Dosing Pump Market Key Insights:

The Dosing Pump Market size was valued at USD 5.8 Billion in 2023 and is projected to reach USD 9.79 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.0% from 2024 to 2032.

The Dosing Pump Market is primarily driven by the increasing demand for accurate and precise dosing of chemicals and other fluids in various industries such as water treatment, pharmaceuticals, food and beverage, and oil and gas. The market is also expected to be driven by the growing need for automation in various industries, which has led to the development of advanced dosing pumps that are capable of remote monitoring and control.

A dosing pump is used to dispense a specific amount of liquid or chemical into a system accurately. It is commonly used in industries such as water treatment, agriculture, and manufacturing. The dosing pump works by using a motor to drive a piston or diaphragm, which then pushes the liquid or chemical through a valve and into the system. This process ensures that the correct amount of substance is added to the system, which can improve efficiency and reduce waste. Dosing pumps come in a variety of sizes and designs and can be customized to meet the specific needs of a particular application. They are an essential tool for many industries and are relied upon for their accuracy and reliability.

Market Size and Forecast:

-

Market Size in 2023: USD 5.8 Billion

-

Market Size by 2032: USD 9.79 Billion

-

CAGR: 6.0% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020–2022

Get More Information on Dosing Pump Market - Request Sample Report

Dosing Pump Market Trends:

-

Increasing demand for precise chemical dosing in water and wastewater treatment plants is driving market growth.

-

Rising adoption of dosing pumps in oil & gas, chemical processing, and power generation industries is expanding application scope.

-

Growing emphasis on process automation and industrial efficiency is boosting demand for smart and digitally controlled dosing pumps.

-

Strict environmental and safety regulations are accelerating the installation of accurate fluid control systems.

-

Technological advancements such as energy-efficient diaphragm and peristaltic pumps are improving operational reliability and reducing maintenance costs.

-

Expansion of pharmaceutical and food & beverage industries is increasing the need for hygienic and high-precision dosing solutions.

Dosing Pump Market Key Drivers

-

Increasing demand for accurate and precise dosing in various industries

Industries such as pharmaceuticals, water treatment, and agriculture require precise dosing to ensure optimal results. Dosing pumps provide a reliable solution for these industries, allowing for accurate and consistent dosing of chemicals and other substances. As the demand for these industries continues to grow, so does the need for dosing pumps. This trend is expected to continue in the coming years, making the dosing pump market a promising investment opportunity.

-

Growing need for automation and process control in water treatment, chemical processing, and pharmaceuticals industries

Dosing Pump Market Restraints

-

High cost of dosing pumps

Dosing Pump Market Opportunities

-

Increasing focus on sustainability and environmental protection

As the world becomes more conscious of the impact of human activities on the environment, there is a greater need for industries to adopt sustainable practices. This has led to an increased demand for dosing pumps, which are used to accurately and efficiently dispense chemicals and other substances in various industrial processes. Dosing pumps are essential in industries such as water treatment, agriculture, and manufacturing, where precise dosing of chemicals is critical to achieving optimal results. With the growing focus on sustainability, there is a need for these industries to reduce their environmental footprint by using eco-friendly chemicals and minimizing waste. Dosing pumps play a crucial role in achieving these goals by ensuring that chemicals are used efficiently and in the right quantities.

-

Development of new technologies such as smart dosing pumps

Dosing Pump Market Challenges

-

Complexity of dosing pump systems

The Impact of Covid-19

The COVID-19 pandemic had a mixed impact on the dosing pump market. With the global economy experiencing a downturn, many industries have been affected, including the dosing pump market. The pandemic has caused a decrease in demand for dosing pumps, as many businesses have had to shut down or reduce their operations. However, the dosing pump market has also seen some positive effects from the pandemic. With the increased focus on hygiene and sanitation, there has been a surge in demand for dosing pumps in the healthcare and pharmaceutical industries. Additionally, the need for dosing pumps in the production of hand sanitizers and disinfectants has also increased.

Impact of Recession:

The recession has led to a shift in consumer behavior, with many businesses and industries cutting back on their spending and investments. This has had an impact on the dosing pump market, as companies are less likely to invest in new equipment or upgrade their existing systems. More details are comprised in the final report.

Key Market Segmentation

By Type:

-

Solenoid Pumps

-

Piston Pumps

-

Plunger Pumps

-

Hydraulic Pumps

-

Others

By Flow Rate:

-

Upto 50 L/min

-

51-100 L/min

-

More than 100 L/min

By Application:

-

Water & Wastewater Treatment

-

Oil & Gas

-

Chemical Processing

-

Pharmaceuticals

-

Food & Beverages

-

Paper & Pulp

-

Other Industries

Regional Analysis

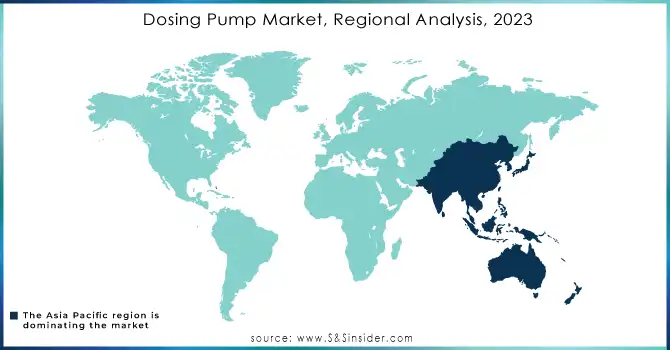

The Asia Pacific region has emerged as a dominant player in the dosing pump market owing to the region's growing industrialization, increasing demand for water treatment solutions, and the presence of key market players. As countries in the Asia Pacific region continue to develop, there is a growing need for dosing pumps in various industries, including chemical, pharmaceutical, and food and beverage. This has led to an increase in demand for dosing pumps, which has in turn driven the growth of the market in the region. With the growing population and industrialization, there is a greater need for clean water. Dosing pumps are an essential component of water treatment systems, and the Asia Pacific region has seen a surge in demand for these systems in recent years. Moreover, the presence of key market players in the region has also contributed to its dominance. Many of the leading dosing pump manufacturers are based in the Asia Pacific region, and they have been able to leverage their expertise and experience to gain a competitive advantage in the market.

Europe is expected to grow with the highest CAGR during the forecast period in the dosing pump market. One of the primary reasons for Europe's expected growth in the dosing pump market is the region's increasing focus on sustainability and environmental responsibility. As more companies and industries seek to reduce their carbon footprint and minimize waste, the demand for dosing pumps that can accurately and efficiently dispense chemicals and other substances is on the rise. Additionally, Europe's robust manufacturing sector is driving demand for dosing pumps in a variety of applications, including chemical processing, water treatment, and food and beverage production. As these industries continue to expand and modernize, the need for precise and reliable dosing pumps will only increase.

Need any customization research on Dosing Pump Market - Enquiry Now

Regional Coverage

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are SPX Flow, Inc., W.E.S. Ltd., Seko SpA, Nikkiso Co., Ltd., Grundfos Holding A/S, EMEC s.r.l., Netzsch Pumpen Systeme GmbH, Idex Corporation, ProMinent GmbH, Blue-White Industries, and other key players will be included in the final report.

| Report Attributes | Details |

| Market Size in 2023 | USD 5.8 Bn |

| Market Size by 2032 | USD 9.79 Bn |

| CAGR | CAGR of 6.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Diaphragm Pumps, Solenoid Pumps, Piston Pumps, Plunger Pumps, Hydraulic Pumps, Peristaltic Pumps, and, Others) • By Flow Rate (Upto 50 L/min, 51-100 L/min, More than 100 L/min) • By Application (Water & Wastewater Treatment, Oil & Gas, Chemical Processing, Pharmaceuticals, Food & Beverages, Paper & Pulp, and Other Industries) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | SPX Flow, Inc., W.E.S. Ltd., Seko SpA, Nikkiso Co., Ltd., Grundfos Holding A/S, EMEC s.r.l., Netzsch Pumpen Systeme GmbH, Idex Corporation, ProMinent GmbH, Blue-White Industries |

| Key Drivers | • Increasing demand for accurate and precise dosing in various industries |

| Market Opportunities | • Increasing focus on sustainability and environmental protection |