Virtual Machine Market Report Scope & Overview:

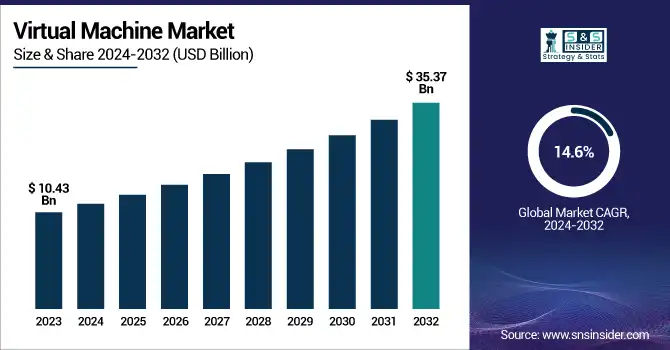

The Virtual Machine Market Size was valued at USD 10.43 billion in 2023 and is expected to reach USD 35.37 billion by 2032 and grow at a CAGR of 14.6% over the forecast period 2024-2032.

To Get more information on Virtual Machine Market - Request Free Sample Report

The Virtual Machine (VM) Market is witnessing rapid growth driven by increasing cloud adoption, demand for cost-efficient computing, and the need for scalable IT infrastructure. Organizations across industries are leveraging VMs to optimize resource utilization, enhance security, and enable seamless workload management. Cloud-based VMs are seeing high adoption, particularly in hybrid and multi-cloud environments, allowing businesses to achieve flexibility and operational efficiency. Advancements in hypervisor technology, containerization, and AI-driven workload optimization are reshaping the market.

The U.S. Virtual Machine (VM) Market size was USD 2.61 billion in 2023 and is expected to reach USD 8.09 billion by 2032, growing at a CAGR of 13.4% over the forecast period of 2024-2032. The U.S. Virtual Machine Market is experiencing steady growth, driven by the increasing adoption of cloud computing, virtualization, and AI-driven workloads. Businesses are leveraging VMs for cost-effective infrastructure management, enhanced scalability, and improved operational efficiency. The rising demand for hybrid and multi-cloud environments, coupled with advancements in hypervisor technologies, is further fueling market expansion. Additionally, investments in secure and high-performance computing solutions are shaping the future of the U.S. Virtual Machine market.

Virtual Machine Market Dynamics

Key Drivers:

-

Increasing Adoption of Cloud Computing and Virtualization Drives Growth in the Virtual Machine Market

The rising adoption of cloud computing and virtualization technologies is a major driver propelling the Virtual Machine (VM) Market forward. Organizations are increasingly shifting to virtualized environments to enhance operational efficiency, reduce IT costs, and improve scalability. Cloud-based VMs enable businesses to deploy applications quickly, manage workloads efficiently, and ensure seamless data access across multiple locations. Enterprises are adopting hybrid and multi-cloud strategies, further fueling the demand for VMs as they offer flexibility and interoperability across platforms.

Additionally, advancements in hypervisor technology and containerization are optimizing resource utilization, making VMs more efficient for enterprise applications. The rapid growth of AI, big data analytics, and IoT-based solutions also contributes to higher VM adoption, as businesses require scalable computing environments to process large volumes of data. With cloud service providers expanding their VM offerings, the market is expected to witness sustained growth driven by increasing digital transformation efforts worldwide.

Restraint:

-

Rising Security Concerns and Cyber Threats Limit the Expansion of the Virtual Machine Market

Despite the numerous advantages of virtualization, rising security concerns pose a significant challenge to the Virtual Machine Market. VMs are vulnerable to cyber threats such as hypervisor attacks, VM sprawl, and data breaches, making security a critical concern for enterprises. Hackers often exploit VM-based vulnerabilities to gain unauthorized access to sensitive enterprise data, leading to potential financial and reputational losses.

Additionally, multi-tenant cloud environments heighten security risks as multiple organizations share the same infrastructure, increasing the risk of cross-VM attacks. Organizations must invest in robust security frameworks, including encryption, network segmentation, and identity management, to mitigate potential risks. However, implementing advanced security measures increases operational costs, which can be a deterrent for small and medium-sized enterprises (SMEs). While cloud service providers are enhancing security features, ongoing cybersecurity threats and compliance requirements continue to limit the widespread adoption of VMs, especially in highly regulated industries.

Opportunity:

-

Growing Demand for AI and High-Performance Computing Creates Lucrative Opportunities for the Virtual Machine Market

The increasing demand for artificial intelligence (AI) and high-performance computing (HPC) is creating lucrative growth opportunities in the Virtual Machine Market. Businesses across various industries are leveraging AI-driven applications, big data analytics, and machine learning models, all of which require significant computational power and scalable infrastructure. Virtual Machines provide a cost-effective and flexible solution for running AI workloads, enabling organizations to train complex models without investing in expensive physical hardware. Cloud-based VMs, powered by GPUs and TPUs, are increasingly used for deep learning and real-time analytics, further driving market growth.

Additionally, enterprises in sectors such as healthcare, finance, and automotive are utilizing VMs for high-performance computing tasks, including genomic research, risk assessment, and autonomous vehicle simulations. With continued advancements in AI and edge computing, the demand for virtualized computing environments will rise, presenting major expansion opportunities for cloud providers and virtualization technology vendors.

Challenge:

-

High Infrastructure and Licensing Costs Pose Challenges for Widespread Adoption of Virtual Machines

The growth of the Virtual Machine Market is the high cost associated with infrastructure, licensing, and maintenance. Organizations deploying VMs must invest in powerful servers, hypervisors, and cloud services, which can be expensive, especially for small and medium-sized enterprises (SMEs). Additionally, licensing costs for virtualization software, such as VMware, Microsoft Hyper-V, and Citrix, add to the financial burden. Many businesses also face challenges related to VM sprawl, where an excessive number of virtual machines consume significant resources, leading to increased operational costs.

Moreover, enterprises must continuously upgrade their virtualization infrastructure to keep up with evolving technological demands, further escalating expenses. While cloud-based VMs offer cost-saving advantages, long-term subscription fees can accumulate, making it challenging for budget-conscious businesses. Addressing cost-related concerns through affordable pricing models and efficient resource allocation strategies will be essential for the broader adoption of virtual machines.

Virtual Machine Market Segment Analysis

By Type

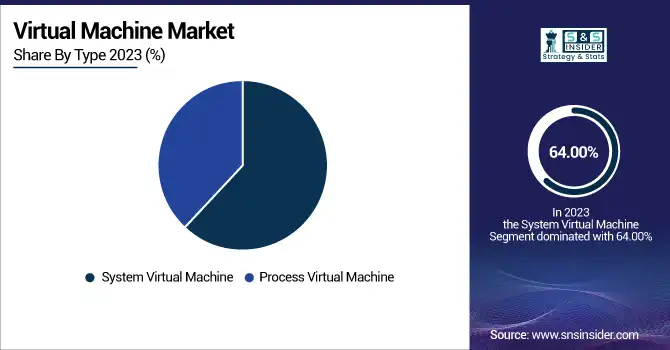

The System Virtual Machine segment held the largest market share, accounting for 64.00% of total revenue in 2023, driven by its extensive use in data centers, enterprise IT infrastructure, and cloud environments. System VMs enable organizations to run multiple operating systems on a single physical machine, enhancing resource efficiency and cost savings. Leading virtualization providers continue to introduce advanced hypervisor solutions and cloud-based VM offerings to improve performance and security. Recent advancements in system VM technology, including AI-powered workload management and integration with edge computing, have further bolstered demand.

The Process Virtual Machine segment is projected to grow at the fastest CAGR of 15.6% over the forecast period, fueled by the rising demand for lightweight and efficient runtime environments. Process VMs are widely used in software development, containerized applications, and serverless computing, making them essential for modern IT operations. The increasing adoption of cloud-native applications and microservices architecture is driving the demand for process VMs, as they provide an isolated execution environment for specific processes without requiring a full OS installation.

By Vertical

The BFSI segment held the largest revenue share of 29.00% in 2023 within the Virtual Machine (VM) market, driven by the sector’s increasing reliance on virtualization for secure and scalable IT infrastructure. Financial institutions are leveraging virtual machines to enhance data security, support high-frequency transactions, and improve disaster recovery solutions. With the expansion of digital banking, fintech innovations, and real-time payment systems, BFSI organizations require robust, flexible, and high-performance computing environments. Virtual machines allow banks and insurance companies to operate multiple secure environments on a single server, reducing costs and improving efficiency.

The Government & Public segment is projected to grow at the highest CAGR in the forecast period, driven by increasing digital transformation initiatives, cloud migration, and the need for secure computing environments. Governments worldwide are deploying virtual machines to enhance cybersecurity, optimize data management, and support e-governance applications. The adoption of cloud-based VMs allows public sector agencies to manage vast amounts of citizen data while ensuring compliance with data protection regulations. With the rise of smart city projects, AI-driven public services, and national security systems, the demand for high-performance and scalable VM solutions is surging.

Regional Analysis

North America dominated the Virtual Machine (VM) market in 2023, holding an estimated market share of approximately 38%. This leadership is driven by the region’s strong adoption of cloud computing, advanced IT infrastructure, and widespread deployment of virtualization technologies across enterprises. The presence of leading cloud service providers, extensive investment in data centers, and increasing demand for virtualized environments in BFSI, healthcare, and government sectors have contributed to North America's dominance.

Additionally, with the rapid advancements in AI, machine learning, and cybersecurity, businesses in North America are integrating VMs with high-performance computing to enhance security, agility, and cost-effectiveness. The U.S. government’s growing investments in cloud-first policies and digital transformation further bolster the Virtual Machine market in the region.

Asia Pacific is the fastest-growing region in the Virtual Machine (VM) market, projected to expand at a CAGR of 15.7% over the forecast period. This rapid growth is fueled by the increasing adoption of cloud-based virtualization, rising IT spending, and the expansion of digital businesses across emerging economies like China, India, and Southeast Asia. Governments and enterprises in the region are embracing virtualization to enhance operational efficiency, manage large-scale data storage, and improve cybersecurity frameworks.

Additionally, cloud service providers and hyperscale data center operators are expanding their footprint in Asia Pacific to meet the rising demand for virtualized workloads, AI-driven computing, and remote work solutions. As businesses shift towards digital transformation, the region's focus on cloud adoption, AI integration, and cost-effective IT infrastructure will drive sustained VM market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Amazon.com Inc. (Amazon Elastic Compute Cloud (EC2), AWS Lambda)

-

Citrix Systems Inc. (Citrix Hypervisor, Citrix Virtual Apps and Desktops)

-

Hewlett Packard Enterprise LP (HPE Synergy, HPE SimpliVity)

-

Huawei Technologies Co. Ltd. (FusionCompute, Huawei Cloud Stack)

-

International Business Machine Corporation (IBM PowerVM, IBM Cloud Virtual Servers)

-

Microsoft Corporation (Microsoft Hyper-V, Azure Virtual Machines)

-

Oracle Corporation (Oracle VM VirtualBox, Oracle Cloud Infrastructure Compute)

-

VMware Inc. (VMware vSphere, VMware Workstation Pro)

-

Parallels Inc. (Parallels Desktop, Parallels Remote Application Server)

-

Red Hat Inc. (Red Hat Virtualization, Red Hat OpenStack Platform)

-

Cisco Systems (Cisco UCS Manager, Cisco HyperFlex)

-

Intel Corporation (Intel VT-x [Virtualization Technology], Intel Server GPU)

Recent Trends

-

In November 2024, Hewlett Packard Enterprise (HPE) announced the availability of HPE VM Essentials, a virtualization product designed to run on both HPE and third-party platforms. This solution aims to provide customers with a flexible and efficient virtualization option, potentially appealing to those seeking alternatives in the virtualization market.

-

In November 2024, Microsoft announced significant advancements in its Azure Cloud platform, introducing new virtual machines (VMs) and enhanced cooling and power delivery technologies to support the growing demands of artificial intelligence (AI) workloads.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.43 Billion |

| Market Size by 2032 | US$ 35.37 Billion |

| CAGR | CAGR of 14.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (System Virtual Machine, Process Virtual Machine) • By Organization Size (Large Enterprises, SMEs) • By Vertical (BFSIs, Telecommunications & ITES, Government & Public Sector, Healthcare & Life Sciences, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon.com Inc., Citrix Systems Inc., Hewlett Packard Enterprise LP, Huawei Technologies Co. Ltd., International Business Machine Corporation, Microsoft Corporation, Oracle Corporation, VMware Inc., Parallels Inc., Red Hat Inc., Cisco Systems, Intel Corporation. |