Live Streaming Market Report Scope & Overview:

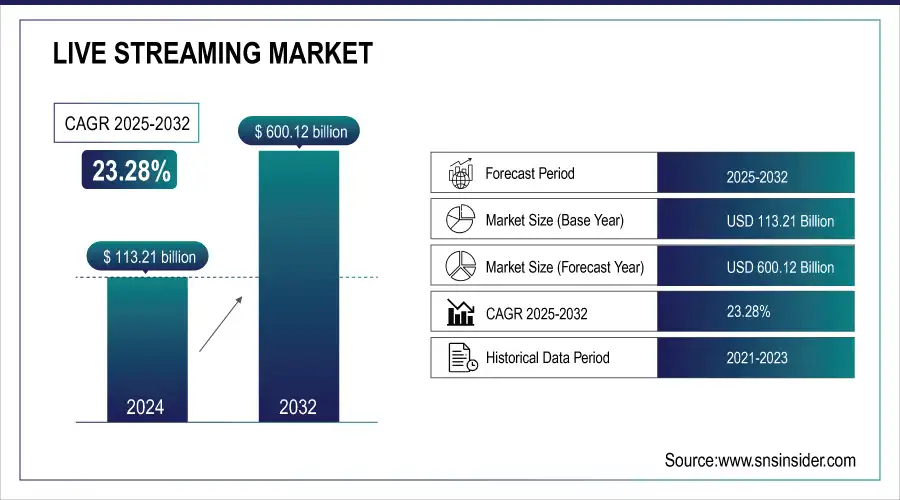

The Live Streaming Market was valued at USD 113.21 billion in 2024 and is expected to reach USD 600.12 billion by 2032, growing at a CAGR of 23.28% from 2025-2032.

To Get more information on Live Streaming Market - Request Free Sample Report

The growth of the Live Streaming Market is primarily driven by increasing internet penetration, widespread adoption of smartphones, and the rising popularity of real-time content across platforms.

-

According to TRAI’s 2024–25 performance report, India recorded 969.10 million internet subscribers as of March 31, 2025 up 1.54% year-over-year while broadband subscriptions reached 944.12 million, growing 2.17%. The surge in gaming, e-sports, online education, and virtual events has significantly fueled demand.

Additionally, the integration of advanced technologies like AI, 5G, and edge computing enhances streaming quality and user engagement. Content creators and brands increasingly leverage live streaming for real-time interaction, marketing, and monetization.

-

Netflix, for instance, reported that its ad-supported tier now has over 94 million users, and it aims to double its advertising revenue in 2025 through innovations in its in-house ad-tech stack, including interactive and pause-screen ads.

Moreover, the expansion of subscription-based and ad-supported revenue models supports scalable growth. The shift toward digital-first entertainment and hybrid experiences further strengthens the market's long-term trajectory.

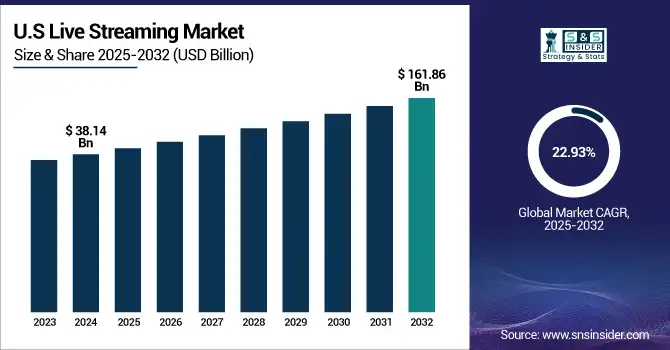

The U.S. Live Streaming Market was valued at USD 38.14 billion in 2024 and is expected to reach USD 161.86 billion by 2032, growing at a CAGR of 22.93% from 2025-2032.

The U.S. live streaming market is growing due to high internet speeds, rising demand for interactive content, expansion of OTT platforms, increased gaming and e-sports viewership, and strong adoption of live commerce and influencer-driven broadcasts.

Live Streaming Market Dynamics

Drivers

-

Increasing preference for interactive and immersive content is accelerating the adoption of live streaming across entertainment, gaming, and education.

Audiences increasingly favor interactive formats over passive content, driving up the popularity of live Q&A sessions, virtual concerts, and eSports broadcasts. Live streaming offers real-time engagement, allowing viewers to comment, react, and influence content. This dynamic interaction boosts viewer retention and monetization opportunities. In education, live classes and webinars foster direct communication between instructors and learners. Social media integrations and gamification features further enhance engagement. Businesses and content creators are leveraging this trend to deepen user relationships and increase digital presence, creating strong momentum in the live streaming ecosystem.

Restraints

-

Content moderation and copyright enforcement challenges reduce platform trust and limit adoption among creators and advertisers.

Live streaming’s real-time nature makes it difficult to monitor and filter inappropriate, illegal, or copyright-infringing content effectively. Platforms struggle to implement robust moderation systems that ensure safe and compliant environments without affecting user experience. For content creators, the risk of takedowns and demonetization can discourage investment in high-quality streams. Advertisers, wary of brand safety issues, may limit spending on such platforms. Regulatory scrutiny is also increasing, requiring compliance with content and data laws across jurisdictions. These concerns can inhibit user trust and investor confidence, restricting the live streaming market’s growth and broader institutional adoption.

Opportunities

-

Rising demand for virtual events, online concerts, and remote experiences is expanding commercial applications of live streaming platforms.

As in-person gatherings remain limited or costly, organizations and entertainers increasingly turn to live streaming for audience engagement. Virtual conferences, product launches, online workshops, and digital concerts are now mainstream. This trend opens new monetization models through ticketing, subscriptions, and sponsorships. Audiences also value the accessibility and convenience of remote participation, extending reach beyond geographical limits. Corporate and educational sectors are embracing live streaming for training, communication, and outreach. This shift presents a vast opportunity to diversify offerings and embed live streaming across industries, driving revenue and global market expansion.

Challenges

-

Ensuring user privacy and compliance with global data regulations adds complexity and risk to platform operations.

Live streaming platforms collect vast amounts of user data, from viewing behavior to chat interactions. Ensuring that this data is securely handled and compliant with evolving privacy laws (like GDPR, CCPA, and others) presents legal and technical challenges. Cross-border data flows and differing regulatory environments increase operational risk. Users are also becoming more privacy-conscious, leading to higher expectations for transparency and control over personal data. Failure to meet these standards can result in fines, reputational damage, or user loss. These regulatory and ethical hurdles demand significant resources and can constrain growth and innovation.

Live Streaming Market Segmentation Analysis

By Component

The Platforms segment dominated the Live Streaming Market with a 65% revenue share in 2024 due to its centralized role in delivering and hosting content. Major players like YouTube, Facebook, and Twitch provide scalable infrastructure, monetization tools, and wide global reach, making them indispensable for both creators and audiences. Their strong brand presence and user ecosystems drive sustained engagement and ad revenue generation.

The Services segment is projected to grow at the fastest CAGR of 24.98% from 2025 to 2032, driven by rising demand for professional support such as live production, cloud streaming, analytics, and content moderation. Businesses, educational institutions, and content creators increasingly seek specialized service providers to enhance quality, scalability, and compliance, creating substantial growth potential across verticals through value-added, tech-enabled streaming solutions.

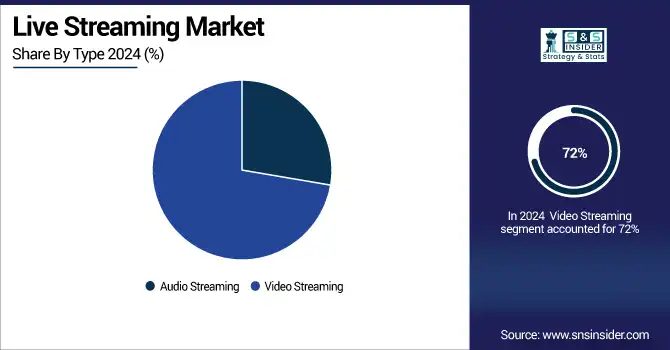

By Type

The Video Streaming segment led the Live Streaming Market in 2024 with a 72% revenue share due to high consumer preference for visual content across entertainment, gaming, sports, and events. The proliferation of mobile devices, smart TVs, and 5G connectivity has enabled easy access to high-definition, interactive video experiences, solidifying video as the dominant format in the digital content consumption landscape.

The Audio Streaming segment is expected to expand at a CAGR of 25.28% from 2025 to 2032, fueled by the growing popularity of podcasts, music performances, and real-time radio content. The segment benefits from its lower bandwidth requirements, ease of multitasking, and rising interest in creator-driven spoken content, making it increasingly attractive to both listeners and advertisers across platforms.

By End-use

The Gaming segment accounted for the largest revenue share of 39% in the Live Streaming Market in 2024, driven by the global popularity of eSports, multiplayer game streaming, and influencer-led gaming content. Platforms like Twitch and YouTube Gaming enable interactive viewer experiences, tipping, and live chats, fostering high viewer retention and monetization. Gaming continues to dominate as a culture-driven content vertical.

The Education & Professional segment is projected to grow at the fastest CAGR of 26.78% from 2025 to 2032, supported by increased adoption of virtual learning, webinars, and professional development streams. Post-pandemic digital transformation, combined with rising demand for scalable, remote educational solutions, has created fertile ground for platforms offering live instructional content across schools, universities, and enterprise training environments.

By Revenue Model

The Ad-Supported segment captured the highest revenue share of 49% in 2024, owing to the widespread use of free-to-access platforms monetized through advertising. Advertisers are attracted to the large, engaged audiences on live platforms, particularly in entertainment and gaming. The model offers accessibility to users without subscription costs, driving massive scale and viewership while allowing creators and platforms to generate stable income.

The Subscription-Based segment is expected to register a CAGR of 25.08% from 2025 to 2032 due to the growing consumer appetite for ad-free, premium content experiences. As users increasingly value exclusive access, high-quality streams, and enhanced viewing features, content providers are capitalizing through recurring revenue models. This trend is strengthened by the shift toward creator economy monetization and platform loyalty.

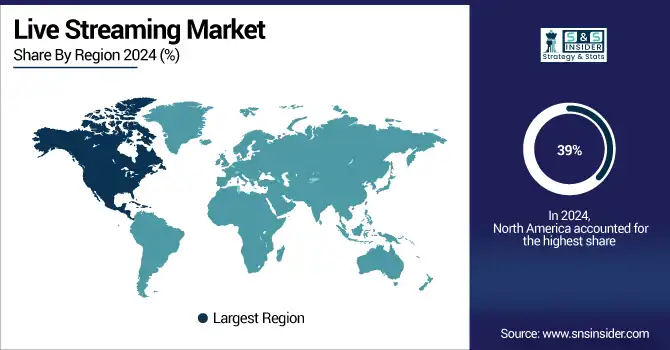

Live Streaming Market Regional Outlook

North America held the highest revenue share of 39% in the Live Streaming Market in 2024 due to its advanced digital infrastructure, high internet penetration, and early adoption of streaming technologies. The presence of major platforms, a mature advertising ecosystem, and strong content creator communities further fuel growth. Consumer demand for interactive entertainment, eSports, and premium content continues to drive sustained market dominance in this region.

The United States is dominating the North American live streaming market due to its large user base, advanced infrastructure, and strong content ecosystem.

Asia Pacific is projected to grow at the fastest CAGR of 25.23% from 2025 to 2032, fueled by rapid internet expansion, smartphone adoption, and a young, mobile-first population. Countries like China, India, and Southeast Asian nations are experiencing surging demand for gaming, education, and entertainment streams. Government support for digital infrastructure and increasing investment from global platforms are further accelerating market expansion across this dynamic and diverse region.

China is dominating the Asia Pacific live streaming market due to its massive user base, strong platform ecosystem, and high mobile penetration.

Europe is witnessing strong growth in the live streaming market due to high internet penetration, increasing demand for interactive content, and rapid digital transformation. The region benefits from advanced infrastructure, growing consumer preference for on-demand experiences, and rising mobile usage.

The United Kingdom is dominating the European live streaming market, driven by high digital adoption, strong content demand, and advanced broadband infrastructure.

The Middle East & Africa live streaming market is expanding due to rising smartphone adoption, improving internet access, and growing youth engagement with digital content. Latin America is witnessing growth fueled by social media integration, mobile-first users, and increasing creator-driven platforms.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

YouTube LLC (Google/Alphabet Inc.), Microsoft Corporation, Amazon Web Services (AWS), Netflix Inc., Wowza Media Systems, LLC, Brightcove Inc., Zoom Video Communications, Inc., Cisco Systems, Inc., Bigo Technology Pte. Ltd. (JOYY Inc.), DailyMotion SA (Vivendi), Kuaishou Technology, Flux Broadcast Ltd., Huya Inc., International Business Machines Corporation, Meta, Pluto Inc. (Pluto TV), TikTok Inc., Twitch Interactive, Inc., Vimeo, Inc., Dacast, Inc.

Recent Developments:

-

2025: Twitch Interactive, Inc. introduced vertical livestreams (portrait mode) and open beta 2K (1440p) streaming for partners and affiliates. Also launched “Combos,” gift‑sub promotions, clippable reactions, and moderator tools.

-

2024: Amazon Web Services (AWS) launched Media Quality‑Aware Resiliency (MQAR) in November 2024 linking CloudFront and AWS Media Services to dynamically select origin region based on video quality, ensuring uninterrupted high‑quality stream delivery.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 113.21 Billion |

| Market Size by 2032 | USD 600.12 Billion |

| CAGR | CAGR of 23.28% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Platforms, Services) • By Type (Audio Streaming, Video Streaming) • By Revenue Model (Ad-Supported, Subscription-Based, Pay-Per-View) • By End-use (Gaming, Media & Entertainment, Education & Professional, Sports, News & Events, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | YouTube LLC (Google/Alphabet Inc.), Microsoft Corporation, Amazon Web Services (AWS), Netflix Inc., Wowza Media Systems, LLC, Brightcove Inc., Zoom Video Communications, Inc., Cisco Systems, Inc., Bigo Technology Pte. Ltd. (JOYY Inc.), DailyMotion SA (Vivendi), Kuaishou Technology, Flux Broadcast Ltd., Huya Inc., International Business Machines Corporation, Meta, Pluto Inc. (Pluto TV), TikTok Inc., Twitch Interactive, Inc., Vimeo, Inc., Dacast, Inc. |