Dimethyl Sulfoxide Market Report Scope & Overview:

Get E-PDF Sample Report on Dimethyl Sulfoxide Market - Request Sample Report

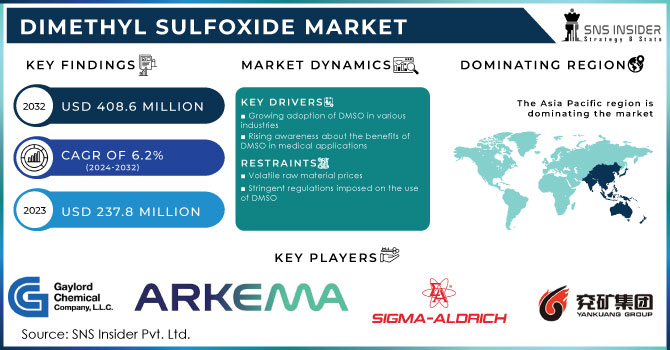

The Dimethyl Sulfoxide Market Size was valued at USD 237.8 million in 2023 and is expected to reach USD 408.6 million by 2032, and grow at a CAGR of 6.2% over the forecast period 2024-2032.

The global Dimethyl Sulfoxide market is projected to continue growing over the coming years, driven by steady growth in applications across a broad range of industries. The demand for Dimethyl Sulfoxide from the pharmaceutical industry acts as the main driving factor in this market. In pharmaceutical applications, the versatility of the solvent makes it more widely used in drug formulation for a wide range of applications, especially due to its exceptionally strong skin-penetrating ability and making it capable of facilitating drugs with higher efficiencies. Due to its anti-inflammatory and analgesic properties, it also has the potential to establish itself in medical treatments and turn out to be an inseparable ingredient in a large number of therapeutic products. It is counted as one of the major factors for market growth that has increased dependency on Dimethyl Sulfoxide in the pharmaceutical industry.

Besides pharmaceutical applications, Dimethyl Sulfoxide finds a great application in industry. It exhibits excellent solvent properties and hence is used in the production of adhesives, paints, and coatings. The great ability of this solvent to dissolve all types of substances enhances functionality in the chemical synthesis and manufacturing processes. The demand for Dimethyl Sulfoxide keeps on being strong since industries continuously look for effective and more efficient solvent solutions.

Apart from industrial and pharmaceutical applications, the agricultural field, over these years, has also been increasingly using Dimethyl Sulfoxide for its beneficial properties: as a carrier in both pesticides and herbicides, improving the potency of the latter to deliver active ingredients to crops; it is used as a plant growth regulator to ensure that plants grow more healthily, hence increasing crop yields. This versatility of Dimethyl Sulfoxide in all these aspects underlines its increasing market presence.

Further fueling this expansion is the ongoing research and development being undertaken within the Dimethyl Sulfoxide market. Scientists and researchers are continuously investigating new applications and benefits of the compound, opening further markets for the same. Along with innovations emerging along with diversified use of the compound, the global dimethyl sulfoxide market is expected to gain further momentum on account of its broad applicability, coupled with ongoing advancements in multiple sectors.

Market Dynamics:

Drivers:

-

Increasing demand from the pharmaceutical industry for effective solvent solutions and drug delivery systems is driving growth in the Dimethyl Sulfoxide Market

Strong demand from the pharmaceutical industry for effective solvent solutions, combined with advanced drug delivery systems, is one of the main factors driving the growth of the Dimethyl Sulfoxide Market. In pharmaceutical applications, Dimethyl Sulfoxide plays an important role due to a variety of useful properties it exhibits as a potent solvent, which enhances the solubility of various active pharmaceutical ingredients, APIs, thereby making the solvent critical in the process of new medicine development. Examples of this are the development of transdermal drug delivery systems, where DMSO works as a skin penetration promoter for drugs, enabling them to break more easily into biological barriers. This is especially vital for those medicines where dosages have to be very specific and absorption rates extremely high. Further, the critical role of Dimethyl Sulfoxide in cryopreservation protects biological samples against freezing-showcases again the versatility and importance of this chemical reagent both in research and in therapeutic use. The growing trend for personalized medicine and novel formulation of drugs, most of which require special solvents that ensure complete efficacy and delivery, further fuels the demand for DMSO. Companies like BASF and Merck KGaA develop high-purity DMSO to cater to the changing demands coming from the pharmaceutical industry, which is a reflection of the dynamic growth the market witnesses on account of such critical applications.

-

The rising adoption of Dimethyl Sulfoxide in environmentally friendly agricultural chemicals due to its low toxicity and high solubility is further fueling market expansion

The increasing use of Dimethyl Sulfoxide in the agrogreen chemical field, based on low toxicity and a high degree of solubility, develops the studied market. In this respect, Dimethyl Sulfoxide has great importance as an effective solvent in formulating agricultural chemicals and thus helps in the development of environmental-friendly products highly efficient for use. It is also being increasingly applied in pesticide formulation processes due to the capability for dissolving a wide range of organic compounds, which significantly enhances the effectiveness and stability of the active ingredient. The result is improved pest control with less environmental damage. In addition, Dimethyl Sulfoxide is used in herbicide formulations to increase the permeability of the herbicidal agents themselves in plant tissues for more efficient weed control with less risk of widespread chemical application. The foregoing environmental profile jibes well with emerging demand for sustainability within agricultural processes, where the minimization of chemical runoff and soil contamination becomes a major concern. This trend is beneficial, as agrarian firms seek alternatives to their conventional solvents, which may be more deleterious to ecosystems. Therefore, agriculture using Dimethyl Sulfoxide contributes toward the development of innovative and sustainable solutions, driving its market growth in this sector.

Restraint:

-

Stringent regulatory requirements for pharmaceutical-grade Dimethyl Sulfoxide, including high purity and safety standards, can hamper the growth for market players

Stringent regulatory demands for pharmaceutical-grade DMSO, which involve very high levels of purity and safety, may also pose a great challenge for the players operating in this market. In fact, the standards set by the regulatory bodies on the use of Dimethyl Sulfoxide in pharmaceuticals can be so painstaking that assuring safety and efficiency within the prescription formulation often necessitates a great deal of testing and certification. For example, regulatory bodies like the U.S. The strict regulations by the FDA and EMA on the levels of impurities in Dimethyl Sulfoxide used in drug manufacturing require immense investment in terms of quality control measures, purification technologies, and compliance procedures. This could become particularly heavy for smaller companies or new entrants in the market, as ultimately, the cost involved in maintaining such high standards inversely reduces competitiveness. These regulatory challenges will compromise entry and market growth, hence denting the overall growth of the Dimethyl Sulfoxide Market.

Opportunity:

-

Expanding applications in advanced electronics and high-performance coatings offer significant growth opportunities for Dimethyl Sulfoxide producers seeking to enter new markets

Growing usages in advanced electronics and high-performance coatings provide significant opportunities for Dimethyl Sulfoxide manufacturers to gain entry into new markets. Dimethyl Sulfoxide has gained immense use in the electronics industry because of its properties as a very good solvent and its ability to clean sensitive components without leaving any residues. Dimethyl Sulfoxide is used in the manufacture of cleaning agents, by their nature affecting the effective cleaning of flux residues from circuit boards without damage to the sensitive electronic parts. Its applications in high-performance coatings are on the rise due to its ability to dissolve a wide range of polymers, which are increasingly used in aerospace and automotive coatings for their performance-enhancing and durable properties. These emerging applications give new horizons to Dimethyl Sulfoxide, enabling the manufacturer to strive in various applications for the product and work one's way into the emerging markets where demand for advanced materials and coatings is on its way to growth. In this trend of high-tech application, the added advantage of rising demand is not only increasing the scope of the market but also increasing the value and volumes required for Dimethyl Sulfoxide in specialized industrial processes.

Challenge:

-

The need for continuous innovation to improve the production process and address environmental and safety concerns remains a significant challenge for maintaining market competitiveness

The constant need to innovate to improve production, environment-related issues, and safety concerns is another major challenge for sustaining competitiveness in the Dimethyl Sulfoxide Market. In addition to increasingly stringent environmental regulations, producers are also under pressure to develop new technologies and procedures to reduce emissions and manage waste from the production process. For example, the improvement in the catalytic process and use of other feedstocks that are not as damaging will be about compliance with both regulatory and environmental sustainability requirements. In addition, guaranteeing the safety of DMSO through the manufacturing process and handling involves extensive testing and the establishment of tight safety measures that prevent exposure and contamination. Companies that cannot keep up with the pace of innovation regarding these changing demands will be at the risk of being penalized through rising operational and regulatory costs, taking a real toll on their market position and overall profitability. Thus, further research and development is essential for the solution to these challenges in maintaining growth within a competitive and ecologically aware marketplace.

KEY MARKET SEGMENTS

By Raw Material

The Sulphur segment dominated the Dimethyl Sulfoxide Market in 2023, which accounts for over a 50% share of the market. The dominance in Sulphur can be justified by the fact that it acts as one of the major raw materials in the chain of manufacturing Dimethyl Sulfoxide, where it undergoes oxidation and further reaction to produce the compound. Sulphur is selected due to its availability, reasonable cost, and easy production process. For example, sulphur is easily and hugely available due to several industrial processes as by-products, thus making its mass production cheap and easy. Besides that, Dimethyl Sulfoxide produced through sulphur plays a major role in the formulation of high-purity solvents used in pharmaceuticals and electronics, since its effectiveness and reliability are critical to them. Due to this wide application in key sectors, sulphur can be said to dominate the market.

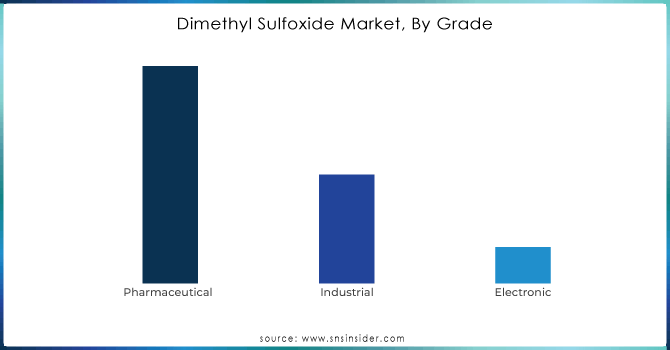

By Grade

The Pharmaceutical-grade segment dominated the Dimethyl Sulfoxide Market, accounting for over 60% of the estimated market share in 2023. This is because DMSO is vital to the pharmaceutical industry with the formulation of drugs and acting as a carrier in drug formulas. The pharmaceutical-grade Dimethyl Sulfoxide will ensure high effectiveness in DDS-transdermal patches and an intravenous solution. Such as its functionality concerning the enhancement of solubility for various medications is indispensable when working on the elaboration of new treatments and improving existing ones. The high regulatory bar and increased interest in progressive drug delivery techniques determine the leading position of the pharmaceutical-grade segment and its considerable market share in the overall market.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Application

The Pharmaceuticals segment dominated the Dimethyl Sulfoxide Market in 2023 with a market share of more than 55%. This supremacy of Dimethyl Sulfoxide in this segment is because the product finds its vital application as a solvent and carrier in the pharmaceutical industry. Hence, it finds intensive applications in the formulation of drug delivery systems at the site of action, for example, in the formulation of transdermal patches and intravenous solutions, because its role about API solubility enhancement and its absorption is of prime importance. For example, the ability of Dimethyl Sulfoxide to penetrate biological membranes with ease makes it an active ingredient in the development of new drugs and improving the permeation of most of the already developed drugs. Therefore, this market segment held a significant share due to the pharmaceutical industry's demand for high-purity solvents and its development toward the advanced mode of drug delivery, leading it to the top in the Dimethyl Sulfoxide market.

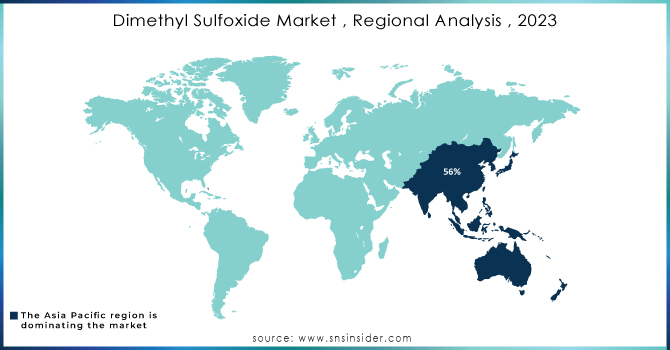

Regional Analysis

The Asia Pacific dominated the Dimethyl Sulfoxide market with about a 56% revenue share in 2023. China is the dominating country in the region of the Asia Pacific with the highest revenue share. Developing countries in regions like China, Japan, and South Korea have rising demands for Dimethyl Sulfoxide due to their robust industrial sectors. The countries have been recording significant development in industries like pharmaceuticals, electronics, and agrochemicals; most of these industries have a high demand for Dimethyl Sulfoxide because of its multi-perspective properties. Moreover, the Asia-Pacific is experiencing rapid research and development, owing to which this continent achieved developed status in most sectors. Due to its versatile properties both as a solvent and cryoprotectant, DMSO found wide-range applications in research labs and medical centers. This has further boosted the demand for Dimethyl Sulfoxide in the region.

North America emerged as the fastest-growing region with a significant CAGR of about 6.3% in the Dimethyl Sulfoxide market during the forecast period. Growth in the North American DMSO market is expected; this is because growth in demand for pharmaceutical products and the development of drug delivery systems are driving demand for DMSO as a solvent and carrier. The reason is that DMSO assists in facilitating the absorption and dissolution of 006Ff drugs administered, thus improving their therapeutic effectiveness. In addition, the growing industry of electronics within North America is also driving the demand for DMSO. The solvent properties of DMSO are excellent and, at the same time, it is of low toxicity; hence, this chemical is used in the manufacture of electronic parts like semiconductors and printed circuit boards. Because of this, the demand for DMSO is also growing with the increase in demand for such electronic gadgets.

Key Players

The major key players are Gaylord Chemical Corporation, Arkema Group, Parchem Fine & Specialty Chemicals, Hubei Xingfa Chemicals Group, Sigma-Aldrich Co. LLC., Zhuzhou Hansen Chemicals Co., Ltd, Otto Chemie Pvt. Ltd., Honeywell International Inc., Yankuang Lunan Chemicals, Toray Fine Chemicals Co. Ltd., and other key players are mentioned in the final report.

Recent Development:

-

January 2024: Honeywell and NXP's smart teamed up for better energy efficiency. Through this joint effort, the team is aiming high to make buildings smarter with the incorporation of NXP Semiconductors' neural network-enabled industrial-grade applications processors into Honeywell's building management systems.

-

June 2023: Toray Fine Chemicals introduced DMSO-StG, a cryopreservation liquid for cells

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 237.8 Million |

| Market Size by 2032 | US$ 408.6 Million |

| CAGR | CAGR of 6.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Raw Material (Raw Cotton, Black Liquor, Sulphur, Lignin) •By Grade (Pharmaceutical, Industrial, Electronic) •By Application (Polymer Processing, Pharmaceuticals, Removers & Cleaners, Agrochemicals, Coatings, Fine Chemicals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Gaylord Chemical Corporation, Arkema Group, Parchem Fine & Specialty Chemicals, Hubei Xingfa Chemicals Group, Sigma-Aldrich Co. LLC., Zhuzhou Hansen Chemicals Co., Ltd, Otto Chemie Pvt. Ltd., Honeywell International Inc., Yankuang Lunan Chemicals, Toray Fine Chemicals Co. Ltd. and other key players |

| Key Drivers | • Increasing demand from the pharmaceutical industry for effective solvent solutions and drug delivery systems • Rising adoption of Dimethyl Sulfoxide in environmentally friendly agricultural chemicals due to its low toxicity and high solubility |

| RESTRAINTS | • Stringent regulatory requirements for pharmaceutical-grade Dimethyl Sulfoxide, including high purity and safety standards |