Advanced Process Control Market Size:

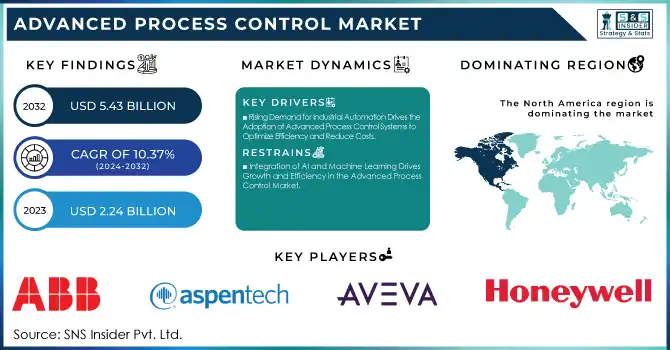

The Advanced Process Control Market was valued at USD 2.24 billion in 2023 and is expected to reach USD 5.43 billion by 2032, growing at a CAGR of 10.37% from 2024-2032.

To get more information on Advanced Process Control Market - Request Free Sample Report

This report includes insight on adoption rates, investments trends, regulatory impacts, customer segments, and implementation timeframes. APC solutions improve operational efficiency whilst minimizing costs and are increasingly being widely implemented across industry sectors. Market growth is driven by investments in automation and process optimization technologies, while regulations and customer demand for sustainability and compliance shape the market dynamics of the process analytical technology market. Getting started faster is important for gaining a competitive edge.

Advanced Process Control Market Dynamics

Drivers

-

Rising Demand for Industrial Automation Drives the Adoption of Advanced Process Control Systems to Optimize Efficiency and Reduce Costs

The rapid drift of industries into automation, in manufacturing, chemicals, and oil & gas in particular, transforms the way their processes are conducted. Advanced Process Control systems spearhead this trend by allowing live monitoring, with reduced human intervention and increased precision in operations. In such an environment, where businesses look to increase the efficiency of production, minimize downtime, and enhance overall output, APC systems allow for smoother operations by optimizing key variables and ensuring consistent quality. This integration of APC within automated environments helps reduce operational costs, optimize resource usage, and maintain high standards in production processes, making automation a critical growth driver in the APC market.

Restraints

-

High Implementation Costs and Integration Challenges Hinder Widespread Adoption of Advanced Process Control Systems

The main disadvantage of Advanced Process Control systems is the high initial investment and the subsequent maintenance costs required to deploy them. The cost of acquiring, installing, and maintaining APC systems is a significant barrier for many industries, especially for small businesses with limited budgets. This increases costs and complicates the implementation process. Specialized training, combined with continuous updates and support, adds to the financial burden. These factors may slow down the widespread adoption of APC, especially in industries where the return on investment may not be clear immediately or in areas where budgetary constraints are the limiting factors for technological up-gradation.

Opportunities

-

Integration of AI and Machine Learning Drives Growth and Efficiency in the Advanced Process Control Market

The integration of Artificial Intelligence and Machine Learning into Advanced Process Control systems is poised to revolutionize the market, enhancing real-time decision-making and predictive maintenance capabilities. These technologies enable APC systems to become more intelligent, thus allowing for faster optimization of processes and reducing downtime. Additionally, the rise of smart manufacturing and Industry 4.0 principles creates a demand for highly automated and efficient systems, providing a significant opportunity for APC adoption. The increasing focus on energy efficiency and environmental sustainability across industries further drives the need for APC solutions. In addition, emerging markets combined with scalable solutions for small and medium-sized enterprises will present future growth in the APC market in terms of integration with AI.

Challenges

-

Integration Complexity with Legacy Systems Creates Barriers to Widespread Adoption of Advanced Process Control Systems

Integrating Advanced Process Control systems with existing infrastructure, especially in industries with legacy systems, is a very challenging task. The process is often complex, requiring customization to ensure seamless compatibility between new APC technologies and older equipment. Time-consuming integration efforts can result in prolonged downtime, affecting overall productivity during the transition period. Moreover, the cost of retrofitting and upgrading existing systems to accommodate APC can be too high for companies with limited budgets. These challenges hinder the adoption of APC systems, as businesses are reluctant to invest in the required infrastructure changes. Overcoming such integration barriers is important to realize the full potential of APC in enhancing operational efficiency in different sectors.

Advanced Process Control Market Segment Analysis

By Enterprise Size

The Large Enterprises segment led the Advanced Process Control Market in 2023, holding around 69% of the revenue share. This is due to their high financial resources, ability to invest in advanced technologies, and requirement for highly efficient, automated processes. The Small & Medium Enterprises segment is expected to grow at the fastest CAGR of 11.95% from 2024-2032, driven by the increasing availability of affordable, scalable APC solutions and the growing demand for automation to improve efficiency and reduce operational costs.

By End Use

The Oil and Gas segment dominated the Advanced Process Control (APC) Market in 2023, holding about 27% of the revenue share, due to the industry's need for precise process optimization, safety, and cost control in complex operations. The Pharmaceuticals is expected to lead with the highest CAGR of 14.04% in the forecast period of 2024-2032, owing to the need for increased regulatory compliance for quality of products, better production efficiency, and growing demand for automation in the manufacturing sector to achieve consistency and regulatory compliance.

By Component

Software led the Advanced Process Control Market in 2023, garnering around 44% revenue share, due to the capability of software-based solutions to perform real-time monitoring, process optimization, and data analytics, all of which play a vital role in enhancing the efficiency of businesses. The Service segment is expected to grow at the fastest CAGR of 12.38% from 2024-2032, supported by the increase in demand for maintenance, consulting, and training services to be able to provide support for implementing, optimizing, and troubleshooting the APC systems from different industries.

By Technology

The Advanced Regulatory Control segment dominated the Advanced Process Control (APC) Market in 2023, capturing about 33% of the revenue share, due to its widespread application in maintaining optimal process conditions and ensuring regulatory compliance across industries like oil & gas and chemicals. The Multivariable Model Predictive Control segment is expected to grow at the fastest CAGR of 12.41% from 2024-2032, driven by its ability to handle complex, dynamic processes and optimize performance across multiple variables, making it highly effective in industries requiring advanced process optimization.

Advanced Process Control Market Regional Analysis

In 2023, North America accounted for the highest revenue share of about 38% in the Advanced Process Control Market. The dominance of this region can be attributed to the robust industrial infrastructure, extensive adoption of automation across key sectors such as oil & gas, chemicals, and pharmaceuticals, and significant investments in technological advancements. North America's focus on efficiency, safety, and regulatory compliance further accelerates the demand for APC systems, making it the leader in the market.

Asia Pacific is expected to register a fastest CAGR of around 12.20% during 2024-2032. Factors such as increased pace of industrialization in many emerging economies in this region are responsible for its growth. With the rising adoption of manufacturing and automation technologies, companies are increasingly adopting APC solutions to streamline their operations, save on cost, and meet rising demand. Additionally, the expanding energy and chemical industries in Asia Pacific are poised to contribute significantly to the region's market expansion, making it a key area for APC growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

ABB Ltd. (Advanced Control for Process Industries, ABB Ability System 800xA)

-

Aspen Technology Inc (Aspen DMC3, Aspen Plus)

-

AVEVA Group Limited (AVEVA APC, AVEVA System Platform)

-

General Electric Company (Proficy Process Systems, GE Digital APC)

-

Honeywell International Inc. (Experion PKS, UOP APC)

-

Mitsubishi Electric Corporation (MELSOFT iQ-R Series, Mitsubishi Electric Process Control Solutions)

-

Panasonic Corporation (Panasonic Industrial Process Control, Panasonic PLC Solutions)

-

Rockwell Automation (FactoryTalk InnovationSuite, PlantPAx Distributed Control System)

-

Rudolph Technology (NIR Process Control, APC for Semiconductor Manufacturing)

-

SAP SE (SAP Integrated Business Planning, SAP Predictive Analytics)

-

Siemens (SIMATIC PCS 7, Siemens Process Control Solutions)

-

Yokogawa Electric Corporation (CENTUM VP, ProSafe-RS)

-

Emerson Process Management (DeltaV Control Systems, AMS Device Manager)

-

Schneider Electric (EcoStruxure Automation Expert, Foxboro Evo DCS)

-

Invensys (Wonderware System Platform, InFusion Enterprise Control System)

-

Endress+Hauser (Picomag, Liquiphant FTL51)

-

Linde Engineering (Linde Process Control Systems, Smart Cluster Control)

-

Kroger Inc. (Kroger Process Optimization Solutions, Process Control Systems)

-

Veolia North America (Veolia Water Solutions, Smart Process Optimization Tools)

Recent Developments:

-

In January 2024, ABB launched a new process automation solution for the cold block stage of beer production, aimed at optimizing processes, reducing energy and water consumption, and enhancing productivity.

-

In 2024, Rockwell Automation introduced FactoryTalk Analytics Pavilion8, an advanced control and optimization software platform that integrates with any control system to provide real-time insights and enhance process stability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.24 Billion |

| Market Size by 2032 | USD 5.43 Billion |

| CAGR | CAGR of 10.37% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Service) • By Technology (Advanced Regulatory Control, Multivariable Model Predictive Control, Sequential Control, Inferential Control, Compressor Control) • By Enterprise Size (Small & Medium Enterprises, Large Enterprises) • By End Use (Oil and Gas, Chemicals, Pharmaceuticals, Energy & Power, Paper & Pulp, Mining, Minerals, and Metals, Food & Beverages, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Ltd., Aspen Technology Inc., AVEVA Group Limited, General Electric Company, Honeywell International Inc., Mitsubishi Electric Corporation, Panasonic Corporation, Rockwell Automation, Rudolph Technology (Onto Innovation), SAP SE, Siemens, Yokogawa Electric Corporation, Emerson Process Management, Schneider Electric, Invensys (now part of Schneider Electric), Endress+Hauser, Linde Engineering, Kroger Inc., Veolia North America. |