SiC-on-insulator (SiCOI) Film Market Size & Trends:

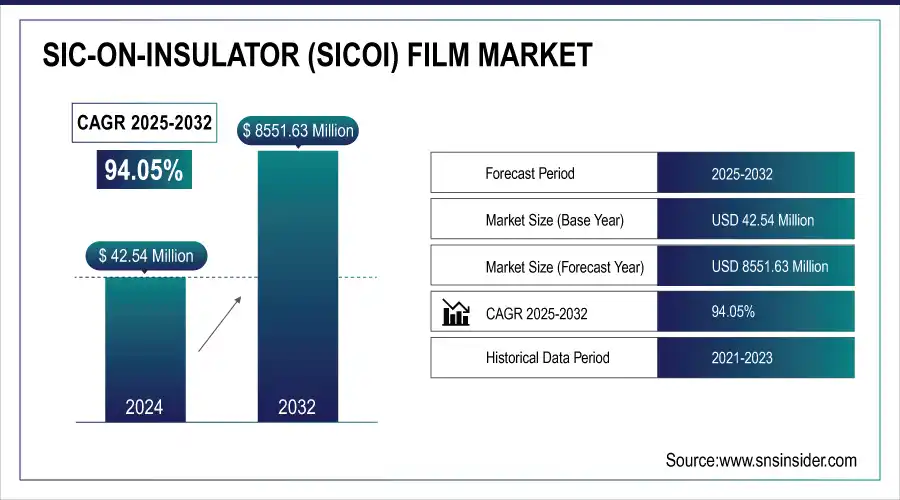

The SiC-on-insulator (SiCOI) Film Market size was valued at USD 42.54 million in 2024 and is expected to reach USD 8551.63 million by 2032, growing at a CAGR of 94.05% over the forecast period of 2025-2032. The SiC-on-insulator Film Market is driven by increasing adoption in high-power electronics, wafer size advancements, Smart Cut technology integration, and growing demand from EVs, aerospace, and energy-efficient semiconductor applications.

To Get More Information On SiC-on-insulator (SiCOI) Film Market - Request Free Sample Report

SiC-on-insulator (SiCOI) Film Market is increasing rapidly as it helps in overcoming the limitations of standard silicon in poor thermal conductivity, low voltage tolerability and poor switching speed. These inherent advantages of the material provide improved performance over monolithic device architecture suitable for miniaturized and high-power systems.

U.S. SiC-on-insulator (SiCOI) Film Market Surges with Tech Demand and Investments

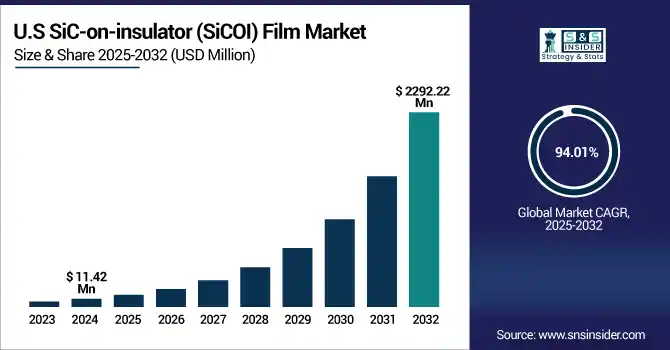

The U.S. SiC-on-insulator (SiCOI) Film Market size was valued at USD 11.42 million in 2024 and is projected to grow at a CAGR of 94.01%, reaching USD 2292.22 million by 2032.

Growing demand for high efficiency power electronics in EVs, renewable energy, aerospace and defense coupled with targeted government and industry investments in wide bandgap technology are driving the U.S. SiCOI film market. U.S. research teams demonstrated a 4H-SiCOI photonic platform featuring integrated microheaters and low-loss waveguides, achieving ultrafast (~7 µs) thermo-optic tuning and precise resonance shifts (11.7 pm/mW), vital for microcombs and optical filters.

The U.S. CHIPS Act has issued USD 79 million in preliminary grants to bolster SiC substrate and epitaxial wafer production, with broader semiconductor infrastructure incentives under ongoing renegotiations in 2025.

Role of Generative AI

-

AI-driven workloads are driving the construction of hyperscale data centers and edge computing platforms.

-

Global data centers consumed ~415 TWh of electricity in 2024; this demand is expected to exceed 945 TWh by 2030.

-

SiCOI films provide compact solutions with excellent thermal and voltage performance, ideal for AI infrastructure.

-

Shift to 200 mm SmartSiC™ bonded wafers for higher productivity and sustainability.

-

Use of Smart Cut technology and top-tier single-crystal SiC has reduced CO₂ emissions by up to 70%.

-

Integration of photonics (e.g., microheaters, waveguides) enables applications such as microcombs and optical filters.

SiCOI Films Revolutionize High-Performance Applications Across Power-Dense Sectors with Unmatched Thermal and Voltage Capabilities

When compared with standard silicon, SiCOI films outperform in thermal conductivity, voltage tolerability, and switching speed. This capability of reducing the power system footprint with superior performance is critical in markets such as:

SiC-on-insulator (SiCOI) Film enable small-sized and high-voltage systems in electric vehicles suitable for efficient powertrains. In industrial automation, they allow the integration of strong and high-efficiency control systems. Better performance of Inverters and converters for Renewable energy systems. SiCOI gives the thermal and power stability necessary for telecommunications in 5G and other high frequency networks. They enable the power density and thermal reliability required for edge and hyperscale compute in AI-driven data infrastructure.

Critical Restraints and Integration Challenges Slowing Down SiCOI Film Advancement in Semiconductor Innovation

Several technical and integration challenges of SiCOI films still need to be addressed. These manufacturing processes involving Smart Cut and wafer bonding can be intricate and require high precision to yield reproducible results. Defect-free and homogeneous thin-film fabrication is a challenge that has persisted until present days, and there is a lack of availability of large-diameter SiC substrates, which keeps scalability low in order to deploy the technology to the mass-market. Instead, thermal expansion coefficient mismatches also pose challenges for integrating these materials with established CMOS process flows and industry-standard protocols at device qualification and commercialization are still limited for SiCOI based devices.

Comprehensive segmentation highlights key growth areas across the SiCOI market:

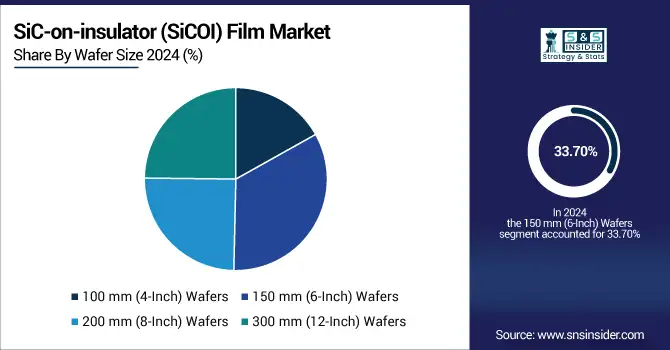

By Wafer Size

Due to the high use in existing fabrication lines and a high degree of compatibility to the current semiconductor manufacturing infrastructure, 150 mm (6-Inch) SiC-on-Insulator (SiCOI) wafers made up 33.7% of the market in 2024. GaN transistor have become the material of choice for many power electronics and industrial applications that rely on well-matured and cost-effective supply chain solutions for high-volume, mid-and high range power devices.

The 200 mm (8-Inch) segment is predicted to witness the highest growth rate, in terms of value, during 2025 and 2032, due to the semiconductor industry moving toward larger wafer sizes for greater throughput and improved economics. These wafers allow for greater chip yields per substrate while becoming more critical to address the growing needs of electric vehicles, AI data centers as well as next-gen. power devices.

By Technology

Smart Cut technology emerged as the biggest market share in SiC-on-Insulator (SiCOI) film in 2024 due to its high precision, low material loss ratio and high wafer uniformity with this technology, thin and high-quality SiC layers can be transferred to insulating substrates, perfect for high-performance, compact power devices in applications such as electric vehicles, aerospace, and renewable energy systems.

The Grinding/Polishing/Bonding technology is anticipated to hold fastest CAGR over the forecast period from 2025 to 2032 owing to lesser initial capital investment and ease of process adaptation. This approach is becoming popular for low-cost and developing applications that do not require ultra-precision. Continuous developments in bonding adhesives and surface finishing technologies are enhancing process yield and facilitating new application spaces for this technology in the medium-power and consumer segments.

By Substrate

Silicon (Si) substrates accounted for a 39.6% share of the SiCOI film market in 2024, as they are readily available, are less complex to manufacture, and are CMOS compatible. Such substrates are used in low-cost applications and pilot-line production, where the maturity of conventional silicon facilitates integration and manufacturing scalability.

Due to its better thermal conductivity, higher breakdown voltage, and higher efficiency for high-power applications, Silicon Carbide (SiC) substrate is anticipated to witness the highest CAGR during 2025 to 2032. These types of substrates are gaining critical importance in development of electric vehicles, renewable energy systems, and defense electronics.

By Application

Power Electronics was the market leader in the SiC-on-Insulator (SiCOI) film market in 2024 with a49.7%-increase to 37.4% in market share, benefiting from rising demand for high efficiency and high-temperature semiconductor devices required by industrial drives, inverters, power supplies, and grid-connected systems. SiCOI films have high thermal properties and high breakdown voltage and result in compact high-density power modules ideal for renewable energy and smart grid applications.

The Automotive industry is projected to register the fastest CAGR within the anticipated period from 2025 to 2032, attributed to global trends in vehicle electrification. As the increasing demand for compact, reliable, and efficient components in EV powertrains, onboard chargers, and battery management systems continues to be witnessed, automakers are progressing toward SiCOI-based devices.

SiC-on-insulator (SiCOI) Film Market Regional Analysis:

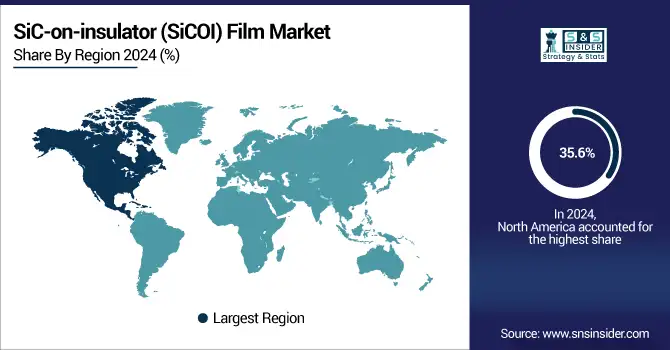

The SiC-on-Insulator (SiCOI) film market in 2024 was dominated by the North America region with a share of 35.6%, owing to extensive investments in semiconductor R&D, development of strong manufacturing infrastructure, and increasing electric vehicle, aerospace and defense sector demand. Key regional strength was also bolstered by presence of major-scalar foundry for the foundry business and abundance of government support associated with next-generation chip technologies

In North America, heavy weighting towards the US is primarily due to the US's advanced semiconductor manufacturing ecosystem, robust country-level funding initiatives, and high SiCOI demand driven by Electric Vehicles, Defense, and AI-enabled Infrastructure.

Get Customized Report as Per Your Business Requirement - Enquiry Now

The SiC-on-Insulator (SiCOI) film market in Asia Pacific is anticipated to command the highest CAGR of 95.20% from 2025 to 2032, owing to high industrialization rate, rising number of semiconductors fabs, and growing need for improved efficiency in electronics. Adoption is being driven by robust government support, increasing electric vehicle production, and rising investments in AI, 5G, and renewable energy infrastructure. Given its established supply chain and low-cost manufacturing, the region is poised to be a center for SiCOI film development and manufacturing efforts.

The breadth of EV manufacturing, the investment capabilities in semiconductor production, and the roadmap for materials and infrastructure development underpinned by government support allowed China to dominate the Asia Pacific SiCOI film market.

Europe is progressing on the SiC-on-Insulator (SiCOI) film market, driven by well-developed R&D capabilities, the electric vehicle market, and clean energy technologies. The demand is being fueled by regional initiatives to boost semiconductor autonomy and address sustainable electronics manufacturing. Collaborations between material suppliers and research institutions also expedite industrial implementation of SiCOIs to power electronics, aerospace, and high-frequency communication systems in the region.

The SiC-on-Insulator (SiCOI) film market in Latin America and Middle East & Africa is gradually influencing by the accelerating demand for renewable energy, industrial automation, and electric mobility. The government initiatives for modernization of technology coupled with increasing awareness towards energy efficient semiconductors are creating new opportunities for the market, despite being at the early stage of adoption. Future growth prospects in these regions can be further improved with regional infrastructure investment and partnerships with global semiconductor players.

Key Players:

Some of the major Global SiC-on-insulator (SiCOI) Film Companies are TE Connectivity, Amphenol, Hirose Electric, Molex, Binder, Bulgin, Switchcraft, Lemo, Samtec, and Souriau-Sunbank.

Recent Developments:

-

In May 2024, Soitec partnered with Tokai Carbon to co-develop poly‑SiC substrates for its SmartSiC™ SiCOI wafers.

-

In February 2025, Infineon announced the rollout of products based on 200 mm SiC wafers, signaling a shift to larger SiCOI platforms.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 42.54 Million |

| Market Size by 2032 | USD 8551.63 Million |

| CAGR | CAGR of 94.05% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Wafer Size (100 mm (4-Inch) Wafers, 150 mm (6-Inch) Wafers, 200 mm (8-Inch) Wafers, and 300 mm (12-Inch) Wafers) • Technology (Smart Cut Technology, Grinding/Polishing/Bonding Technology) • Substrate (Silicon (Si) Substrate, Silicon Carbide (SiC) Substrate, Sapphire Substrate, and Other) • Application (Power Electronics, Aerospace and Defense, Automotive, Consumer Electronics, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Soitec, Coherent, Infineon, Wolfspeed, SK Siltron, Rohm, GlobalWafers, STMicroelectronics, onsemi, and Siltronic. |