024, while MES (Manufacturing Execution System) is the fastest-growing segment with a CAGR of 21.54%.

-

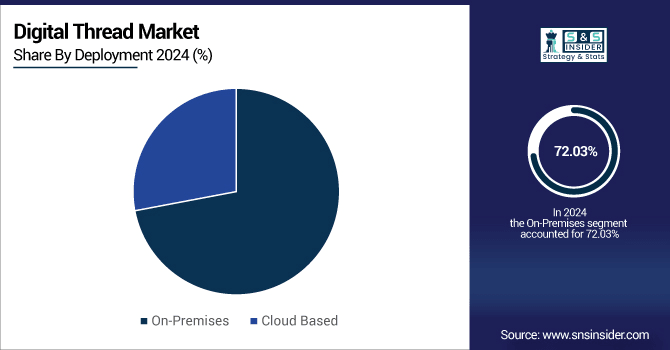

By deployment, On-Premises solutions dominated with around 72.03% share in 2024, whereas Cloud-Based solutions are the fastest-growing segment with a CAGR of 20.99%.

-

By application, Design & Engineering accounted for the largest share at about 37.61% in 2024, while Maintenance & Services is the fastest-growing segment with a CAGR of 12.48%.

-

By vertical, Automotive held the majority share at approximately 35.78% in 2024, while Machinery Manufacturer is the fastest-growing vertical with a CAGR of 21.14%.

By Deployment, On-Premises Dominate While Cloud Based Shows Rapid Growth

In 2024, the Deployment in segment On-Premises is projected to lead the Digital Thread Market in 2024 as these are the ones looking for security, compliance, and complete control over their own infrastructure. Legacy industries like aerospace, defense and automotive have become accustomed to on-premises systems for sensitive data management. But, Cloud-Based deployment is emerging as a fastest growing with scalability, cost efficiency and flexibility. The growing acceptance of IoT, AI, and remote-collaboration services is driving cloud centric offerings globally.

By Technology, ERP (Enterprise Resource Planning) Leads Market While MES (Manufacturing Execution System) Registers Fastest Growth

Based on Technology, the ERP (Enterprise Resource Planning) segment is dominating the Digital Thread Market in 2024, due to its high usage in improvising basic business processes and data traceability across organizations. ERP solutions have a tight integration with supply chain, finance and production processes which contributes to its dominance. Manufacturing Execution System (MES) solutions, drawing focus from a range of industries looking to gain real-time shop floor visibility as well as improve production efficiency and predictive analytics to minimize lost time is expected to be fastest growing.

By Application, Design & Engineering Lead While Maintenance & Services Registers Fastest Growth

By Application, Design & Engineering dominates the Digital Thread Market in 2024, as businesses concentrate on offering a product innovation, simulation and integration capabilities across its lifecycle. This category is gaining traction owing to adoption of CAD-based PLM & ERP mechanisms to ensure accuracy in design. At the same time, Maintenance & Services is forecasted to witness the swiftest growth due to developments in the predictive maintenance, real-time monitoring, and connected asset management.

By Vertical, Automotive Lead While Machinery Manufacturer Grow Fastest

By Vertical, Automotive would be the leading market in the Digital thread market during the forecast period Market Drivers #growingf demand for connected cars, #electricvehicles, and #advancedmanufacturingintegration pushed up the demand for Digital thread. It’s a sector which is really into PLM, MES and ERP systems as a means to ensure that it maximizes design, production and supply chain efficiency. By comparison, Machinery Manufacturers will be the largest and fastest-growing IoT market over the forecast period, with worldwide revenues.

Digital Thread Market Growth Drivers:

-

Rising Adoption of Industry 4.0 and Smart Manufacturing Technologies in Digital Thread Market growth.

The Digital Thread Market is expanding because of enterprising manufacturers are using IoT, AI and cloud platforms to take operations to the next level. Connecting to PLM, ERP and MES systems for product lifecycle visibility. This connection can streamline processes and eliminate mistakes. This has reduced development time still further and led to enhanced product quality on the global market.

Over 60% of global manufacturers have implemented connected factory initiatives, with 85% of them adopting Digital Thread to manage real-time data flow.

Digital Thread Market Restraints:

-

High Implementation Costs and Integration Complexities of the Digital Thread Market

The Digital Thread Market faces several restraints that may hinder the lack of interoperability with legacy systems still represents challenging technical problems to be solved by the industry. There are also security and privacy issues that limit the potential for deployment across industries. A lack of trained manpower also affects the clear implementation and monitoring. These factors together contribute towards the dampening of the growth of the digital thread market as a whole.

Digital Thread Market Opportunities:

-

Expansion in Emerging Markets and Industrial Automation in the Digital Thread Market

The Digital Thread Market is rising implementation of connected supply chains and predictive maintenance tools are also driving demand. Cutting-edge technologies such as AI, IoT and cloud integration further increase the scope for innovation. A growing concern for sustainability and economic optimization further contributes to the market potential. Taken as a whole, these conditions set the digital thread market up for strong worldwide growth.

Industrial IoT (IIoT) platforms are used by over 65% of large manufacturers in APAC, generating real-time data that feeds digital thread ecosystems.

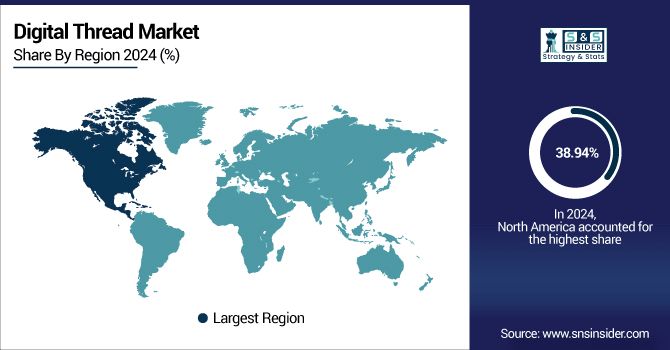

Digital Thread Market Regional Analysis

North America Digital Thread Market Insights

In 2024 North America dominated the Digital Thread Market and accounted for 38.94% of revenue share, this leadership is due to the prevalence of advanced manufacturing industries in the region, its early adoption of Industry 4.0 technologies, as well as its large investments in IoT, AI and cloud platforms. Supportive government policies and the increasing demand for connected supply chains reinforce its position. Furthermore, the existence of major tier players promotes the digital thread in the various industries.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Digital Thread Market

The U.S. Digital Thread Market is growing at an enormous rate because of the increasing time-to-market pressure being faced by the automotive industry, the aerospace and the defense industry, and other industrial sectors, among others. In many cases manufacturers are using IoT, AI and cloud platforms to provide this level of visibility, as well as operational efficiencies, for real-time product life cycle management. Integration to PLM, ERP, and MES systems enables more streamlined processes, fewer errors, and shorter development cycles.

Asia-pacific Digital Thread Market Insights

Asia-pacific is expected to witness the fastest growth in the Digital Thread Market over 2025-2032, with a projected CAGR of 21.84% due to high manufacturing output, and the adoption of smart factory initiatives. For example, in countries such as China, Japan, and India, the government is spending considerably on digitalization and Industry 4.0 projects, which encourages advanced technology implementation. Growing need for connected supply chain, predictive maintenance, and real-time analytics in automotive, electronics, and consumer goods industries drives the market growth.

China Digital Thread Market

China Digital Thread Market is growing significantly as China is persistently driving towards smart manufacturing ecosystem and strategic implementation of technologies behind the industry 4.0. Growing adoption of industrial automation as well as IoT, AI, cloud technologies to boosting the efficiency and productivity in all the industries. Digital thread solutions integrated with PLM, ERP, and MES can facilitate greater product lifecycle visibility.

Europe Digital Thread Market Insights

In 2024, Europe emerged as a promising region in the Digital Thread Market, due to adoption of digital thread in Industry 4.0 and government-led digitalization programs. The area is home to a strong automotive and aerospace presence, each greatly investing in advanced manufacturing techniques. Increased emphasis of energy for efficiency production processes additionally drives digital thread adoption.

Germany Digital Thread Market

Germany Digital Thread Market is witnessing emergence as one of the key digital manufacturing markets. Widespread use of Industry 4.0 tech like IoT, AI and cloud-based platforms is improving operational productivity. Digital thread solutions synchronized with PLM, ERP, and MES enhance product lifecycle visibility. Moreover, the emphasis on sustainability and focus on precision engineering is also accelerating the market demand.

Latin America (LATAM) and Middle East & Africa (MEA) Digital Thread Market Insights

The Digital Thread Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the industrialization is permeating at a slow pace and investments related to advanced manufacturing technologies are rising. Rising penetration of IoT, artificial intelligence, and cloud into major industries is accelerating the pace of digitalization. Also, government initiatives for smart factories and connected supply chains are adding to the market potential.

Digital Thread Market Competitive Landscape:

Siemens AG is world leader of integrative Digital Thread Markets, with cloud-based Complete Suite of MES software and manufacturing execution capabilities. It provides cutting-edge PLM, MES, and IoT solutions by connecting suppliers to the enterprise through smart digital threads. Siemens combines innovation with sustainability and integration potential with Industry 4.0 to provide manufacturers with proof of how they can increase efficiency and product quality. It’s worldwide presence and strategic partnerships validate its leadership in the global digital thread ecosystem.

-

In April 2025, Siemens AG showcased its leadership in the Digital Thread Market at Hannover Messe, unveiling AI-driven, cloud-based solutions that integrate design, manufacturing, and quality inspection into a unified digital thread. This demonstration highlighted Siemens' commitment to smart manufacturing and next-generation product development.

PTC Inc’s, platform allows manufacturing companies to link information across design, engineering, manufacturing, and service, getting real-time information and boosting collaboration. PTC's vision enables companies to reduce time to market, improve quality, decrease cost, and build in product and process innovation by integrating information throughout the product lifecycle and across an entire extended, multi-enterprise value chain.

-

In March 2025, PTC unveiled Windchill® AI, a generative AI-driven product lifecycle management (PLM) assistant, at Hannover Messe. This innovation aims to enhance decision-making and accelerate product development by leveraging comprehensive product data stored in Windchill.

Dassault Systèmes, company, is a catalyst for human progress, providing businesses and people with collaborative virtual environments to imagine sustainable innovations. Their platform allows manufacturers to integrate data across the design, engineering, manufacturing and service stages, allowing for real time insights and better collaboration. The Dassault Systèmes solution enables companies to optimize their business operations, time to market and product quality with an integrated digital thread approach.

-

In December 2024, Dassault Systèmes introduced "3D UNIV+RSES," embedding multiple generative AI technologies at the core of global intellectual property lifecycle management (IPLM), enhancing real-time decision-making and collaboration across the product lifecycle.

General Electric (GE) is one of the key companies involved in the Digital Thread Market, using its cutting-edge technologies to connect data throughout entire product lifecycle. GE's Digital Thread solution knits together design, manufacturing, and operation data, providing real-time insights and improved decision making. This integration allows for superior product quality, shorter product development cycles, and more efficient maintenance.

-

In July 2025, General Electric (GE) advanced its Digital Thread capabilities by expanding the Predix platform, linking design, engineering, manufacturing, supply chain, and services into a globally scalable intelligent system. This initiative integrates Digital Twin technology across GE Aviation, GE Power, and GE Vernova, enabling real-time insights, predictive maintenance, and improved operational efficiency.

Digital Thread Market Key Players

Some of the Digital Thread Market Companies are:

-

Siemens AG

-

PTC Inc.

-

Dassault Systèmes

-

General Electric Company

-

IBM Corporation

-

ANSYS, Inc.

-

Oracle Corporation

-

SAP SE

-

Microsoft Corporation

-

Autodesk, Inc.

-

Rockwell Automation, Inc.

-

Bosch Rexroth AG

-

Honeywell International Inc.

-

Tata Consultancy Services Limited

-

HCL Technologies Limited

-

Accenture plc

-

Capgemini SE

-

Altair Engineering Inc.

-

Synopsys, Inc.

-

Hexagon AB

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 11.76 Billion |

| Market Size by 2032 | USD 52.69 Billion |

| CAGR | CAGR of 20.64% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (PLM (Product Lifecycle Management), CAD (Computer-Aided Design), CAM (Computer-Aided Manufacturing), ERP (Enterprise Resource Planning), MES (Manufacturing Execution System), MRP (Material Requirements Planning)), • By Deployment (On-Premises and Cloud Based) • By Application (Design & Engineering, Manufacturing, Maintenance & Services, Distribution) • By Vertical (Automotive, Aerospace, Consumer Goods, Machinery Manufacturer) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Siemens AG, PTC Inc., Dassault Systèmes, General Electric Company, IBM Corporation, ANSYS, Inc., Oracle Corporation, SAP SE, Microsoft Corporation, Autodesk, Inc., Rockwell Automation, Inc., Bosch Rexroth AG, Honeywell International Inc., Tata Consultancy Services Limited, HCL Technologies Limited, Accenture plc, Capgemini SE, Altair Engineering Inc., Synopsys, Inc., Hexagon AB |