Conversational AI Market Report Scope & Overview:

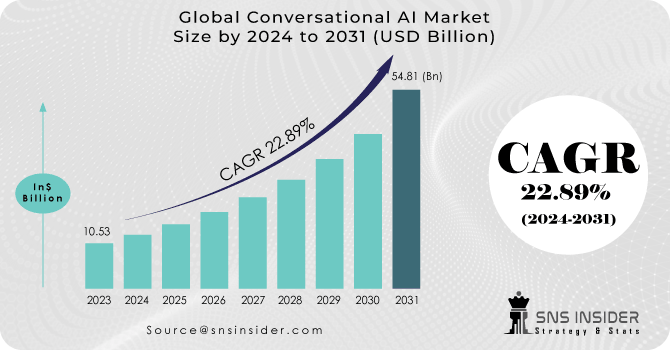

Conversational AI Market Size was valued at USD 10.1 Billion in 2023 and is expected to reach USD 64.5 Billion by 2032 and grow at a CAGR of 22.89 % over the forecast period 2024-2032.

The Conversational AI market is driven by the consistently increased demand and cost reductions in chatbot development, AI-powered customer support services, and omnichannel deployment. The rapid adoption of AI-powered messaging and speech-based apps is transforming traditional mobile and web applications, shaping a new communication paradigm. Commercial applications of AI and machine learning are expanding, particularly in Asian markets, bolstering market dominance and financial growth. Integration of technologies such as ChatGPT enhances conversational AI platforms, improving accuracy, fluency, versatility, and user experience, driving further market expansion. Conversational AI allows people to communicate quickly using their own vocabulary or phrases, and it provides organizations with a method to connect with customers through customized contact while receiving an unprecedented quantity of critical business information.

Get More Information on Conversational AI Market - Request Sample Report

Market Dynamics

Drivers:

-

Businesses are increasingly adopting conversational AI to automate customer interactions, leading to operational efficiency and cost savings.

-

The increasing developments in NLP technologies enhance the accuracy and capabilities of conversational AI systems, improving user experiences.

-

Consumers expect personalized and efficient interactions with brands, driving the adoption of conversational AI solutions to deliver tailored experiences.

-

The growth of online retail and e-commerce platforms fuels the need for AI-powered chatbots and virtual assistants to handle customer queries and improve sales.

Businesses are shifting to conversational AI to improve customer interactions, boost operational efficiency and cut costs. Advancements in NLP technology enhance AI precision and capabilities, enhancing user experiences. This results in more effective handling of user queries, increased interactions, and higher customer satisfaction. The fusion of conversational AI and NLP technologies is delivering substantial advantages to businesses, including enhanced operational processes, cost-efficiency, and elevated levels of customer engagement.

Restraints:

-

The collection and processing of personal data by conversational AI systems raises privacy concerns among users and regulatory challenges for businesses.

-

Implementing and managing conversational AI solutions require technical expertise, leading to challenges for organizations without sufficient resources or expertise.

-

Integrating conversational AI with existing systems and workflows can be complex, especially for legacy systems or heterogeneous IT environments.

-

Initial setup costs, including software development, training data collection, and infrastructure, can be significant barriers for smaller businesses or startups.

-

Ensuring ethical use of conversational AI, including avoiding bias and promoting transparency, requires careful planning and governance.

Opportunities:

-

Conversational AI presents opportunities to deliver personalized and engaging experiences, driving customer satisfaction and loyalty.

-

Analyzing conversational data can provide valuable insights into customer preferences, behavior patterns, and market trends, enabling data-driven decision-making.

-

Integrating conversational AI across multiple channels such as websites, mobile apps, and social media platforms enhances omnichannel customer experiences.

-

The rise of voice-activated assistants and smart speakers creates opportunities for conversational AI in voice-based e-commerce and retail interactions.

-

Conversational AI can improve healthcare services by providing virtual health assistants, remote patient monitoring, and personalized medical advice.

-

AI-powered chatbots and virtual tutors can enhance learning experiences, providing personalized support and feedback to students and professionals.

The emergence of voice-activated assistants and smart speakers presents opportunity for conversational AI to grow, particularly in voice-based e-commerce and retail settings. These technologies enable improve interactions between users and AI systems, facilitating tasks such as product searches, purchases, and personalized recommendations through voice commands. Voice-based e-commerce and retail interactions powered by conversational AI offer a hands-free and easy shopping experience, helping to growing trend of voice search and command usage among consumers. This shift opens new opportunities for businesses to implement conversational AI for enhanced customer engagement, improved sales, and a competitive edge in the market.

Challenges:

-

Ensuring high-quality training data and continuous learning are essential for the accuracy and performance of conversational AI systems.

-

Dealing with complex or ambiguous user queries and maintaining context over extended conversations are ongoing challenges for conversational AI.

-

Protecting conversational AI systems from security threats, including data breaches, malicious attacks, and fraud, requires robust security measures.

-

The data privacy regulations, industry standards, and ethical guidelines pose compliance challenges for organizations deploying conversational AI.

Impact of Russia-Ukraine War

The Russia-Ukraine war has led to global economic uncertainty, impacting various industries including the conversational AI market. Supply chain disruptions, fluctuating currency values, and geopolitical tensions have created challenges for businesses operating in the AI sector. Additionally, heightened cybersecurity concerns and potential shifts in market dynamics due to geopolitical developments may influence investment decisions and market growth in the conversational AI industry.

Impact of Economic Downturn:

An economic downturn can affect the conversational AI market in several ways. Businesses may reduce their technology budgets, leading to slower adoption rates and investment in AI solutions. reduced consumer spending could lower demand for AI-powered customer support services. The cost-saving measures and the increasing emphasis on automation and efficiency during downturns could also drive some organizations to accelerate their adoption of conversational AI to streamline operations and improve customer experiences.

Market segmentation

By Offering:

-

Solutions

-

Services

-

Training & Consulting

-

System Integration & Implementation

-

Support & Maintenance

-

By Conversational Interface

-

Chatbots

-

Interactive Voice Routing (IVR)

-

Intelligent Virtual Assistants (IVA)

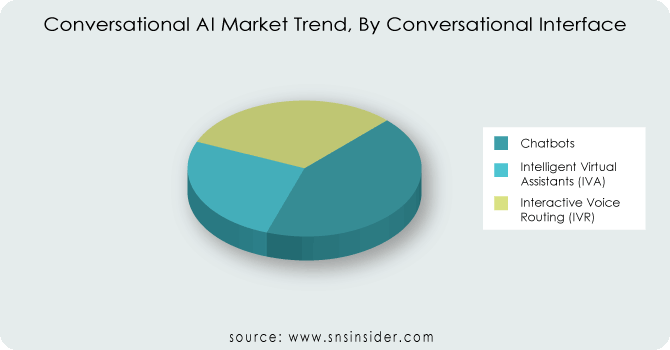

On the basis of Conversational Interface, the chatbot segment dominates the market with holding revenue share of more than 43%. Significant advancements in machine learning (ML) and Natural Language Processing (NLP) within chatbots are driving market growth. Chatbots excel in data collection and customer engagement, offering clarity on products/services and facilitating appointments. With improved NLP, chatbots mimic human language, aided by deep learning models and ML algorithms for accuracy and context awareness. The Intelligent Virtual Assistants (IVA) segment is projected to grow at a CAGR of over forecast period, featuring AI service providers developing personalized virtual assistants and chatbots. Notable innovations such as Astro, launched in September 2021, further exemplify this trend by offering unique functionalities like family communication and home monitoring.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Business Function:

-

Information Technology Service Management (ITSM)

-

Human Resource (HR)

-

Sales and Marketing

-

Operations and Supply Chain

-

Finance and Accounting

By Technology

-

ML and Deep Learning

-

NLP

-

ASR

-

Other Technologies

By Channel

-

Emails and Websites

-

Mobile Apps

-

Telephones

-

Messaging Apps

On the Basis of channel, Mobile apps segment to have largest market During the forecast period, Conversational AI enables businesses to maintain a contextual and continuous messaging experience through features like triggered messages, contextual information, in-app campaigns, sales bots, and intelligent message routing. This technology serves as a personal assistant within mobile apps, offering enhanced Natural Language Understanding (NLU) capabilities, seamless integration with business and consumer data, and rapid execution of interconnected algorithms for delivering hyper-personalized content in a human-centric conversational interface.

By Vertical

-

Banking, Financial Services and Insurance (BFSI)

-

Retail & eCommerce

-

Healthcare & Life Sciences

-

Travel & Hospitality

-

IT & ITES

-

Media & Entertainment

-

Telecom

-

Automobile & Transportation

-

Others

Regional Analysis

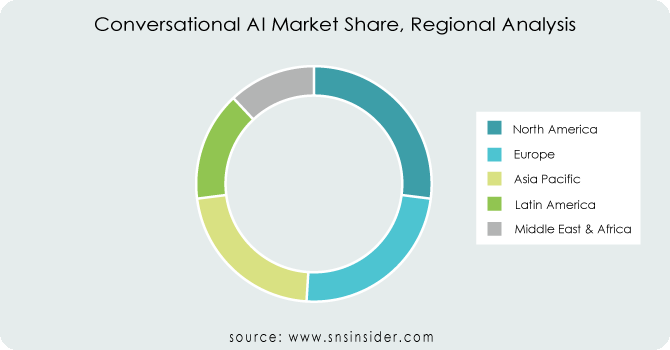

North America Region dominates the market with holding a significant revenue share of more than 27%, driven by the increasing adoption of emerging technologies and a growing demand for AI-powered customer support services. Organizations in the region are increasing investing in technological advancements to meet customer needs, with a growing emphasis on health consciousness further increasing the demand for conversational AI. The healthcare industry in North America is leveraging technologies such as AR, VR, robotics, and AI, integrating conversational AI with intelligent virtual agents for efficient communication. The Asia Pacific region is growing with the Fastest CAGR during the forecast period, driven by growing awareness among organizations about innovative customer support services.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major key players are Amazon Web Services, Inc., Artificial Solutions Holding ASH AB, Baidu, Inc., Conversica Inc., Haptik, IBM Corporation, Microsoft Corporation, Oracle Corporation, Google LLC, SAP ERP, and other players mentioned in the final report.

Oracle Corporation -Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.1 Billion |

| Market Size by 2032 | US$ 64.5 Billion |

| CAGR | CAGR 22.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By offering (Solutions, Services) • By Conversational Interface (Chatbots, Interactive Voice Routing (IVR), Intelligent Virtual Assistants (IVA)) • By Business Function (Information Technology Service Management (ITSM), Human Resource (HR), Sales and Marketing, Operations and Supply Chain, Finance and Accounting) • By Technology (ML and Deep Learning, NLP, ASR, Others), By Channel (Emails and Websites, Mobile Apps, Telephones, Messaging Apps) • By Vertical (Banking, Financial Services, and Insurance (BFSI), Retail & eCommerce, Healthcare & Life Sciences, Travel & Hospitality, IT & ITES, Media & Entertainment, Telecom, Automobile & Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services, Inc., Artificial Solutions Holding ASH AB, Baidu, Inc., Conversica Inc., Haptik, IBM Corporation, Microsoft Corporation, Oracle Corporation, Google LLC, SAP ERP |

| Key Drivers | • Businesses are increasingly adopting conversational AI to automate customer interactions, leading to operational efficiency and cost savings. • The increasing developments in NLP technologies enhance the accuracy and capabilities of conversational AI systems, improving user experiences. |

| Market Restraints | • The collection and processing of personal data by conversational AI systems raises privacy concerns among users and regulatory challenges for businesses. • Implementing and managing conversational AI solutions require technical expertise, leading to challenges for organizations without sufficient resources or expertise. • Integrating conversational AI with existing systems and workflows can be complex, especially for legacy systems or heterogeneous IT environments. |