Pharmaceutical Fine Chemicals Market Size:

The Pharmaceutical Fine Chemicals Market Size was valued at USD 138.3 Billion in 2023 and is expected to reach USD 255.5 Billion by 2032 and grow at a CAGR of 7.1% over the forecast period 2024-2032.

The Pharmaceutical Fine Chemicals Market is witnessing growth driven by increasing demand for specialized chemicals required in drug development and manufacturing. The shift toward personalized medicine and advanced therapies has necessitated the development of high-quality intermediates and active pharmaceutical ingredients, fostering innovation in this space. Companies are emphasizing efficient and sustainable production processes, with advancements in green chemistry playing a pivotal role. For instance, in October 2023, researchers introduced new catalysts enabling environmentally friendly production of fine chemicals, addressing the industry's demand for cost-efficient and sustainable solutions. These developments align with the growing need for scalable manufacturing processes that adhere to stringent regulatory standards and environmental norms.

Recent corporate activities underscore the dynamism within the Pharmaceutical Fine Chemicals Market. In January 2024, Hikal invested ₹500 crore to establish a fine chemicals plant in Panoli, enhancing its capacity to meet the rising demand for pharmaceutical intermediates. Similarly, in February 2024, Pharmaids Pharmaceuticals acquired a 50-60% stake in Anugraha Chemicals, reflecting its commitment to expanding its chemical production capabilities. In October 2024, Colorcon introduced an innovative excipient to improve the performance of oral solid dosage forms, showcasing the industry's focus on formulation advancements. Additionally, developments in South Korea during October 2024 highlighted significant investments and technological progress in fine chemical manufacturing, reinforcing the market’s competitive and evolving nature. These strategic efforts by leading companies demonstrate the proactive steps being taken to cater to the increasing demand for fine chemicals while maintaining a focus on innovation and sustainability.

Pharmaceutical Fine Chemicals Market Size and Forecast

-

Market Size in 2023: USD 138.3 Billion

-

Market Size by 2032: USD 255.5 Billion

-

CAGR: 7.1% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020–2022

To get more information on Pharmaceutical Fine Chemicals Market - Request Free Sample Report

Pharmaceutical Fine Chemicals Market Trends

-

Rising demand for specialized fine chemicals and high-purity intermediates driven by the rapid expansion of drug development, manufacturing, and advanced therapeutic formulations.

-

Growing shift toward personalized medicine, targeted therapies, and orphan drugs, increasing the need for custom fine chemicals, high-potency APIs, and precision manufacturing capabilities.

-

Increasing adoption of green chemistry and sustainable production processes, supported by advancements in environmentally friendly catalysts, biocatalysis, and energy-efficient manufacturing technologies.

-

Rapid growth of the biopharmaceutical and biosimilars market, accelerating demand for high-quality fine chemicals used in biologics, injectables, and complex drug formulations.

-

Expansion of outsourcing trends, with pharmaceutical companies increasingly relying on contract manufacturing organizations (CMOs) and fine chemical suppliers to optimize costs and scalability.

-

Technological advancements in automation, AI-driven process optimization, and digital manufacturing enhancing production efficiency, yield optimization, and regulatory compliance.

-

Rising investments in emerging markets across Asia-Pacific and Latin America, supported by government incentives, expanding healthcare infrastructure, and growing pharmaceutical production capacities.

-

Increasing regulatory scrutiny and compliance requirements driving demand for premium-grade, traceable, and quality-compliant pharmaceutical fine chemicals.

Pharmaceutical Fine Chemicals Market Dynamics:

Drivers:

-

Rising Demand for Custom Fine Chemicals in Personalized Medicine Drives Pharmaceutical Fine Chemicals Market Expansion

The growing focus on personalized medicine is significantly driving the demand for custom fine chemicals in the pharmaceutical sector. Personalized medicine tailors treatments to individual patients based on genetic, environmental, and lifestyle factors, requiring the production of specific pharmaceutical intermediates and active ingredients. Fine chemicals play a critical role in developing targeted therapies such as cancer treatments, immunotherapies, and orphan drugs, where precision and specificity are paramount. This shift toward individualized care is prompting pharmaceutical companies to collaborate with fine chemical manufacturers to create specialized compounds, driving growth in this market. Additionally, regulatory bodies support these efforts by fast-tracking approvals for personalized treatments, further emphasizing the importance of high-quality fine chemicals.

-

Growing Adoption of Green Chemistry Techniques in Fine Chemical Production Bolsters Market Expansion

-

Rapid Expansion of Biopharmaceuticals Accelerates Demand for High-Purity Fine Chemicals in Drug Manufacturing

-

Increasing Outsourcing Trends in Pharmaceutical Manufacturing Drive Demand for High-Quality Fine Chemicals

Restraint:

-

Stringent Regulatory Frameworks and Compliance Costs Impede Growth in the Pharmaceutical Fine Chemicals Market

Opportunity:

-

Growing Investment in Emerging Markets Provides Lucrative Opportunities for Fine Chemical Manufacturers

Emerging markets, particularly in Asia-Pacific and Latin America, present significant opportunities for pharmaceutical fine chemical manufacturers. Rapid industrialization, a rising middle class, and increasing healthcare access in these regions are driving demand for pharmaceuticals and their intermediates. Local governments are also supporting this growth by offering incentives to foreign investors and simplifying regulatory requirements. Manufacturers establishing a presence in these markets can benefit from lower production costs and access to untapped customer bases.

-

Technological Innovations in Fine Chemical Production Open Avenues for New Product Development

-

Expansion of Biosimilars Market Drives Demand for Cost-Effective Pharmaceutical Fine Chemicals

| Cost Factor | Trend/Insight | Impact on Market |

|---|---|---|

| Raw Material Price Fluctuations | Increased volatility in raw material prices due to supply chain disruptions and geopolitical factors | Affects overall production costs, driving up pricing for fine chemicals. |

| Technological Advancements in Production | Adoption of automation, AI, and green chemistry to reduce manufacturing costs | Enables cost savings in production, allowing companies to offer more competitive pricing. |

| Economies of Scale | Larger manufacturers benefit from cost reductions as they scale production volumes | Leads to price stability for large companies, making them competitive in bulk pricing. |

| Regulatory Compliance Costs | Compliance with stringent regulations raises operational costs, particularly for API manufacturing | Increases the price of high-quality products and impacts pricing structures. |

| Sustainability Initiatives | Investments in eco-friendly production technologies such as biocatalysis increase operational costs | Can lead to higher initial production costs but can allow for premium pricing of sustainable products. |

In the Pharmaceutical Fine Chemicals Market, cost trends significantly influence pricing dynamics. Raw material price fluctuations, often caused by supply chain disruptions and geopolitical factors, drive up overall production costs, forcing manufacturers to raise prices. Technological advancements, like automation and green chemistry, offer manufacturers opportunities to reduce production costs, which can help maintain competitive pricing. Economies of scale allow larger producers to stabilize prices, providing advantages in bulk pricing. However, compliance with stringent regulations, particularly for APIs, adds costs, influencing product pricing. Finally, sustainability initiatives, while raising initial costs, can lead to premium pricing for products that cater to the growing consumer demand for environmentally friendly options.

Pharmaceutical Fine Chemicals Market Segments

By Type

Active Pharmaceutical Ingredients (APIs) dominated the Pharmaceutical Fine Chemicals Market in 2023, accounting for a 55% market share. Within the APIs segment, high-potency APIs (HPAPIs) emerged as the leading subsegment, holding approximately 30% of the API market. The dominance of APIs is driven by their critical role in drug formulation and manufacturing, where they serve as the bioactive components responsible for therapeutic effects. HPAPIs, in particular, are in high demand due to their efficacy in treating life-threatening diseases such as cancer and autoimmune disorders. For example, the rising use of HPAPIs in targeted therapies and personalized medicine underscores the demand for precise and high-purity fine chemicals, which are essential for manufacturing APIs.

By Formulation

Oral dosage forms dominated the Pharmaceutical Fine Chemicals Market in 2023, capturing a 50% market share, with tablets being the dominant subsegment, holding approximately 60% of the oral dosage forms market. Oral dosage forms are widely preferred due to their ease of administration, patient compliance, and cost-effectiveness in manufacturing. Tablets, in particular, are favored because of their stability, accurate dosing, and scalability in production. For example, sustained-release tablets that utilize advanced excipients and fine chemicals to ensure controlled drug release have seen significant growth, particularly in treating chronic conditions like diabetes and hypertension.

By Application

Drug manufacturing dominated the Pharmaceutical Fine Chemicals Market in 2023, contributing to a 45% market share. This segment’s leadership stems from its pivotal role in the pharmaceutical value chain, as fine chemicals are integral to producing active ingredients, intermediates, and excipients. The growth in this segment is driven by the increased production of both branded and generic drugs to meet rising global healthcare demands. For instance, the surge in demand for antiviral drugs during pandemics and ongoing efforts to develop advanced therapies has bolstered the need for high-quality fine chemicals in drug manufacturing.

By End-User

Pharmaceutical companies dominated the end-user segment in the Pharmaceutical Fine Chemicals Market in 2023, holding a 60% market share. Their dominance is attributed to their central role in drug discovery, development, and large-scale production. Major pharmaceutical firms invest heavily in sourcing and manufacturing fine chemicals to ensure the quality and efficacy of their products. For example, leading pharmaceutical companies have been enhancing their partnerships with fine chemical manufacturers to secure reliable supplies of APIs and intermediates for their blockbuster drugs and innovative therapies. This trend is further supported by their robust R&D pipelines and global market reach.

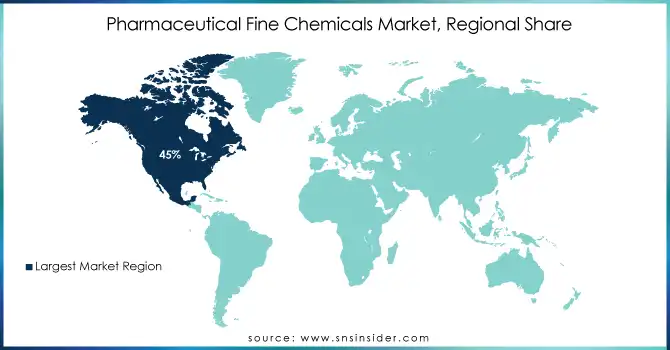

Pharmaceutical Fine Chemicals Market Regional Analysis

In 2023, North America dominated the Pharmaceutical Fine Chemicals Market, accounting for an estimated 45% market share. The region’s dominance is primarily driven by the presence of leading pharmaceutical companies and significant investment in R&D and manufacturing capabilities. The United States, in particular, holds a commanding position due to its robust pharmaceutical industry, with companies such as Pfizer, Johnson & Johnson, and Merck driving demand for fine chemicals. For instance, the United States is a global leader in the production of Active Pharmaceutical Ingredients (APIs) and has a large number of manufacturing facilities complying with stringent regulatory standards such as those set by the FDA. Additionally, the region benefits from a well-established supply chain, a highly skilled workforce, and a favorable regulatory environment that encourages innovation. Canada's role as a key player in the market is also notable, driven by its growing pharmaceutical sector and government support for pharmaceutical research. As of 2023, Canada's pharmaceutical industry generated over $30 billion in revenue, with increasing demand for high-quality fine chemicals. The regulatory environment in North America ensures that manufacturers maintain high standards of quality and compliance, making the region a preferred hub for the production of fine chemicals used in drug manufacturing.

The Asia-Pacific (APAC) region emerged as the fastest-growing region in the Pharmaceutical Fine Chemicals Market in 2023, with an estimated CAGR of 8.5%. This growth is driven by factors such as the rapid expansion of the pharmaceutical and biopharmaceutical sectors in countries like China, India, and Japan. China, as the world's second-largest pharmaceutical market, has seen a surge in the demand for fine chemicals, especially in API production. China’s pharmaceutical market was valued at over $170 billion in 2023, and the country remains a key global supplier of both generic and branded drugs. India, a leader in generic drug production, is also witnessing significant growth in pharmaceutical fine chemicals, spurred by its increasing focus on biosimilars and contract manufacturing. India's pharmaceutical industry reached a market value of $50 billion in 2023, with fine chemicals playing an integral role in drug manufacturing. Japan, with its aging population, has seen a shift toward more specialized and personalized medicines, driving demand for high-purity pharmaceutical chemicals. The growth in these countries is supported by a combination of factors such as government investments, improvements in healthcare infrastructure, and a rising demand for advanced drug formulations. The growth of contract manufacturing organizations (CMOs) in these regions is also fueling the demand for pharmaceutical fine chemicals, as global companies increasingly outsource production to cost-effective, yet highly skilled, manufacturers in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Recent Developments

-

October 2024: Colorcon partnered with LOTTE Fine Chemical to enhance pharmaceutical formulations using LOTTE’s AnyCoat® Hypromellose product family for controlled and immediate release, combining their expertise in excipients.

-

October 2024: Pharmaids Pharmaceuticals acquired a 50.60% stake in Anugraha Chemicals to expand its presence in manufacturing APIs and fine chemicals.

Key Players

-

Albemarle Corporation (Bromine, Lithium compounds, Catalysts)

-

Azelis (Solvents, Active ingredients, Excipients)

-

BASF SE (Paracetamol, Vitamin A, Cysteamine)

-

Bayer AG (Aspirin, Diclofenac, Imidazole)

-

Cipla Ltd. (Cetirizine Hydrochloride, Levofloxacin, Salbutamol)

-

DSM Nutritional Products (Vitamin D3, Vitamin E, Omega-3)

-

Evonik Industries AG (Polyvinylpyrrolidone, Cysteine, Vitamin B12)

-

Gujarat Alkalies and Chemicals Ltd. (Hydrochloric acid, Caustic soda, Sodium hypochlorite)

-

Hikal Ltd. (Active pharmaceutical ingredients, Custom synthesis, Intermediates)

-

Huntsman Corporation (Methyl ethyl ketone, Ethylene amines, Polyurethanes)

-

Ineos Group (Acetone, Methyl methacrylate, Styrene)

-

Lonza Group AG (Erythropoietin, Monoclonal antibodies, Carbohydrates)

-

Merck Group (Cyclohexane, API Intermediates, Silica gel)

-

Novartis AG (Imatinib, Hydroxychloroquine, Rifampicin)

-

PTT Group (Styrene, Butadiene, Polyethylene)

-

Syngenta AG (Glyphosate, Imidacloprid, Atrazine)

-

Taiyo Nippon Sanso Corporation (Oxygen, Nitrogen, Hydrogen)

-

Takeda Pharmaceutical Company Limited (Lisinopril, Valsartan, Uloric)

-

Wacker Chemie AG (Silicone, Polymers, Polysiloxanes)

-

Taj Pharmaceuticals Ltd. (Aspirin, Paracetamol, Ibuprofen)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 138.3 Billion |

| Market Size by 2032 | USD 255.5 Billion |

| CAGR | CAGR of 7.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Active Pharmaceutical Ingredients (APIs), Excipients, Intermediates) •By Formulation (Oral Dosage Forms [Tablets, Capsules], Parenteral Dosage Forms [Injectables, Infusions], Topical Dosage Forms [Creams, Ointments]) •By Application (Drug Manufacturing, Biopharmaceuticals, Contract Manufacturing Organizations (CMOs), Research & Development (R&D), Regulatory Applications) •By End-User (Pharmaceutical Companies, Contract Research Organizations (CROs), Contract Manufacturing Organizations (CMOs), Research Laboratories) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Bayer AG, Lonza Group AG, Azelis, Huntsman Corporation, Evonik Industries AG, Syngenta AG, Wacker Chemie AG, Albemarle Corporation, Taj Pharmaceuticals Ltd. and other key players |