Non-Dispersive Infrared Market Size:

To get more information on Non-dispersive Infrared (NDIR) Market - Request Sample Report

The Non-dispersive Infrared Market Size was valued at $600 million in 2023 & is expected to reach $1199.4 million by 2032 & grow at a CAGR of 8.0% by 2024-2032.

Environmental Regulations on air pollution and greenhouse gas emissions, Heightened awareness of workplace safety has led to a surge in demand for efficient gas detection solutions in industries like manufacturing and mining. NDIR sensors offer a reliable and versatile solution are driving demand for NDIR sensors. NDIR sensors are used in air quality monitoring stations to measure the concentration of various gases like ozone (O3) and carbon monoxide (CO), providing valuable data for pollution control efforts. Example, City environmental agencies can deploy NDIR sensors in urban areas to track ozone levels, aiding in implementing measures to reduce smog during peak pollution seasons. also, NDIR technology has the potential for breath analysis in non-invasive disease diagnosis. Researchers are exploring the use of NDIR sensors to detect specific biomarkers in exhaled breath, potentially aiding in the early detection of conditions like diabetes or lung cancer.

| Report Attributes | Details |

|---|---|

| Key Segments | • By Gas Type (Carbon Dioxide, Hydrocarbons, Refrigerant, Acetylene, Ethylene, Sulphur Hexafluoride, Carbon Monoxide, Anesthetic, VOCs, Hydrogen Sulphide, Chlorine) • By Product Type (Fixed, Portable) • By Application(Monitoring, HVAC, Detection & Analysis) • By Industry Vertical (Automotive & Transportation, Oil & Gas, Industrial & Manufacturing, Food Processing & Storage, Chemicals, Medical, Environmental, Others) |

| Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell, S+S Regeltechnik, Nano Environmental Technology, Emerson Electric, Cubic Sensor and Instrument, Amphenol, Senseair AB, Dynament, MIPEX TECHNOLOGY, Shenzhen Mindray Bio-Medical Electronics and Other. |

Non-dispersive Infrared Market Dynamics:

KEY DRIVERS:

-

Stringent regulations on air pollution and greenhouse gas emissions are driving demand for NDIR sensors.

-

Increasing Expansion of IoT and Smart Building Solutions drives the market growth

IoT devices collect real-time data on various aspects of a building's operation, such as temperature, humidity, occupancy, and energy consumption. Smart building solutions leverage this data to optimize building operations. The expansion of IoT and the increasing adoption of smart building solutions create a mutually beneficial cycle. As more IoT devices are deployed in buildings, the market for smart building solutions to manage and analyze the data grows. Conversely, as smart building solutions become more sophisticated and affordable, the demand for IoT devices to integrate into these systems increases.

RESTRAINTS:

-

High Initial Investment Costs

-

Limited Gas Detection Range

NDIR sensors struggle to detect certain gases at low concentrations or in the presence of interfering gases. For example, an NDIR sensor designed for CO2 detection might not be suitable for measuring trace amounts of methane (CH4) in the same environment.

OPPORTUNITIES:

-

Developing portable NDIR-based breath analyzers for point-of-care diagnostics or at-home monitoring can pose opportunity for the emerging field of medical technology.

-

Building Automation and Smart Homes

The increasing focus on energy efficiency and occupant health in buildings is driving the demand for smart building technologies. NDIR sensors can be integrated into HVAC systems and air purifiers for real-time monitoring of CO2, VOCs (volatile organic compounds), and other pollutants. This allows for automated adjustments to ventilation and filtration systems, creating a healthier indoor environment. Companies developing miniature, low-power NDIR sensors specifically designed for integration into smart thermostats or air purifiers can cater to this growing market.

CHALLENGES:

-

The need to differentiate products to meet the unique requirements of end users.

-

Competition from Alternative Technologies

NDIR sensors must compete with alternative gas detection technologies, such as electrochemical sensors, which are difficult for market access and deployment.

IMPACT OF RUSSIA-UKRAINE WAR

Russia is a major supplier of key materials such as indium gallium phosphide (InGaP), a key component of some NDIR sensors. As a result, sanctions and trade restrictions with Russia have limited the availability of these materials, causing shortages and price increases. the war also severely affected global shipping and logistics. Companies are struggling to transport NDIR sensors and components due to airspace closures, port congestion and general instability in the transport network. some NDIR sensor manufacturers, particularly European manufacturers, have reported a production slowdown due to a shortage of parts from Russia.

IMPACT OF ECONOMIC SLOWDOWN

Businesses tends to reduces their budgets during economic slowdown, leading to a decrease in investments in new equipment and technologies that utilize NDIR sensors. This could hamper the demand for NDIR sensors in some sectors like industrial automation or environmental monitoring for new projects. NDIR sensors are known for their reliability, longevity, and relatively low maintenance costs. During economic slowdown, companies prioritize these factors, potentially increasing the adoption of NDIR sensors in applications where they can offer a cost-effective solution compared to alternative technologies. Therefore, As businesses look to optimize costs and resource utilization during a slowdown, there might be a rise in demand for NDIR sensors used for leak detection (industrial sector) or preventive maintenance (predictive maintenance in industrial equipment).

Non-dispersive Infrared Market Segment Overview:

By Gas Type

Based on Gas Type, Carbon dioxide is projected to hold the largest market share in 2024, driven by growing concerns about climate change and the need to monitor CO2 levels in industries such as automotive, healthcare and agriculture. Due to strict regulations and increasing awareness of the environmental impact of CO2 emissions, the demand for accurate and reliable CO2 sensors such as NDIR sensors is increasing, increasing its market share in the coming years.

By Application

Based on Application, The HVAC application in the NDIR market is growing due to the demand for energy efficient HVAC systems. NDIR sensors provide accurate and reliable measurements of indoor air quality, allowing HVAC systems to optimize their efficiency and reduce energy consumption. With increasing emphasis on environmental sustainability and indoor air quality regulations, the adoption of NDIR sensors in HVAC systems will increase during the forecast period.

By Industry Vertical

Based on industry verticals, the Non-dispersive infrared (NDIR) market is dominated by the automotive and transportation segment . The turnover of this sector was USD 135.0 million in 2023, indicating a significant position in the NDIR market. The automotive industry's adoption of NDIR technology for emissions control and air quality monitoring positions it as a market leader. On the other hand, the fastest growing segment of the NDIR market is the industrial and manufacturing sector. This segment is growing rapidly due to increasing demand for NDIR sensors in industrial applications, environmental monitoring and emission control.

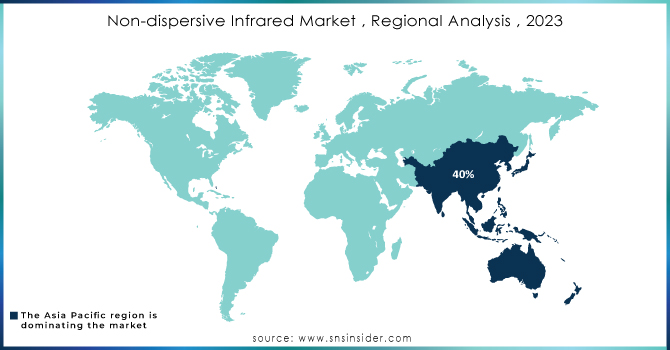

Non-dispersive Infrared Market Regional Analysis:

The Asia Pacific has a significant market share, exceeding 40% in 2023 in the Non-dispersive Infrared (NDIR) market. This region is experiencing a rapid rise in NDIR sensor adoption Fueled by dynamic economic growth and surging industrialization, countries like China and India have a growing demand for NDIR technology. China, Japan, India, and South Korea are among the top 20 automobile manufacturers in the world, therefore the region's NDIR industry has a lot more potential to grow in the forecasted period.These sensors play a crucial role in monitoring and controlling emissions from factories, ensuring compliance with environmental regulations. As cities across Asia Pacific embrace smart city initiatives, NDIR sensors are being integrated into urban infrastructure. This allows for real-time environmental monitoring and enhanced public safety measures. also, The automotive industry in the region is increasingly adopting NDIR technology for emission control. This aligns with stricter global environmental standards and paves the way for cleaner transportation.

North America has a significant market share of approx 30% in the forecasted period 2024-2031. North America's established industrial base, focus on environmental regulations, and technological advancements position it as a strong contender in the NDIR market. As NDIR sensor technology continues to evolve and costs become more competitive, the market in North America is expected to see continued growth. also, North America is home to leading companies in automation, robotics, and sensor development. This strong technological foundation fosters innovation and adoption of advanced NDIR technologies.

Get Customized Report as per Your Business Requirement - Request For Customized Report

KEY PLAYERS :

The key market players in Non-dispersive Infrared (NDIR) Market are Honeywell, S+S Regeltechnik, Nano Environmental Technology, Emerson Electric, Cubic Sensor and Instrument, Amphenol, Senseair AB, Dynament, MIPEX TECHNOLOGY, Shenzhen Mindray Bio-Medical Electronics and Other.

RECENT DEVELOPEMENTS

-

In February 2024, Honeywell International Introduced the SentAir EC4 NDIR CO2 sensor specifically designed for commercial buildings. This sensor offers exceptional accuracy and stability for demand-controlled ventilation, optimizing energy efficiency and enhancing indoor air quality

-

In January 2024, Senseair AB unveiled its new Sunrise CO2 sensor at the AHR 2024 conference in January 2024. This innovative sensor is designed to revolutionize HVAC systems by optimizing energy efficiency and enhancing indoor air quality.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 600 Million |

| Market Size by 2032 | US$ 1199.4 Million |

| CAGR | CAGR of 8.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Drivers | • Increasing focus on worker safety • Reduce toxic gas leakages |

| Restraints | • Sensor development is a time-consuming procedure • High manufacturing cost |