Dissolved Gas Analyzer Market Key Insights:

Get More Information on Dissolved Gas Analyzer Market - Request Sample Report

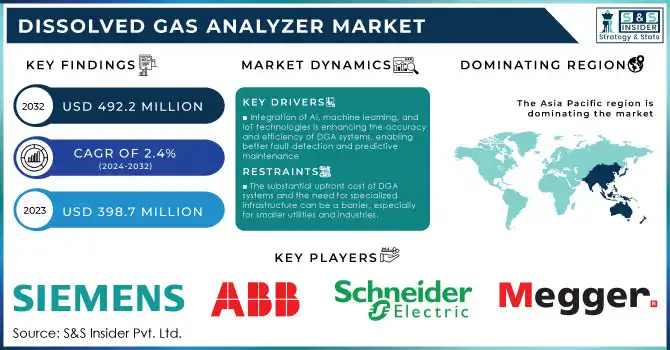

The Dissolved Gas Analyzer Market Size was valued at USD 398.7 Million in 2023 and is expected to reach USD 492.2 Million by 2032, growing at a CAGR of 2.4% over the forecast period 2024-2032.

Increasing global demand for energy and strong government spending on maintenance and monitoring of the energy infrastructure are factors likely to drive the growth of the dissolved gas analyzers (DGA) market. The growing embrace of smart grid technology is increasing the demand for DGA systems as they are essential to detecting failures in transformers and avoiding future breakdowns. The U.S. Department of Energy recently reported that in 2023, the federal government invested about USD 10 billion in transformer monitoring and predictive maintenance programs to ensure grid reliability and resilience. In 2023 too, the European Union had committed an investment of €12 billion to improve grid infrastructure and in particular DGA adoption as part of its Green Deal initiative throughout its member countries, allowing balancing services so that afresh growing share of renewable energy channels supported by grids. In addition, about 30% of the installations of large transformers from the International Energy Agency (IEA) are found in Asia due to fast industrialization and urbanization. With the increased load in power grids, this transition also highlights the vital demand for real-time monitoring solutions such as DGA. This shows that there is great support in many regions around the world for DGA as a proactive maintenance tool, particularly ESOMs with aging grid systems.

The dissolved gas analyzer (DGA) market has been growing, majorly due to the rising awareness and associated benefits of DGA along with investments on utility infrastructure. As demand for smarter and more efficient analyzers rises, particularly from modern users, the market is poised for expansion. Adoption of the smart grid technology and increasing electrification in developing regions, such as the Asia Pacific and North America drive this factor notably. In addition, the increasing concerns about the safety and maintenance of high voltage transformer systems along with government regulation to support DGA systems are further driving their demand. Market growth is also previously anticipated due to the increasing number of power generation plants across the globe during the forecast period.

Market Dynamics

Drivers

-

Integration of AI, machine learning, and IoT technologies is enhancing the accuracy and efficiency of DGA systems, enabling better fault detection and predictive maintenance

-

With the rising demand for reliable power supply and increasing focus on grid modernization, DGA systems are critical for continuous monitoring of transformers, minimizing downtime and reducing operational costs.

Technological advancements such as the integration of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) are among the major drivers in the DGA market. Such innovations have led to a substantial enhancement in DGA system capabilities and deployment, especially for predictive maintenance and fault detection. The use of AI and ML algorithms in DGA systems allows DGA to analyze high volumes of data from transformers and other power assets for patterns that human operators may not be able to see. For instance, by analyzing dissolved gas concentrations in transformer oils, these systems can predict potential failures, reducing the need for unscheduled maintenance and preventing costly breakdowns. According to recent data, AI-powered DGA systems have been proven to increase fault detection rates by 30% when compared to traditional DGA systems.

In addition, IoT connectivity enables real-time monitoring and data sharing across the power grid. This also ensures that maintenance teams are alerted of any irregularities instantly, and even in distant locations, helping to avoid problems escalating. For instance, continuous data integration as provided by online DGA monitors available from a supplier like ABB would help power utilities in taking timely corrective actions and ensure the reliability and safety of critical infrastructure . The operational advantages provided by these technological strides give utilities and industries a strong incentive to implement DGA solutions as they look to improve grid stability and ameliorate operational risk.

Restrain

-

The substantial upfront cost of DGA systems and the need for specialized infrastructure can be a barrier, especially for smaller utilities and industries.

-

Existing infrastructure may not always be compatible with advanced DGA systems, limiting their adoption in regions with older power grids

The high initial investment cost is one of the major restraints for the DGA market. DGA solutions help provide transformer health and costly failure avoidance perspectives to utilities, but due to the high upfront costs for purchasing and implementing such advanced condition monitoring systems; they can be prohibitive in many utility and industry segments. If a company simply cannot justify the investment but does have existing infrastructure in place, or is lacking sufficient means for integrating smaller companies those with limited budgets may take an even bigger hit. However, there are continuing costs such as system maintenance, ongoing software updates, and staff training to operate the technology effectively. These factors might discourage adoption, especially where electricity usage is low or in businesses that have yet to upgrade their grid systems to facilitate the use of such advanced monitoring implements.

Segmentation Analysis

By Extraction Type

In 2023, the vacuum extraction or rack method dominated the dissolved gas analyzer market by occupying 75% of the total market share. The reason why this approach is so popular is that it can remove dissolved gases from an oil sample without damaging their chemical structures, making sure that the data obtained will be as accurate as possible. The vacuum extraction method is in line with government initiatives promoting dependable and accurate transformer diagnostics. For example, Japan's Ministry of Economy, Trade and Industry (METI) released a report elaborating that 80% of its high-voltage transformers undergo DGA testing with vacuum extraction methods highlighting the preferred status of this method for regions with developed power landscapes. Its widespread adoption stems from its compatibility with a range of DGA devices, providing utilities with a cost-effective and efficient solution.

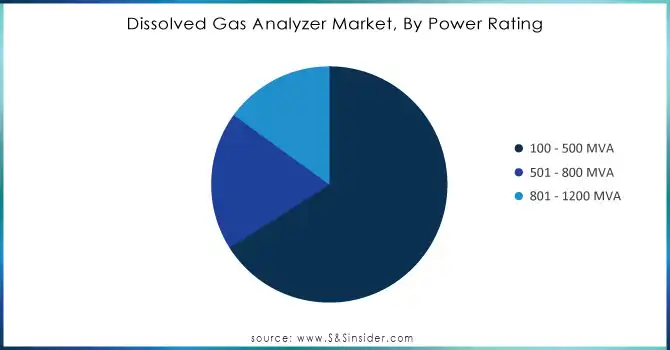

By Power Rating

The dissolved gas analyzer market was dominated by the 100 – 500 MVA category with a major share of revenue of 66% in the year 2023. The dominance of transformers in this power range is primarily due to their unparalleled importance for use in industrial sectors, where continuous power supply is critical. As per the report published by the India Ministry of Power in 2023, an estimated 60% of newly added capacity belonged to a range of transformers in between 100 - 500 MVA demand for DGA systems specific to such transformers is expected to drive growth over the forecast period. DGA testing is performed more frequently for this power rating class, which is sensitive to overheating and other elements that place stress on its integrity a critical factor in the ongoing reliability of the grid.

Need Any Customization Research On Dissolved Gas Analyzer Market - Inquiry Now

By Analysis Type

In 2023, the DGA market was dominated by laboratory services, accounting for the largest revenue share of 38% in 2023. Laboratory testing provides the accuracy and thorough feedback necessary to survive these high-stake applications when used to manage power infrastructure. New government publications released by the U.S. Department of Energy indicate that more than 45% of utility companies in the U.S. selected laboratory-based DGA testing this year further solidifying lab services as a competitive standard for accurate, detailed gas analysis.

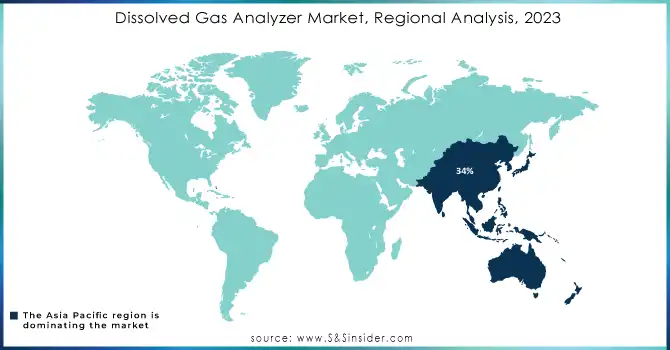

Regional Analysis

In 2023, Asia Pacific held the largest revenue share of 34% in the dissolved gas analyzer (DGA) market. The region’s market leadership can be attributed to the rapid industrialization, urbanization, and growing energy infrastructure in key nations such as China and India. DGA systems are in great demand due to the burgeoning pressure on existing power generation and distribution capacity, therefore requiring reliable transformer diagnostics. China National Energy Administration (NEA) announced that investment in the modernization of the grid investments in 2023 surged by 18%, which increases the important role of DGA systems in ensuring reliable Transformers at High-Stress Applications. In turn, India’s Ministry of Power noted a 12% increase in new DGA solutions year-on-year, largely due to greenfield energy projects and aging transformers where continuous real-time monitoring is required. Asia Pacific has come out on top in the DGA market due to increased energy requirements, aging infrastructure, and government assistance.

In contrast, Latin America is projected to register a significant CAGR during the forecast period. The reasons responsible for this growth are enhanced investment in the energy sector, expansion of power grids to accommodate industrial development and renewable energy sources, and so on by countries such as Brazil and Argentina. Brazil's Ministry of Mines and Energy revealed $2.5 billion to be spent on energy infrastructure in 2023, which includes the implementation of DGA systems on key transformer assets. With the Latin American region steadily shifting towards sustainable power generation methods, the need to maintain grid stability is further stimulating demand for DGA systems in the region. A major driving force behind the Latin America DGA market growth is government initiatives with the increasing need for energy reliability demanding faster return on investments through public and private sector partnerships.

Recent Developments

-

Siemens rolled out the new Sitrax DGA dissolved gas analyzer with improved multi-gas detection and IoT-based real-time monitoring in January 2024. This technology allows utilities to optimize transformation diagnostics and prediction maintenance to ensure the reliability of power while reducing the cost of maintenance.

-

The GasSense 3000 is a compact, portable dissolved gas analyzer for field engineers that ABB launched in March 2024. The rapid transformer oil analysis provides on-site diagnostics, minimizes downtime, and increases operational efficiency with multiple gas detection and a user-friendly interface for fast data interpretation.

Key Players

Key Service Providers/Manufacturers in the Dissolved Gas Analyzer Market:

-

Siemens (Sitrax DGA, Sitras X)

-

ABB (GasSense 3000, GasSense 2000)

-

General Electric (GE) (T-Rex DGA, DGA 1000)

-

Schneider Electric (Transformer Monitor, Asset Monitoring Solutions)

-

Mitsubishi Electric (DGA-5000, DGA-1000)

-

Emerson Electric Co. (Rosemount 3051S, DGA 4500)

-

Megger (MPRT 2000, MPDGA-2)

-

HYDRO-WATT (TGI DGA, DGA Kit)

-

Hanwei Electronics (DGA-4, DGA-2 Series)

-

Vaisala (DGA Monitor, Transformer Gas Analyzer)

Users of DGA Services/Products:

-

State Grid Corporation of China

-

National Grid (UK)

-

Florida Power & Light Company

-

Electricité de France (EDF)

-

Tata Power (India)

-

Pacific Gas and Electric (PG&E)

-

Korea Electric Power Corporation (KEPCO)

-

China Southern Power Grid

-

AEP (American Electric Power)

-

Brazilian Energy Group (Eletrobras)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 398.7 Million |

| Market Size by 2032 | USD 492.2 Million |

| CAGR | CAGR of 2.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Extraction Type (Vacuum Extraction or Rack Method, Headspace Extraction, Stripper Column Method, Others) • By Technology (Gas Chromatography, Photo Acoustic Spectroscopy (PAS), Others) • By Power Rating (100 - 500 MVA, 501 - 800 MVA, 801 - 1200 MVA) • By Analysis Type (Smoke Alarms, Early Warning DGA Monitoring, Comprehensive DGA Monitoring, Laboratory Services, Database Software, Portable DGA Devices) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens, ABB, General Electric (GE), Schneider Electric, Mitsubishi Electric, Emerson Electric Co., Megger, HYDRO-WATT, Hanwei Electronics, Vaisala |

| Key Drivers | • Integration of AI, machine learning, and IoT technologies is enhancing the accuracy and efficiency of DGA systems, enabling better fault detection and predictive maintenance • With the rising demand for reliable power supply and increasing focus on grid modernization, DGA systems are critical for continuous monitoring of transformers, minimizing downtime and reducing operational costs. |

| Restraints | • The substantial upfront cost of DGA systems and the need for specialized infrastructure can be a barrier, especially for smaller utilities and industries. |