Distributed Antenna System (DAS)Market Report Scope and Overview:

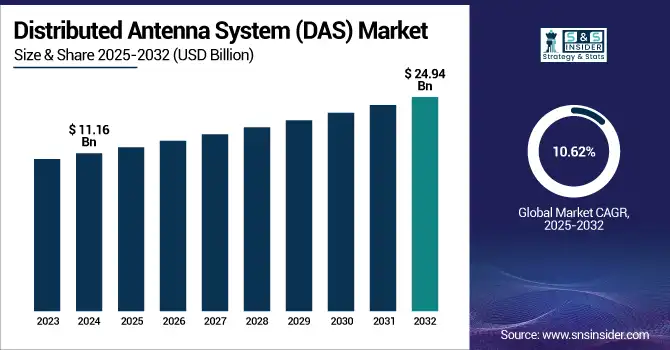

The Distributed Antenna System (DAS) Market Size was valued at USD 12.35 Billion in 2024. It is estimated to reach USD 27.68 Billion by 2032, growing at a CAGR of 10.62% during 2025-2032.

The distributed antenna system (DAS) market has emerged as a crucial component in enhancing wireless communication capabilities across various sectors, including healthcare, retail, and transportation. One of the key factors contributing to the expansion of the DAS market is the surge in data traffic, fueled by the advent of 5G technology. In the first quarter of 2024, the global adoption of 5G technology surged to nearly two billion connections, with an impressive addition of 185 million new connections. North America led this expansion, with 5G connections constituting 32% of all wireless cellular connections, reflecting an 11% growth and 22 million new connections, totaling 220 million in the region. Latin America also showed robust growth, adding eight million new 4G LTE connections for a total of 591 million, while its 5G connections reached 48 million after an addition of nine million new connections. With 5G offering significantly higher bandwidth and lower latency, the need for robust infrastructure becomes paramount. DAS plays a vital role in addressing coverage gaps in urban areas, ensuring that users experience consistent connectivity, even in densely populated spaces such as stadiums, airports, and shopping malls. Moreover, with the Internet of Things (IoT) ecosystem expected to grow significantly and projected to reach 6 billion subscriptions by 2032, the reliance on DAS will intensify. As IoT devices proliferate and demand for low-latency connectivity increases, DAS can enhance network capacity and enable operators to manage the heightened data traffic effectively.

Get more information on Distributed Antenna System (DAS) Market - Request Sample Report

Distributed Antenna System (DAS)Market Size and Forecast:

-

Market Size in 2024 USD 12.35 Billion

-

Market Size by 2032 USD 27.68 Billion

-

CAGR 10.62% from 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025–2032

-

Historical Data 2021–2023

Distributed Antenna System (DAS)Market Highlights:

-

Growing need for connectivity due to increasing mobile device usage and 5G deployment drives demand for seamless coverage in crowded areas like stadiums, malls, offices, and city centers

-

Rising IoT device adoption requires strong network coverage, efficient signal distribution, and minimal dead spots

-

Smart city projects necessitate reliable communication infrastructure for traffic management, energy systems, and public safety, boosting DAS adoption

-

Expansion of commercial buildings, airports, hospitals, and public venues increases the need for tailored, high-capacity wireless coverage

-

Small cells, Wi-Fi networks, and traditional cellular towers provide competitive connectivity solutions, sometimes limiting DAS implementation

-

Small cell networks are often cheaper and easier to deploy while existing Wi-Fi infrastructure reduces the urgency for new DAS installations

In addition to urban areas, DAS is increasingly being deployed in enterprise settings, where organizations require reliable wireless communication for day-to-day operations. For instance, hospitals have recognized the importance of DAS in supporting critical communication between medical devices, staff, and patients. In healthcare facilities, seamless connectivity can be a matter of life and death, making DAS an essential component in ensuring that caregivers can access real-time patient data without interruption. Furthermore, DAS can facilitate the use of telemedicine solutions, enhancing patient care by enabling remote consultations and monitoring.

Distributed Antenna System (DAS)Market Drivers:

-

The increased need for better mobile connectivity is a key factor in driving the growth of the distributed antenna system (DAS) market.

As mobile devices become increasingly common in everyday life, users anticipate uninterrupted connections, even in difficult situations. Conventional mobile networks frequently face difficulties in offering sufficient coverage in crowded locations like stadiums, shopping malls, and city centers. DAS provides a remedy by placing numerous antennas around an area, effectively broadening the reach and capability of cell signals. This need is especially noticeable as the implementation of 5G networks speeds up. The benefits promised by 5G technology, such as faster data speeds and lower latency, necessitate a more closely spaced network of antennas. As a result, companies, local governments, and service providers are making investments in DAS installations to address these demands. Improved service quality is a result of enhanced coverage, which in turn leads to higher data consumption and increased user satisfaction. As mobile services become increasingly essential for consumers' communication, entertainment, and business needs, the demand for reliable coverage puts more pressure on operators, leading to the expansion of the DAS market. Additionally, the increasing number of IoT devices adds to the need for strong mobile network coverage. With the increasing number of devices utilizing cellular networks, the efficient distribution of signals becomes crucial. DAS systems aid in handling the higher demand by enhancing signal strength and minimizing dead spots, facilitating the seamless operation of a variety of IoT applications. The tendency is expected to persist as businesses implement IoT solutions, increasing the demand for sophisticated DAS infrastructure.

-

The DAS market benefits greatly from the growth of smart cities and improvements in infrastructure development.

Smart cities strive to improve residents' quality of life through technology, efficiency, and connectivity. This project needs a strong communication structure that can handle different services like transportation, energy management, and public safety. DAS effortlessly integrates into this vision, offering the essential network coverage and connectivity for intelligent applications. With government and city planners investing in smart city infrastructure, the implementation of DAS is crucial. Intelligent traffic management systems rely on real-time data transfer to improve traffic flow, lessen congestion, and increase the efficiency of public transportation, as instance. DAS ensures that reliable communication is maintained across urban landscapes, even in densely populated areas. Moreover, the continued development of commercial buildings, airports, hospitals, and public venues continues to drive the demand for DAS. These establishments need strong wireless networks to meet the demands of residents, staff, and guests. DAS systems provide personalized coverage designed for the specific needs of different environments, such as high-capacity data needs in corporate offices or improved communication for emergency services in hospitals.

Distributed Antenna System (DAS)Market Restraints:

-

Various alternative technologies competing for market share create a significant challenge for the Distributed Antenna System market in the competitive landscape.

Small cell networks, Wi-Fi networks, and traditional cellular towers provide comparable features, posing a challenge to DAS systems. As companies look into various ways to improve connectivity, the availability of other choices can hinder the implementation of DAS. Small cell networks, especially, have become popular as a feasible option to DAS. These networks use low-power cellular nodes to enhance coverage and capacity in certain regions. They are frequently cheaper and simpler to implement than DAS, which makes them attractive to organizations looking to improve their wireless networks. Moreover, incorporating small cells into current infrastructure does not require extensive changes, which also helps simplify the installation procedure. Wi-Fi networks also contend with DAS for providing coverage and capacity solutions. Numerous companies already depend on Wi-Fi for their connectivity requirements, especially in indoor settings. Even though DAS offers better cellular coverage, organizations may be reluctant to invest in DAS installations due to their familiarity with and existing investments in Wi-Fi.

Distributed Antenna System (DAS)Market Regional Analysis:

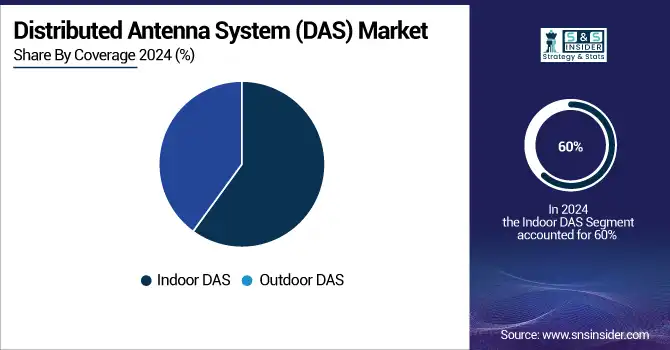

By Coverage

Indoor DAS dominated the DAS market in 2024 with a 60% market share, mainly because it caters to connectivity requirements in crowded settings with poor cellular signals caused by obstacles. Indoor DAS solutions play a crucial role in ensuring continuous and top-notch network coverage in expansive establishments like shopping malls, airports, hospitals, and stadiums. For instance, CommScope has implemented Indoor DAS in stadiums to offer dependable connectivity during high-data usage events. In the same way, TE Connectivity provides Indoor DAS solutions for hospitals, guaranteeing reliable communication for healthcare professionals.

The outdoor DAS is supposed to become the fastest-growing during 2025-2032 because of the increase in infrastructure projects and the demand for strong outdoor connectivity in urban, suburban, and rural regions. Outdoor Distributed Antenna Systems (DAS) are commonly installed in areas like campuses, stadiums, and city centers to enhance mobile network performance in areas with poor coverage. For example, American Tower Corporation has installed Outdoor DAS solutions in main city centers to improve 4G and 5G network coverage for city dwellers. AT&T also uses Outdoor DAS on college campuses to guarantee constant connection in large outdoor areas.

By Ownership

Neutral-host ownership dominated the distributed antenna system (DAS) market in 2024 with a 48% market share, offering a communal infrastructure that can accommodate various carriers and service providers at the same time. This model allows operators to reduce costs and enhance coverage in high-demand areas without requiring several individual installations. Neutral-host DAS installations are becoming more popular in urban areas, malls, and big venues, allowing multiple service providers to work together. Crown Castle and Mobilitie have successfully installed neutral-host DAS solutions in places like airports and convention centers, enabling different telecommunications companies to utilize the same infrastructure.

The carriers ownership is expected to quickly develop as the most rapidly expanding segment in the distributed antenna system (DAS) market during 2025-2032. In this scenario, telecom companies invest in and oversee DAS systems to improve network coverage and capacity in busy locations such as stadiums, airports, and large commercial buildings. The rising need for mobile connectivity and data services is driving this growth, as carriers strive to enhance user experiences and cater to the requirements of 5G technologies. Major carriers like AT&T and Verizon have implemented DAS solutions at venues like the AT&T Stadium in Texas and MetLife Stadium in New York.

By Signal Source

The small cell held the dominant position in 2024 with a market share of 45%. Small Cells are condensed base stations that improve cellular coverage and capacity, especially in densely populated areas. Their purpose is to enhance the current macro network by diverting traffic and enhancing user satisfaction. The increase in smartphones and mobile data services has led to a growing need for Small Cells, which offer uninterrupted connectivity in city settings, shopping centers, and sports venues. Firms such as AT&T and Verizon make use of Small Cells in crowded city locations to enhance network performance. For example, Verizon has installed Small Cells in New York City to guarantee dependable service during busy times and special occasions.

The off-air antenna segment is expected to have the fastest CAGR during 2025-2032 in the DAS market. These antennas gather signals from neighboring cell towers and disperse them indoors or in limited spaces, enhancing cellular coverage without requiring substantial infrastructure. Off-air antennas are especially useful in settings like big corporate offices, convention centers, and distant areas with poor conventional signal sources. CommScope and Corning are at the forefront of implementing Off-Air Antennas due to their quick-to-deploy and scalable solutions. For instance, CommScope has effectively installed Off-Air Antenna systems in different tall buildings, allowing companies to improve their mobile communication abilities without the expensive process of laying down new fiber.

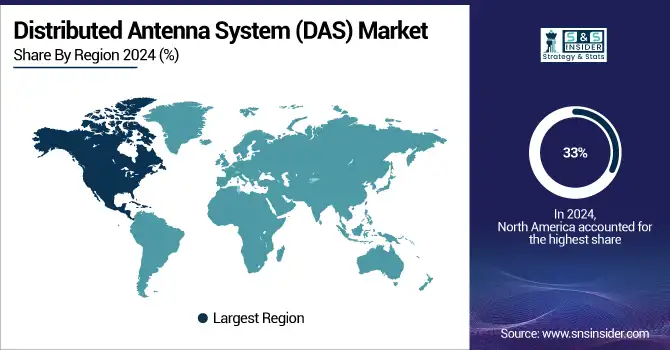

Distributed Antenna System (DAS)Market Regional Analysis:

North America Distributed Antenna System (DAS)Market Trends:

In 2024, North America led the distributed antenna system (DAS) market with a 33% market share because of the strong need for improved wireless communication infrastructure, especially in cities. Significant investments in DAS technology are driven by the region's top telecommunications network and the participation of major companies like Corning, CommScope, and Verizon. Additionally, the market is driven further by the rise in the use of 5G technology and the increasing demand for continuous connectivity in places like stadiums, airports, and offices. AT&T and other companies are implementing DAS solutions to ensure strong coverage and capacity in crowded areas.

Asia-Pacific Distributed Antenna System (DAS)Market Trends:

The APAC region is anticipated to experience a rapid growth rate during 2025-2032 in the distributed antenna systems market due to fast urbanization, population expansion, and rising smartphone usage. Nations such as China, India, and Japan are seeing a rise in mobile data usage, requiring enhancements to wireless networks. The area's fervent focus on 5G networks and smart city projects is hastening the adoption of DAS. NEC Corporation and Huawei are taking the lead in implementing DAS installations to improve connectivity in cities and large public spaces.

Europe Distributed Antenna System (DAS) Market Trends:

In 2024, Europe held a significant share of the DAS market, driven by advanced urban infrastructure, high smartphone penetration, and increasing demand for uninterrupted connectivity in airports, railways, and office complexes. The rollout of 5G networks is accelerating DAS adoption, with major players such as Ericsson, CommScope, and Nokia leading installations to enhance wireless coverage and capacity in densely populated cities.

Latin America Distributed Antenna System (DAS) Market Trends:

Latin America’s DAS market is growing as cities modernize infrastructure and mobile data usage surges. Key drivers include demand for seamless wireless coverage in commercial spaces and public venues. Telecom operators and DAS providers like CommScope, Corning, and Huawei are expanding deployments across Brazil, Mexico, and Argentina to support the rollout of 5G networks and enhance connectivity in urban centers.

Middle East & Africa Distributed Antenna System (DAS) Market Trends:

The Middle East & Africa region is witnessing steady DAS growth due to expanding urban centers, increased mobile subscriptions, and rising investments in smart city and digital infrastructure projects. Countries like the UAE, Saudi Arabia, and South Africa are deploying DAS to support 4G/5G networks, with companies such as Huawei, Ericsson, and Corning actively participating to improve network reliability in stadiums, malls, and airports.

Get Customized Report as per your Business Requirement - Request For Customized Report

Distributed Antenna System (DAS)Market Key Players:

-

CommScope (ION-E, Era C-RAN DAS)

-

Corning (ONE Wireless Platform, Optical Network Evolution)

-

TE Connectivity (FlexWave Prism, InterReach Fusion)

-

American Tower Corporation (ATC DAS, MetroCell)

-

AT&T (DAS Small Cells, Cellular DAS Solutions)

-

Boingo Wireless (Converged DAS, Cellular DAS)

-

Comba Telecom (ComFlex DAS, Champion II DAS)

-

SOLiD Technologies (ALLIANCE DAS, EXPRESS DAS)

-

Dali Wireless (Matrix DAS, t-Series Digital DAS)

-

Ericsson (DOT Indoor DAS, Radio Dot System)

-

Huawei (LampSite, LampSite Sharing)

-

Nokia (Flexi Zone DAS, AirScale Indoor Radio)

-

ZTE Corporation (QCell, Easy Macro DAS)

-

Betacom Incorporated (Private DAS, Public Safety DAS)

-

Galtronics Corporation (PEAR DAS, VertuPro DAS Antennas)

-

Fiber-Span (Fiber DAS Solutions, Mobile DAS Solutions)

-

JMA Wireless (XRAN DAS, TEKO DAS)

-

Axell Wireless (Idas, D-Cell DAS)

-

Advanced RF Technologies (ADRF) (ADRF ADX V DAS, PSR-VU DAS)

-

Anixter (Anixter Wireless DAS, DAS Indoor Solutions)

Suppliers Providing Components to DAS Key Players

-

Broadcom (RF Amplifiers, RF Filters)

-

Analog Devices (Power Amplifiers, DAS Modems)

-

Texas Instruments (Data Converters, Amplifiers)

-

NXP Semiconductors (RF Power Transistors, RF Modulators)

-

Qorvo (Power Amplifiers, DAS Filter Modules)

-

Murata Manufacturing (Capacitors, Inductors)

-

Skyworks Solutions (RF Front-End Modules, Low Noise Amplifiers)

-

Keysight Technologies (Signal Generators, Spectrum Analyzers)

-

Infineon Technologies (Power Semiconductors, RF Transistors)

-

MACOM (DAS Diodes, Power Amplifiers)

Distributed Antenna System (DAS)Market Competitive Landscape:

Toshiba Infrastructure Systems & Solutions Corporation, established in 2017 and headquartered in Kawasaki, Japan, specializes in social infrastructure technologies. The company develops, manufactures, and sells advanced systems and services, focusing on transportation and communication solutions. In 2024, it introduced the ART3711, a 5G Distributed Antenna System enabling efficient network sharing and supporting 4x4 MIMO technology for urban deployments.

-

January 2024: Toshiba introduced the ART3711, a fresh 5G distributed antenna system for Neutral Host Applications. The ART3711 allows several mobile network operators (MNOs) to share the same infrastructure, increasing resource efficiency and speeding up the expansion of 5G networks.

CommScope Holding Company, Inc. Founded in August 1976 by Frank M. Drendel and Jearld Leonhardt, CommScope is a global leader in network infrastructure solutions. Headquartered in Claremont, North Carolina, the company designs, manufactures, and supports hardware and software that enable broadband, enterprise, and wireless networks. In 2019, CommScope acquired Arris International and Ruckus Networks, expanding its portfolio.

-

July 2024: CommScope, a major player in network connectivity worldwide, revealed it has signed a firm contract to offload its Outdoor Wireless Networks (OWN) division and the Distributed Antenna Systems (DAS) business unit of its Networking, Intelligent Cellular & Security Solutions segment to Amphenol Corporation.

Ericsson (Telefonaktiebolaget LM Ericsson) Founded in 1876 by Lars Magnus Ericsson in Stockholm, Sweden, Ericsson is a global leader in telecommunications and networking technology. The company provides hardware, software, and services to enable the full value of connectivity, supporting the evolution of mobile, broadband, and cloud networks. Ericsson operates in over 180 countries and employs approximately 100,000 people

-

September 2024: Ericsson has introduced its detailed Enterprise 5G plan, with a focus on private and neutral host 5G solutions to improve essential connectivity for businesses in different operational settings.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 12.35 Billion |

| Market Size by 2032 | USD 27.68 Billion |

| CAGR | CAGR of 10.62% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Coverage (Indoor DAS, Outdoor DAS) • By Ownership (Carrier Ownership, Neutral-Host Ownership, Enterprise Ownership) • By Frequency Protocol (Cellular, VHF/UHF, Others) • By Signal Source (On-site Base Transceiver Station, Off-Air Antennas, Small Cell) • By User Facility Area (>500 K SQ. FT., 200–500 K SQ. FT., <200 K SQ. FT.) • By Application (Public Venue & Safety, Hospitality, Airport & Transportation, Healthcare, Education Sector & Corporate Offices, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | CommScope, Corning, TE Connectivity, American Tower Corporation, AT&T, Boingo Wireless, Comba Telecom, SOLiD Technologies, Dali Wireless, Ericsson, Huawei, Nokia, ZTE Corporation, Betacom Incorporated, Galtronics Corporation, Fiber-Span, JMA Wireless, Axell Wireless, Advanced RF Technologies, Anixter |