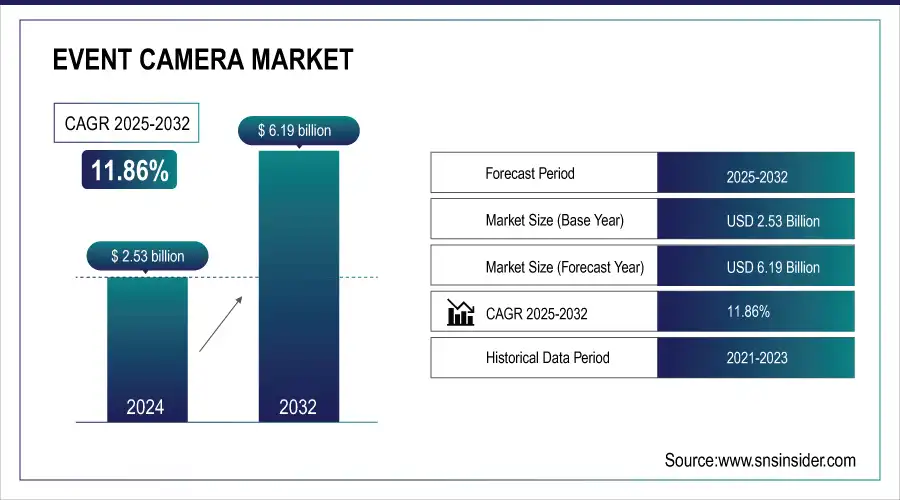

Event Camera Market Size & Growth:

The Event Camera Market Size was valued at USD 2.53 billion in 2025E and is expected to reach USD 6.19 billion by 2033 and grow at a CAGR of 11.86% over the forecast period 2026-2033.

The worldwide market for Event Cameras is expanding as a result of an exponential demand for real-time and smart imaging systems. Addition of the edge AI functionality is improving the performance of robotics, autonomous vehicles, surveillance systems and immersive media. Advancement in technology and increasing demand of Low-latency visual processing based applications is also boosting the market in developed and developing regions. Market participants are concentrating on innovations and strategic collaborations to serve different industry needs, and growing investments in smart infrastructure and neuromorphic engineering are additionally bolstering global prospects for future growth.

Market Size and Forecast:

-

Market Size in 2025E USD 2.53 Billion

-

Market Size by 2033 USD 6.19 Billion

-

CAGR of 11.86% From 2026 to 2033

-

Base Year 2025

-

Forecast Period 2026-2033

-

Historical Data 2022-2024

To Get more information on Event Camera Market - Request Free Sample Report

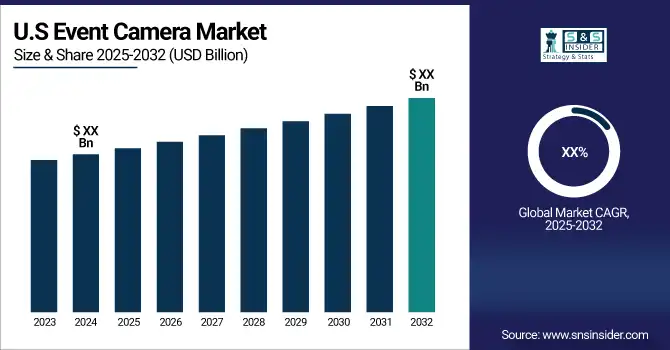

The U.S. Event Camera market size was valued at an estimated USD 0.95 billion in 2025 and is projected to reach USD 2.35 billion by 2033, growing at a CAGR of 10.6% over the forecast period 2026–2033. Market growth is driven by increasing adoption of event-based vision sensors in applications requiring high-speed motion capture and low-latency imaging, such as autonomous vehicles, robotics, industrial automation, and surveillance systems. Rising demand for energy-efficient imaging solutions capable of operating in dynamic and low-light environments is further accelerating market expansion. Additionally, continuous advancements in neuromorphic vision technology, integration with AI and edge computing platforms, and growing investments in advanced sensing technologies support the steady growth outlook of the U.S. e

Event Camera Market Trends:

• Rising adoption of event cameras in surveillance for ultra-low latency and real-time detection in low-light or fast-motion conditions.

• Growing investments in smart cities, public safety, and border security driving neuromorphic vision system adoption.

• Increasing use of event cameras in live streaming, sports analytics, and interactive media requiring zero-latency capture.

• Expansion of AR and VR applications leveraging high-speed motion and dynamic light capture capabilities.

• Rising demand from content creators and media industries for AI-enhanced, immersive visual tools and custom event-based vision solutions.

Event Camera Market Growth Drivers:

-

With increasing need for superior surveillance capabilities, event cameras are becoming an integral part of security systems.

Event cameras provide a number of benefits for surveillance, with ultra-low latency, real-time detection in dim or fast-moving conditions. This allows them to conserve bandwidth and aids detection of threats in important security operations by capturing only changes in the scene. Increasing global public safety concerns and spending on smart city development and border patrol are now driving security companies and law enforcement agencies to adopt neuromorphic vision systems. This can be very evident in areas such as airports, transit hubs, and defense.

Event-based vision systems can reduce bandwidth usage by up to 80%, as they transmit data only when a change is detected.

Event cameras offer latency as low as 1 millisecond, compared to 30–60 milliseconds in traditional frame-based systems—making them ideal for real-time surveillance s.

Event Camera Market Restraints:

-

Usual lack of awareness and technical capability limit market penetration through typical commercial applications.

Event cameras are still a largely new paradigm for vision systems, and most end-users do not know the benefits or how to successfully deploy them. The integration of event-based data with traditional processing tools is a steep learning curve, usually needing proprietary software and AI models. The lack of widespread developer communities and educational resources will also slow adoption by these segments — and this problem scales up outside of the high-tech centers, to startups, content-creators, and mid-sized businesses.

Event Camera Market Opportunities:

-

The growing scope of entertainment, sports broadcasting and AR/VR applications is driving new use cases for event camera deployments.

With the growth of live streaming, sports analytics, and interactive content requiring zero latency of immersive experiences and accurate capture, event cameras excel at meeting these demands. They can capture high-speed motion and dynamic light, which would be great for AR and VR exposures. As studios, sports leagues, and content creators become more creative in the ways they explore event-based vision, they present a massive opportunity for manufacturers to start targeting media and entertainment industries with custom solutions.

Over 200 million content creators are active worldwide as of early 2025, with increasing adoption of immersive and AI-enhanced visual tools.

Nearly 75% of major sports leagues in the U.S. and Europe adopted AI-based visual tracking in 2024, with rising trials using event cameras for real-time motion analysis.

Event Camera Market Segment Analysis:

By Technology

Ultra High Definition (UHD/4K) segment accounted for a maximum revenue share of the Event Camera Market, at over 29.10% in 2025. Puerto Rico — The continued growth has fueled increasing consumer expectations for immersive-compost quality in media and broadcasting market along with surging demand for high-quality images, the former hold a significant market share. Crisp UHD cameras are perfect for critical surveillance and cinematics, where every detail matters. Sony Corporation, for example, have been instrumental at introducing 4K sensors to multiple camera platforms, quickly increasing the uptake. High-resolution imaging is now a necessity across multiple industries where the demand for clarity and precision is uncompromising.

360-Degree Cameras segment is projected to grow best at a CAGR of 15.66% from 2026–2033. This expansion is driven by continued application of immersive use cases like virtual reality, interactive content creation, and situational awareness for autonomous systems. So is the 360-degree camera space: Insta360 is broadening its scale to add both consumer and enterprise segments. This also fuels growth in this burgeoning segment with increasing demand in smart city, tourism, and remote monitoring applications.

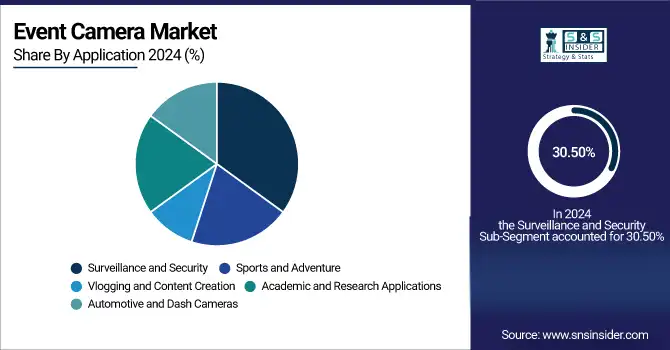

By Application

Surveillance and Security segment dominated the Event Camera Market with the highest revenue share of about 30.50% in 2025. The dominance stems from the critical need for real-time, latency-free visual monitoring in public infrastructure, defense, and industrial zones. Integration with facial recognition and behavioral analysis has elevated the value of event cameras. Companies such as Hikvision are increasingly deploying advanced event-based vision systems into smart surveillance networks, strengthening security frameworks globally and contributing to the segment's substantial share.

Automotive and Dash Cameras is expected to grow at the fastest CAGR of about 14.12% from 2026–2033. This rise is fueled by the demand for enhanced driver assistance systems (ADAS), autonomous driving technologies, and insurance telematics. Event cameras are ideal due to their low latency and energy-efficient design. Firms like Prophesee are innovating in automotive vision systems, enabling real-time tracking and motion analysis, which is driving rapid integration across next-gen vehicles.

By End User

Media and Entertainment Companies segment accounted for the largest segment of Event Camera Market in 2025, of 24.90%. The reason why, its widespread adoption in sports casting and movie make-outs in the field of live event shooting where speed and correctness matters. And demand, in turn, fueled by better motion tracking, scene tracking, and ultra high-resolution output. With event cameras now firmly established as critical components to inspire colourful content, culling through the market should start with small action camcorders made for this market, paving the way ahead are firms like GoPro Inc.

Security Service Providers is expected to grow at the highest rate of CAGR over 13.33% during 2026–2033. Civil security segment benefitting with rising threat levels, increasing demand for private monitoring services and demand for real-time response capabilities These demand notifications are fulfilled by event cameras, which are ultimately better in terms of free capability since they can persist working with much less energy than the traditional digital cam and since they generate low information due to the fact that activity events are caught asynchronously. Solution providers, especially the leaders like Bosch Security Systems are leveraging these technologies to deploy smart surveillance networks across commercial and residential infrastructures.

By Distribution Channel

The Event Camera Market was led in 2025 by Electronics and Appliance Stores segment with the largest revenue share of 26.1%. Consumers prefer in-person product trials, expert advice, and the immediate availability of the physical product, which drives this dominance. High-investment products are better sold through physical stores as they provide greater trust channels. Retailers such as Best Buy capitalized on this relationship, pairing package deals with next generation cameras and further solidifying this distribution channel in urban/project and, suburban markets.

The Third-Party eCommerce Platforms segment is anticipated to record the fastest growth rate of more than 14.12% during the forecast period (2026–2033). Factors like increasing digital penetration, worldwide availability, and ease of comparison shopping contribute to this growth. Diverse product listings, peer reviews, and competitive pricing are advantages customers can take advantage of. Thanks to giants like Amazon, this growth is being supplemented with international brands, quicker delivery and further buyer protection, creating the conditions for consumers to begin purchasing large quantities of items online across countries.

By Features

Stabilization Technologies held a significant revenue share of about 25.3% in 2025, on Event Camera segment in Event Camera video segment. This dominance can be attributed to market preference for smooth, shake-free footage in both the prosumer and consumer use cases. Stability equals clarity, be it for action sports filming, broadcasting, or automotive applications. Continuous innovations in gyroscopic and sensor-based stabilization from brands such as DJI have performed wonders in boosting the performance of event-based vision products while also broadening its use cases across applications.

Voice Control segment will grow at the highest CAGR of almost 15.36% during 2026-2033. Consumer demand for hands-free operation in dynamic environments is driving the adoption of voice-activated camera systems. Seamless interaction, however, is not just an aggregate feature; it contributes to usability, whether during action filming, with vlogs, and in automotive setups. Garmin and others are building advanced voice recognition capabilities into their camera ranges to improve accessibility and make it easier to use in both leisure and commercial settings.

Event Camera Market Regional Analysis:

North America Event Camera Market Insights

North America dominated the Event Camera Market, accounting for 32.50% of revenue share in 2025, due to early adoption and implementation of novel imaging technologies in defense, autonomous systems, and consumer electronics. In particular, the U.S. plays a key role in innovation based on robust government funding, an established technology infrastructure and major camera and sensor suppliers that are actively pursuing innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Event Camera Market Insights

Asia Pacific is expected to be the fastest growing region with a CAGR of 13.87% during the forecast period 2026 - 2033, due to rapid urbanization, governmental smart city projects, and growing investments in robotics and AI. AVS is expanding enormously in the region with high adoption of advanced surveillance and automation technologies being adopted by countries such as China, Japan, and South Korea.

-

China leads the Asia Pacific Event Camera Market owing to massive surveillance infrastructure expansion, rapid smart city development, and government support for AI and robotics. Its strong manufacturing ecosystem and increasing demand for real-time imaging technologies further strengthen its dominant regional position.

Europe Event Camera Market Insights

Europe has a long way to go in the Event Camera Market due to growing investments in smart surveillance in addition to automotive safety system and industrial automation. Robotics, security, and scientific research are also bringing event-based vision technologies to countries such as Germany, France, and the U.K. The market growth in the region is attributed to the presence of supportive regulations, robust R&D frameworks, and cooperative partnerships between technology companies and universities.

-

Germany is the dominant country in the European Event Camera Market. Its leadership is driven by a strong industrial base, advanced automotive sector, and extensive investments in robotics and automation. Germany’s emphasis on Industry 4.0, along with strong R\&D capabilities and partnerships between tech companies and research institutions, positions it at the forefront of event camera adoption in the region.

Latin America (LATAM) and Middle East & Africa (MEA) Event Camera Market Insights

Middle East & Africa and Latin America, which will be boosted by the rising urbanization and growing focus on smart city projects across these regions, increasing integration of artificial intelligence (AI) in Event Camera and the increasing demand for security solutions are some of the factors contributing toward the growth of Event Camera market in these regions. The strides made by the UAE and Brazil in this regard is also evidenced by increasing investments in Surveillance & Automotive Technologies, and Advanced Imaging Systems for both Public and Industrial applications.

Event Camera Market Key Players:

Some of the Event Camera Market Companies are

-

Prophesee

-

iniVation AG

-

Sony Corporation

-

Samsung Electronics

-

Insightness AG

-

SynSense

-

Hillcrest Labs

-

FLIR Systems (Teledyne Technologies)

-

Panasonic Corporation

-

Huawei Technologies

-

Northrop Grumman Corporation

-

CenturyArks Co., Ltd.

-

OmniVision Technologies, Inc.

-

Imago Technologies GmbH

-

Pepperl+Fuchs SE

-

STMicroelectronics N.V.

-

Melexis NV

-

Himax Technologies Inc.

-

IDS Imaging Development Systems GmbH

-

Basler AG

Competitive Landscape for Event Camera Market:

iniVation AG is a pioneering company in the event camera market, specializing in neuromorphic vision sensors that capture high-speed motion with ultra-low latency. Their innovative solutions serve applications in robotics, automotive, industrial automation, and surveillance, enabling real-time detection, energy-efficient processing, and advanced AI-driven visual analytics for dynamic environments.

-

In March 2025, iniVation AG launched the Aeveon™ Adaptive Event Vision sensor, featuring multi-bit change events, full-frame readout, and region-based HDR capturing—a significant leap beyond traditional DVS technology.

SynSense is a leading player in the event camera market, developing advanced neuromorphic vision and AI-powered sensing solutions. Their event-based cameras excel in ultra-low latency, high-speed motion detection, and energy-efficient processing, catering to applications in robotics, automotive, surveillance, and industrial automation, enabling real-time analytics and intelligent decision-making.

-

In November 2024, SynSense introduced the Speck Demo Kit, combining their low-power event-based vision module with Bluetooth, enabling fast prototyping for industrial and IoT applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.53 Billion |

| Market Size by 2033 | USD 6.19 Billion |

| CAGR | CAGR of 11.86% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Standard Definition (SD), High Definition (HD), Full HD (FHD), Ultra High Definition (UHD/4K), 360-Degree Cameras) • By Application (Sports and Adventure, Surveillance and Security, Vlogging and Content Creation, Academic and Research Applications, Automotive and Dash Cameras) • By End User (Individual Consumers, Professional Videographers, Media and Entertainment Companies, Law Enforcement Agencies, Security Service Providers) • By Distribution Channel (Online Retail, Offline Retail (Specialty Stores), Electronics and Appliance Stores, Direct Sales, Third-Party eCommerce Platforms) • By Features (Waterproof and Rugged Designs, Stabilization Technologies, Wi-Fi Connectivity, Live Streaming Capabilities, Voice Control), |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Prophesee, iniVation AG, Sony Corporation, Samsung Electronics, Insightness AG, SynSense, Hillcrest Labs, FLIR Systems (Teledyne Technologies), Panasonic Corporation, Huawei Technologies, Northrop Grumman Corporation, CenturyArks Co., Ltd., OmniVision Technologies, Inc., Imago Technologies GmbH, Pepperl+Fuchs SE, STMicroelectronics N.V., Melexis NV, Himax Technologies Inc., IDS Imaging Development Systems GmbH, Basler AG |