Micro Server IC Market Size:

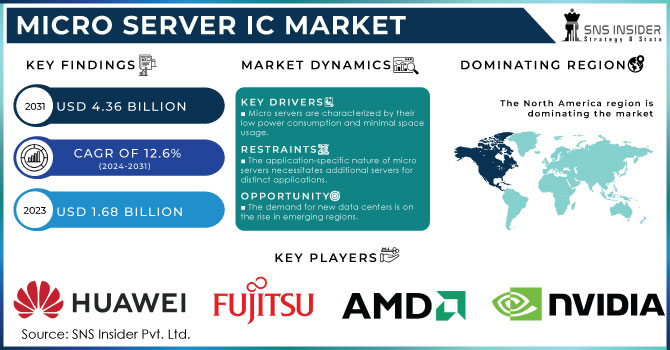

The Micro Server IC Market size was valued at USD 1.68 Billion in 2023 and is expected to grow to USD 4.88 Billion by 2032 and grow at a CAGR of 12.6% over the forecast period of 2024-2032.

The escalating demand for data centers, driven by the expansion of application software, multimedia files, and internet user numbers, is propelling the micro server IC market globally. As data centers become increasingly essential for various applications, they require a multitude of micro server ICs and corresponding software. This surge in data center demand is anticipated to continue driving the market in the foreseeable future.

Get more information on Micro Server IC Market - Request Sample Report

Moreover, advancements in micro server IC technology, including the reduction in transistor sizes, are contributing to their increased energy efficiency and performance. Users are consequently upgrading existing micro server ICs to enhance energy efficiency, computational capacity, and minimize heat generation. Simultaneously, companies are leveraging these technological advancements to produce more cost-effective and energy-efficient micro server ICs. Additionally, the rising demand for Cloud computing and web hosting further fuels market growth as the decreasing costs associated with online services prompt cloud service providers to expand their data processing, storage, and security capacities.

Micro Server IC Market Dynamics:

DRIVERS

-

Micro servers are characterized by their low power consumption and minimal space usage.

Micro servers boast lower power consumption and require less space compared to traditional high-end servers. They utilize low-power integrated circuits (ICs) commonly found in commercial personal computers. Furthermore, the power consumption of micro servers' streamlined silicon is notably lower than the 90-W-plus thermal design power (TDP) of processors found in high-end servers; micro server chips typically have a TDP of below 45 W, and even drop to sub-10-W levels. This reduced power consumption translates to lower operational costs, making micro servers more cost-effective for computing tasks. The advantage of their low power consumption and compact size allows enterprises to deploy more computing power within a given space while consuming less energy than traditional server solutions. Consequently, this aids in decreasing electricity bills and significantly reducing the operating expenses of data centers.

RESTRAIN

-

The application-specific nature of micro servers necessitates additional servers for distinct applications.

Micro servers offer a scale-out architecture favoured for application-specific purposes, making them particularly suitable for predefined workload environments like web hosting. To enhance capacity, users must augment nodes and related software to ensure compatibility with increased workloads. However, this limitation of micro servers serves as a constraint for the Micro Server IC Market , unlike traditional servers where such system upgrades are typically unnecessary. In the future, advancements in technology may enable manufacturers to overcome this restriction of micro servers.

OPPORTUNITY

-

The demand for new data centers is on the rise in emerging regions.

The rising demand for new data centers in emerging regions is driving the adoption of micro server integrated circuits (ICs) in data center applications. These ICs offer cost savings, reduced power consumption, and space efficiency compared to traditional enterprise-class rack servers. This trend is fueled by the increasing need for data centers across diverse business sectors including IT & telecom, banking, healthcare, agriculture, and government. As these industries continue to expand and digitize, the demand for efficient and cost-effective data center solutions is expected to grow, thereby contributing to the expansion of the micro server IC market.

CHALLENGES

-

The utilization of micro servers may be constrained by the presence of blade servers.

A blade server is a compact server chassis housing multiple slender, modular electronic circuit boards referred to as server blades, with each blade functioning as an individual server often dedicated to a single application. Widely regarded as the most efficient large computing devices, blade servers serve as the backbone of modern business computer infrastructure. They are increasingly favored over rack-mounted servers in numerous large office setups worldwide. However, micro servers, though limited to specific applications such as web servers that do not necessitate multi-CPU cores, are emerging as potential competitors to blade servers. Advancements in hardware and software technologies, including the introduction of more powerful components like 64-bit processors by Intel (US) and ARM (UK), as well as low-power System-on-Chips (SoCs) by ARM (UK), are anticipated to enhance the competitiveness of micro servers. These advancements will enable micro servers to accommodate technologies such as server clustering and cloud data centers, expanding their capabilities to cater to traditional businesses with high workload applications.

IMPACT OF RUSSIAN UKRAINE WAR

The Russia-Ukraine war has significant repercussions on the global economy, affecting various technology sectors, including the Micro Server IC Market . Potential consequences include supply chain disruptions, with estimates suggesting a 10-20% decrease in production due to shortages of crucial raw materials supplied by the two countries. Additionally, increased energy prices and transportation costs may lead to a 5-15% price hike for micro servers. Economic uncertainty stemming from the war could result in a 3-7% decrease in sales as businesses prioritize core IT infrastructure needs over new technology investments. However, there are potential silver linings, such as a projected 5-10% growth in cloud-based micro server solutions and a long-term shift towards domestic manufacturing incentivized by the war. The overall impact on the Micro Server IC Market varies depending on the war's trajectory, with short-term disruptions potentially causing a 5-10% decrease, while a prolonged crisis could lead to a more severe 15-20% decrease. Various factors like government policies and technological advancements will influence the actual impact, emphasizing the need for careful consideration and adaptation within the industry.

IMPACT OF ECONOMIC SLOWDOWN

During economic downturns, businesses typically tighten budgets, delaying non-essential IT investments and emphasizing core infrastructure needs over new technology adoption. This shift can lead to a 3-7% decrease in micro server sales as companies reassess their spending priorities. Moreover, economic challenges heighten price sensitivity among businesses, pressuring micro server vendors and potentially sparking price wars as they compete for a smaller customer base, impacting profit margins. However, there are positive impacts to consider, such as the increased adoption of cloud computing as a cost-saving measure during downturns, which could drive a 5-10% growth in demand for cloud-based microserver solutions offered by major cloud providers. Overall, the net effect of the economic slowdown on the microserver market remains uncertain, with potential scenarios ranging from a stable market or slight decrease in sales during a moderate slowdown to a more significant decrease in sales (5-7%) in severe economic downturns. Various factors, including the severity and duration of the slowdown, industry-specific trends, and the emergence of innovative microserver solutions, will ultimately influence the market's trajectory. Therefore, the long-term outlook for the microserver market hinges on its ability to adapt to evolving business needs and offer solutions that prioritize superior performance, energy efficiency, and cost-effectiveness, ensuring resilience even in challenging economic conditions.

Micro Server IC Market Segment Analysis:

By Offering

Hardware is projected to dominate the micro server ICs market share in the upcoming year. As hardware forms the primary component of a System-on-Chip (SoC), companies like Intel and ARM are focusing on enhancing their ICs' capabilities by densifying and optimizing the architecture. The increasing uptake of micro servers for various purposes such as dedicated hosting, front-end web services, handling big data workloads, facilitating content delivery networks, supporting computing applications, and fulfilling space and application-specific requirements is fueling the market's growth trajectory.

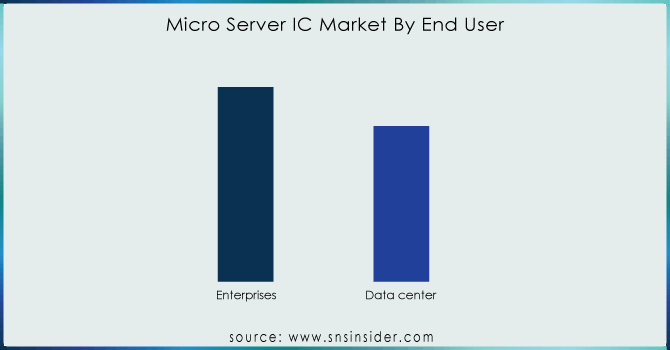

By End User

During the forecast period, it is anticipated that the enterprise end-user segment will dominate the micro server IC market. The proliferation of smartphones, social platforms, big data, and IoT has led to a significant increase in both the volume and variety of data. This has resulted in the need for managing heavy workloads, enhancing data storage and security, modernizing outdated systems, and meeting the demands of a mobile workforce.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

Edge computing stands out as a burgeoning use case for micro server ICs, poised to exhibit the most substantial growth trajectory in the foreseeable future. The adoption of hyperscale cloud infrastructure and increased investments in IoT have propelled edge computing into the forefront. In the quest to maintain competitiveness in the digital landscape, particularly in the aftermath of the pandemic, organizations are turning to edge computing as a pivotal tool for garnering customer insights and enhancing retention rates. Consequently, independent software vendors, system integrators, and enterprises are poised to develop cloud-independent solutions, thereby fueling the expansion of edge computing applications.

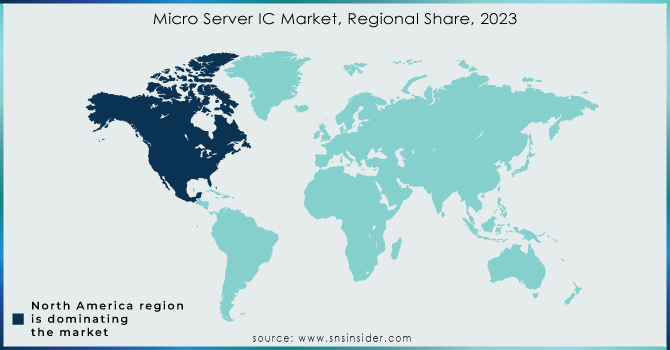

Micro Server IC Market Regional Analysis:

North America continues to lead the market, a trend expected to persist throughout the forecast period. The region's dominance is fueled by increased investments in miniaturized Integrated Circuits (ICs) research and development, which are set to significantly drive demand for micro server IC systems. The emphasis on R&D highlights a dedication to technological progress and innovation, particularly in compact and efficient ICs. This uptick in demand aligns with the broader trend of electronics miniaturization, with microserver ICs playing a crucial role in delivering high performance in limited spaces.

Meanwhile, the Asia-Pacific region is poised for rapid market growth, driven mainly by countries with sizable populations and a growing adoption of micro servers, particularly among small and medium enterprises. The proliferation of internet services and the widespread use of smart devices have led to a substantial increase in data generation, consequently fueling the expansion of data centers in the APAC region.

KEY PLAYERS:

The key players in the micro server IC market are Advanced Micro Devices, Fujitsu Limited, Huawei Technologies, Nvidia Corporation, STMicroelectronics, Dell Technologies, Hewlett Packard Enterprise Development, Intel Corporation, NXP Semiconductors, Super Micro Computer & Other Players.

RECENT DEVELOPMENT

-

In March 2022: Medtronic plc entered into a strategic partnership with Vizient, a leading healthcare performance enhancement company in the United States. As part of this agreement, Touch Surgery Enterprise will join Vizient's broad array of solutions, serving more than half of the country's healthcare providers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.68 Billion |

| Market Size by 2031 | US$ 4.88 Billion |

| CAGR | CAGR of 12.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software) • By Processor Type (X86, ARM) • By Application (Web hosting and enterprise applications, Analytics and cloud computing, Edge computing) • By End User (Enterprises, Data center) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Advanced Micro Devices, Fujitsu Limited, Huawei Technologies, Nvidia Corporation, STMicroelectronics, Dell Technologies, Hewlett Packard Enterprise Development, Intel Corporation, NXP Semiconductors and Super Micro Computer. |

| Key Drivers | • Hyperscale data centre architecture is taking shape. • Micro servers have low power consumption and take up little space. |

| Restraints | • Lack of Standard specifications. • The application-specific nature of micro servers necessitates the use of additional servers for each application. |