Digital Trust Market Report Scope & Overview:

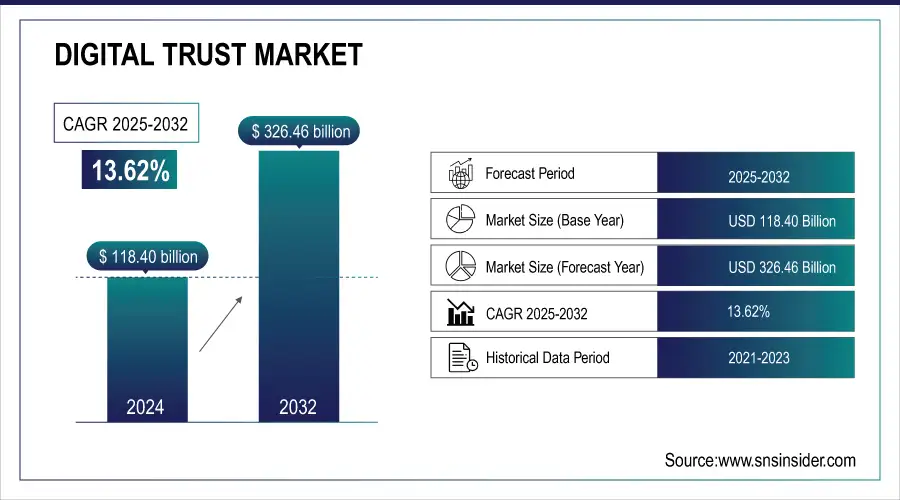

The Digital Trust Market was valued at USD 118.40 billion in 2024 and is expected to reach USD 326.46 billion by 2032, growing at a CAGR of 13.62% from 2025-2032.

The Digital Trust Market is growing rapidly due to increasing cybersecurity threats, rising adoption of cloud services, and the need for secure digital transactions. Organizations are prioritizing data protection, regulatory compliance, and identity verification to build customer confidence. Additionally, the expansion of e-commerce, digital banking, and IoT ecosystems drives demand for trust solutions. Integration of AI and blockchain technologies further enhances security, transparency, and reliability, fueling market growth.

The U.S. federal government has accelerated efforts to modernize its IT infrastructure, with initiatives like the Zero Trust Architecture under Executive Order 14028, aiming to enhance cybersecurity across federal agencies.

Moreover, a notable 67% of security executives report that generative AI has increased their cyberattack surface over the past year, highlighting the growing role of AI in both enhancing and challenging cybersecurity measures.

To Get more information on Digital Trust Market - Request Free Sample Report

Key Digital Trust Market Trends

- Increasing adoption of AI and blockchain for secure, transparent digital transactions.

- Rising focus on data privacy and compliance with global regulations (GDPR, CCPA, etc.).

- Growing use of multi-factor authentication and biometric solutions to strengthen identity verification.

- Expansion of cloud-based trust services for scalable and resilient digital operations.

- Integration of zero-trust frameworks to minimize cyber risks across networks and applications.

- Rising demand for digital certificates, encryption, and secure key management in enterprises.

- Increased collaboration between fintech, cybersecurity, and cloud providers to enhance digital trust ecosystems.

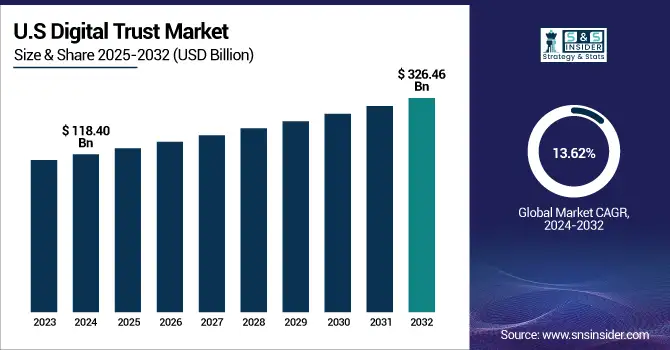

U.S. Digital Trust Market was valued at USD 32.32 billion in 2024 and is expected to reach USD 88.28 billion by 2032, growing at a CAGR of 13.38% from 2025-2032.

The U.S. Digital Trust Market is growing due to rising cybersecurity threats, increasing cloud adoption, and stricter data privacy regulations. Organizations are investing in identity management, secure transactions, and compliance solutions to protect sensitive information. Expansion of digital services and integration of AI-driven security tools further drive market growth.

Digital Trust Market Growth Drivers:

-

Increasing digital transformation initiatives and demand for trustworthy online ecosystems strengthen digital trust adoption across industries worldwide rapidly

Increasing digital transformation initiatives across industries demand highly secure, transparent, and reliable digital ecosystems to support operations and customer engagement. Enterprises are adopting advanced technologies such as AI, IoT, and blockchain, all requiring a strong foundation of trust. Consumers now expect seamless and secure online experiences, prompting businesses to strengthen trust frameworks. In sectors like banking, e-commerce, and healthcare, expanding digital services directly builds customer confidence. By enabling risk reduction, fraud prevention, and robust digital identity assurance, digital trust becomes a vital driver of sustainable business transformation, innovation, and long-term growth.

-

Recent findings from the 2025 Thales Digital Trust Index reveal a decline in global trust across most industries. Banking remains the most trusted sector, but younger demographics show reduced confidence, emphasizing the need for strong, adaptive digital trust frameworks.

-

The adoption of AI, IoT, and blockchain technologies requires a secure foundation of trust. With 86% of consumers expecting data privacy rights, businesses must prioritize transparency and reliability to meet expectations and strengthen long-term customer relationships.

Digital Trust Market Restraints:

-

Lack of standardized frameworks and interoperability challenges hinder widespread adoption of digital trust systems across industries and geographies considerably today

Lack of global standardization in digital trust frameworks presents challenges for seamless adoption across industries and geographies. Organizations operating in multiple regions face difficulties in complying with diverse regulatory requirements, slowing adoption. Interoperability issues between different trust platforms, digital certificates, and authentication systems create fragmentation, limiting scalability. This inconsistency complicates user verification, data security, and cross-border digital transactions, reducing overall trust efficiency. Businesses often hesitate to implement digital trust solutions due to uncertainty about long-term compatibility. Without harmonized global standards and stronger regulatory alignment, organizations remain cautious, hindering the growth and effectiveness of digital trust ecosystems worldwide.

Digital Trust Market Opportunities:

-

Growing adoption of blockchain and decentralized identity solutions offers new opportunities to expand digital trust applications across industries significantly

Growing adoption of blockchain and decentralized identity solutions provides significant opportunities to enhance digital trust frameworks. Blockchain’s immutable and transparent nature enables secure verification, reduces fraud, and fosters user confidence in digital ecosystems. Decentralized identity systems empower individuals with greater control over their personal data, aligning with rising privacy concerns. Industries like banking, supply chain, and healthcare can leverage these innovations to streamline trust, compliance, and verification processes. By reducing reliance on centralized systems, blockchain-driven solutions open new markets, improve efficiency, and create innovative trust-based services, driving transformative growth in digital trust adoption globally in coming years.

-

The European Commission's Digital Strategy emphasizes blockchain's role in enhancing digital identity frameworks, aiming to contribute to the implementation of the European Digital Identity (EUDI) framework and support other relevant authentication purposes.

Key Digital Trust Market Segment Analysis

-

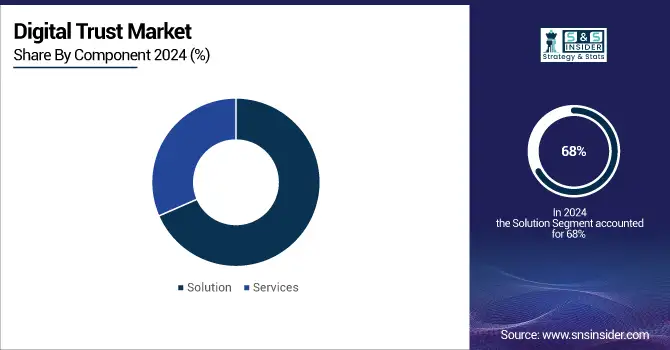

By Component, Solution segment dominated with 68% share in 2024; Services segment fastest growing (CAGR 15.26%).

-

By Enterprise Size, Large Enterprises led with 69% share in 2024; Small & Medium-sized Enterprises fastest growing (CAGR 14.98%).

-

By End Use, BFSI dominated with 33% share in 2024; Healthcare & Life Sciences fastest growing (CAGR 14.76%).

-

By Technology, AI & ML led with 29% share in 2024; Cloud Computing fastest growing (CAGR 16.04%).

By Component, Solutions dominated while Services are projected to grow fastest

The solution segment dominated the digital trust market in 2024 due to its ability to provide end-to-end security frameworks, including identity verification, encryption, and fraud detection, which are critical for enterprises managing sensitive data. Organizations preferred integrated trust solutions that ensure compliance, scalability, and long-term reliability across multiple industry applications.

The services segment is expected to grow at the fastest pace from 2025 to 2032 as businesses increasingly seek managed and professional services for implementation, maintenance, and training. Growing complexity of digital ecosystems pushes organizations to rely on service providers for expertise, seamless integration, and continuous support in deploying trust solutions.

By Enterprise Size, Large Enterprises led while Small and Medium Enterprises are expected to grow rapidly

Large enterprises dominated the digital trust market in 2024 owing to their higher budgets, complex IT infrastructures, and greater need for advanced security measures. Their global operations demand comprehensive digital trust frameworks to meet regulatory compliance, manage large-scale data, and build customer confidence, making them the largest revenue contributors.

Small and medium-sized enterprises are expected to grow fastest from 2025 to 2032 as digitalization accelerates across emerging markets. Rising cyber threats, regulatory requirements, and cost-effective trust solutions tailored for SMEs drive adoption. Cloud-based digital trust services enable affordability, scalability, and accessibility, fostering significant growth momentum among smaller businesses.

By End Use, BFSI held the largest share while Healthcare and Life Sciences are expected to grow fastest

The banking, financial services, and insurance segment dominated the digital trust market in 2024 because financial transactions require the highest levels of security, identity verification, and fraud prevention. Strict regulatory requirements, digital banking expansion, and consumer demand for secure financial interactions positioned BFSI as the largest adopter of trust frameworks.

Healthcare and life sciences are expected to grow fastest from 2025 to 2032 as increasing digitization of patient records, telemedicine, and clinical research demands robust digital trust. Rising cyberattacks on healthcare systems and strict data privacy regulations drive rapid adoption of advanced trust solutions to safeguard sensitive medical information.

By Technology, AI and ML dominated while Cloud Computing is expected to expand fastest

AI and ML dominated the digital trust market in 2024 due to their role in enabling intelligent fraud detection, identity verification, and real-time security analytics. Enterprises rely on AI-driven trust frameworks to process vast data volumes, predict threats, and strengthen compliance, making them the most widely adopted technology.

Cloud computing is expected to grow fastest from 2025 to 2032 as organizations accelerate cloud adoption for scalability and efficiency. The need for secure cloud infrastructures, combined with growing remote work, hybrid models, and multi-cloud strategies, drives investments in cloud-based trust frameworks, fueling rapid growth across industries worldwide.

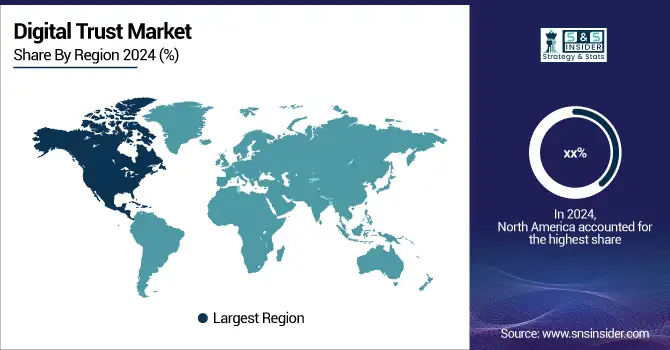

North America Digital Trust Market Insights

North America dominated the digital trust market in 2024 with the highest revenue share, largely due to its mature technological ecosystem, strict regulatory frameworks, and strong demand for advanced security and identity solutions. The region’s established digital infrastructure, widespread cloud adoption, and high cybersecurity investments drive consistent reliance on trust frameworks. Moreover, leading technology providers and strong consumer expectations for privacy and secure digital interactions further strengthen North America’s position as the largest contributor to global revenues.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Digital Trust Market Insights

Asia Pacific is expected to grow at the fastest pace from 2025 to 2032, supported by rapid digital transformation, surging e-commerce activities, and growing internet adoption across diverse economies. Rising cyberattacks, coupled with increasing awareness of digital security, accelerate demand for advanced trust solutions. Government-led initiatives promoting digital identity verification and financial inclusion further fuel growth. Additionally, the shift toward cloud adoption and expansion of mobile-first economies position Asia Pacific as the most dynamic emerging market.

Europe Digital Trust Market Insights

Europe holds a significant position in the digital trust market, driven by stringent data protection regulations such as GDPR and increasing emphasis on user privacy and compliance. Strong adoption of digital identity verification, cybersecurity frameworks, and secure financial transactions supports market growth. Growing digital banking, e-governance initiatives, and rising cyber threats across industries further accelerate adoption, making Europe a key contributor to global digital trust expansion.

Middle East & Africa and Latin America Digital Trust Market Insights

The Middle East and Africa digital trust market is expanding with growing investments in cybersecurity, digital banking, and government-led smart city initiatives, though challenges like limited infrastructure and high costs persist. Latin America is witnessing rising adoption driven by increasing cyberattacks, regulatory reforms, and digital financial services growth, positioning both regions as emerging markets with strong potential for accelerated digital trust adoption in the coming years.

Digital Trust Market Competitive Landscape:

Amazon Web Services, Inc. (AWS) is a key player in the Digital Trust Market, offering comprehensive cloud-based security and identity solutions. Its platform provides robust encryption, identity management, and threat detection services, enabling enterprises to ensure data integrity, compliance, and secure digital interactions. AWS’s scalable and integrated solutions support diverse industries, helping organizations build trusted digital ecosystems while addressing evolving cybersecurity challenges and regulatory requirements efficiently.

-

In 2025, Amazon Web Services, Inc.: Launched the AWS Trust Center, an online hub detailing AWS's security practices, compliance programs, and data protection controls providing transparent insights to help customers trust and secure their cloud environments.

DigiCert, Inc. is a leading provider in the Digital Trust Market, specializing in SSL/TLS certificates, PKI solutions, and identity authentication services. The company ensures secure digital communications, safeguarding websites, applications, and IoT devices against cyber threats. DigiCert’s scalable and automated solutions help enterprises maintain compliance, strengthen customer trust, and enable secure online transactions. Its innovative certificate management and encryption technologies position it as a trusted partner for global digital security.

-

In March 2025, DigiCert’s Trust Lifecycle Manager update added automated AEConfig retrieval via API, enhanced security with digitally signed binaries, and support for SAML-based Seat ID mapping to streamline enterprise trust workflows.

-

In 2023, DigiCert launched Trust Lifecycle Manager, a CA-agnostic certificate management and PKI solution unifying trust across public and private environments, enabling streamlined digital trust operations for enterprises.

Key Players

Some of the Digital Trust Market Companies

-

Amazon Web Services, Inc.

-

Cisco Systems, Inc.

-

DigiCert, Inc.

-

IBM Corporation

-

Microsoft Corporation

-

Oracle Corporation

-

OneTrust, LLC

-

RSA Security USA LLC

-

Salesforce, Inc.

-

Symantec (by Broadcom)

-

Entrust Datacard Corporation

-

Verizon Communications Inc.

-

Trustwave Holdings, Inc.

-

ForgeRock

-

Ping Identity Corporation

-

RSA Security LLC

-

OneSpan Inc.

-

Okta, Inc.

-

Signicat AS

-

Jumio Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 118.40 Billion |

| Market Size by 2032 | USD 326.46 Billion |

| CAGR | CAGR of 13.62% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Technology (AI & ML, Privacy Enhancing Technologies (PETs), Cloud Computing, Multi-Factor Authentication (MFA), Others) • By Enterprise Size (Small & Medium Size, Large Enterprises) • By End Use (Banking, Financial Services, and Insurance (BFSI), Healthcare and Life Sciences, Retail and E-commerce, IT and Telecommunications, Government Sector, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Amazon Web Services, Inc., Cisco Systems, Inc., DigiCert, Inc., IBM Corporation, Microsoft Corporation, Oracle Corporation, OneTrust, LLC, RSA Security USA LLC, Salesforce, Inc., Symantec (by Broadcom), Entrust Datacard Corporation, Verizon Communications Inc., Trustwave Holdings, Inc., ForgeRock, Ping Identity Corporation, RSA Security LLC, OneSpan Inc., Okta, Inc., Inc., Signicat AS, Jumio Corporation |