Offshore Drilling Fluid Market Report Scope & Overview:

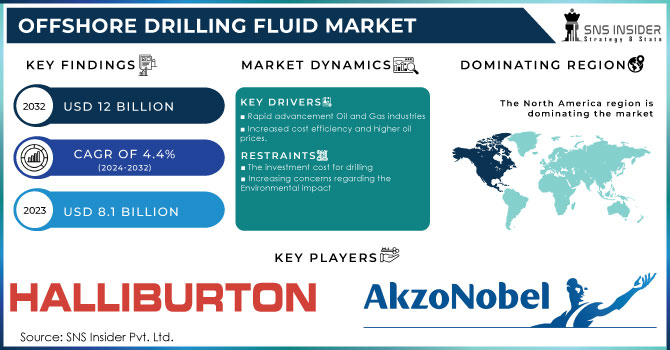

The Offshore Drilling Fluid Market Size was valued at USD 4.10 Billion in 2023 and is expected to reach USD 6.36 Billion by 2032, growing at a CAGR of 5.01% over the forecast period of 2024-2032.

Get More Information on Offshore Drilling Fluid Market - Request Sample Report

The offshore drilling fluids market is innovating towards more sustainable/recyclable technologies as well. Our report highlights the major offshore drilling fluid suppliers that are propelling growth in the market and the influence of regional policies and environmental standards on the market dynamics. It provides insights into the tailoring of offshore drilling fluids for multiple applications and exploration depths ranging from shallow to ultra-deepwater drilling. Also, it provides a thorough detailed cost analysis of offshore drilling fluids, detailing raw materials, production, etc., enabling decision making in the market.

Offshore Drilling Fluid Market Dynamics

Drivers

-

Rising Offshore Oil and Gas Exploration Activities in Untapped Regions Propel Demand for Offshore Drilling Fluids

The growing offshore oil and gas exploration activities, especially in unexplored areas, like the Arctic, offshore Africa, and Southeast Asia, are one of the key drivers of the offshore drilling fluids market. The move towards offshore drilling opens many new exploration projects and the potential for innovation will grow as companies aim to exploit some of its most under-examined reserves, further fuelling the demand for offshore drilling fluids. More novel and extreme methods of drilling using specialized drilling fluids and management processes are required to produce hydrocarbons from deep water or extreme environments. The growth of the market at a global level is due to increased focus on untapped reserves and ever-increasing number of offshore drilling rigs in service, which is contributing to the demand for offshore drilling fluids. The continued increase in exploration will no doubt drive demand for excellent, high-performance drilling fluids.

Restraints

-

Fluctuating Oil Prices and Economic Uncertainty Affect Investment in Offshore Drilling Fluid Technologies

Oil prices fluctuate, which directly impacts the offshore drilling industry and in turn the global offshore drilling fluids demand. Economic uncertainty and fluctuations in oil prices can result in companies postponing or cancelling offshore exploration and drilling projects, which decreases the demand for offshore drilling fluids. Most oil and gas firms tie the decision to invest in new drilling technologies or upgrade existing fluid systems to their financial condition. Moreover, when oil prices decrease, exploration & production activities decline, which results in decreased consumption of drilling fluids and a slowdown in market growth. Such price sensitivity renders the offshore drilling fluids market susceptible to wider economic movements, which can restrict growth in certain periods.

Opportunities

-

Growing Investment in Renewable Energy Projects Drives Demand for Offshore Drilling Fluids in Renewable Energy Industry

The global focus on renewable energy is having a wider impact on offshore markets, requiring offshore drilling fluids for various renewable energy projects, including offshore wind energy developments. Offshore drilling fluids are used to install offshore wind turbines and other infrastructure as governments and companies turn their focus to boosting their capacities in renewable energy. As a result, the growing need for specialty fluids for these renewable energy projects represents a lucrative opportunity for the firms operating in the market to diversify and expand the offerings. The offshore drilling fluids market is projected to benefit from this shift towards more sustainable energy solutions, as companies adapt their offerings to meet changing demand in the energy market.

Challenge

-

Complexities in Developing Specialized Offshore Drilling Fluids for Harsh Environments Pose Technological and Operational Hurdles

Drilling in ultra-deepwater and high-temperature offshore locations require specialized fluids that can withstand extreme environmental conditions. Difficulties of this kind of fluids development bring not only technological but also operational problems of serious importance. Oceanic drilling fluids, as they are known, must be meticulously crafted not only to behave accurately and stay stable, but also of course stay safe and abide by tight ecological laws. The advancements needed in these fluids also come with high R&D costs and sophisticated testing and quality control practices. However, delivering on the market's diverse requirements in terms of project scope and site conditions poses technical challenges that can potentially stifle growth and innovation, especially in regions with difficult and/or extreme drilling environments such as HTHP or high mud losses.

Offshore Drilling Fluid Market Segmental Analysis

By Type

In 2023, Water-Based Drilling Fluids led the Offshore Drilling Fluids market, holding around 45.7% market share. This segment's significant influence is mainly due to the rising transition to eco-friendly solutions in offshore drilling operations. Due to its green characteristics, water-based materials have gained acceptance in terms of growing external enforcement and environmental challenges worldwide, which replaces it to oil-based materials. The adoption of water-based fluids, which do not contain such hazardous compounds, is also encouraged by stricter regulations regarding hazardous fluids in offshore activities, such as those from the International Maritime Organization (IMO). Furthermore, European and North American governments particularly Norway and the United States are emphasizing sustainability, thereby increasing the demand for water-based drilling fluids in the offshore segment.

By Drilling Depth

In 2023, Deepwater Drilling dominated the offshore drilling fluids market with around 45.3% of share. The popularity of this segment is driven less by oil and gas technology advances than by the continued exploration and development of deepwater oil and gas deposits in the Gulf of Mexico and offshore Brazil. Reaching these challenging resources has been made possible through advances in offshore drilling technologies, including specialized fluids for deepwater conditions. Major corporations such as ExxonMobil and BP still spend billions in deepwater drilling ventures, creating an increasing demand for high-quality drilling fluids that can withstand high pressure and high temperature environments. In addition, it indicates the increasing trend towards the growth of deepwater exploration and to gain the recommendation of international energy authorities and oil & gas body for the improvement of marine drilling capabilities in these unexplored field.

By Application

In 2023, the Oil & Gas Extraction application segment dominated the offshore drilling fluids market, accounting for 61.8% of the global market share. Offshore drilling fluids are crucial for maintaining wellbore stability, controlling pressure, and enabling efficient extraction processes in offshore oil and gas fields, and the significant demand for oil and gas extraction in this market segment has been the leading factor motivating it. Advocates claim offshore oil and gas exploration is vital for global energy security as organizations such as the American Petroleum Institute (API) and International Energy Agencies persistently point out the need for energy security in the world. As a case in point, deepwater oil recovery in offshore fields like the North Sea and offshore West Africa, require considerable amounts of these specialized fluids for the successful completion of the operations resulting in significant stimulus to growth of the oil and gas extraction segment.

By End-Use Industry

In 2023, Oil & Gas Sector dominated and held the largest share of 58.5% of the Offshore Drilling Fluids market. This segment has significant opportunity as the largest producer of offshore drilling fluids required to perform these operations in the exploration and production of oil and natural gas. Something that many oil majors such as Shell, TotalEnergies and Chevron have their fingers in are large scale offshore drilling projects, which use specialized drilling fluids to succeed out in the challenging subsea environment. The oil and gas industry further amplifies the demand for offshore drilling fluids due to continued exploration of untapped offshore reserves, such as those in the Middle East, Africa, and Asia-Pacific. Moreover, the move toward deep and complex oilfields leads to continued growth in this segment.

Offshore Drilling Fluid Market Regional Outlook

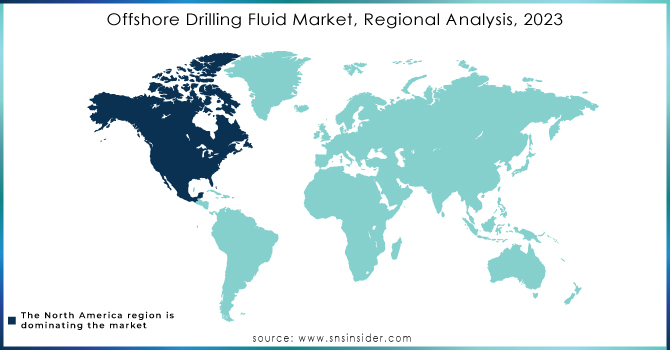

In 2023, North America dominated and held a 35.6% share of the Offshore Drilling Fluids market. The U.S., especially in the Gulf of Mexico, is still a center for offshore drilling, bolstered by big oil companies like ExxonMobil and Chevron. Such operations require these companies to have specialized offshore drilling fluids. For one, supportive government policies and regulations are supplying further wind in the sails of offshore drilling, courtesy of agencies such as the Bureau of Ocean Energy Management (BOEM) and the Environmental Protection Agency (EPA). Furthermore, Canada, primarily Newfoundland and Labrador, also holds a significant share of the market. North America is a dominant contributor to the global offshore drilling fluids market, owing to the abundance of offshore reserves along with significant technological advancements and active involvement of the key industry players.

On the other hand, Asia Pacific is the fastest growing region in Offshore Drilling Fluids market with a 7.83% CAGR. That growth is in part due to increased offshore oil exploration in nations such as China, India, Malaysia and Australia. Key contributors include China’s offshore drilling especially in the South China Sea and India’s exploration in the Krishna-Godavari Basin. Australia is also developing offshore projects off its western coast. The increasing requirement of offshore drilling fluids is primarily driven by rising energy demand in these countries, as well as government investments in offshore infrastructure. Technological progress and growing interest in deepwater and ultra-deepwater drilling are also stimulating growth in the region.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Recent Highlights

-

January 2025: Halliburton secured a significant offshore drilling contract with Petrobras. This partnership expanded Halliburton's presence in Brazil's offshore oil sector, focusing on improving drilling efficiency with advanced technologies.

-

December 2024: QatarEnergy joined Chevron for offshore exploration in Namibia. The collaboration aimed to tap into the region's hydrocarbon potential while promoting sustainable exploration practices.

Key Players

-

Akzo Nobel N.V. (Berol 6446, Witbreak NEO, Ethylan 1005)

-

ASAP Fluids Pvt. Ltd. (Drilchem FLC, Drilchem NanoSeal, Drilchem Superseal)

-

Baker Hughes Company (RheoGel, VersaClean, Performax)

-

CES Energy Solutions (CES) (Liquidrill, Envirodrill, Drillchem)

-

China Oilfield Services Limited (COSLFLUID, COSLMEG, COSLTHIN)

-

Gumpro Drilling Fluids Pvt. Ltd. (Gumbase, GumboStop, Gumvis)

-

Halliburton (Baroid, Aqua-Drill, BaraPure)

-

National Energy Services Reunited Corp. (NESR WBF, NESR OBM, NESR Spacer)

-

National Oilwell Varco, Inc. (NOV VersaMod, NOV TergaTherm, NOV DeepDrill)

-

Newpark Resources Inc. (Evolution, OptiDrill, Kronos)

-

Scomi Group Bhd (Dura-Fluid, SmartDrill, BaseStar)

-

Schlumberger Limited (DuraDril, MEGADRIL, BioDril)

-

SECURE ENERGY (X-TraVis, X-TraThix, X-TraClean)

-

TETRA Technologies (TETRA CS Neptune, TETRA SafeCarb, TETRA Vis)

-

Weatherford International Ltd. (WetarGel, FloPro, SureDrill)

-

MB Petroleum Services (MP Drilfluid, MP EnviroMud, MP ThermaMud)

-

Geo Drilling Fluids Inc. (GeoGuard, GeoVis, GeoClay)

-

M-I SWACO (A Schlumberger Company) (RheGuard, MEGADRIL, HydraHib)

-

Canadian Energy Services (CES) (PureDrill, Liquidrill, Envirofloc)

-

QMax Solutions Inc. (QMax Supreme, QMax Terra, QMax Aqua)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.10 Billion |

| Market Size by 2032 | USD 6.36 Billion |

| CAGR | CAGR of 5.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Oil-Based, Water-Based, Synthetic-Based, Others) •By Drilling Depth (Shallow Water Drilling, Deepwater Drilling, Ultra-Deepwater Drilling) •By Application (Oil & Gas Extraction, Mineral Extraction, Wellbore Stability, Others) •By End-Use Industry (Oil & Gas, Energy & Power, Mining & Mineral Extraction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Halliburton, Schlumberger Limited, Baker Hughes Company, Weatherford International Ltd., Newpark Resources Inc., National Oilwell Varco, Inc., China Oilfield Services Limited, TETRA Technologies, Scomi Group Bhd, CES Energy Solutions (CES) and other key players |