Seeding and Planting Robots Market Size Analysis:

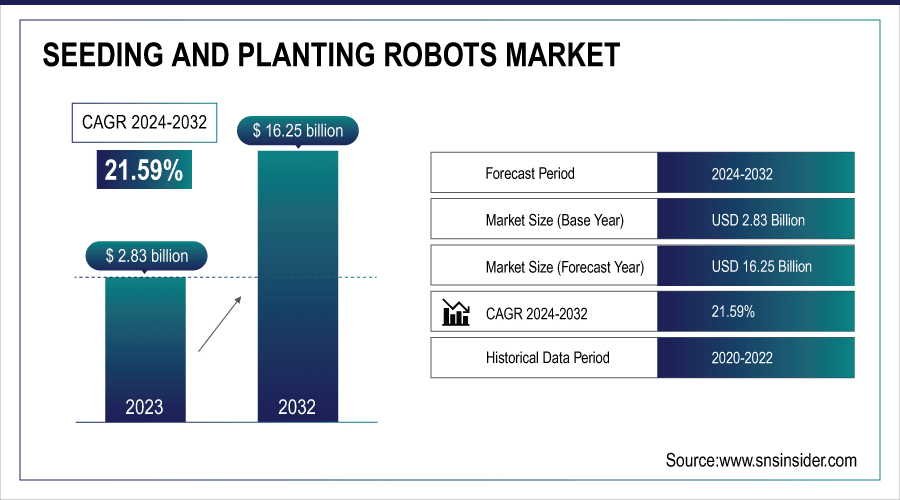

The Seeding and Planting Robots Market Size was valued at USD 2.83 billion in 2023 and is expected to reach USD 16.25 billion by 2032 and grow at a CAGR of 21.59% over the forecast period 2024-2032. This growth is driven by the increasing demand to enhance agricultural efficiency, minimize dependence on manual labor, and meet food security issues through precision farming. These robots facilitate even seed distribution and optimal planting, leading to increased yields and resource utilization. Sustained advancements in autonomous systems, machine learning, and real-time monitoring of fields are revolutionizing conventional farming methods. Whereas North America remains a market leader, Asian-Pacific nations are observing an accelerated rate of adoption led by government push, growing farm mechanization, and increasing consciousness across commercial farmers as well as small-scale ones.

To Get More Information On Seeding and Planting Robots Market - Request Free Sample Report

The U.S. Seeding and Planting Robots Market size was USD 0.61 billion in 2023 and is expected to reach USD 2.81 billion by 2032, growing at a CAGR of 18.53% over the forecast period of 2024–2032. This development is fueled by mounting labor shortages in the agricultural sector, growing demand for farm production efficiency, and rapid uptake of high-tech farming technologies. Autonomous and sensor-based robotic systems are being used more and more by U.S. farmers to increase planting accuracy, lower operational costs, and maximize crop yields. Government backing for smart agriculture and funding for agritech startups are adding further market vigor. The availability of major players, technological advancement, and large-scale commercial farming activities remains to keep the U.S. at the forefront as a progressive and leading player in the international agricultural robot industry.

Seeding & Planting Robots Market Dynamics

Key Drivers:

-

Rising Need for Precision Agriculture and Autonomous Technologies Fuels Growth in the Seeding and Planting Robots Market.

The growing demand for precision agriculture is a key driver propelling the use of seeding and planting robots. The farmers are forced to increase productivity while lowering the cost of inputs and minimizing their environmental footprint. The robots provide improved seed placement accuracy, uniform depth and spacing, and data-based information that assists in optimizing crop yields. In addition, the incorporation of technologies like GPS guidance, machine vision, and AI provides real-time decision-making and automation of monotonous tasks. With ongoing labor shortages affecting the agricultural industry, particularly in developed economies, autonomous solutions are emerging as crucial tools for optimized farm operations. The increased availability of affordable and scalable robotic solutions has made it more convenient for large and small-scale farmers to embrace them. With agriculture increasing its reliance on technology, precision farming will be the driving factor that will continue to fuel the growth in the seeding and planting robots market.

Restrain:

-

High Initial Investment and Maintenance Costs Hinder the Widespread Adoption of Seeding and Planting Robots.

The initial capital outlays continue to be a deterrent for most farmers, particularly in the developing world. The expense of buying, installing, and integrating these robots into existing farm structures can be deterrent enough for small- and medium-scale agricultural operations. Additionally, the cost does not stop there with procurement. Regular maintenance, software patches, and expert labor for operation and troubleshooting add more to the overall cost of ownership. Farmers do not want to invest without assurance of a return or without knowing the long-term savings. Where agricultural subsidies are non-existent or limited, this cost factor is even greater. Therefore, though technologically ready, affordability is still a key bottleneck. Until the price of robotic systems becomes more affordable and financing arrangements are enhanced, adoption will be slower among resource-limited farming communities.

Opportunities:

-

Rising Government Support and Smart Farming Initiatives Create Growth Opportunities for Seeding and Planting Robots Market Expansion.

Government-backed programs encouraging smart farming practices offer a substantial opportunity for the seeding and planting robots market. In different countries, public policies are increasingly focusing on digital agriculture to enhance food security, resource efficiency, and environmental sustainability. These initiatives comprise subsidies, grants, and technical support to make advanced technologies such as robotics and AI-based technologies appealing to farmers. Moreover, partnerships among governments, research institutions, and agritech startups are yielding pilot projects and demos that generate awareness and confidence in these innovations. In the US, Europe, and Asia-Pacific, smart agriculture initiatives aren't merely encouraging automation but are also making data-sharing platforms and precision mapping more readily available, which makes integrating robotics into established farm systems less difficult. These initiatives will help minimize the cost factor and knowledge deficit, especially among small and medium-sized farms. As smart agriculture policies increase, the market for seeding and planting robots is expected to grow significantly.

Challenges:

-

Limited Technical Knowledge and Infrastructure in Rural Regions Pose Challenges to Robot Adoption in Agricultural Practices.

Holding back the development of the seeding and planting robots market is the low technical expertise among farmers, particularly in rural and remote regions. Although advanced robotics is becoming more widely available, its effective utilization demands some degree of digital literacy, experience with software interfaces, and rudimentary troubleshooting capabilities. In most developing areas, farmers don't have access to training facilities, internet services, and proper power grids, all of which are necessary for running and fixing robotic systems. Furthermore, the unavailability of local maintenance and repair service providers scares farmers away from adopting such technologies. In the absence of proper support networks, even highly technological solutions get used sparingly or left unused altogether. Closing this digital gap is essential to the mass adoption of robotics in agriculture. Until rural communities are provided with the infrastructure and education needed, the potential of seeding and planting robots will go unrealized in much of the world market.

Planting and Seeding Robots Market Segment Outlook:

By Technology

The Autonomous Robots segment held the largest revenue share of 35.69% in 2023, owing to the growing demand for labor-free, efficient agricultural solutions. These robots are independent with GPS, sensors, and vision systems to plant seeds accurately in extensive fields. Major companies such as Deere & Company have pushed this segment forward by launching the 8R Autonomous Tractor, improving planting accuracy, and diminishing manual intervention. Naïo Technologies' autonomous field robots, such as Dino, also serve sustainable agriculture. The use of autonomous robots in seeding and planting on a large scale lowers the cost of operations and increases productivity, making it a market-leading technology.

The Machine Learning and AI Integration segment is anticipated to advance at the Fastest CAGR of 22.91% over the forecast period 2024–2032, revolutionizing planting operations with real-time decision-making and adaptive learning. AI empowers robots to examine soil, weather, and crop information for optimized seed placement. Blue River Technology's See & Spray applies AI to plant-level detection and precision application, featuring real-time ML deployment. IBM's Watson Decision Platform for Agriculture supports predictive planting strategies. These innovations empower more intelligent and sustainable agriculture. As AI technology matures, its use in seeding robots will fuel huge innovations and uptake in precision agriculture methods.

By Robot Type

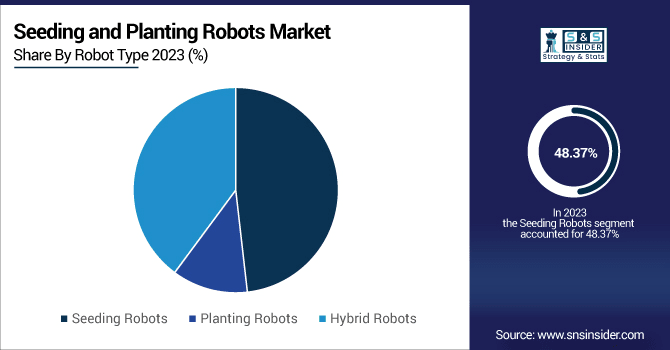

The Seeding Robots accounted for the Highest revenue share of 48.37% in 2023, as more farmers embrace automation to improve planting efficiency and precision. The seeding robots simplify the seeding process through even depth, spacing, and speed, ultimately boosting crop yield. Agrobot and PrecisionHawk are among the companies that have launched purpose-built robotic systems for row crops and large plantings. Deere & Company's precision seeding solutions combine GPS and autonomous capabilities, allowing data-driven planting decisions. The need for high-performance, dependable seeding technologies continues to increase, cementing this segment's dominance in the Seeding and Planting Robots Market.

The Hybrid Robots are becoming the fastest-growing category with an estimated CAGR of 22.85% during the period 2024-2032, driven by their multi-functionality. Hybrid robots integrate seeding, planting, monitoring, and even weeding operations, providing farmers with more flexibility and cost savings. Naïo Technologies and Blue River Technology have introduced multi-purpose robotic platforms that can carry out concurrent agricultural operations with high accuracy. The Naïo Oz robot, for instance, provides seeding and soil preparation in one step. As farms look to adopt integrated solutions to save labor and enhance efficiency, hybrid robots are poised to have a tremendous influence on the future of the Seeding and Planting Robots Market.

By Application

The Farming Agriculture segment led the Seeding and Planting Robots Market with a 53.66% revenue share in 2023 due to the need for high-efficiency, large-scale seeding solutions. The robots are mainly applied in row-crop farming for crops such as corn, wheat, and soybeans, where speed and precision are paramount. Corporations like Deere & Company and AGCO Corporation have invested in sophisticated autonomous tractors and robotic seeders that are highly tailored to specific open-field farm requirements. Examples include Deere's ExactEmerge planters, which allow for high-precision, high-speed planting options. As production is maximized and labor needs minimized, market leadership is accelerated by seeding robot adoption in broad-acre farming.

The Greenhouse Farming will expand at the Fastest CAGR of 23.62% over the forecast period, fueled by increasing controlled-environment agriculture and year-round production demand. Seeding and planting robots for greenhouses facilitate accurate placement of crops, lower human error rates, and make optimal use of space. Organizations such as Iron Ox and Spread Co., Ltd. have made automated greenhouse systems with robotics implementation for planting and transplanting. For instance, Iron Ox employs robots autonomously to oversee seeding and plant care within AI-driven greenhouses. As climate-resilient agriculture catches pace, robotics integration in the functioning of greenhouses is accelerating the Seeding and Planting Robots Market transformation at a speedy pace, particularly in urban and peri-urban settings.

By End-User

The Commercial Farmers segment dominated the Seeding and Planting Robots Market with a 51.97% revenue share in 2023 due to large-scale farming operations that want to maximize efficiency and productivity. These farmers spend heavily on autonomous and precision planting technologies to cut labor expenses and achieve consistent yields. Organizations such as Deere & Company and AGCO Corporation have engineered their offerings, like the Fendt Momentum Planter and John Deere's autonomous tractors, to suit commercial farms' scalability requirements. Commercial farms are progressively using robotic systems to simplify seeding operations amid escalating global demand for food, thus cementing the market leadership of this segment.

The Agricultural Cooperatives segment will lead the growth with the Fastest CAGR of 23.66% through 2024–2032 due to collective investment in sophisticated farming technology. Cooperatives enable small and medium-scale farmers to use high-cost innovations such as seeding and planting robots through collective ownership. Firm partners such as Trimble and Naïo Technologies facilitate this model by providing scalable, plug-and-play solutions that are appropriate for group farm operations. For instance, Trimble's precision planting solutions are growing increasingly popular among cooperatives for increasing regional output. While the cooperative model increases its popularity in Europe, Asia, and Latin America, it is largely driving robotic adoption, particularly in resource-limited but cooperative farming communities.

Seeding and Planting Robots Market Regional Analysis:

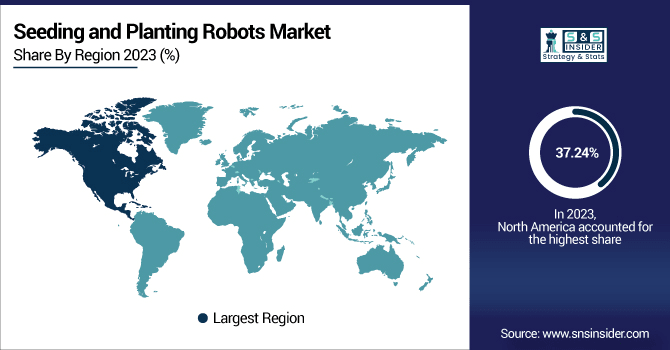

The North America segment led the Seeding and Planting Robots Market with a revenue share of 37.24% in 2023, owing to the immense uptake of precision farming solutions, lack of workforce, and solid technological framework. Prominent firms such as John Deere, AGCO Corporation, and Trimble have unveiled groundbreaking autonomous tractors, seeding robots, and precision planting tools that cater specifically to the requirements of commercial-level farmers in the U.S. and Canada. Strong rural focus of the region, also backed by public incentives for smart farming, otherwise enhances market development. The prosperous agritech domain of North America makes it an industry leader of the Seeding and Planting Robots Market due to extensive implementations of autonomous units in various kinds of farming enterprises.

The Asia Pacific market is anticipated to grow at the Fastest CAGR of 23.24% over the forecast period, led by rising demand for agricultural automation and an emerging need for food security. China, India, and Japan are among the countries making huge inroads towards using seeding and planting robots, caused by increased agricultural activities and encouragement from the government for the modernization of farming. Firms such as Naïo Technologies and Agribotix have introduced products appropriate for the region's varied agricultural requirements, providing affordable, scalable solutions. As the region's agriculture moves towards high-efficiency, technology-based farming, the Seeding and Planting Robots Market is set to grow at a fast pace in Asia Pacific.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Seeding and Planting Robots Companies are:

-

Agrobot – (Strawberry Harvester, Bug Vacuum)

-

Blue River Technology – (See & Spray™, LettuceBot)

-

Harvest Automation – (OmniVeyor HV-100, OmniVeyor TM-100)

-

PrecisionHawk – (Lancaster Drone, PrecisionAnalytics)

-

AGCO Corporation – (Fendt Momentum Planter, Massey Ferguson Planter)

-

AgEagle Aerial Systems Inc. – (eBee Ag Drone, MicaSense RedEdge Sensor)

-

Agribotix LLC – (Agribotix Field Analyzer, Agribotix Drone Data Processing)

-

Lely Industries – (Lely Vector Feeding System, Lely Juno Feed Pusher)

-

Naïo Technologies – (Dino, Oz)

-

Deere & Company – (ExactShot, 8R Autonomous Tractor)

Recent Development:

-

In February 2025, John Deere announced new planter technologies, including seed-level sensing, fertilizer-level sensing, and active vacuum automation, to optimize planting efficiency and provide real-time data to farmers.

-

In November 2023, Naïo's allows the entire fleet of robots to operate autonomously without human supervision, enhancing efficiency and addressing labor shortages.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.83 Billion |

| Market Size by 2032 | USD 16.25 Billion |

| CAGR | CAGR of 21.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Technology (Autonomous Robots, Teleoperated Robots, Sensor-Based Systems, Machine Learning and AI Integration) •By Robot Type (Seeding Robots, Planting Robots, Hybrid Robots) •By Application (Agricultural Farming, Horticultural Operations, Forestry and Reforestation, Greenhouse Farming) •By End-User (Commercial Farmers, Small Scale Farmers, Agricultural Cooperatives, Research and Development Institutions) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Agrobot, Blue River Technology, Harvest Automation, Precision Hawk, AGCO Corporation, AG Eagle LLC, Agribotix LLC, Lely Industries, Naio Technologies, Deere & Company |