Insight Engines Market Size & Overview:

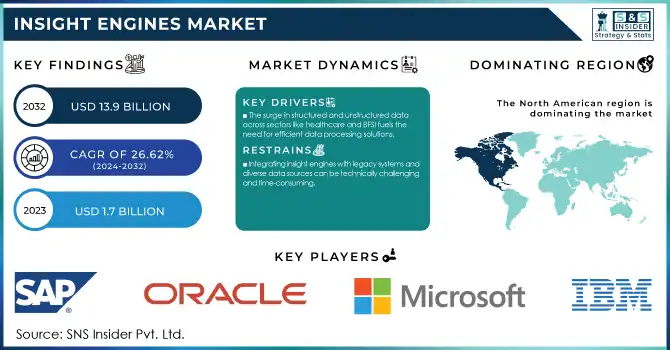

The Insight Engines Market was valued at USD 2.15 Billion in 2024 and is expected to reach USD 14.22 Billion by 2032 and grow at a CAGR of 26.62% from 2025-2032. The Insight Engines Market is experiencing significant growth due to its ability to derive actionable insights from vast amounts of structured and unstructured data. Leveraging natural language processing (NLP), machine learning, and AI, insight engines enhance data discovery and deliver valuable insights across industries such as IT, healthcare, BFSI (banking, financial services, and insurance), and e-commerce. As cloud adoption expands, real-time analytics are becoming more accessible to businesses of all sizes, including small- and medium-sized enterprises (SMEs), which can now use cloud-based insight engines to access valuable data insights without major infrastructure costs. With an ongoing emphasis on customer experience and operational efficiency, the Insight Engines Market is set to grow, driven by the demand for rapid data insights and the shift toward automation in data processing and analytics.

Get More Information on Insight Engines Market - Request Sample Report

For instance, According to recent reports, about 70% of employees spend up to 30 minutes daily searching for information. Insight engines help optimize this by providing quick, intuitive data access, boosting productivity, and enhancing decision-making. In healthcare, insight engines facilitate diagnostic data analysis, patient journey tracking, and large dataset management, improving patient outcomes and operational efficiency. Adoption in healthcare is expected to increase with rising data volumes from medical devices and patient records. Additionally, data privacy regulations such as Europe’s GDPR and California’s CCPA are driving market growth, encouraging organizations to implement insight engines for compliance monitoring. These engines assist in managing and tracking data access logs to meet privacy standards, reducing regulatory risks. For instance, JP Morgan recently invested in upgrading its insight engine capabilities for improved fraud detection and personalized financial services, mitigating financial risks.

Market Size and Forecast:

-

Market Size in 2024 – USD 2.15 Billion

-

Market Size by 2032 – USD 14.22 Billion

-

CAGR (2025–2032) – 26.62%

-

Base Year – 2024

-

Forecast Period – 2025–2032

-

Historical Data – 2021–2023

Insight Engines Market Market Trends:

-

Public cloud deployment held a 58% market share in 2024, advancing at a 32.4% CAGR through 2032, driven by scalability and cost efficiency.

-

Conversational search is set to grow at a 30.1% CAGR through 2030, reflecting the increasing demand for interactive and intuitive user interfaces.

-

Small and Medium Enterprises (SMEs) recorded the fastest growth at a 34.1% CAGR, indicating a shift towards democratizing advanced analytics tools.

-

The Healthcare and Life Sciences sector is forecast to post a 29.5% CAGR to 2032, highlighting the critical role of real-time data analysis in patient care and operational efficiency.

-

North America retained a 46% market share in 2024, with the U.S. leading due to robust technology infrastructure and regulatory support.

Insight Engines Market Drivers:

-

Advanced AI and NLP capabilities enable insight engines to perform semantic searches and predictive analytics, enhancing data understanding.

-

The surge in structured and unstructured data across sectors like healthcare and BFSI fuels the need for efficient data processing solutions.

-

The shift to cloud-based solutions allows SMEs to leverage insight engines without substantial infrastructure investments.

Cloud-based solutions have significantly expanded access to insight engines for small- and medium-sized enterprises (SMEs), enabling them to adopt advanced tools without the high infrastructure costs typically associated with on-premises setups. By removing the need for costly hardware, storage, and IT resources, cloud-hosted insight engines help smaller businesses overcome traditional barriers. Instead, these cloud-based platforms deliver scalable, on-demand data processing and analytics, offering SMEs a flexible and cost-effective solution. Through cloud infrastructure, SMEs can efficiently manage large data volumes, perform complex queries, and quickly derive valuable insights, all with minimal upfront investment. Cloud-based insight engines also come with regular updates and enhanced security, ensuring businesses consistently benefit from the latest technology and compliance features without needing specialized in-house expertise. This setup enables SMEs to focus on utilizing data insights rather than maintaining IT infrastructure.

The cloud model supports real-time analytics and team collaboration, allowing access to insights from any location, which is essential in today’s remote work environment. Moreover, cloud scalability allows SMEs to adjust resources based on demand, paying only for their use, further optimizing costs.

By making insight engines more accessible and adaptable, the cloud approach empowers SMEs to enhance customer service, gain real-time insights, and compete effectively with larger enterprises in the data-driven marketplace. Overall, the shift to cloud-based insight engines is a significant growth driver, democratizing advanced data analytics and enabling businesses of all sizes to unlock valuable insights.

|

Aspect |

On-Premises Insight Engines |

Cloud-Based Insight Engines |

|---|---|---|

|

Updates & Security |

Manual updates by in-house team |

Automatic updates and security patches |

|

Upfront Investment |

Significant |

Minimal, pay-as-you-go pricing |

|

Scalability |

Limited by physical resources |

Easily scalable based on demand |

|

Maintenance |

Requires in-house IT management |

Managed by cloud provider |

Insight Engines Market Restraints:

-

Integrating insight engines with legacy systems and diverse data sources can be technically challenging and time-consuming.

-

Some platforms may struggle to scale efficiently with the massive data quantities generated by larger organizations.

-

Initial setup, customization, and integration expenses can be substantial, deterring smaller companies from adoption.

The Insight Engines Market offers sophisticated tools for data analysis and decision-making; however, the costs associated with initial setup, customization, and integration can pose significant challenges for smaller companies. Implementing an insight engine involves various expenses, such as software licenses, hardware infrastructure, and hiring specialized personnel to tailor the solution to specific business needs. With limited budgets, smaller enterprises often find it difficult to allocate sufficient resources for these initial investments.

Furthermore, integrating insight engines with existing systems and data sources can be complex and time-consuming. Many organizations depend on legacy systems that may not easily work with modern insight engines. Achieving smooth integration requires additional investment in technology and skilled labor to ensure efficient data flow, which can prolong implementation timelines and complicate decision-making for smaller businesses that are already under operational pressure. Additionally, many SMEs lack the in-house expertise needed to effectively manage and implement these technologies. Hiring external consultants or service providers to assist with setup and integration can further increase costs. The ongoing maintenance and support necessary to keep the insight engine functioning properly also add to the overall financial burden. As a result, smaller companies may view this investment as too risky or unfeasible, leading them to delay or abandon the adoption of insight engines altogether.

This reluctance can restrict their ability to take full advantage of advanced analytics and data-driven decision-making, placing them at a competitive disadvantage. Ultimately, while insight engines can deliver valuable insights and enhance operational efficiency, the substantial initial investment needed for setup and integration often serves as a significant barrier for smaller enterprises looking to enter the market.

Insight Engines Market Segment Analysis:

By Component

In 2024, the software segment dominated the market, representing over 75.6% of total revenue. This significant share is largely attributed to increased investments from companies in insight engine software. Several key factors are driving this growth, including the rising volume and complexity of data, the demand for faster and more accurate insights, and advancements in artificial intelligence and machine learning technologies. For example, In March 2023, Squirro, an insight engine provider, entered a strategic partnership with Deloitte, a leading consulting firm, to enhance customer engagement through data-driven insights. This collaboration aims to combine Squirro's AI-powered insights with Deloitte's consulting expertise to create tailored solutions for clients in various sectors, thereby improving decision-making and operational efficiency.

The services segment is projected to experience substantial growth during the forecast period. Insight engine services encompass training, support, deployment, and integration of the engines. These services can be provided as standalone offerings or as add-ons to existing software products, with vendors usually charging fees for any services beyond the software subscription. To better serve customers, insight engine suppliers are increasingly forming partnerships with service providers for these offerings. As the demand for consulting, support, and related services continues to rise, the services segment is expected to grow significantly.

By Deployment

In 2024, the on-premises segment dominated the market and accounted for the highest share of more than 59.9% of the market's total revenue. Solutions are deployed internally, hosted on the organization’s servers behind their firewalls, with licensed and maintained software put into place on-site. This structure provides better security than the cloud structures. On-premises solutions also afford a higher level of customization and integration with existing systems, providing organizations the ability to adapt the software to their processes—something that can be a challenge with cloud solutions.

The cloud segment is anticipated to grow at the highest CAGR during the forecast period. The rise of cloud computing comes with newer forms of flexibility for businesses around cost, time, agility, and scalability. Cloud computing offers advanced capabilities like almost no other software but that has also led many software applications to the cloud enabling cost efficiencies and operational flexibility for providers alike. But this paradigm ignores organizations that are not ready for cloud or in some cases, would never go full-bore cloud. Public & private cloud deployment vary significantly and should be implemented to reflect the unique requirements of each business and its operational environment.

By Enterprise Size

The large enterprises segment dominated the market in 2024 and represented over 74.3% of the revenue share. This growth is mainly due to improved data access and discovery, enhanced data analysis and visualization, better customer engagement and satisfaction, reduced operational costs, and greater efficiency. Many large enterprises are investing in insight engines to meet their growing need for advanced solutions and information intelligence. Additionally, companies are launching new products and solutions to fulfill this demand. These enterprises produce significant amounts of data daily, necessitating quick and effective analysis. Insight engines enable them to efficiently search, analyze, and process data from various sources, significantly shortening the time required for decision-making and action.

The small and medium enterprises (SMEs) segment is expected to see substantial growth in the coming years. With numerous SMEs operating in nearly every country, these businesses often opt for more affordable solutions due to limited financial resources. Some may encounter difficulties in acquiring these technologies because of tight IT budgets. However, despite these financial hurdles, the market is projected to grow, driven by increasing scalability, wider accessibility, and cloud-based deployments of these solutions.

Insight Engines Market Regional Analysis:

North America Insight Engines Market Insights:

North America dominated the market in 2024 and represented over 46.7% of the total revenue share. This growth is largely driven by developed countries such as Canada and the U.S., which have extensively adopted insight engine technology, resulting in significant revenue generation for the region. North America's dominance is linked to its wide-ranging use of advanced technologies like chatbots, speech recognition, and natural language processing. The expansion of the insight engines market here is bolstered by factors such as the rapid growth of the Internet of Things (IoT) and lower ownership costs associated with cloud-based platforms. Various sectors, including IT, telecommunications, healthcare, media, and entertainment, are harnessing the capabilities of insight engines to quickly address consumer inquiries, further enhancing their adoption across the region.

Do You Need any Customization Research on Insight Engines Market - Enquire Now

Asia-Pacific Insight Engines Market Insights:

The Asia Pacific region is poised to offer significant market opportunities in the coming years. Leading players in the APAC insight engines market are focusing on increasing investments, expanding product portfolios, enhancing analytic solutions, and forming strategic partnerships to create robust and user-friendly functionalities. China stands out as a major player in the Asia Pacific, marked by rising technological adoption and some of the fastest internet speeds globally. Companies like Alibaba thrive in this landscape. Moreover, China's restrictive regulatory framework, which limits the operations of international firms such as FAANG (Facebook, Amazon, Apple, Netflix, and Google), has reinforced the position of local companies like iQiyi, Tencent, and Youku. These firms primarily utilize insight engines for general recommendations and targeted advertising to refine their business strategies. The region has experienced moderate growth, driven by numerous domestic opportunities.

Europe Insight Engines Market Insights:

Europe accounted for approximately 25% of the global market in 2024. The region benefits from the UK, Germany, and France, where enterprises are focusing on digital transformation, data-driven decision-making, and regulatory compliance. Increased adoption of AI-powered search and analytics tools across banking, healthcare, and retail sectors is driving market growth. The European market is projected to grow at a CAGR of 24% during 2025–2032, supported by cloud adoption and increasing investment in enterprise AI solutions.

Latin America Insight Engines Market Insights:

Latin America held around 10% of the global market in 2024. Growth is driven by Brazil and Mexico, where enterprises are increasingly adopting AI-based analytics for operational efficiency and customer experience improvement. The region’s market is expected to expand at a CAGR of 27% during 2025–2032, supported by rising digital infrastructure investments and expanding cloud service adoption.

Middle East & Africa (MEA) Insight Engines Market Insights:

MEA contributed roughly 5–6% of the market in 2024. Countries such as UAE, Saudi Arabia, and South Africa are investing in AI-powered enterprise analytics and cloud infrastructure. Growing awareness of data-driven decision-making and regulatory support for technology adoption are key growth drivers. The region is expected to grow at a CAGR of 25% during 2025–2032, driven by investments in smart cities, e-governance, and enterprise digital transformation projects.

Insight Engines Market Key Players:

The major key players with their Product

-

IBM Corporation - IBM Watson Discovery

-

Microsoft Corporation - Microsoft Azure Cognitive Search

-

SAP SE - SAP Analytics Cloud

-

Oracle Corporation - Oracle Analytics Cloud

-

Salesforce.com, Inc. - Salesforce Einstein Analytics

-

Google LLC - Google Cloud BigQuery

-

Amazon Web Services, Inc. (AWS) - Amazon Kendra

-

QlikTech International AB - Qlik Sense

-

Tableau Software, LLC - Tableau Desktop

-

Sisense, Inc. - Sisense Fusion Analytics

-

Domo, Inc. - Domo Business Cloud

-

Alteryx, Inc. - Alteryx Designer

-

TIBCO Software Inc. - TIBCO Spotfire

-

MicroStrategy Incorporated - MicroStrategy Analytics

-

Zoho Corporation Pvt. Ltd. - Zoho Analytics

-

Looker (a Google Cloud product) - Looker BI

-

ThoughtSpot, Inc. - ThoughtSpot Search & AI-Driven Analytics

-

Elastic N.V. - Elastic Search

-

Cloudera, Inc. - Cloudera Data Platform

-

DataRobot, Inc. - DataRobot AI Platform

B2B User

-

NHS (National Health Service)

-

Heathrow Airport

-

Coca-Cola

-

Nestlé

-

Toyota

-

Snapchat

-

Siemens

-

Cisco

-

Charles Schwab

-

GE

-

eBay

-

Unilever

-

Dell

-

Starbucks

-

Ola Cabs

-

Sony

-

Lowe's

-

Netflix

-

Johnson & Johnson

-

Allstate

Insight Engines Market Competitive Landscape:

Microsoft Corporation is a global technology leader headquartered in Redmond, Washington. Founded in 1975 by Bill Gates and Paul Allen, Microsoft is renowned for its software products, including the Windows operating system, Microsoft Office suite, and Azure cloud platform. The company has been at the forefront of integrating artificial intelligence (AI) into its offerings, enhancing user experiences across various applications.

-

March 2024: Microsoft Corporation Introduced new features in Microsoft Azure Cognitive Search, enhancing its capabilities for integrating AI-driven insights into enterprise applications.

IBM Corporation is a U.S.-based multinational technology company headquartered in Armonk, New York. Founded in 1911, IBM is a global leader in cloud computing, artificial intelligence, and enterprise software solutions. The company offers AI-powered insight engines, data analytics platforms, and enterprise search solutions, helping organizations transform unstructured data into actionable intelligence. IBM’s Watson AI platform and hybrid cloud solutions enable businesses to gain real-time insights for improved decision-making and operational efficiency. With a presence in over 175 countries and a workforce exceeding 350,000 employees, IBM continues to drive innovation in AI, data analytics, and intelligent automation for enterprises worldwide.

-

February 2024: IBM Corporation Launched enhancements to IBM Watson Discovery, integrating advanced AI features for improved data insights and analysis across various industries.

SAP SE is a German multinational enterprise software company headquartered in Walldorf, Baden-Württemberg. Founded in 1972, SAP is the world's largest vendor of enterprise resource planning (ERP) software. The company offers a comprehensive suite of applications, including SAP S/4HANA, SAP Business One, and SAP SuccessFactors, which integrate business processes across finance, procurement, HR, and supply chain. SAP's solutions empower organizations to leverage data-driven insights, enhancing decision-making and operational efficiency. With a global presence and a commitment to innovation, SAP continues to lead in providing intelligent enterprise solutions that drive business transformation.

-

January 2024: SAP SE Announced updates to SAP Analytics Cloud, adding predictive analytics tools to provide businesses with deeper insights and foresight.

Google LLC, a subsidiary of Alphabet Inc., is a global leader in internet services, cloud computing, and artificial intelligence. Founded in 1998 by Larry Page and Sergey Brin, Google revolutionized information access through its search engine. The company offers a suite of products including Google Search, Google Cloud, YouTube, and Google Workspace. Google’s AI-driven technologies, such as Google Gemini, enhance data processing and analytics, making it a key player in the Insight Engines Market. With a workforce of over 183,000 employees, Google continues to innovate, shaping the future of digital information and enterprise solutions.

-

December 2023: Google LLC Announced enhancements to Google Cloud’s Looker, integrating AI features to provide more tailored insights for business users.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 |

USD 2.15 Billion |

| Market Size by 2032 |

USD 14.22 Billion |

| CAGR | CAGR of 26.62% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Component (Software, Services) •By Deployment (Cloud, On-premises) •By Enterprise size (Large Enterprise, Small & Medium Enterprise) •By Application (Workforce Management, Customer Experience Management, Sales & Marketing Management, Risk & Compliance Management, Others) •By Vertical (BFSI, IT & Telecom, Retail & Ecommerce, Healthcare, Manufacturing, Government, Others) |

| Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

IBM Corporation, Microsoft Corporation, SAP SE , Oracle Corporation, Salesforce.com, Inc, Google LLC , Amazon Web Services, Inc. (AWS) , QlikTech International AB,Tableau Software, LLC, Sisense, Inc., Domo, Inc. |