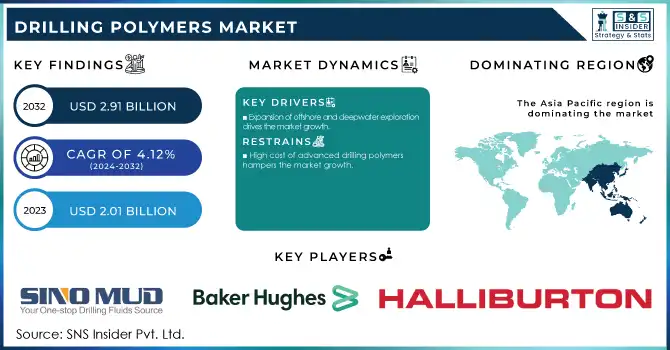

Drilling Polymers Market Key Insights:

The Drilling Polymers Market size was valued at USD 2.01 Billion in 2023. It is expected to grow to USD 2.91 Billion by 2032 and grow at a CAGR of 4.12% over the forecast period of 2024-2032.

The rising demand for oil and gas exploration is a major driver for the growth of the drilling polymers market. It is due to rise the in energy demand around the world, especially in developing countries. This increasing demand is driving exploration in both traditional as well as non-conventional resources (shale oil, deepwater, and offshore fields). With exploration activities pushing toward more complicated environments, the requirement for next-generation, high-performance drilling polymers is being seen. The use of these polymers contributes to the optimization of drilling performance, reduction of operational cost, and faster exploration to meet the growing demand for oil and gas resources across the globe.

Drilling Polymers Market Size and Forecast

-

Market Size in 2023: USD 2.01 Billion

-

Market Size by 2032: USD 2.91 Billion

-

CAGR: 4.12% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2021–2022

To get more information on Drilling Polymers Market - Request Free Sample Report

Drilling Polymers Market Trends

-

Rising global oil and gas exploration activities across conventional and unconventional reserves including shale, offshore, and deepwater fields

-

Increasing demand for high-performance drilling polymers to enhance wellbore stability, fluid control, and drilling efficiency in complex environments

-

Growing adoption of environmentally friendly and biodegradable drilling fluid formulations due to stricter environmental regulations

-

Expansion of offshore and ultra-deepwater drilling projects requiring advanced polymers with superior thermal and chemical resistance

-

Strong shift toward sustainable drilling practices supported by regulatory frameworks such as the Clean Water Act (CWA) and Oil Pollution Act (OPA)

-

Technological advancements in polymer chemistry enabling improved lubrication, friction reduction, and reduced operational costs

In the U.S., the boom in shale oil production has led to a dramatic increase in exploration activities. As per the EIA, shale oil production reached 9.2 million barrels per day in 2022, which is a major contributor to the U.S.'s position as one of the world's top oil producers.

Oil and gas industry is also moving towards sustainability, which is significantly impacting the drilling polymers market positively. Governments along with numerous environmental organizations that are intent on lessening the environmental impact of exploration and production activities are insisting on stricter regulations which have now paved the way for an increased focus on green materials and technologies. To combat these pressures, the oil and gas industry is making use of green formulations of drilling fluid using various biodegradable and non-toxic polymers. Such drilling polymers contribute to minimizing the ecological impact of drilling activities (water and soil pollution, etc.) and promote environmentally friendly extraction processes. There is also the boosting use of bio-based polymers coming from renewable resources, propelled by regulations and increasing environmental awareness.

According to the U.S. Environmental Protection Agency (EPA), regulations on oil and gas exploration have become more stringent in recent years. The Clean Water Act (CWA) and the Oil Pollution Act (OPA) set specific guidelines to minimize contamination from drilling operations, which has led to an increased focus on using environmentally friendly drilling fluids.

Drilling Polymers Market Dynamics

Drivers

-

Expansion of offshore and deepwater exploration drives the market growth.

The growth of the drilling polymers market is considerably fueled by the increasing offshore and deepwater exploration. With oil and gas companies looking deeper and further offshore to meet global energy demand, the unique difficulties presented by these drilling environments, such as corrosion and weight, are driving a need for custom materials. The extreme pressures, temperatures, and salty, highly corrosive environments of offshore drilling operations particularly in ultra-deepwater fields present unique challenges to engineering. In these segments, how polymers are utilized is vital for increasing the function of drilling fluids, maintaining wellbore integrity, and increasing the effectiveness of drilling processes. This helps prevent common issues faced during deepwater and offshore drilling, including wellbore instability, fluid loss, and formation damage. Also, the move to deeper and more remote drilling locations is creating the need for high-performance polymers uniquely able to meet the demands of these types of wellbore operations with superior lubrication and friction reduction. With technological advancement coupled with the search for new energy sources, risk-taking exploration is in progress in offshore and deep-water regions, which is expected to enhance the market demand for high-performance Drilling Polymers fuelling the industry growth.

The International Energy Agency (IEA) reports that offshore oil and gas fields will contribute around 25% of global oil production by 2040. As exploration moves to more remote and challenging locations, the need for advanced drilling technologies, including specialized polymers, is expected to rise.

Restraints

-

High cost of advanced drilling polymers hampers the market growth.

The drilling polymers are cost-effective but often come with high price tags that hamper the growth of the global drilling polymers market. The oil and gas industry is now exploring oil and gas in more complex and harsher environmental areas like deepwater and offshore fields where high-performance polymers are required for extreme conditions. These polymers have thus far been produced at elevated costs, especially for environmentally benign, low toxicity, and tailored enhancement of drilling fluids. Their high cost is due partly to the necessity for specific raw materials and other materials and also to the need for extensive research and development to produce such polymers. Such high expense of these advanced materials in drilling operations can translate into high project costs which can deter the usage of these advanced materials because there are cheaper alternative drilling fluids available. On top of that cost, the delivery, storage, and handling of those in distant offshore or deepwater fields incur even more expense.

Drilling Polymers Market Segmentation Analysis

By Type

The polyacrylamide held the largest market share around 69% in 2023. It has excellent properties that help in performing as a good drilling fluid. Due to its viscosity improvement and stabilization of wellbore properties along with the prevention of fluid loss during drilling operations, Polyacrylamide is used in both water-based drilling fluids as well as oil-based drilling fluids. It has very high-water absorption and great gelling ability that enables to production of thick and stable mud systems, resistant to very harsh conditions like high pressure and temperature of deep water or offshore drilling. Furthermore, polyacrylamide is a versatile polymer with many formulations available (anionic and cationic) suited for varying needs throughout the drilling process. Also, its cost is low compared to the other advanced polymers, which plays an important function in large-scale operations where the budget is limited.

By Application

Diamond drilling held the highest market share around 32% in 2023. This is because it outperforms other drilling types in difficult geological formations and has a wide range of applications in both the exploration and extraction of resources. The diamond-tipped drill bit used for diamond drilling permits drilling hard rock formations, thus this method can be effectively used in mineral exploration, geological surveying, and deep core drilling. The core samples obtained by it are the key to why it is so dominant; they are highly important for geological analysis.

Diamond drilling provides accuracy and precision; this is an essential trait in the mining, oil and gas, and civil engineering industries, as accurate information about subsurface geology is necessary for executing successful projects. This is also particularly interesting as diamond drilling is easily the best technique to drill deep holes while minimizing environmental impact, this being in line with the growing need for sustainable and environmentally friendly drilling methods.

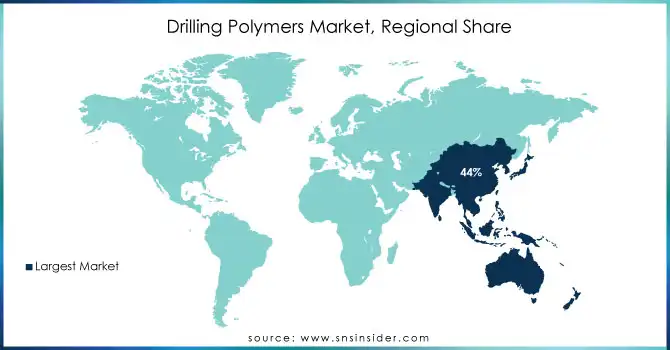

Drilling Polymers Market Regional Outlook

Asia Pacific held the largest market share around 44% in 2023. The oil and gas producers in the countries including China, India, and Malaysia, all of which are investing much more into new technologies which drive the market growth. As these countries expand their exploration efforts, the need for effective, high-performance drilling polymer to enhance drilling efficiency, stability of the wellbore, and reduction of operational hazards in complex and challenging environments increases.

Besides, Asia Pacific is witnessing a surge in energy demand, forcing oil & gas exploration and production. The region's ambitious infrastructure and energy security goals have also increased demand for specialty high-performance drilling fluids. In addition, governing bodies in Asia Pacific have presented favorable policies to support the exploration of oil and gas, thereby increasing investment in drilling technologies that include polymers. All of these, coupled with the competitive manufacturing costs and high-scale operations in the region, have resulted in Asia Pacific dominating the consumption of drilling polymers and thus driving the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

SINO MUD (Mud Cleaner, Drilling Fluid Additives)

-

Baroid Industrial Drilling Products (Baroid LCM, BAROID Drilling Fluids)

-

Baker Hughes, Inc. (Baroid Drilling Fluids, VersaFlo)

-

Halliburton, Inc. (Baroid Drilling Fluids, OPTI-CLEAN)

-

Chevron Corp. (Chevron Drilling Fluids, Unimud)

-

Schlumberger Ltd. (XTREME Clean, DRILPLEX)

-

Global Drilling Fluids and Chemicals Ltd. (SlickWater, Mud Additives)

-

Global Envirotech (Eco-Clean, Eco-Drill)

-

Di-Corp (Di-Drill, Di-Versify)

-

M-I SWACO (A Schlumberger Company) (Baroid Mud Systems, Drilplex)

-

FMC Technologies, Inc. (Rheology Modifiers, Friction Reducers)

-

Tetra Technologies, Inc. (TETRA-PAC, TETRA-THIN)

-

Newpark Resources, Inc. (Clear Water, NewForce)

-

Weatherford International, Inc. (Performa, Wellbore Cleaners)

-

Expro Group (ExproPro, ExproFlow)

-

AkzoNobel N.V. (Akzo Drilling Fluids, Drilplex Additives)

-

Clariant International Ltd. (Exolit OP, Ecotool)

-

BASF SE (BASF Drilling Fluids, Rheovis)

-

Lonza Group Ltd. (Lonzagard, Polymeric Fluids)

-

Chemcon Speciality Chemicals Ltd. (MudChem, Defoamer)

Recent Developments:

-

In 2023, BASF SE launched a new series of drilling fluid additives designed to improve wellbore stability and reduce friction in deepwater and offshore drilling operations. This development focused on enhancing the performance of water-based drilling fluids while ensuring environmental sustainability.

-

In 2022 Solvay launched a new line of polymeric additives for water-based drilling fluids. These additives improve the efficiency of drilling operations by reducing friction and controlling fluid loss, crucial for enhancing performance in challenging drilling environments such as deepwater and shale gas exploration.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.01 Billion |

| Market Size by 2032 | USD 2.91 Billion |

| CAGR | CAGR of 4.12% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Polyacrylamide, Others) • By Application (Down The Hole Drills, Diamond Drilling, Top Hammer Drilling, Reverse Circulation Drilling, Others) • By End-Use (Mining, Oil & Gas, Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SINO MUD, Baroid Industrial Drilling Products, Baker Hughes, Inc., Halliburton, Inc., Chevron Corp., Schlumberger Ltd., Global Drilling Fluids and Chemicals Ltd., Global Envirotech, Di-Corp, M-I SWACO (A Schlumberger Company), FMC Technologies, Inc., Tetra Technologies, Inc., Newpark Resources, Inc., Weatherford International, Inc., Expro Group, AkzoNobel N.V., Clariant International Ltd., BASF SE, Lonza Group Ltd., Chemcon Speciality Chemicals Ltd. |

| Key Drivers | • Expansion of offshore and deepwater exploration drives the market growth. |

| Restraints | • High cost of advanced drilling polymers hampers the market growth. |